Cheap Life Insurance – If you use the Galaxy Fold, you can consider unfolding your phone or viewing it in full screen to best optimize the experience.

Advertiser Disclosure Many of the offers displayed on this page come from companies from which The Motley Fool receives compensation. This compensation may affect how and where products appear on this site (including, for example, the order in which they appear), but our reviews and ratings are not affected by the compensation. We do not cover all companies or all offers on the market.

Contents

- Cheap Life Insurance

- Insurance For Newly Wedded Couples

- Globe Life Insurance Review 2023: Pros And Cons

- The Affordable Safety Net: Exploring The Benefits Of Cheap Term Life

- Reasons Why Life Insurance Is Important By Prowe Insurance Solutions

- Buy Cheap Life Insurance Online Buy Cheyenne, Wyoming

- Is Life Insurance Worth It?

- Colonial Penn Life Insurance Review

- Life Insurance Incontestability Clause (terms Explained)

- Gallery for Cheap Life Insurance

- Related posts:

Cheap Life Insurance

Many or all of the products here are from our partners who reimburse us. This is how we make money. But our editorial integrity ensures that our expert opinions are not influenced by compensation. Terms and conditions may apply to the offers on this page.

Insurance For Newly Wedded Couples

Buying insurance is, among other things, about protecting your assets. Finding the best cheap life insurance also means making sure your beneficiaries have everything they need in the event of your death. To help you navigate the sometimes confusing waters of life insurance, we’ve sorted through insurers to find which ones offer cheap life insurance with high levels of protection. Here are our picks for the best cheap life insurance.

4.00/5 I circle. Our ratings are based on a 5-star scale. 5 stars is the best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals fair. 1 star equals bad. We want your money to work harder for you. As such, our ratings are characterized by offerings that offer versatility while keeping costs down. = Best = Excellent = Good = Fair = Poor

