Best Car Insurance Rates – Partner Content: This content is created by Dow Jones business partners and is researched and written independently of the newsroom. Links in this article may earn us a commission. learn more

The cheapest car insurance for 21-year-olds can be found at USAA, with a fully insured policy starting at $134 per month or $1,609 per year

Contents

- Best Car Insurance Rates

- What’s The Best Car Insurance For 20 Year Olds?

- Cheapest Car Insurance Quotes In Sacramento, Ca For 2023

- Compare Car Insurance Quotes (from $48/mo.)

- Car Insurance Quote

- Best Car Insurance Companies (november 2023)

- What Are The Cheapest Cars To Insure? (2023)

- Insurance Companies In Nashville, Tn

- Cheapest Car Insurance In California

- The Best Car Insurance For People With Good Credit In 2023

- Gallery for Best Car Insurance Rates

- Related posts:

Best Car Insurance Rates

Written by: Daniel Robinson Written by: Daniel Robinson Writer Daniel is a staff writer on the Guides team and has written for a number of automotive news and marketing companies in the US, UK and Australia, specializing in car finance and car care topics. Daniel is your guide’s team authority on auto insurance, loans, warranty options, auto services, and more.

What’s The Best Car Insurance For 20 Year Olds?

Editor: Rashawn Mitchner, Editor: Rashawn Mitchner Managing Editor Rashawn Mitchner is a Guides team editor with more than 10 years of experience covering personal finance and insurance topics.

For a 21-year-old, finding cheap car insurance can be difficult. Monthly and annual premiums tend to be expensive because younger drivers pose a greater risk to insurance companies. In this article, our team at Guides ranks the best car insurance for 21 and shows you how to get affordable rates.

Cheapest Car Insurance for Young People Car Insurance Discounts Best Car Insurance Companies Average Cost of Car Insurance

The Guide team is committed to providing reliable information to help you make the best decisions about your vehicle insurance. Because consumers rely on us for objective and accurate information, we created a comprehensive ratings system to develop our ranking of the best auto insurance companies. We collected data from dozens of car insurance providers to rank the companies based on a variety of ranking factors. The end result, after 800 hours of research, is an overall rating for each provider, with the highest-scoring insurance companies on the list.

Cheapest Car Insurance Quotes In Sacramento, Ca For 2023

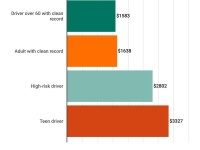

According to our rate estimates, a 21-year-old pays an average of $2,786 per year or $232 per month for full coverage auto insurance. That’s about 56 percent higher than the average cost for a 35-year-old driver ($1,785 per year, about $149 per month). Typically, car insurance rates are much more expensive for a 21-year-old driver than for an older driver.

The cost of car insurance for a 21-year-old driver is determined based on a variety of factors, including driving history, location, and credit score. Gender also plays an important role in calculating premiums, especially for teenagers or young adults. For example, young men have disproportionately high accident rates, which causes them to pay more for insurance than young women. However, some states do not allow insurance companies to use gender to calculate premiums.

Compared with older drivers, 21-year-old drivers have less driving experience and are more likely to be involved in accidents. Car insurance companies compensate for these risk factors by charging people in this age group higher rates.

In 2015, drivers ages 20 to 24 were 74 percent more likely to be involved in an accident than drivers in their 30s, according to the AAA Foundation for Traffic Safety. Below, you can see the collision rates for each age group.

Compare Car Insurance Quotes (from $48/mo.)

High-risk drivers pay higher rates on average, and younger drivers often fall into this category. You can see below how the average costs by age relate to the crash profile above.

The cheapest car insurance for a 21-year-old is USAA, with an average rate of $134 per month. However, USAA is only available to military members, veterans and their immediate family members. Geico is the cheapest company for 21-year-old drivers, with an average rate of $154 per month. Other affordable companies include Auto Owners Insurance Company, Erie Insurance Company, and Nationwide Insurance Company.

The best car insurance for a 21-year-old isn’t necessarily the cheapest, but cheap rates definitely help. Below you can find out what 11 popular car insurance providers charge for 21-year-olds.

*Auto insurance estimates are based on an all-risk policy with $50,000 per person bodily injury, $100,000 per accident for bodily injury, $50,000 per accident for property damage, and a $500 deductible for collision and comprehensive coverage.

