All Car Insurance Companies – Updated February 20, 2020 | 0 min read | By Bryan Ochalla Bryan Ochalla is the Editor-in-Chief of SEO. He specializes in auto, home and health insurance, and his research has been cited in Boston 25 News, Becker’s Hospital Review, MSN and Yahoo.

Anyone who has ever purchased car insurance knows that there are many companies to choose from. If you’re in this situation right now and feeling overwhelmed, start at the top. In other words, start your search with the largest auto insurance companies in the United States.

Contents

- All Car Insurance Companies

- J. Antonio Tramontana Law Firm Reveals The 10 Worst Auto Insurance Companies In Louisiana

- Things Car Insurance Companies Don’t Want You To Know

- Largest Auto Insurance Companies (december 2023)

- Insurance Companies In Nashville, Tn

- Major Car Insurance Companies In Powerpoint And Google Slides Cpb

- The Best 10 Auto Insurance In Alhambra, Ca

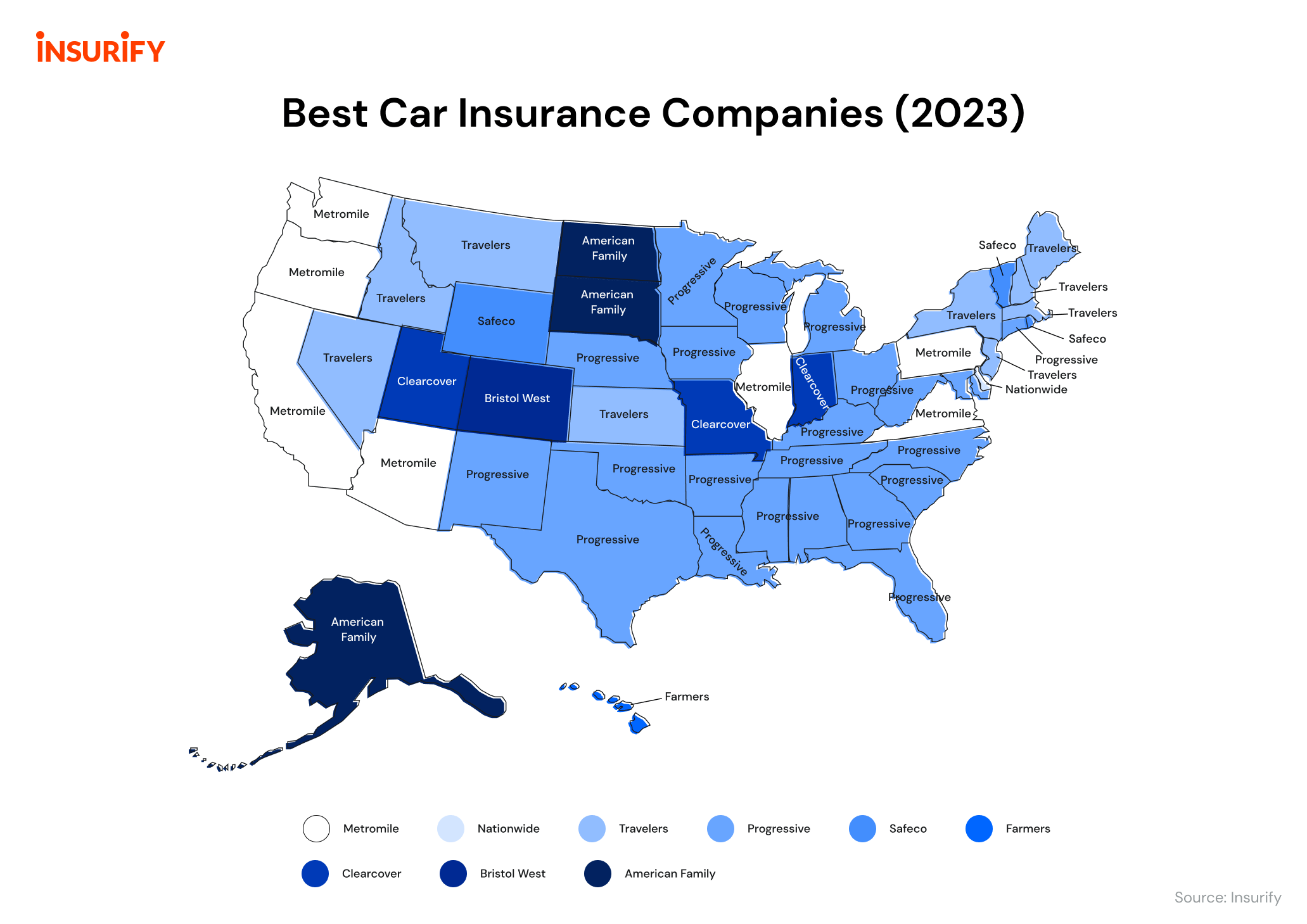

- What Is The Best Car Insurance Company In My State?

