Car Insurance Usa – Auto insurance protects you financially by paying for the other driver’s car repair and medical bills if you cause an accident. Depending on the type of coverage you have, you may also pay to repair or replace your car if it is damaged or stolen.

Texas has a Consumer Bill of Rights for auto insurance. Your insurance company will give you a copy of the claim form when you accept or change the policy.

Contents

- Car Insurance Usa

- What You Need To Know About Car Insurance In The Usa

- Amazon.com: Besulen Car Registration Insurance Holder, Usa American Flag Wallet Driver License Case For Cards Documents, 2 Pack Pu Leather Auto Glove Box Organizer (red)

- Usa Insurance Company.jpg

- Cheap Car Insurance With Tickets: What You Need To Know

- How Much Auto Insurance Do You Need?

- Car Insurance Policies Are Changing: What To Know

- Best Car Insurance Company In Usa 2023 24

- How Do Insurance Companies Find Out About Accidents In Usa? (full Process)

- Top Auto Insurance Companies In The Usa For 2023

- How To Save Money On Car Insurance

- Gallery for Car Insurance Usa

- Related posts:

Car Insurance Usa

Texas law requires drivers to show proof that they can pay for accidents they cause. Most drivers do this by purchasing auto liability insurance. Liability insurance pays to repair or replace a driver’s car, or other property that is damaged, and pays for the medical expenses of other people if you are at fault in an accident.

What You Need To Know About Car Insurance In The Usa

If you still owe money on your car, your lender will require you to have accident and comprehensive coverage.

Learn more: 10 steps to finding the right car insurance | See: What kind of car insurance do you need?

Learn more: Do you need additional uninsured motorist coverage? | See: What are the different types of car insurance?

Most policies cover you, your family, and people who drive your car with your permission. Ask your agent or read your policy to find out who your policy covers and if anyone is excluded from coverage.

Amazon.com: Besulen Car Registration Insurance Holder, Usa American Flag Wallet Driver License Case For Cards Documents, 2 Pack Pu Leather Auto Glove Box Organizer (red)

Policy recommendations vary and depend on the type of coverage you choose. This table shows some of the things that most policies do and don’t cover. Read your policy or talk to your agent to verify your exact coverages.

Damage to your vehicle due to fire, hail, theft, flood, flying gravel, or being hit by an animal (if you have adequate coverage)

Accidents that occur while driving for a long-haul service or delivering food or other goods for a fee.

Accidents that occur while driving a vehicle that is not yours but may be used regularly, such as a company car.

Usa Insurance Company.jpg

Car repairs, lost wages, and medical and funeral expenses to other drivers and passengers in the event of an accident

When you get a new car, your current insurance will automatically cover you for about 20 days. The type of coverage depends on whether the vehicle is an addition or a replacement vehicle.

Tell your company about a new car as soon as you can to avoid losing coverage.

Rental cars. Rental companies offer damage waivers and liability policies. Damage prevention is not a guarantee. This is an agreement that the rental company will not compensate you for damage to a rented car.

Cheap Car Insurance With Tickets: What You Need To Know

You may not need the rental company’s liability policy. Your own auto policy will usually cover you while you are driving a rental car for personal use. Ask your agent if your policy covers you when you drive a rental car for work.

Before you rent a car, ask your agent if you need the rental company’s liability policy and damage exclusion.

Borrower cars. If you cause an accident while driving a borrowed car, the car owner’s insurance pays the claim. If the owner doesn’t have insurance — or doesn’t have enough to cover the damages and injuries you cause — your insurance will pay.

If you don’t own a car, but regularly borrow a car, you can buy a non-owner’s liability policy that pays for damages and injuries you cause to other people while driving a rented car. It does not cover your injuries or damages to the vehicle you are driving.

How Much Auto Insurance Do You Need?

If you rent a car from a repair shop, your insurance policy will pay for damages to the car. It will also pay for other people’s injuries and damages if you are at fault in the accident. Check your liability limits to make sure they are sufficient to cover damages.

Mexico does not recognize American car policies. Some companies provide permits for short trips to Mexico, but the area may not meet Mexican legal requirements. If you drive in Mexico, you must purchase a Mexican liability insurance policy. Some agents in Texas sell them. Your agent can help you find a suitable agent.

