Accident Insurance – Accidental means is a condition for losses covered by an insurance policy that requires the loss to be the result of an accident and not an accident. As a condition, contingency funds are designed to protect insurers from paying claims in the event of non-accidental events.

Insurers use the word “accident” to describe an event that happened unintentionally and is unexpected or unforeseen. Accidental means can include acts that caused harm or damage but were themselves accidental. Both the injury and the event must be considered accidents for the claim to be covered. A fortuitous means is a precise definition of “accident” and is stricter than simply defining an accident as an unforeseen event.

Contents

- Accident Insurance

- What Do I Do If My Insurance Lapses And I Get In A Car Accident?

- Accident Insurance Vs Health Insurance {2023 Complete Guide}

- Student Accident Insurance (bob Mccloskey Insurance)”

- Group Accident Insurance

- Occupational Accident Insurance Abstract Concept Vector Illustration. Stock Vector By ©visualgeneration 397880882

- What Does Accident Insurance Cover?

- Uninsured After A Car Accident? Follow These Steps And Advice

- Accident Plan: Covering Gaps In Health Insurance

- Gallery for Accident Insurance

- Related posts:

Accident Insurance

Bodily injury or death insurance policies often include provisions that require the death or injury to be caused by external, violent, accidental means. A random measure considers both the cause and the effect of an event, not just the outcome of the event.

What Do I Do If My Insurance Lapses And I Get In A Car Accident?

For example, a construction worker with an accidental death and dismemberment policy who is injured would have to (1) not know that the risk of an activity would cause a loss and (2) not know that some event triggering that activity could occur. in loss If that worker used a machine that he knew had faulty wiring and was electrocuted, then he would not receive the benefit because he should have known that they could be injured because of the wiring problem.

A typical clause in an insurance policy providing coverage for accidental death might read: “Evidence that the death of the insured resulted, directly and independently of all other causes, from bodily injury caused solely by external, violent and accidental means… “.

Whether a particular event will be covered depends on how the relevant jurisdiction interprets “external, forceful and accidental means”. “Violent” and “extrinsic” often qualify the concept of “incidental means,” and courts generally agree on that definition.

Some states consider bodily injury policies that use the words “accidental means” to be different from those that mention “accidental injuries.” Court cases may depend on whether the wording of the policy implies that the insurer is liable for the cause of the accident (death or injuries resulting from the accident), or whether the liability depends on the consequence (injury or death).

Accident Insurance Vs Health Insurance {2023 Complete Guide}

The offers shown in this table are from compensated associations. This compensation may affect how and where ads appear. it does not include all the offers available in the market.

By clicking “Accept all cookies”, you consent to the storage of cookies on your device to improve site navigation, analyze site usage and assist in our marketing efforts. 92% of founders and CHROs worldwide believe that true group personal accident insurance coverage can be a game-changer for businesses. However, companies still struggle to choose the right personal accident insurance that perfectly meets the requirements of their workforce.

This blog will cover everything you need to know before purchasing the right personal accident insurance plan for your employees.

Imagine your employee has an accident on his way home after a hard day’s work. If you are an organization that really cares about their employees and have the right group personal accident cover, then your employee needn’t worry.

Student Accident Insurance (bob Mccloskey Insurance)”

The coverage will financially cover the totality of the permanent or temporary disability caused by an accident. A group personal plan will provide compensation for the cause of death of the employee and make the employee’s family members completely free of money.

Despite taking so many precautions, accidents do happen. Therefore, a comprehensive personal accident group insurance policy is essential to protect your employees against such unforeseen events. Only when employees have a complete sense of protection, they can contribute enormously to the growth of the company.

In a year, more than one billion lives are covered under a group personal insurance policy in India. In this market, it can be very difficult for companies to find the best group accident insurance for their business.

Here are some criteria you should ensure before buying the right personal accident group insurance.

Group Accident Insurance

Insurance refers to the degree of risk or liability that the insurance policy assumes in the event of adverse circumstances. It is essential to ensure that your group personal accident insurance covers all possible accidents that may occur during your daily routine.

Also, if you are in a business that requires frequent travel, it is imperative that you check that your policy covers worldwide coverage along with other essential coverages.

Different coverage benefits have limits and sub-limits that apply. That’s why it’s important to ask your insurance provider or broker for a full explanation of sublimits.

If the insured experiences total temporary disability, the benefit may be a fixed amount or a weekly payment of 1% of the insured amount for a maximum of 100 weeks, according to the terms of the policy.

Occupational Accident Insurance Abstract Concept Vector Illustration. Stock Vector By ©visualgeneration 397880882

A GPA insurance policy comes with several additional coverages. These extensions can consist of expenses such as children’s education, ambulance expenses, transportation of mortal remains and funeral expenses. Make sure you choose plugins based on your business requirements.

However, an additional premium must be paid for these extensions. It is also necessary to consider the potential areas of risk and danger that require insurance. Terrorism, maritime perils and traffic accidents are examples of potential risk exposure.

Most insurance policies include benefits such as permanent total disability, permanent partial disability and accidental death coverage. It is important to confirm that the policy also covers expenses related to emergency services and hospitalization.

Unexpected and unfortunate events can lead to significant financial burdens. It is necessary to take preventive measures to protect your employees from the financial consequences of such events.

What Does Accident Insurance Cover?

Choosing the right group accident insurance is an important step to success in your business. To help you navigate your insurance journey, engaging a top insurance broker can be a huge help.

