Bike Insurance – As an avid rider, you are well aware that bikes can cost a lot of money. It doesn’t matter if you’re riding on pavement, downhill, gravel, or just on local bike paths. Bicycles are a huge investment and like all good things, bad things can happen to them.

Until recently, most cyclists relied on their home or renters insurance policies to protect their bikes from common losses such as theft and damage while traveling. But what many people don’t realize is that these policies provide less coverage than you think.

Contents

- Bike Insurance

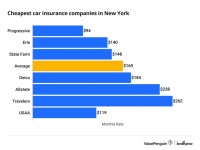

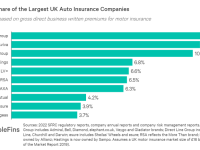

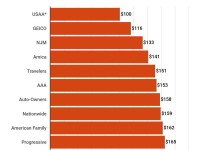

- How Much Is Motorcycle Insurance On Average? (2023)

- What Is The Average Motorcycle Insurance Cost?

- What Are Sections In The Bike Insurance Policy

- Renew Bike Insurance, Two Wheeler Insurance Renewal

- What Is Electric Bike Insurance, And Do You Need It?

- Benefits To Compare Bike Insurance Policy Online

- What Made You Choose America’s Best Bike Insurance?

- Gallery for Bike Insurance

- Related posts:

Bike Insurance

If you really care about your bike, the best solution is to buy a single bike insurance policy. Bike insurance can provide more coverage than your existing insurance policy and cover what you care about most.

How Much Is Motorcycle Insurance On Average? (2023)

Different bike insurance policies are slightly different. For example, simple bike insurance covers many situations (we call them accidents) that you may encounter as a cyclist and bike owner. Here are some of the main categories that bicycle insurance can cover.

Everyone loves funny collision videos, but you won’t laugh if your footage is bent or cracked. You will harm not only yourself, but also your wallet. Luckily, bicycle insurance covers repairs to your bike after a collision. Essentially, insurance covers all types of accidents, whether you collide with another racer, get hit by a car, or crash into a telephone pole. Basic bike insurance will even cover the cost of renting a bike while your bike is in the shop.

When it comes to collisions, bike insurance covers your liability as the driver. This way, if you cause an accident and another person is seriously injured or you damage their property, your liability insurance will pay for the damage. Another thing that most bike insurance policies include is medical coverage. This is a policy that covers your medical expenses if you are injured in an accident. It will pay for things like x-rays, ambulances and physical therapy.

Like car insurance, many bicycle insurance policies include roadside assistance. While you may have the basic tools needed to repair a tire or reinstall a chain, sometimes you just aren’t prepared. If your bike insurance policy includes roadside assistance, it will cover things like flat tire replacement and quick repairs like replacing tubes. Keep in mind that roadside assistance sometimes costs a few extra dollars per year on top of your regular insurance premium.

What Is The Average Motorcycle Insurance Cost?

Bicycle theft is on the rise and this is one good reason to invest in bike insurance. Bike Index research shows that 96,583 bikes were reported stolen in 2020, up 24% on the previous year. The good news is that bike insurance covers theft at home and while on the road. If your bike is stolen, your insurance policy will help cover the cost of a new bike of equal value.

If you are a serious cyclist, you need to have the right equipment. Bike insurance typically covers parts, equipment and clothing. So, if you fall and tear your favorite clothes, you can submit a claim to your insurance to have them replaced.

Having spare parts for your bike can be helpful if you work on your bike at home. For example, if your bike is stolen or destroyed in a fire, your bike insurance company will help you replace it.

Competitive cyclists will be happy to know that most bicycle insurance policies cover you and your bike during the race. If you collide with another rider and one of them is injured, your policy will cover your medical expenses and the losses of others if you are at fault. Your insurance company will also pay to repair your bike if it is damaged during the race. A simple bike insurance policy will also cover servicing costs, so if your bike breaks down during a trip and you can’t compete, you’ll get a refund.

What Are Sections In The Bike Insurance Policy

The last risk category for bicycle insurance is damage caused by travel and transportation. Whether you’re strapping your bike to the roof or shipping it across the country for a bike tour, a bike insurance policy will cover your bike and any damage that occurs during transit.

A bicycle insurance policy is comprehensive and is much more than your home or renters insurance policy. However, this does not cover everything. Here are some things that a bicycle insurance policy does not cover:

Another thing to be aware of is that some types of bicycles may not qualify for insurance coverage. However, this often happens with e-bikes.