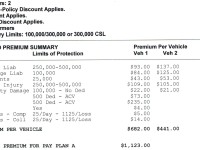

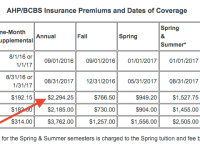

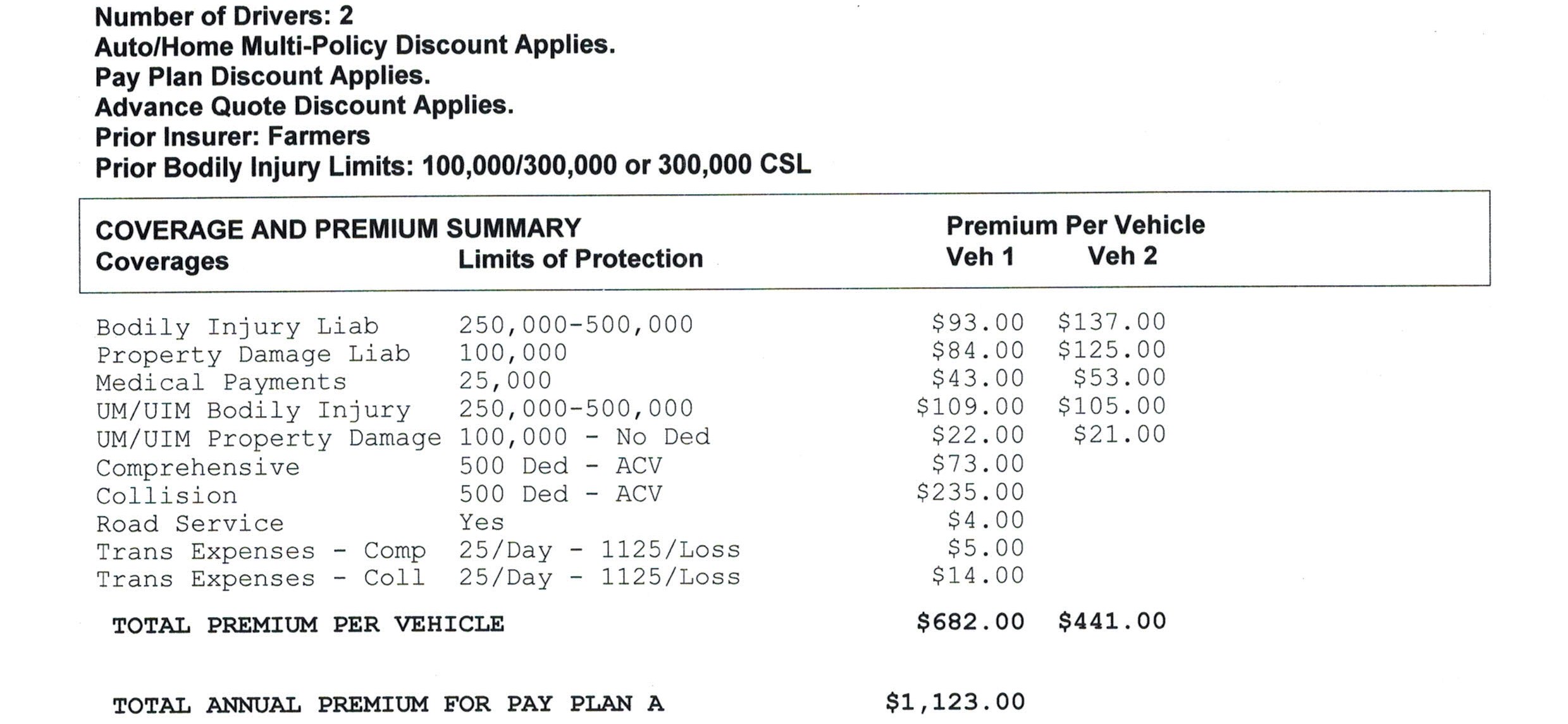

You must pay deductibles for accident, comprehensive, and uninsured/underinsured motorist claims. Deductible is the amount called that you must pay yourself. For example, if you have a $1,500 accident claim and your policy has a $500 accident deductible, the insurance company will deduct $500 from your claim amount and pay you $1,000. Another driver’s insurance company.

