Car Ins – Car insurance is a legal requirement, but many don’t know what other policies mean for them and their cars. We’ve broken down the different types of car insurance, and who will benefit from each policy to choose your car insurance policy that you can feel comfortable with.

Liability insurance is the minimum amount of insurance you need to drive legally. This type of policy covers the other party and their vehicle in an accident that is believed to be your fault. For example, if you accidentally hit someone, and all of your cars are damaged, the tort policy will pay for the damage to their car, but not the damage to you. Liability usually comes at a cheaper price than other car insurance policies, but there is also the risk of not having your person and car covered in the event of an accident that you cause.

Contents

- Car Ins

- Car Insurance Basics

- Best Car Insurance Companies 2023

- Some Auto Insurance Companies Are Asking For Double Digit Rate Hikes. Here’s The List.

- How To File A Car Insurance Claim

- Californians Say Car Insurance Harder To Get

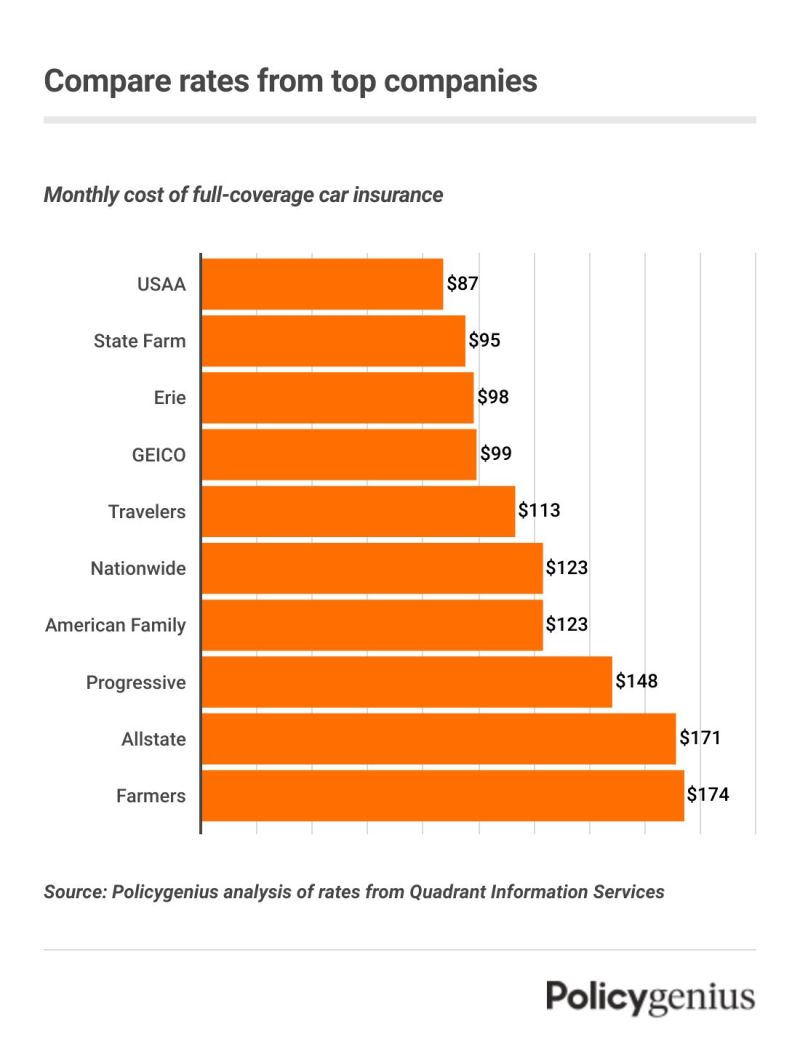

- Cheapest Car Insurance Companies (december 2023)

- How Much Does Car Insurance Cost?

- Feeling Pinched By Car Insurance Premiums? Here Are Some Ways To Save

- Car Insurance Mistakes

- Gallery for Car Ins

- Related posts:

Car Ins

Comprehensive and Collision Insurance, commonly known as comprehensive coverage, is not required by law, but offers several benefits to policyholders. Similar to liability insurance, if you cause a car accident, your insurance will cover the damage done to the other party, AND it will also cover any injuries you may have as well as any damage done to your vehicle. This type of policy also covers accidental damage to your vehicle such as hail and theft. Although these policies are often less expensive than liability policies, they come with added peace of mind that you and your vehicle will be protected in the event of an accident.

Car Insurance Basics

Liability insurance may be a good option for experienced drivers who may not cause accidents or anyone who needs a low monthly payment. Everyone can benefit from Comprehensive and Collision insurance, but it is especially important for inexperienced drivers who are at risk of causing an accident. It is also beneficial for the owners of cars that are expensive to maintain.

Not only is it illegal to not have car insurance, but it also puts you and others at risk. To get the best deal on your car insurance as well as expert guidance on choosing the perfect policy for you, contact us to get in touch with one of our insurance agents. However, choosing a deductible is one of the most important things to consider when comparing auto coverage. High-deductible auto insurance policies lead to different financial results than low-deductible policies.

Read on to learn more about how insurance premiums are deducted and how to choose the right premium for you.

The deductible is the amount you pay out of pocket before your insurance carrier starts paying for repairs. You must pay the deductible each time you file a claim. Let’s think about the basics of deductible insurance and how it works.

