Car Insurance Premium – You drive a modest vehicle. You will stay safe on the road by always obeying traffic signs, following the speed limit and keeping a safe following distance. You have driven your car without any major accident.

It’s a familiar story to American consumers, but there are ways to flip the script. There are ways to save money on car insurance. This requires an ongoing commitment to safety, attention to detail, living in the right area, and not being complacent with your spread.

Contents

- Car Insurance Premium

- Auto Insurance Climbing 5% In 2022. Where It’s Most, Least Expensive

- How Much Is Car Insurance For A 20 Year Old?

- What Is A Car Insurance Deductible?

- How To Lower Your Car Insurance Payments

- How Much Does Car Insurance Cost?

- How Much Does Car Insurance Cost? (2023 Rates)

- Compare Car Insurance Quotes For November 2023

- These Are The Top Five Factors That Influence Your Auto Insurance Rate

- Car Insurance Industry Statistics In 2023

- Insurance Premium Defined, How It’s Calculated, And Types

- Gallery for Car Insurance Premium

- Related posts:

Car Insurance Premium

According to Consumerreports.org, average annual auto insurance premiums have risen 23% nationwide since 2011. If your premiums continue to rise, there is no point in continuing to pay them without looking for a better option.

Auto Insurance Climbing 5% In 2022. Where It’s Most, Least Expensive

Regardless of what you’re buying, it’s always a good idea to check your competitor’s prices before handing over your wallet. You need to call several car insurance providers to ensure you get the best rates.

You can even enlist the help of an insurance agent on your behalf. An independent insurance agent sells insurance policies from several insurance companies. He can review different policies and highlight the ones that will save you the most money.

However, even with professional help, you may miss out on some savings as you will only be shown policies for those companies.

Whether you hire an agent or not, you should be looking for deals regularly. Annual discounts of several hundred dollars can sometimes be found.

How Much Is Car Insurance For A 20 Year Old?

Don’t be afraid to ditch your long-term insurer if it doesn’t offer quality service at a competitive price. However, overdoing it can backfire.

“It’s good to shop around for a better deal, but not every year,” said Matt Caswell, an independent insurance agent in Dunedin, Florida.

“It sends a flag that you’re not loyal. They’ll recognize it. If you have a good carrier, it’s probably not worth it in the long run to jump on it to save a little money.

Instead of the usual $250 or $500 deductible, ask for a $1,000 or $1,500 deductible that lowers your premiums.

What Is A Car Insurance Deductible?

“Always try to maximize your deductibles,” Caswell said. “You will not have accidents, or you will not have accidents. The money saved over the years will pay for that deductible (in the event of an accident).

Of course, accidents happen, so if you plan to increase your deductible, make sure you have enough money to cover expenses in the event of an accident.

Some people prefer the idea of paying higher premiums, knowing that it will cost more in the long run. They like the peace of mind of knowing they won’t have to look for cash in an emergency.

Consider allocating $1,000 to $1,500 toward your deductible if necessary. Then you can take advantage of lower premiums without worrying that an accident could leave you in the red.

How To Lower Your Car Insurance Payments

Combining auto and home insurance can save you time and money if done right. Discounts range from 5% to 25% of your rewards.

Bundling gives you the convenience of managing your insurance policies in one place. If something happens that damages your home and your car, such as a major flood or storm, you can often file a single claim for both properties. You may even be able to avoid paying a single deductible. It’s much easier than calling multiple insurance companies to file multiple claims, plus dealing with what caused the claim.

But don’t assume you’ll save money with the kit. One big disadvantage of bundling is that it can keep you from buying bargains. When the insurance company shoves discounts in your face, it can be difficult to hit the brakes on a direct deal. You want to take advantage of the savings, but of course, the savings aren’t going anywhere. They will still be there if you decide to go back after exploring other options.

