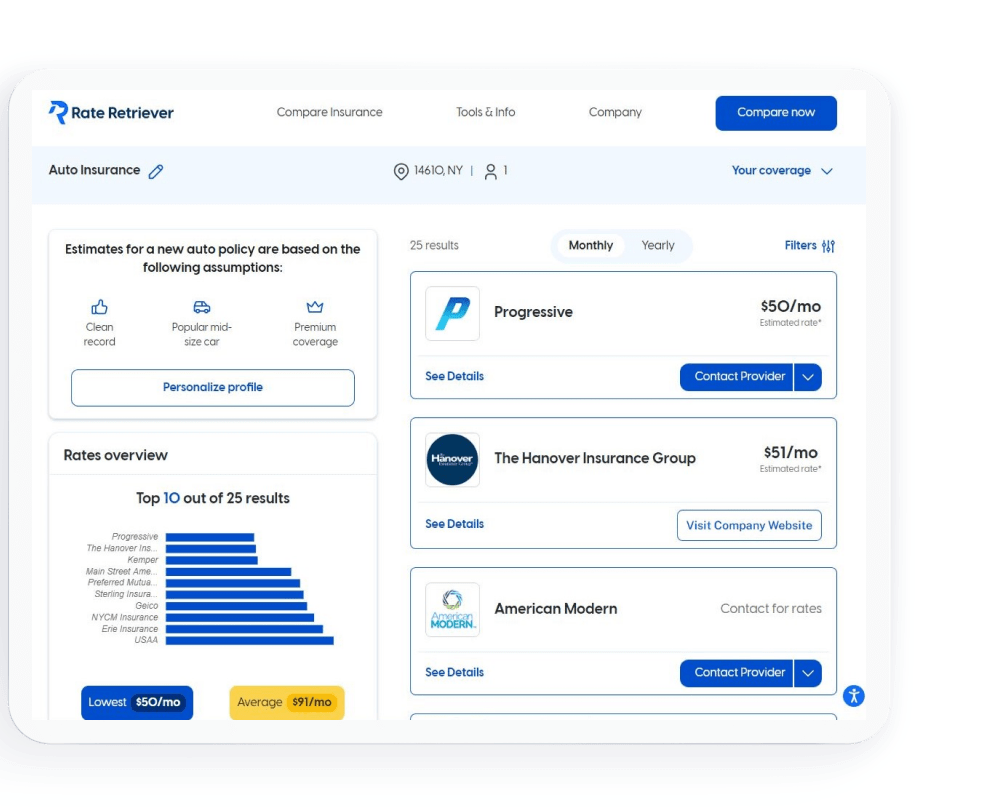

Auto Insurance Compare – To help you better understand how to compare car insurance quotes to find the best policy, a team of insurance experts developed a comprehensive guide with average rates from every major car insurance company for every situation and different groups of drivers.

Auto insurance companies are now facing historic losses that are driving auto insurance rates higher. Insurers will likely continue to raise prices for the foreseeable future. Comparison shopping for auto insurance is the best way to find the best coverage at the lowest price available to you. It’s a good idea to compare individual quotes every six months, because the market changes quickly.

Contents

- Auto Insurance Compare

- Bundle Home And Auto Insurance: Save With Discounts

- How To Shop For Car Insurance

- Agent Support, Ratings Added To Expanding Google Compare

- Amazon.com: Free Auto Insurance Quotes 12

- How To Lower Your Car Insurance Cost In Southaven, Ms

- How To Switch Your Auto Insurance: 8 Easy Steps

- Cheapest Car Insurance In San Antonio, Tx

- Gallery for Auto Insurance Compare

- Related posts:

Auto Insurance Compare

There are many factors that determine your speed, including your age, location, driving record, education level, and the type of car you drive. Each insurance company has a unique way of weighing these factors, which is why the same policy can be priced differently depending on where you get the quote.

Bundle Home And Auto Insurance: Save With Discounts

As an independent insurance agent licensed in all 50 states and Washington, DC, we can help you find personalized quotes. By delivering quotes tailored to your driver’s profile and needs, it can help you save on car insurance – our users save up to $717 annually.

