Buy Health Insurance – A health insurance policy can be defined as financial protection for medical expenses incurred due to accidents, illnesses, or injuries. One can take such a policy against monthly or annual premium payments for a specified period. During the effective period, if the insured has an accident or is diagnosed with a serious illness, the costs incurred for medical purposes are covered by the health insurance policy.

Health plans cover COVID-19 costs. However, you should also check with your insurance to see if it covers COVID-19 under your current policy. If not, you’ll need to look for a new health plan that covers COVID-19.

Contents

- Buy Health Insurance

- Reasons To Buy Health Insurance For Your Family

- Know Why You Should Buy A Senior Citizen Health Plan For Parents

- Top Star Health Health Insurance Agents Near Shoppers Stop Chembur West

- Buy How To Sell Health Insurance Paperback Book Fast English Language Kyun Aur Kaise For Health Insurance (pack Of 1 Book) Book Online At Low Prices In India

- Health Insurance Plans

- Health Insurance: I Have Pre Existing Diseases. Should I Buy Health Insurance For My Spouse And Myself Separately?

- Why Should Millennials And Gen Z Buy Health Insurance?

- Gallery for Buy Health Insurance

- Related posts:

Buy Health Insurance

Purchasing the best health insurance plan will help you protect your loved ones. Health insurance helps you financially if you are diagnosed with a life-threatening illness. Here are six tips for buying the best online health plans in India:

Reasons To Buy Health Insurance For Your Family

Choose a health plan that protects you from various health problems. It should provide benefits such as pre- and post-hospitalization costs, childcare costs, transportation, illnesses, illnesses that may be related to your family’s health history, etc.

When purchasing health insurance for your family, check the terms and conditions that apply to each member of your family.

The health insurance you choose must meet your needs and fit your budget. It is important to choose affordable insurance. In the beginning, choose a plan wisely that covers your basic medical needs. Later, you can update your package and add protection with premium features according to your income, family size and needs.

Individual health plans are suitable if you don’t have a family to support. When you buy health insurance for your family, it gives you more protection and benefits.

Know Why You Should Buy A Senior Citizen Health Plan For Parents

One of the most important features you should always keep in mind is a health insurance plan with a lifetime extension option. When purchasing a health plan, don’t forget to check the validity period of the policy and whether the policy uses a limited renewal period or not.

Check health insurance policies on various websites and compare quotes to make sure you buy the right health insurance plan. You can even request policy details online by entering your requirements on the website and getting a premium estimate for your policy.

After selecting the list of health insurance plans, check the list of hospitals included in the mediclaim. Look for the name of the hospital and doctor you like in the hospital network. Always choose an insurance company that has a wide hospital network worldwide or covers many hospitals.

As the COVID-19 pandemic continues, the number of deaths is increasing rapidly. Medical services and hospital care have become increasingly important due to COVID-19. The cost of medical services continues to rise, so it is better to be prepared with health insurance to cover your medical costs in case of an emergency.

Top Star Health Health Insurance Agents Near Shoppers Stop Chembur West

Choose a health insurance policy if you haven’t already. In times like these, it is important to have protection around you and your family. Purchase your health insurance from Canara HSBC Oriental Bank of Commerce Life Insurance. Health First Plan is a comprehensive health plan that offers protection against heart disease, cancer and other major critical illnesses.

This article is released in the interest of the general public and for general information purposes only. Readers are advised to exercise caution and not rely on the contents of the article as definitive. Students should research further or consult an expert on this matter.

Tags Term Insurance Life Insurance Lip Tax Savings Health Insurance Children’s Insurance Retirement Insurance Guaranteed Savings Plan College Tax Guaranteed Savings Plan Income4Life Plan

I agree that even though my contact number is registered with NDNC / NCPR, I still want the Company to contact me on the number and email id provided to get the product description/information I want and I agree that I have read and understood the Privacy policy. Policy and agree to comply with the same.