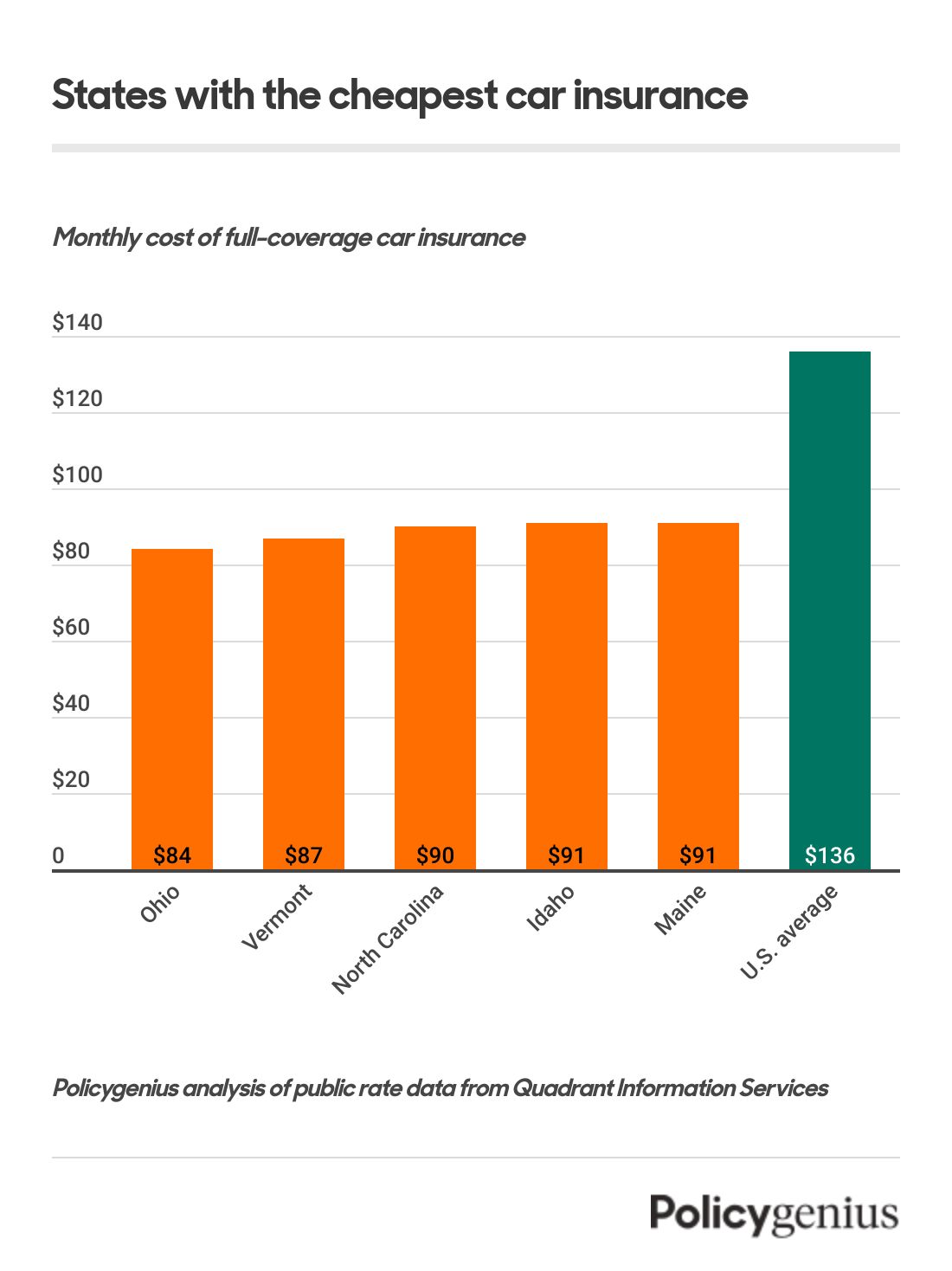

Your zip code can reveal a lot about your risk factors, which can affect your rates. Car insurance companies don’t like high population density in big cities. This leads to congestion, which leads to more accidents and more claims. That’s why you pay more for car insurance when you live in the city than in the suburbs.

How Much Does Car Insurance Cost?

Insurance companies are also not immune to crime in your area. If your neighborhood is prone to car thefts and vandalism, your rates will go up. If the roads in your city are full of potholes, your prices will skyrocket. If you live in an area known for harsh winters or severe environmental disasters, your rates will reflect that.

Unless you live in Hawaii, California or Massachusetts, your credit score affects your premium rate.

A higher credit score indicates reliability and a lower chance of fraudulent insurance claims, qualities valued by all insurers.

If you want to improve your credit score, you need to keep up with your monthly payments. It is the most important factor in calculating your credit score and accounts for 35% of it. Even if you can only make small payments on your loan, it will be enough to keep your credit score from falling. A minimum payment is always better than no payment at all.

How Much Does Car Insurance Cost? (2023 Rates)

And don’t think it’s okay to max out a credit card just because you pay it back on time every month. You will damage your credit.