For example, Simple Bike Insurance insures electric bicycles with a motor power of no more than 750 W and does not use an additional power source. As long as the speed is under 20 mph without power assist, we’ll cover it.

Renew Bike Insurance, Two Wheeler Insurance Renewal

Almost everyone who owns and enjoys a bicycle should consider getting bike insurance. This is especially true if the cost of repairing or replacing your bike abroad is a financial concern for you.

While you may have renter’s or homeowner’s insurance, you don’t have to rely on these policies to protect your bike. Homeowners insurance often provides more personal property coverage than renters insurance, but there is no guarantee that your bike will be fully insured. Also, depending on your policy, your coverage limit may be lower than you think.

That’s what I mean. Let’s say you splurged on the Tern HSD S11, which costs around $4,500. If your house unexpectedly burns down (taking your new e-bike with you), your policy may only cover the cost of your bike up to $1,500, leaving you to pay the rest.

Even if your home or renters insurance policy fully covers your bike, it definitely doesn’t cover things like roadside assistance, bike rentals, and competitions. If you want to receive these benefits, you will need to take out a separate bicycle insurance policy.

What Is Electric Bike Insurance, And Do You Need It?

Simple Bike Insurance makes it easy to insure single and multi-wheeled bicycles. We insure all brands, including many ebikes, with variable plans and deductibles. You can get an online quote and buy your policy in minutes. We will help you and get you back on your bike in no time.

© 2022 Biker. All rights reserved. Use of the Service is subject to the Terms of Service and Privacy Policy. California DBA as Biker Insurance Agency. Company Policy Markel American Insurance 4521 Highwoods Parkway, Glen Allen, VA 23060 Email: [email protected] | Phone: 855-785-2222 August 29, 2023 / ENDURANCE SPORTSWIRE – An insurance technology company specializing in bike insurance for cyclists in the United States, has released a 2023 guide to the best e-bike insurance in America. Electric bike owners have a strong “need” to protect their e-bike with a separate bike insurance policy.

Is a separate insurance policy designed specifically for bicycles and e-bikes, since home insurance often does not provide adequate coverage for bicycles, and e-bikes are often not included in most home or car insurance policies. Protect bikes or e-bikes from accidental riding, transport or theft, and filing a claim will not affect your existing insurance policy.

“The official bicycle insurance provider of USA Cycling, is a highly qualified and experienced bicycle insurance company that shares its commitment to promoting the importance of protecting bicycles and e-bikes from theft, damage and accidents,” said Eric Bennett, USA Membership Director. Cycling. Through USA Cycling’s partnership with , we are committed to providing riders across the United States with the “peace of mind” they deserve, ensuring they can ride and race with confidence, knowing that their various bikes are protected by a separate vehicle insurance policy. “

Benefits To Compare Bike Insurance Policy Online

A smart Californian who owns an electric bike has come up with a simple but effective solution: All e-bikes should have a warning label that says, “This, plug it in.” This active e-bike owner received a smart policy when he purchased his electric bike in September 2022. However, just nine months later, a thief stole his e-bike. Luckily, their insurance reimbursed them $4,420 shortly after filing a claim for the theft of their e-bike. The insurance benefits allowed them to immediately purchase a new bike from a local bike shop and continue their daily lives with minimal interruption.

“Electric bicycles are often classified as vehicles rather than personal property, so they are often excluded from (home, rental and auto) insurance,” said Buzzy Cohn, CEO of eBike Owner. “So eBike insurance starts with the risk of riding, transporting and theft of the e-bike and attachments with separate bike insurance. I have peace cover for my electric road bike because ‘d!’

Find out the top six reasons why insurance experts advise homeowners to consider insurance for major losses rather than bicycle coverage.

![]()

Please note that e-bikes are generally not covered by most insurance policies or home insurance. Because electric bicycles are classified as motorized vehicles and not personal property, they are often not covered by homeowner’s or renter’s insurance.

What Made You Choose America’s Best Bike Insurance?

E-bike laws vary from state to state.

Bike shop insurance, find bike insurance, bike insurance quotes, motorcycle bike insurance, bike compare insurance, bike insurance cost, dirt bike insurance, cheap bike insurance, bike insurance company, my bike insurance, insurance quote bike, best bike insurance