Car Insurance Quote

Location is one of the factors that affects the cost of car insurance, and rates can vary widely from state to state. Here are the cheapest car insurance companies in each state that offer comprehensive coverage for 21-year-olds. By our estimates, USAA and Geico are the cheapest providers in many states.

While the national average for a 21-year-old driver is $232 per month, drivers in some states pay much less. For example, the average premium for this age group in North Carolina is $129 per month.

Whether due to population density or insurance regulations, some states are much more expensive to insure for a 21-year-old than others. Michigan, Connecticut and Massachusetts are all on the list.

Our top five recommendations for the best car insurance for 21-year-olds are Geico, USAA, State Farm, Nationwide, and Auto-Owners Insurance. When comparing car insurance companies, our team considers cost, reputation, coverage, availability, and customer experience. We found these companies to be averagely affordable for young adult drivers.

Best Car Insurance Companies (november 2023)

Geico is our top pick for the best car insurance for 21-year-olds. Its car insurance rates for 21-year-olds are about 34 percent cheaper than the market average for that age group. Geico also offers a 15% discount for outstanding students and up to a 22% discount for students who drive accident-free for five years.

The company was founded in 1936 and has an A+ rating from the Better Business Bureau (BBB).

USAA offers the cheapest car insurance for 21-year-olds, with rates about 42% lower than the market average. However, we don’t call it the best car insurance for 21-year-olds because not everyone can get it. You are only eligible if you are in the military, are a veteran, or have a parent who is a USAA member.

Not only does USAA offer low fares for 21-year-olds, but it’s also known for reliable customer service. The company has an A+ rating from the BBB and has received top scores from J.D. in nearly every region nationwide. Power 2022 U.S. Auto Insurance Study℠ Obtained.

What Are The Cheapest Cars To Insure? (2023)

State Farm is another nationwide provider of affordable car insurance premiums for drivers as young as 21 years old. Our estimates show that the average price at State Farm is about 17% cheaper than the national average for this age group.

State Farm also offers discounts for young drivers, including a generous 25% discount for students who maintain a B average. Younger drivers can also save money through State Farm’s Steer Clear® program, an app-based driving course for drivers under 25 years old.

On average, 21-year-old drivers save approximately 23% Nationwide compared to the national average. Nationwide is unique in that it offers two usage-based remote information processing insurance options. SmartRide® can provide discounts of up to 40% based on a person’s driving habits by tracking acceleration, braking, night driving, etc. Another option is SmartMiles®, a pay-per-mile insurance plan that can help people who drive infrequently save money.

Nationwide has a strong reputation in the industry, with an A+ financial strength rating from AM Best and an A+ rating from the BBB.

Insurance Companies In Nashville, Tn

Another affordable car insurance company for 21-year-olds is Auto Owners. Our estimates show that a 21-year-old who owns a car pays about 26% less than the national average. The company offers discounts of up to 20% for students, as well as discounts for students who are not in school and leave their cars at home. However, Auto-Owners is only available in 26 states.

Fortunately, age isn’t the only factor that determines car insurance rates. There are some things you can do to find cheap prices on the best car insurance for 21-year-olds. We recommend you consider your coverage and deductibles, compare providers, maintain a clean driving record and look for discounts.

