Car Insurance Coverage – Affiliate Content: This content was created by a business partner of Dow Jones and was independently researched and written by the newsroom. Links in this article may earn us a commission. Learn more

Florida auto insurance costs are higher than other states. Learn more about average auto coverage rates in the Sunshine State

Contents

- Car Insurance Coverage

- What Is Full Coverage Car Insurance?

- How Age Affects Rates: How Insurance Coverage Varies For New And Used Cars

- Free Car Insurance Calculator: Instant Cost Estimates

- Things To Know About Auto And Car Insurance

- What You Need To Know About Out Of State Car Insurance

- How Much Car Insurance Do I Need Under The New Michigan No Fault Law?

- Average Cost Of Car Insurance (2024)

- Does Car Insurance Cover Side Mirror Damage?

- Comprehensive Coverage: Florida Car Insurance 101

- Gallery for Car Insurance Coverage

- Related posts:

Car Insurance Coverage

By: Daniel Robinson By: Daniel Robinson Writer Daniel is a Writer for Guide Group, specializing in automotive finance and car care topics for a number of automotive news sites and marketing companies in the US, UK and Australia. Daniel is the Guide team’s authority on car insurance, loans, warranty options, car services and more. Writer

What Is Full Coverage Car Insurance?

Editor: Rashawn Mitchner Editor: Rashawn Mitchner Managing Editor Rashawn Mitchner is a Group Editor for Guides with over 10 years of experience covering personal finance and insurance topics. Senior editor

Florida drivers pay some of the highest auto insurance rates in the nation. In this article, our Guide Team reviews the average cost of car insurance in Florida for different driver profiles. We also researched the best car insurance companies to highlight the best and cheapest providers in the Sunshine State.

Florida Car Insurance Terms Cheapest Florida Car Insurance Tampa Florida Cheap Car Insurance Jacksonville Cheap Car Insurance Miami Florida Average Cost of Florida Car Insurance

The Guide Team is committed to providing reliable information to help you make the best decision about your car insurance. Because consumers rely on us to provide objective and accurate information, we’ve created a comprehensive rating system to rank the best auto insurance companies. We collected data on dozens of car insurance providers to rate the companies on a wide range of rating factors. After 800 hours of research, the final result is an overall rating for each provider, with the highest rated insurance companies at the top of the list.

How Age Affects Rates: How Insurance Coverage Varies For New And Used Cars

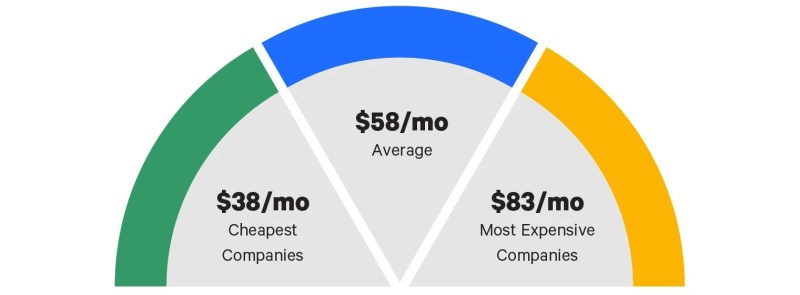

Florida is one of the most expensive states for car insurance. Quadrant Information Services estimates Florida drivers pay $115 per month or $1,385 per year for minimum coverage. That’s more than double the national average for minimum coverage, which is $52 per month or $627 per year.

When it comes to comprehensive insurance coverage, drivers in the Sunshine State pay an average of $270 per month, or $3,244 per year. That’s about 62% more expensive than the national average of $167 per month, or $2,008 per year.