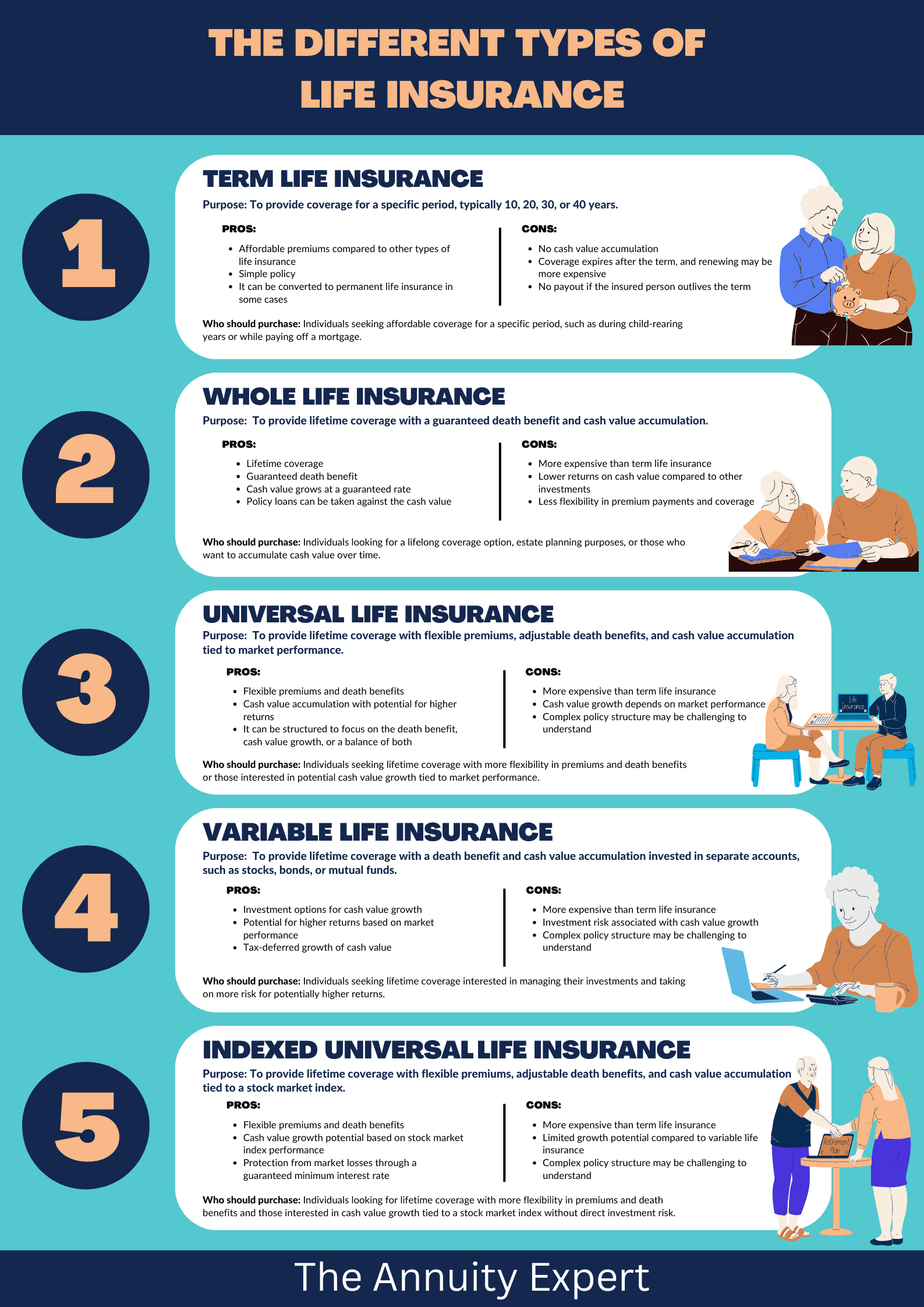

Banner Life offers two types of life insurance – term insurance and universal life insurance. With so few products, the company makes the process of buying insurance simple. It may not be suitable for someone looking to customize their policy, but it is a good option for those who want cheap and easy coverage.

The banner offers policy options up to age 85 and the prices are hard to beat. For example, a 35-year-old non-smoker can get $500,000 of life insurance for as little as $243 a year. For a 35-year-old non-smoking woman, that’s just $208 a year.

Globe Life Insurance Review 2023: Pros And Cons

Although the name “Protective” may not sound familiar, the company has been around since 1907 and offers impressive financial strength. I AM. Both Best and Fitch give Protective an A+ rating, which means the company has the financial ability to support its promises. In addition to term life insurance contracts, Protective offers full and universal life insurance. A wide range of rider options means policyholders can tailor their coverage.

Protective ultimately makes our “best of” list by offering low prices. For example, a 35-year-old non-smoker could pay as little as $252 a year for a $500,000 home. For a 35-year-old non-smoking woman, the premium drops to $216 per year. Applicants with a Costco membership can save up to 15% on their policy costs.

Mutual of Omaha is a household name and the company has strong customer satisfaction ratings. Like principal, Mutual of Omaha accepts applications for life insurance from adults up to age 80 (85 in New York). And like Protective, the company offers a wide range of rider options, such as unemployment benefit waivers and a rider for dependent children. These riders allow the policyholder to determine what types of coverage are most important to them and tailor the policy to their specific needs.

A 35-year-old non-smoker can get a $500,000 policy for just $312 a year. A 35-year-old non-smoking woman can buy the same coverage for just $266 a year.

The Affordable Safety Net: Exploring The Benefits Of Cheap Term Life

4.50/5 I circle. Our ratings are based on a 5-star scale. 5 stars is the best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals fair. 1 star equals bad. We want your money to work harder for you. As such, our ratings are characterized by offerings that offer versatility while keeping costs down. = Best = Excellent = Good = Fair = Poor

State Farm may be better known for auto and home insurance, but that’s one of the reasons it’s a great place to buy life insurance. In addition to a large network of personal insurance agents, J.D. The highest overall customer satisfaction rating in the industry, according to Power. Although State Farm life insurance rates are already low, it is possible to save more by combining life insurance coverage with other types of insurance.

A 35-year-old non-smoker could pay as little as $365 a year for $500,000 in life insurance. For a 35-year-old non-smoking woman, the annual premium is about $300

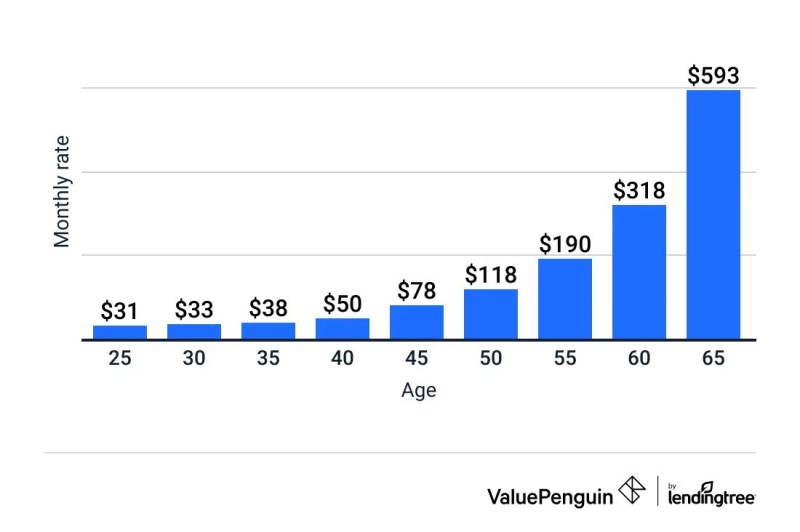

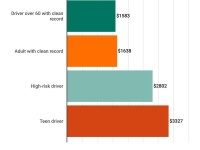

A healthy, non-smoking 30-year-old man might pay about $300 a year for $500,000. A female costs about $252. This means that the “average cost” of life insurance depends on several factors, such as age, gender, health and policy type.

Reasons Why Life Insurance Is Important By Prowe Insurance Solutions

For example, a healthy, non-smoking 50-year-old man might pay about $1,008 a year for a new life insurance policy with a face value of $500,000. Had he bought the policy when he was 20, his annual premium would have been about $312.