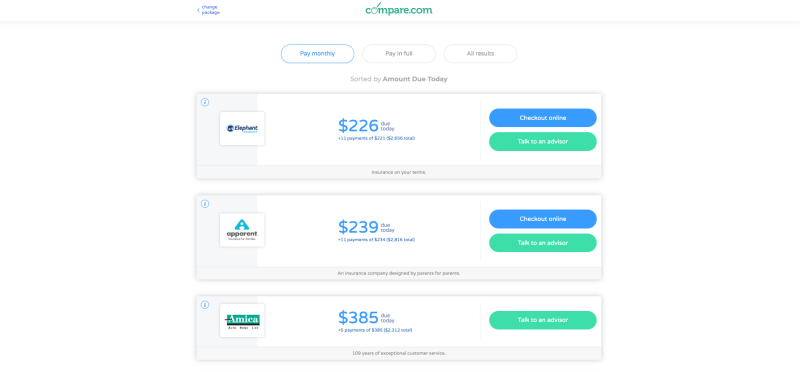

Price is just one factor to consider when purchasing a policy. It’s also important to consider payment options, additional coverage, or special programs the insurance company may offer.

Car insurance comparison shopping gives you access to quotes from top national and regional insurance companies. The process is easy, and we can deliver your personalized quote in minutes.

Everyone wants to find reliable car insurance at affordable rates. But the quality of the insurance company is also important when comparing car insurance. A team of data scientists, editors, and insurance writers put together the table below to help you make more informed insurance buying decisions.

How To Shop For Car Insurance

The data represents average monthly quotes for full coverage insurance from well-known names in the industry. It also allows you to easily compare companies’ Quality Scores, which rate companies based on 15 criteria, including:

Konstantin has led data teams in a variety of industries, including insurance, travel, and biology. He led the engineering team for over three years.

The Quality Score (IQ) uses more than 15 criteria to objectively rate insurance companies on a scale of one to five. The editorial team examined the insurer’s data to determine the final score.

Disclaimer: Table data derived from real-time quotes from 50-plus partner insurance providers and estimated quotes from Quadrant Information Services. Actual quotes may vary based on the policy buyer’s unique driver profile.

Agent Support, Ratings Added To Expanding Google Compare

You have many options to compare car insurance rates. You can work directly with comparison sites, such as lead generation websites, or insurance companies. Each option has advantages and disadvantages.

Getting new car insurance can seem like a daunting task. I got quotes from several operators, and the best I found so far was service and speed. Patty made the whole process run smoothly and was very helpful and insightful. I recommend it to everyone!

I am glad I visited your website. The agents I spoke with were very knowledgeable and went out of their way to make sure I was getting the best price and coverage. If I need new insurance again, I will definitely come back here. Saved me a bunch of money!

After searching for car insurance for several days, I found the best and easiest policy for me. Thank you very much!

Amazon.com: Free Auto Insurance Quotes 12

In addition to liability, comprehensive, and collision coverage, most insurance companies offer additional coverages, including:

A reputable car insurance company that fits your budget and offers solid coverage, quality customer service, and timely claims management is a tall order. Here are some factors to consider when comparing car insurance companies:

IQ Score The quality (IQ) score uses more than 15 criteria to objectively rate insurance companies on a scale of one to five. The editorial team examined the insurer’s data to determine the final score.

Liability-only Liability-only insurance, sometimes called minimum coverage insurance, pays for bodily injuries and property damage to other people in an accident caused by the policyholder. It does not pay for self-insured damages.

How To Lower Your Car Insurance Cost In Southaven, Ms

Comprehensive Coverage Comprehensive coverage auto insurance typically includes liability, collision, and comprehensive coverage, and may include other optional coverages such as uninsured motorist coverage. Collision covers the policyholder’s repair or replacement costs in the event of an accident. Comprehensive covers damages caused by non-accidental events. The average quote shown here represents a policy with the following coverage limits: $50,000 per person bodily injury liability; $100,000 bodily injury liability per accident; $50.00 property damage liability per accident; $1,000 collision deductible; and a $1,000 comprehensive deductible.