Buy How To Sell Health Insurance Paperback Book Fast English Language Kyun Aur Kaise For Health Insurance (pack Of 1 Book) Book Online At Low Prices In India

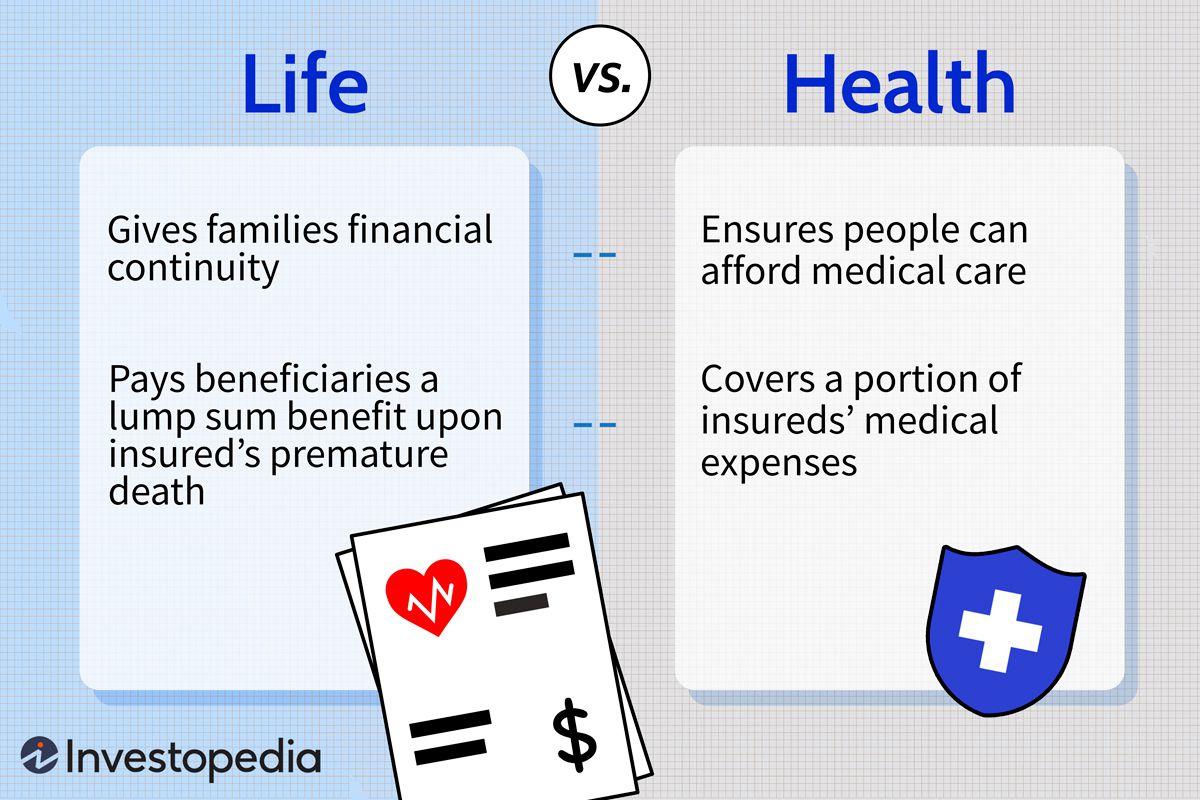

Health Insurance Plans Health Insurance For Families Benefits Of Health Insurance For Seniors Why You Should Buy Critical Illness Insurance 20 Short Term Health Insurance Plans The Difference Between Life Insurance And Health Insurance When To Buy Health Insurance The Difference Between Term Insurance And Health Insurance What Is Health Insurance What Is Insurance Comprehensive Health Health Insurance Covid-19 Accident Insurance for Knee Surgery in Saral Jeevan Bima Tips for Buying Health Insurance

I agree that even though my contact number is registered with NDNC / NCPR, I still want the Company to contact me on the number and email id provided to get the product description/information I want and I agree that I have read and understood the Privacy policy. Policy and agree to comply with the same.