The amount you owe is 30% of your credit score. If you max out your credit card every month, you’re signaling to the credit bureaus that you’ve overpaid and may need the money.

For the best credit score, use no more than 30% of your available credit limit on each of your credit cards, and remember to monitor your credit report. Every 12 months, every office gets one free. This means you can contact Experian, TransUnion and Equifax and request a free copy of your credit report. You can order them all at once for comparison, or split them up every few months for a free review.

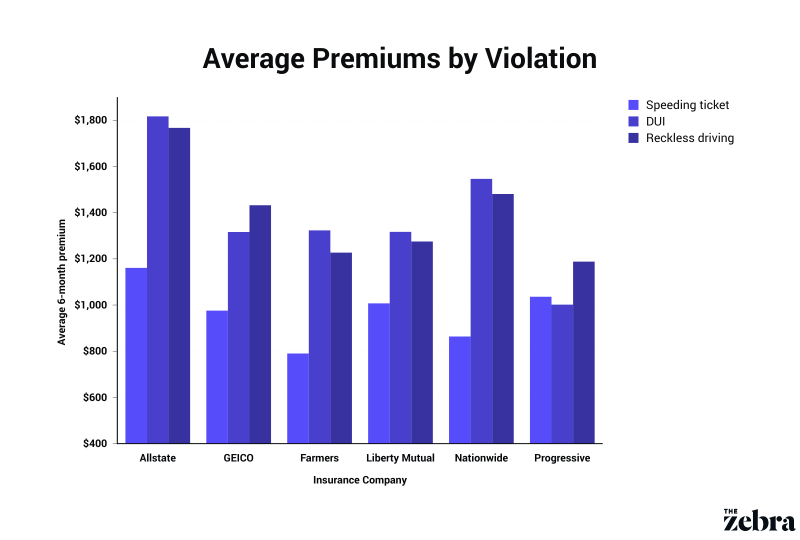

The more moving violations you accumulate, the higher your premiums will be. A moving violation is any law that a driver breaks while a vehicle is in motion. Driving through red lights, ignoring stop signs and drunk driving are considered traffic violations.

Compare Car Insurance Quotes For November 2023

Parking violations don’t increase your rates, so if you get a parking ticket, you don’t have to worry about dealing with your insurer. Equipment violations, such as a broken taillight or a missing rearview mirror, also do not cost more.

The amount you can save varies from company to company, but in general, a longer period without moving violations results in more savings.

Ask about other discounts you may be eligible for. It shouldn’t take long to run through the background and check eligibility. Some discounts may require documentation such as a report card or telemetry picture before taking effect.

Car insurance premiums aren’t just going up, they’re skyrocketing. Since 2011, the average annual insurance premium has increased by more than 20%.

These Are The Top Five Factors That Influence Your Auto Insurance Rate

There are many factors that go into calculating your premium rate. Insurance is meant to cover the costs of accidents. It pays for hospitalizations, which are more expensive than ever. The average cost of a hospital stay has risen 10% since 2010 to $10,700.

If you’re in the hospital after an accident, your car might not be in the best shape either. Insurance companies have to replace damaged cars, and the cars that come out today are more expensive than the ones we drove 10-20 years ago.

Another factor exacerbating the above two points: distributed management is on the rise. It seems we can’t stop looking at our smartphones even when we’re driving down the highway. According to the National Highway Traffic Safety Administration (NHTSA), texting is the most distracting:

“Texting or reading takes your eyes off the road for five seconds,” Caswell said. “55 miles per hour is like going the length of a football field with your eyes closed.”

Car Insurance Industry Statistics In 2023

Distracted driving leads to more accidents, which leads to more claims. The more claims in your area, the more you pay for car insurance.

Insuring a gender teenager means an average annual increase of 79% in your car insurance premium. What about boys? That’s a whopping 92% increase!

Many parents tell their kids that if they want to buy a car, get them a job to insure it. It’s not a bad idea, but don’t let the high cost of youth insurance scare you. The above strategies will help reduce the cost to something reasonable.

Balancing the budget helps further reduce costs. It helps to know where and where your money is coming from

Insurance Premium Defined, How It’s Calculated, And Types

Car insurance premium compare, car insurance premium renewal, car insurance premium increase, online car insurance premium calculator, low premium car insurance, why car insurance premium increase, car insurance premium rates, premium car insurance, reduce car insurance premium, lowest car insurance premium, car insurance renewal premium calculator, car insurance premium calculator