- Your Car Insurance Company Could Give You Credit, Refunds Due To Covid 19

- Car Insurance Agents In Chennai

- Gallery for All Car Insurance Companies

- Related posts:

All Car Insurance Companies

Finding a good option is not difficult. The ten largest insurance companies in the automotive sector currently control approximately 72% of the market, as shown in the table below. Chances are, many of them serve the state you call home.

J. Antonio Tramontana Law Firm Reveals The 10 Worst Auto Insurance Companies In Louisiana

How can you limit your choices? Check out the information we’ve collected in this article. It will help you learn more about the country’s leading auto insurance companies and help you choose between them.

While small auto insurers generally offer a better customer experience than their larger competitors, large auto insurers make up for this in several areas.

For example, the largest auto insurers typically outperform smaller auto insurers in terms of coverage options, discounts and even representative availability. Another reason is that it is often easier to bundle policies if you buy them from a large insurance company.

In fact, the major national brands in the auto insurance industry are more financially stable than the lesser-known regional or local brands.

Things Car Insurance Companies Don’t Want You To Know

Which of the following insurers should you contact when taking out car insurance? This depends on several factors, such as where you live, your driving record, your credit score, and more. To find the best auto insurance company for your situation, compare quotes from different companies before purchasing a policy.

State Farm is the largest auto insurance company in the United States, with 17% of the market. It sells policies in every state except Massachusetts and Rhode Island, so chances are it’s an option where you live.

GEICO is the second largest auto insurance company in the United States. The company sells auto insurance in all 50 states and Washington, D.C., and has a 13% market share.

Progressive has more than 33,000 employees and more than 22 million active policies. Why should you choose this over the other insurance companies highlighted here? Different possibilities:

Largest Auto Insurance Companies (december 2023)

Allstate also has nearly 10% of the auto insurance market share, making it one of the top five insurance companies in the country.

USAA becoming the fifth largest auto insurance company is an impressive feat, especially considering that only military members and their families can purchase insurance from it. They are consistently considered the best car insurance company for military members.

Liberty Mutual ranks sixth among the largest U.S. auto insurance companies, with about 5% of the market. It offers a variety of insurance policies beyond auto, including homeowners, condo and renters insurance.

Speaking of which, if you have more than one policy with Liberty Mutual, you’ll receive a discount. The Boston-based insurance company also offers discounts on:

Insurance Companies In Nashville, Tn

While the Woodland Hills, California-based insurance company initially only offered coverage to rural farmers, it now offers coverage to eligible motorists in all 50 states. It assists these drivers with the help of more than 48,000 exclusive independent agents.

These 10 million households also seem to be happy with the farmers. After all, it has had an A+ rating from the Better Business Bureau (BBB) since 1951.

If you’re looking for more than just liability, collision and comprehensive auto insurance products, Nationwide has what you’re looking for. Not only does it provide coverage for cleanup, towing and labor costs, but it also offers the following optional coverages:

American Family ranks ninth among the nation’s largest auto insurance companies. It captures just over 2% of the market.

Major Car Insurance Companies In Powerpoint And Google Slides Cpb

Madison, Wisconsin-based American Family employs 2,400 independent contract agents who sell auto insurance policies to drivers in 19 states.

Travelers is the tenth largest auto insurer in the country, with a market share of approximately 2%.

Travelers also has an A+ rating from the BBB and the following financial strength ratings: A++ from AM Best, Aa2 from Moody’s and AA from Standard & Poor’s.

LLC has made every effort to ensure that the information on this website is correct, but we cannot guarantee against its inaccuracies, errors or omissions. ALL CONTENT AND SERVICES OFFERED ON OR THROUGH THE SITE ARE PROVIDED “AS IS” AND “AS AVAILABLE” FOR USE. LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or the information, content, materials, or products included on this site. YOU EXPRESSLY AGREE THAT USE OF THE SITE IS AT YOUR SOLE RISK. California seeks to curb discriminatory auto insurance pricing, using jobs and education to charge low-income, non-white drivers more

The Best 10 Auto Insurance In Alhambra, Ca

– Consumer watchdogs will testify at a California Department of Insurance seminar this afternoon that insurance companies are illegally using job and education levels to determine the price of auto insurance, which is discriminatory against low-income drivers and communities of color and must be stopped .