State Farm has been in business for over 100 years, and now sells auto and other vehicle insurance, homeowners, life, health, pet, disability, and small business insurance. Available in all 50 states, State Farm auto insurance policies offer many ways to save, from custom coverage types, to a robust list of discounts. The company had more complaints than expected for the industry, according to the National Association of Consumer Complaints Association of Insurance Commissioners. State Farm also ranks among the top 10 companies for customer satisfaction in each region on the JD Power Overall Customer Satisfaction Index.

A well-known name in auto insurance, GEICO is a subsidiary of Berkshire Hathaway. The company began as a government employee insurance company serving U.S. government employees and military personnel. In addition to auto insurance, GEICO also sells homeowners, flood insurance, life insurance, business insurance, and identity protection, among other products. AM Best gave GEICO its highest rating for financial stability and credit. However, GEICO had nearly twice as many complaints as expected in the National Insurance Commissioner’s Consumer Complaint Index.

I’ve never had a problem; Prices remain high with little to no customer service and little benefit from 26+ years of customer loyalty.

How To Switch Your Auto Insurance: 8 Easy Steps

I was with them for a few years until they started raising my rates every time I went up for renewal. I got a new quote from another company that was $50 less than GEICO for the same coverage. That is no way to show customer loyalty, and is the reason GEICO lost me as a customer.

In business for more than 100 years, USAA exclusively serves military members and their immediate families. The company offers a variety of insurance products, as well as banking, investment and retirement services. Auto insurance customers have access to many discounts, for bundling, insuring multiple vehicles, living on a military base, and more. AM Best gave USAA an A++ rating for financial strength, and the company was rated the highest or second highest of all insurers in every region on the J.D. Customer Satisfaction Index. strength Customer reviews for service and claims processing are mixed.

Travelers has been in business for over 165 years. Today, the company sells auto, homeowners, renters, flood, pet and other types of insurance. In addition to liability and full coverage auto insurance, Travelers offers liability insurance, rental car reimbursement, roadside assistance, rideshare insurance, new car replacement coverage, and more. By bundling multiple policies, policyholders can save on multiple discounts for safe driving, full payment, student discounts, and more. The National Insurance Commissioner’s Consumer Complaints Index has fewer complaints from travelers than expected. AM Best gives the company an A++ for financial strength.

In business since 1925, Nationwide is one of the largest insurers, and sells auto, homeowners, life insurance, umbrella insurance, and more. In addition to liability, collision and comprehensive, Nationwide offers a selection of options such as towing and labor, car rental, and mileage. The company also offers accident forgiveness, and a lost deductible that lowers your deductible each year you drive safely. Nationwide has an A+ rating from A.M. Excellent for financial stability, and only slightly higher than expected for customer complaints on the National Association of Insurance Commissioners Consumer Complaint Index.

Cheapest Car Insurance In San Antonio, Tx

Founded in 1931 by Sears department store executives, Allstate offers auto, home, motorcycle, ATV, rental, condo, and term life insurance. Operating in all 50 states, the company has received high ratings from A.M. Best for financial strength and credit. However, Allstate has many negative reviews on its consumer websites, and ratings of complaints are slightly higher than average on the National Association of Insurance Commission’s Consumer Complaint Index. Allstate offers many discounts including good students, multiple policies, bundled auto and home insurance, new vehicles, safe driving, and good payment history.

Although founding in 1937 makes Progressive relatively young, it is one of America’s largest car insurance companies. The company offers car, home, renters, commercial, and other types of insurance. Progressive consumers can enjoy savings by bundling their car insurance with other types of progressive policies – usually homeowners or renters. Discounts available range from multi-policy and multi-car discounts to snapshot discounts that save drivers. Progressive A.M. The best rating for financial stability is A+. However, the company received slightly more complaints than expected in the Consumer Complaint Index of the National Insurance Commissioner.

Finding affordable coverage doesn’t have to be a chore. this

Compare auto and home insurance, compare cheap auto insurance, compare auto insurance price, compare auto insurance companies, compare auto insurance nj, compare auto insurance plans, auto insurance compare quotes, compare auto insurance online, compare auto insurance, compare auto insurance rates, compare auto insurance quote, auto insurance quotes online compare