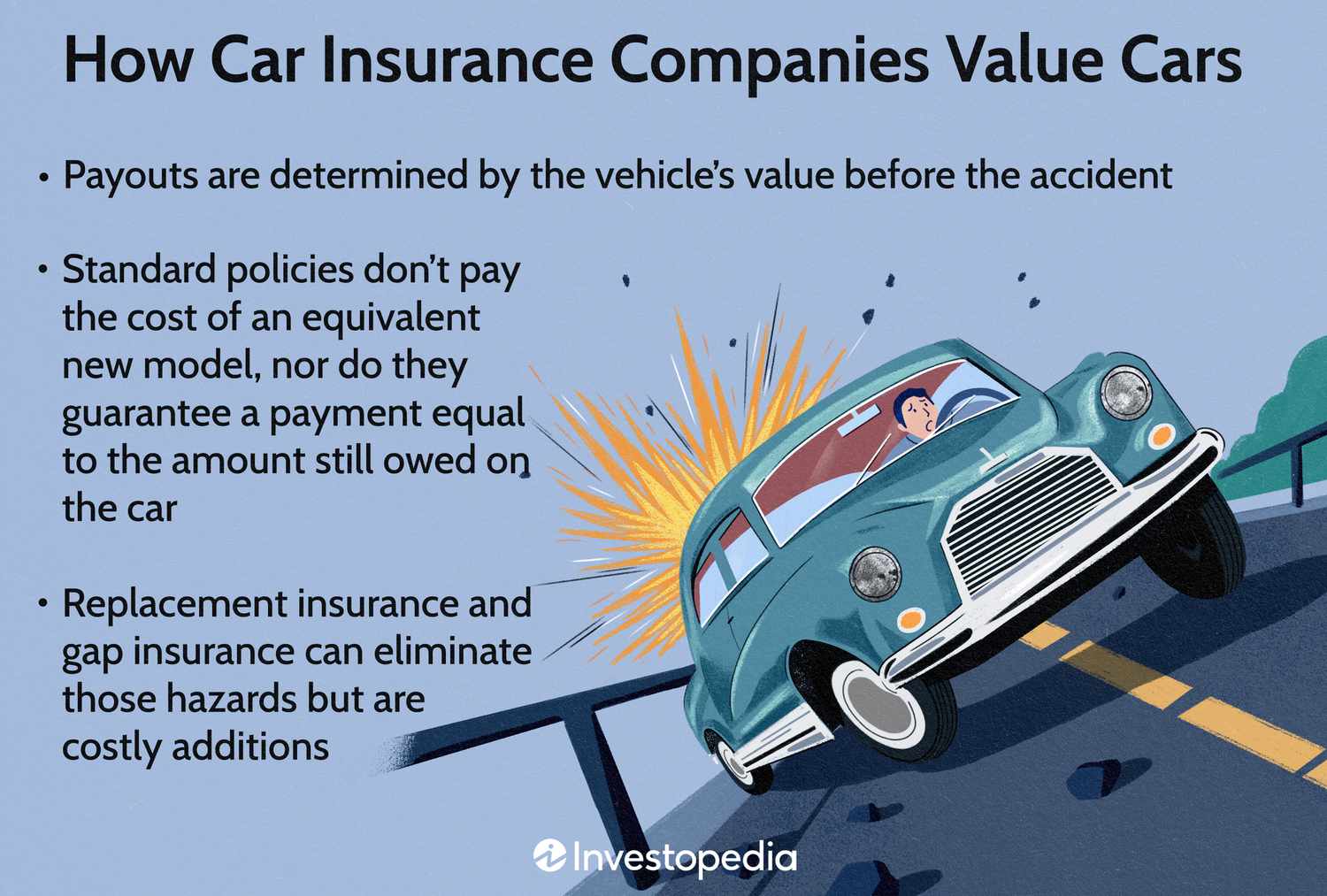

To save money, you can lower your coverage amount with options like comprehensive and collision coverage. You can also waive full coverage and get only the minimum level of bodily injury liability and damage liability coverage. However, if you were at fault for the accident, make sure you can cover any costs that the minimum coverage doesn’t cover.

You can lower your payments by increasing your deductible, which is the amount of money you pay out of pocket when you file a claim. However, make sure you can afford the deduction.

Cheapest Car Insurance In California

One of the easiest ways to get a better price is to compare companies. We recommend comparing rates every time your car insurance policy comes up for renewal. The cheapest company for teenage drivers won’t necessarily be the cheapest for drivers in their early 20s, so it’s worth checking rates as you get older.

Getting a speeding ticket or causing an accident will definitely result in a higher fine, and 21-year-old drivers are already paying above average. A clean driving history will keep your rates as low as possible.

Not all companies offer the same discounts or similar discounts. In our picks for the best car insurance for 21-year-olds above, you can see that State Farm, Geico, and Auto-Owner offer different discount amounts for good students.

Compare quotes online to find the discount that suits your situation. You can also work with your insurance agent to make sure you find any applicable discounts.

The Best Car Insurance For People With Good Credit In 2023

Another way 21-year-old drivers save money

Best car insurance rates ontario, car insurance best rates, best car insurance rates online, find best car insurance rates, best teenage car insurance rates, car insurance quotes best rates, the best car insurance rates, best car insurance premium rates, best car insurance rates toronto, best florida car insurance rates, best car insurance rates alberta, best car insurance rates california