I authorize the company to contact me via email, telephone, Whatsapp or any other means outside of my registration with NDNC/NCPR for product description/information. I have read, understand and agree to the Privacy Policy. With medical inflation increasing at around 15% every year [1], purchasing family health insurance is a smart decision. A family floating plan provides protection for you, your partner, children and dependent parents. However, some family health insurance plans may cover siblings, in-laws, and other extended family members.

Family health insurance benefits you in many ways, especially by providing much-needed funds for medical expenses. However, people often make mistakes in choosing a policy. With so many options available, it is important to consider the main factors that influence coverage and affordability.

Health Insurance Plans

To help you learn how to buy family health insurance and do it right, check out the following guide.

Before you start comparing offers, you need to know your needs. With medical costs increasing [2], you need a family health insurance policy that can provide protection whenever needed. Consider all the members in the policy and get the appropriate numbers. Note that while it is best to get a higher sum assured, you will have to pay a higher premium. Additionally, when comparing different premiums, conduct a thorough analysis of the coverage criteria. This way, you know exactly what you are paying for and can make an informed decision.

Many people do not see the validity of this policy. This is one of the key elements of any policy. Many health insurance companies offer insurance extensions up to age 60-65 years. Once you pass this age, you will not be eligible for the same policy and will have to purchase another, more expensive policy. This is why you should purchase family health insurance that provides lifetime extension. Provides protection against several age-related diseases [3], past retirement age.

Make sure the health plan you buy has a comprehensive family health insurance clause. Medical costs are not limited to hospitalization costs alone. They can cover doctor visits, hospital costs and more. Paying for these sudden expenses yourself can be difficult. Additionally, look for the right coverage benefits for your family. For example, if you are newly married and want to start a family, look for a health plan that covers pregnancy expenses.

Health Insurance: I Have Pre Existing Diseases. Should I Buy Health Insurance For My Spouse And Myself Separately?

Likewise, if any member of your family requires regular OPD maintenance, look for a policy that covers the cost. Comprehensive plans provide comprehensive coverage and cover pre- and post-hospitalization costs. Additionally, many family health insurance policies offer additional benefits. Policies with additional benefits such as free health check-ups, telemedicine services, and free doctor consultations are something to look out for.

Most family health insurance policies have a waiting period, which means you won’t receive reimbursement until that time period has passed. This is a common condition for pre-existing disease, lasting between 2 and 4 years. So, when choosing a policy, look for the policy with the smallest term. Additionally, be sure to declare all medical conditions to the insurance company, as otherwise, they may deny the claim.

Consider deductibles, copayments, hospital networks, and exclusions. Health insurance plans often have limits on room rental, ICU and other costs. Sub-limits also apply to OPD charges, maternity cover, organ transplant charges, AYUSH treatment and home care charges. This, along with a co-payment clause, is a percentage of the costs you will have to cover. Ideally, you want to pay as little as possible for treatment.

Network hospitals are another benefit to look out for. This is a hospital affiliated with an insurance company. At these institutions, you can get cashless claim payments, making the entire process smoother compared to reimbursement.

Why Should Millennials And Gen Z Buy Health Insurance?

Although family health insurance plans are comprehensive, some policies do not cover expenses such as OPD treatment, medical check-ups, cosmetic treatments, plastic surgery, and injuries due to military conditions. This is known as a policy exception. Read the policy text to find out what is covered and what is not included before purchasing the plan.

These tips will help you find the best policy for your family. When comparing family health insurance, make sure you look at the claims

Buy international health insurance, buy health insurance online, buy temporary health insurance, buy personal health insurance, buy short term health insurance, buy health insurance texas, buy health insurance ohio, buy health insurance leads, buy health insurance now, buy family health insurance, buy health insurance florida, buy small business health insurance