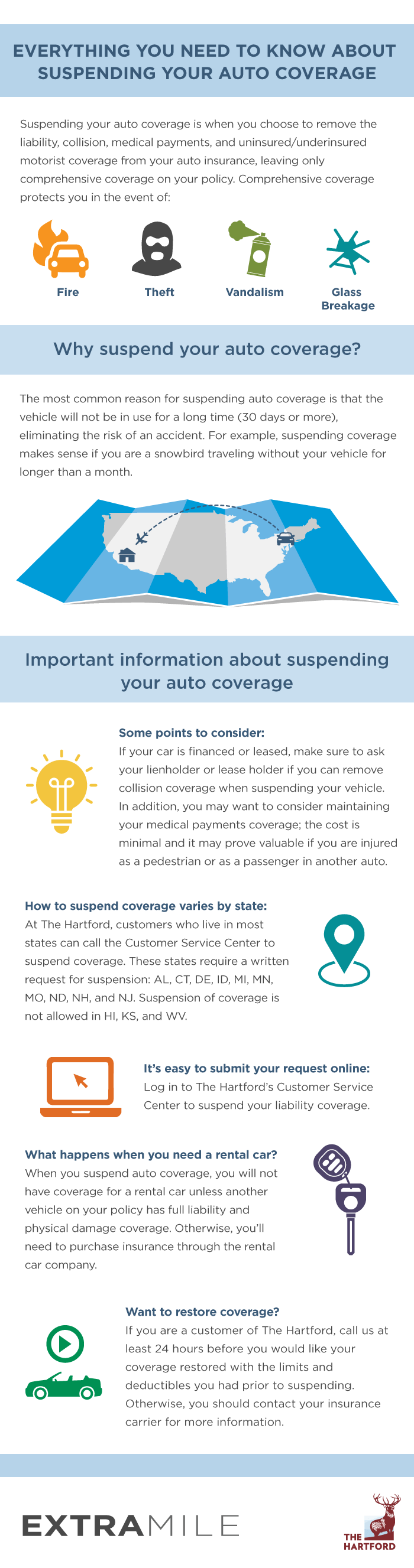

Florida is a no-fault state, meaning that regardless of who caused the accident, each driver’s insurance will cover medical expenses for them and their passengers. Florida is one of the few states that does not require personal injury liability coverage.

It should be noted that property damage liability coverage only pays for damage to someone else’s vehicle. For this reason, many Florida drivers choose to purchase comprehensive insurance policies that include collision coverage and comprehensive insurance coverage.

Free Car Insurance Calculator: Instant Cost Estimates

Collision coverage pays for damage to your vehicle in an accident, while comprehensive coverage protects your vehicle from natural disasters, theft, and acts of vandalism.

When compared to other states that you can compare by state in our auto insurance rate article, auto insurance in Florida is generally more expensive, with some providers offering lower average rates than others. The average price below is for a 35-year-old motorist with a clean driving record and good credit, unless otherwise stated.

State Farm, Geico and Travelers also have some of the lowest comprehensive insurance rates in Florida. However, even the cheapest comprehensive coverage option in the state costs more than the national average.

The city you live in has a significant impact on how much you pay for car insurance. Here’s a look at average car insurance rates for different sizes in Florida cities. These rates are for 35-year-old drivers with good credit and a clean driving record – from Geico, State Farm and Travelers.

Things To Know About Auto And Car Insurance

Floridians who have been involved in an accident, speeding or driving under the influence (DUI) pay significantly higher insurance rates than those with a clean driving record.

The lowest average rates are for drivers speeding 16-20 miles per hour over the posted speed limit. State Farm offers the cheapest comprehensive insurance for drivers in this situation.

State Farm also offers the most affordable single-accident comprehensive coverage for Florida drivers. Geico and Travelers are not far behind, but rates rise steadily from there.

State Farm offers relatively inexpensive auto insurance for Florida drivers with a DUI record. The company’s rates for these high-risk drivers are significantly lower than other providers on this list.

What You Need To Know About Out Of State Car Insurance

Comparing quotes from multiple vendors is one of the best ways to find cheap car insurance, but it’s not the only way to save money on auto insurance.