Best Car Insurance Companies 2023

For example, if you have $3,000 in repairs and a $1,000 car insurance deductible, you will be responsible for paying $1,000. After paying the deductible, the insurance company will pay the remaining $2,000. But, you’ll pay the entire bill if the repairs cost less than the deductible.

Not all types of insurance coverage have a deductible attached to them. Generally, deductibles apply to collision, comprehensive, uninsured/underinsured motorist, and personal injury coverage.

You can choose your deductible when purchasing your project. Policies with low deductibles have higher premiums but lower out-of-pocket costs if you file a claim. And policies with higher deductibles have lower insurance premiums but higher out-of-pocket costs if you file a claim.

You pay the deductible when you file a claim with the insurance company. The carrier covers the amount that exceeds the deductible.

Some Auto Insurance Companies Are Asking For Double Digit Rate Hikes. Here’s The List.

Deductibles apply to some types of car insurance coverage but not to others. Collision, total, property damage for the uninsured driver, and personal injury coverage usually have deductibles attached to them. You will pay the deductible each time you submit a claim in this coverage area.

You can skip filing a claim to avoid the deductible, but you have to pay the entire repair bill.

If the other driver is at fault for the accident, the driver’s insurance company is responsible for paying the cost of repairing your car, and you don’t have to pay the deductible if you have your car repaired.

The average car insurance deductible is $500. However, the cost of car insurance can vary from a few hundred dollars to $2,500. No matter what amount you choose, such as $250, $1,000, $1,500, etc., make sure you can afford it if needed. to file an application.

How To File A Car Insurance Claim

When choosing a deductible car insurance policy, follow these six steps to find the best deal for you and your wallet.

There is a clear relationship between your insurance deductible and the amount you pay for your project. Plans with lower deductibles usually have higher monthly premiums and vice versa. But if you choose a plan with a high deductible to get a low insurance rate, you will pay more out of pocket if you file a claim.

It’s better if you want to avoid a big bill after filing a claim, but your monthly payments will go up

When comparing auto insurance policies, looking at the price difference between plans with high and low deductibles is a good place to start. But remember that your total cost will vary depending on how you submit a claim. It’s best to run a variety of calculations and compare your out-of-pocket expenses if you file no claim, one claim, or two claims.

Californians Say Car Insurance Harder To Get

In the following hypothetical scenario, the driver will save $1,116 per year if he has a high deductible policy and does not make any claims. But if a driver files two claims that year, the low-deductible plan saves them $384 in out-of-pocket expenses.

In general, drivers who have access to auto insurance like this will have a lower cost with a high-deductible auto insurance plan. Fortunately, drivers who don’t file a claim often save with a plan with a higher deductible. However, if you choose a plan with a high deductible, you bet that you will not have an accident.

When considering the possibility of filing a claim, ask yourself if you have a history of car accidents or engaging in high-risk driving behaviors such as speeding or speeding.

Depending on where you live, many insurance companies will only pay up to the actual amount of your car’s value if the insurer declares it a total loss. So, it is usually better to have a lower deductible if your car is not in the best shape.

Cheapest Car Insurance Companies (december 2023)

For example, let’s say your car is worth $3,500, and you have a deductible of $1,500 on your insurance. If your car is totaled, the insurer will only pay $2,000 after you cover the deductible.

On the flip side, if your car is worth $10,000 and you have a $1,000 deductible, the insurance company will pay $9,000.

You need to calculate how much your car is worth. Then compare the value and cost of your insurance. And remember, you don’t have to choose the same deductible for every coverage you have. An insurance agent can help you mix and match deductibles based on the value of your car and the risks you face.

If you have a car accident, you need to pay the deductible before the insurance company starts covering the repairs.

How Much Does Car Insurance Cost?

If you don’t have savings or an emergency fund to cover a high deductible, it may be better to choose a low-deductible policy. High monthly bills for insurance premiums can be a better way to protect your money in the event of an accident.

Choosing a high-deductible plan is a risk-free car accident. If you have an accident with a high deductible policy, you are still covered. But you will pay more out of pocket after an accident than if you have a low-deductible policy.

Jennifer Brozic is an author who specializes in helping people make smart financial decisions. His areas of expertise include insurance, lending, credit management, budgeting, financial planning and more. Before starting her own freelance writing business in 2010, she spent nearly 10 years helping businesses in the financial services and insurance industries build their brand, promote strategic initiatives, … Read more about Jennifer Brozic

Fast Facts About the Car Buying and Selling Market Last year, car buying was struggling, and dealers were holding all…

Feeling Pinched By Car Insurance Premiums? Here Are Some Ways To Save

Fast Facts About Federal Incentives for Electric Vehicles Consumers considering a new electric vehicle or plug-in hybrid may want to…

Quick Facts About Turo A peer-to-peer car sharing marketplace that allows car owners and enthusiasts to rent their cars to others on…

Ford will win the supertruck war in 2024, when Ram bows out. Ford announced the power…

Kia has recalled 2,300 Seltos SUVs from the 2024 model year and Soul small hatchbacks from the 2023 model year because… No one likes to think about car accidents, but they happen to drivers.

Car Insurance Mistakes

Car ins companies, best car ins, statefarm car ins, car ins comparison sites, budget car ins, car ins near me, state farm car ins, car ins quotes online, car ins compare, cheap car ins quotes, car ins. companies, affordable car ins