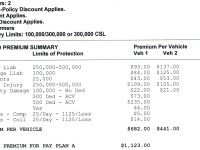

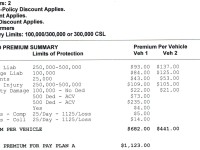

Liability, personal injury coverage, motor vehicle breakdown/impairment, towing and service, and rental coverage have dollar limits. This is the biggest bill of the company, although the price is high. If you don’t have enough coverage, you’ll have to pay the difference yourself. Accident and comprehensive coverages have no dollar limits.

Car Insurance Policies Are Changing: What To Know

The first page of your policy is the declaration page. It contains a summary of your policy, including its coverages, dollar limits, and deductibles.

You have two options to cover your young drivers. You can add them to your policy, or you can buy a separate policy for them. Adding it to your policy is often cheaper.

Some companies require you to include everyone who lives with you and is of driving age on your policy. Tell your company when someone in your family starts driving or turns 16. If you don’t tell the company, and the company finds out about it later, the company will pay you for additional premium you have to pay. The Company may also waive any rights you may have or choose not to renew your policy.

If a young person is the first driver of a car, the company will determine the cost of the car. However, the company will base the young man’s premium on the family car with a higher rate.

Best Car Insurance Company In Usa 2023 24

Some companies require you to keep young drivers on your policy, even if they are out of school. Tell your insurance company if you have a child who lives in another city for school. If your child has a car, the company may charge you differently because the rates depend on where the car is usually located. If your child does not own a car, you may get a discount on your taxes. If your child attends school in another state, check the state’s laws to make sure you have adequate liability coverage.

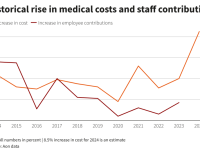

Texas law requires insurance companies to charge rates that are fair, reasonable, and adequate for the risks they cover. We do not approve the fees in advance, but if we find that the insurance company’s prices are too high, we can ask you to reimburse the people who overcharged. Insurance companies can appeal our decisions.

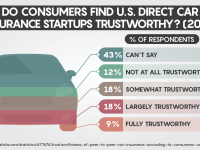

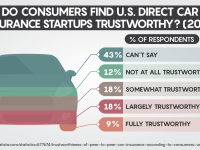

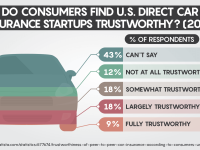

Insurance companies use a process called underwriting to decide whether to sell you a policy and how much they will pay you. The amount you pay for insurance is called the Premium.

Learn more: Learn how to calculate auto and homeowner’s insurance costs | How your credit score affects your insurance rates

How Do Insurance Companies Find Out About Accidents In Usa? (full Process)

Most companies use the Initial Claims Loss Exchange (CLUE) to determine your claims history. The company may charge you more or refuse to sell you a policy based on the information in your CLUE report. You get a free copy of your report every year. Call LexisNexis at 866-312-8076.

Discounts can help lower your taxes. Each company decides what kind of discounts to offer and the amount of the discount. You can get a discount if you have:

Learn more: How to drive to save money on car insurance | See: How to compare car insurance rates

When you ask, a company must tell you in writing why your policy was denied, canceled, or not renewed. You can file a complaint with us if you think a company has unfairly rejected, canceled, or not renewed its policy.

Top Auto Insurance Companies In The Usa For 2023

Cancellation means that you or the insurance company stop coverage before the expiration date of your policy. A company must give you 10 days notice before you can cancel your policy. A company can cancel its policy in the first 60 days for any reason, unless the cancellation violates a law.

If you or the company cancels your policy, the company must pay you any uncollected premiums within 15 days after the date of cancellation. Unearned premium is the amount paid in advance that does not go into the region. For example, say your taxes are $100 a month and you pay them six months in advance. If you cancel your policy after one month, the company will owe you $500 in lost premium.

Non-renewal means that the company refuses to renew your policy when it expires. A company must tell you in writing that it will not change its policy. You must be notified at least 30 days before your policy expires.

A company can only renew its policy after it has been in operation for 12 months. This means that if you buy a six-month policy, the company cannot refuse to renew it when the first six months are up. . It must be renewed to give you a full twelve months of coverage.

How To Save Money On Car Insurance

The company cannot refuse to renew your policy because of your age. It will not renew your policy

Car insurance comparison usa, temporary car insurance usa, car insurance quotes usa, best car insurance usa, car insurance calculator usa, expat car insurance usa, car excess insurance usa, car rental insurance usa, cheapest car insurance usa, car hire insurance usa, insurance car usa, car insurance cost usa