Drivers in Florida pay the average insurance premium across the country. The state’s minimum liability requirements are also very low, meaning drivers in the state may want to purchase comprehensive insurance policies that include collision and comprehensive coverage to ensure they are fully protected.

Auto insurance comparison is the best way to find quality coverage and the best rates to meet your Florida auto insurance needs. We recommend checking out State Farm and Geico to start your search.

Our review team awarded State Farm the “Best Customer Experience” award for its combination of coverage options, affordable prices, and excellent industry reputation. In addition to standard auto coverage options, the company offers additional options such as shared travel insurance, uninsured motorist coverage, and trip interruption benefits when you have a covered breakdown away from home.

How Much Car Insurance Do I Need Under The New Michigan No Fault Law?

State Farm’s telematics insurance program, called Drive Safe & Save™, tracks your driving activity through a mobile app. Safe habits like slow acceleration and slow braking can save you up to 30% when you renew your policy.

Geico earns our recommendation by offering comprehensive auto insurance and maintaining a reputation for strong customer service. The company has higher coverage limits than many of its competitors.

Geico is also known for its variety of discounts, including bundles, safe drivers, military members, federal employees, and more. The company’s usage-based DriveEasy™ program can save you up to 10% on policy renewals.

The average monthly cost of car insurance in Florida is $115 for minimum liability and $270 for full coverage. Auto insurance rates in Florida are higher than the national average, at $1,385 for minimum coverage and $3,244 for full or complete coverage.

Average Cost Of Car Insurance (2024)

No. The state only requires $10,000 for personal injury coverage and property damage liability coverage. The 100/300 plan covers $100,000 per person for bodily injury and $300,000 for accident. This provides more coverage, but will be higher than Florida car insurance requirements.

According to Quadrant Information Services, 25-year-old Florida drivers with clean records pay an average of $302 per month, or $3,624 per year, for a comprehensive auto policy. Younger drivers typically pay more for coverage, but as drivers get older and more experienced, costs begin to level off.

To meet the state’s minimum liability insurance requirements, you must have at least $10,000 in personal injury protection (PIP) and property damage liability insurance. Make sure you follow these restrictions to avoid any penalties associated with driving without insurance or as an uninsured driver.

Because consumers rely on us to provide objective and accurate information, we’ve created a comprehensive rating system to rank the best auto insurance companies. We collected data on dozens of car insurance providers to rate the companies on a wide range of rating factors. The final result is an overall rating for each provider, with the insurance companies with the highest scores ranked first.Partner content: This content is created by a Dow Jones business partner and is independent of the news department and carefully researched and write Links in this article may earn us a commission. Learn more

Does Car Insurance Cover Side Mirror Damage?

By: Daniel Robinson By: Daniel Robinson Writer Daniel is a Writer for Guide Group, specializing in automotive finance and car care topics for a number of automotive news sites and marketing companies in the US, UK and Australia. Daniel is the Guide team’s authority on car insurance, loans, warranty options, car services and more. Writer

Editor: Rashawn Mitchner Editor: Rashawn Mitchner Managing Editor Rashawn Mitchner is a Group Editor for Guides with over 10 years of experience covering personal finance and insurance topics. Senior editor

We at The Guide Team explain everything you need to know about car liability insurance – what it does and doesn’t cover, how much it usually costs and recommendations for liability insurance providers.

If you’re in the market for new car insurance, we’ve also reviewed and ranked the best car insurance companies.

Comprehensive Coverage: Florida Car Insurance 101

Cheapest car insurance Compare car insurance 10 largest car insurance companies in the United States average cost of car insurance

A team of guides will take place

Usaa car insurance coverage, personal car insurance coverage, good car insurance coverage, full coverage car insurance, veterans car insurance coverage, insurance coverage car, extended car insurance coverage, best car insurance coverage, compare car insurance coverage, car insurance collision coverage, medical coverage car insurance, liability car insurance coverage