Offers a cost-effective, customizable and personalized group personal accident insurance policy for businesses. Purchasing a group personal accident insurance policy offers additional benefits.

A user-friendly, technology-enabled dashboard that allows HR to manage and administer policies in one convenient place. Additionally, employees can access the Paz app on their mobile devices to manage their policies. The policy also includes free wellness sessions for employees, dedicated account managers and round-the-clock customer support. Get in touch today!

Before taking out a group personal accident insurance policy, make sure you opt for premium coverage, monitor sub-limits, look for additional coverage options and check your policy benefits. Contact sujith@ and insurance experts will help you find the right coverage

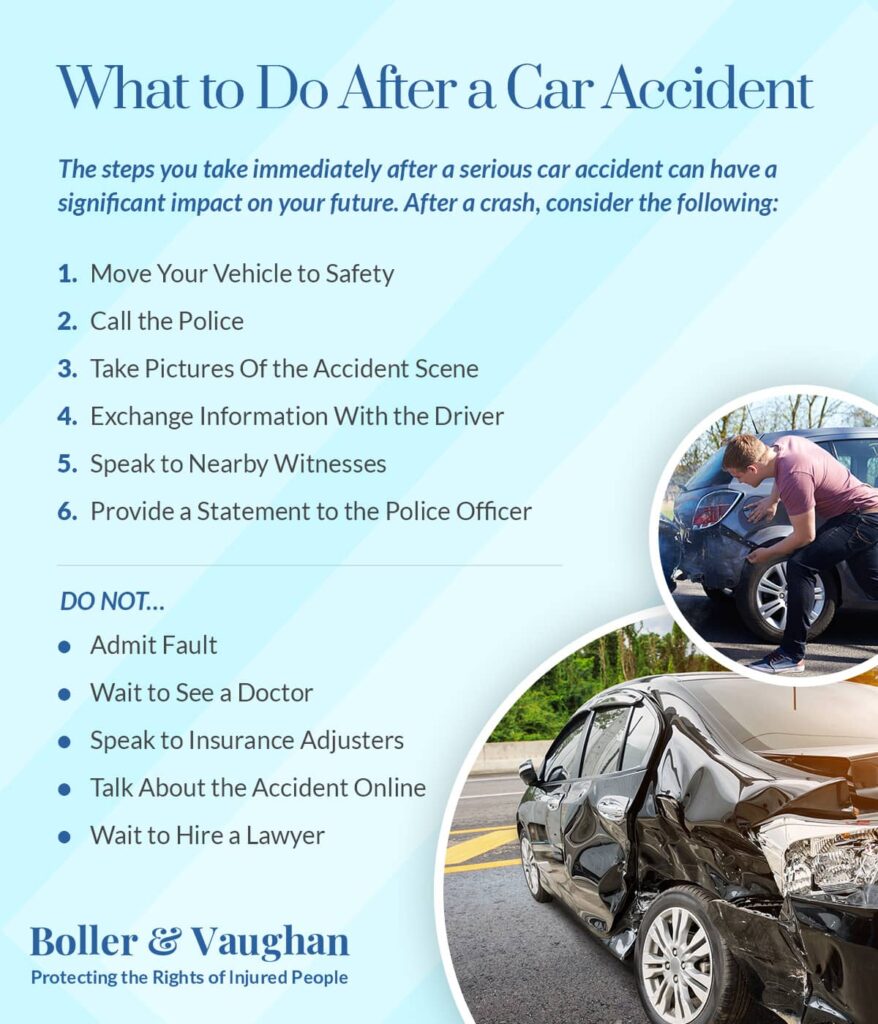

Uninsured After A Car Accident? Follow These Steps And Advice

Taking out a group personal accident insurance policy provides financial coverage for permanent or temporary disability caused by an accident. Also, the policy provides compensation for the cause of death of the employee and makes the next of kin of the employee completely cash free. Simply put, accident insurance is a form of insurance policy that provides payouts when people are injured or killed in accidents. This type of insurance usually does not cover negligence, acts of force or natural disasters, and the policy may include restrictions such as limits on total payments or limits on payments for activities considered risky. Many insurance companies sell accident insurance, which can be purchased as a stand-alone policy or combined with an existing insurance policy.

Like other forms of insurance, buying accident insurance is, in a sense, a gamble. The consumer pays a premium to the insurance company in the hope that an accident will not occur, and the insurance company writes the policy in the hope that they will not have to pay.

This type of policy can be a good idea for people who: do not have adequate health care (ensuring they can access medical treatment after an accident); or for families who would suffer financially if the sole breadwinner died (offers greater financial security).

Accident insurance policies have payouts that vary based on the severity of injuries. Some include very specific language about amounts to be paid in the event of loss of certain limbs, for example. The payment is designed to cover medical care along with pain and suffering. If the accident results in permanent disability, the payment can be structured to provide support for the accident victim. In the event of death, benefits will be paid to the beneficiary named in the policy.

Accident Plan: Covering Gaps In Health Insurance

When purchasing accident insurance, people should ask about premiums and what types of accidents and events are covered. Know the reputation of the company before purchasing a policy because some companies charge more than others and some delay payments until they are sure that the customer actually meets the payment requirements. For people who need money for urgent expenses, this can be a problem.

One of the most common types of accident insurance is car accident insurance purchased by drivers

Car accident insurance, accident without insurance, accident insurance settlement, car accident no insurance, accident no insurance, car accident insurance lawyer, pet accident insurance, car accident insurance settlement, uber accident insurance, no fault accident insurance, accident only pet insurance, accident claim insurance