The workshop will discuss the proposed rule after consumer watchdogs and 10 other civil rights and community groups petitioned the U.S. Department of Commerce to ban the use of employment and education levels in auto insurance ratings in 2019. The group will urge the Commerce Department to make clarifying revisions before making a formal recommendation to adopt the rule, after two years of investigation into the practice and decades of abuse by insurance companies.

California Proposition 103, passed by voters in 1988, requires auto insurance prices to be based primarily on an individual’s driving style: driving record, miles driven per year and years of driving experience. It also offers consumer groups the opportunity to work together to negotiate discounts for their members. Yet for decades, insurance companies have illegally given discounts to drivers with white-collar jobs and college degrees by forcing other drivers to pay more.

“Insurers have long used education and profession as a backdoor to charge California drivers of color and low-income drivers higher rates,” said Daniel L. Sternberg, staff attorney at Consumer Watchdog (Daniel L. Sternberg). “Proposition 103 prohibits racial and economic disparities caused by current insurance company practices.”

What Is The Best Car Insurance Company In My State?

The proposed rule would end insurance companies’ illegal use of employment and education as rating factors and preserve the discounts negotiated by legitimate consumer groups for their millions of members. They would ban insurance companies from offering group discounts only to drivers in high-paying professions or college graduates. For example, AAA offers group discounts for riding on this list of random white-collar tracks.

Insurers must demonstrate that their group discounts are not concentrated in wealthy zip codes, but are distributed more equitably across California’s low-income and diverse communities. If this is not the case, group discounts cannot be offered.

A September 2019 Department of Insurance report found that insurers’ current practices are creating “large socioeconomic disparities,” with premiums 25% higher for drivers with less education and who live in zip codes with lower per-year incomes capita (representing jobs). communities of color predominate.

In 2017, only 12.2% of Latinos and 24% of Black Californians over the age of 25, respectively, had a bachelor’s degree or higher. Latinos and black Californians also have lower median incomes than white Californians. Undocumented Californians are especially likely to find jobs in low-wage industries such as agriculture, childcare, restaurants, hotels and construction. The groups said in a 2019 petition that these communities pay more to provide discounted subsidies to professional drivers with higher incomes.

Your Car Insurance Company Could Give You Credit, Refunds Due To Covid 19

Currently, seven of the ten largest auto insurance companies in California discriminate against drivers based on their employment and education.

Massachusetts prohibits the use of education and occupation in setting auto insurance rates; New York banned their use in 2017 unless an insurance company can prove it will not result in unfairly discriminatory rates; in addition, the use of education and profession in car insurance rates is prohibited. The use of education and occupation in television ratings is currently up to the New Jersey Legislature.

Carmen Balber, executive director of Consumer Watchdog, has been with the organization for nearly two decades. She led the organization’s Washington, D.C., office for four years, where she advocated for major health insurance reforms that were ultimately signed into law as part of the Affordable Care Act.

Spectrum News 1 (San Fernando Valley) – Los Angeles, CA: Affordability of Fire Insurance 03:51 KGO (ABC) – San Francisco, CA: Consumer watchdogs and the Office of the Insurance Commissioner are at loggerheads 03:12 KNBC- LA (NBC ) – Los Angeles Los Angeles, CA: California considers new rules for property insurance prices 01:49 KPIX-SF (CBS) – San Francisco, CA: Insurance reform 03:06 NBC Nightly News: Climate change drives home insurance rates up 01:55 KCAL-LA – Los Angeles, CA: Insurance Risk Areas 03:02 KTLA-LA (CW) – Los Angeles, CA: Insurers once again offering coverage in California fire zones 00:48 KXTV-SAC (ABC) – Sacramento, CA : Changes in the home insurance market 02:32 KCBS-LA (CBS) – Los Angeles, CA: California insurance pricing proposal 02:08 KCRA3 – Sacramento, CA: California lawmakers hold hearing on home insurance crisis 02:28 KTVU- SF (FOX) – San Francisco, CA: California homepage

Car Insurance Agents In Chennai

Car warranty insurance companies, do all car insurance companies check credit, list all car insurance companies, car insurance quotes from all companies, all car insurance companies in florida, car repair insurance companies, all life insurance companies, compare all car insurance companies, all the car insurance companies, names of all car insurance companies, commercial car insurance companies, pa car insurance companies