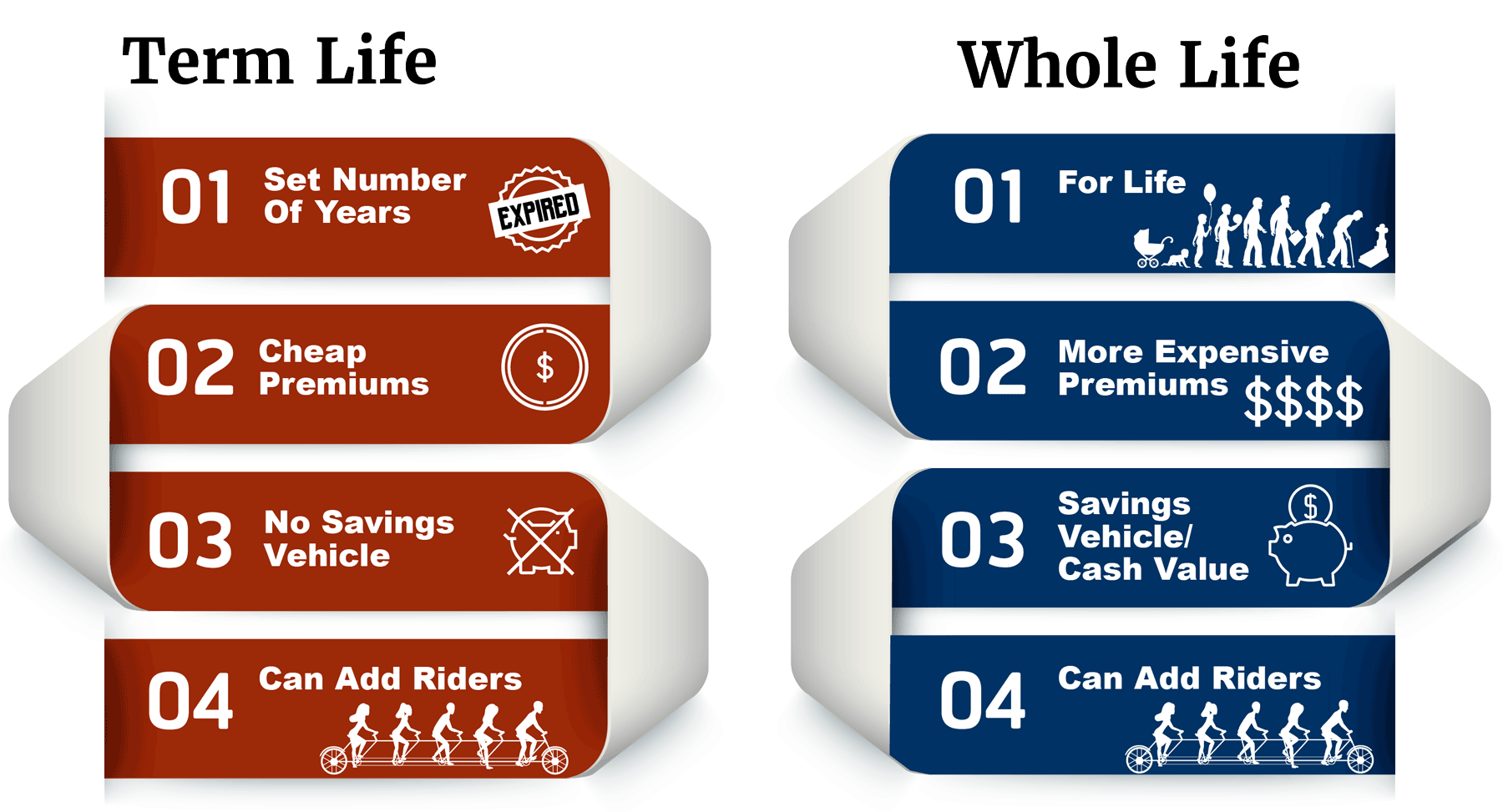

If the same 50-year-old man bought a permanent policy instead of a term, he would pay over $12,500 a year instead of $1,008. Although some permanent policies create cash value, it is worth considering the difference in premium costs.

How much a person can expect to pay for life insurance depends on how much of a risk the life insurance company perceives them to be. For example, an older person can expect to pay more for a policy than a younger person simply because their age statistically puts them closer to death. Besides age, here are some other factors that affect the cost of life insurance.

Anyone unhappy with their life insurance quote can take these steps to lower their premium costs.

Buy Cheap Life Insurance Online Buy Cheyenne, Wyoming

Buying life insurance is not fun for anyone, but the best life insurance companies make it easy by offering online deals on some products. They also help the potential policyholder determine the required sum insured and the insurance product that best meets their financial goals. This may mean permanent life insurance for one person and term life insurance for another.

There are so many different life insurance policies on the market that it helps to have an expert on hand. In the meantime, it’s good to know that affordable life insurance is available.

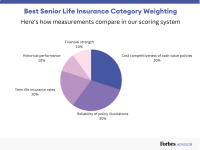

Let’s look at general customer sentiment from those who have direct experience with a particular life insurance company. It has been compiled by examining both publicly available data and surveys of visitors to this site.

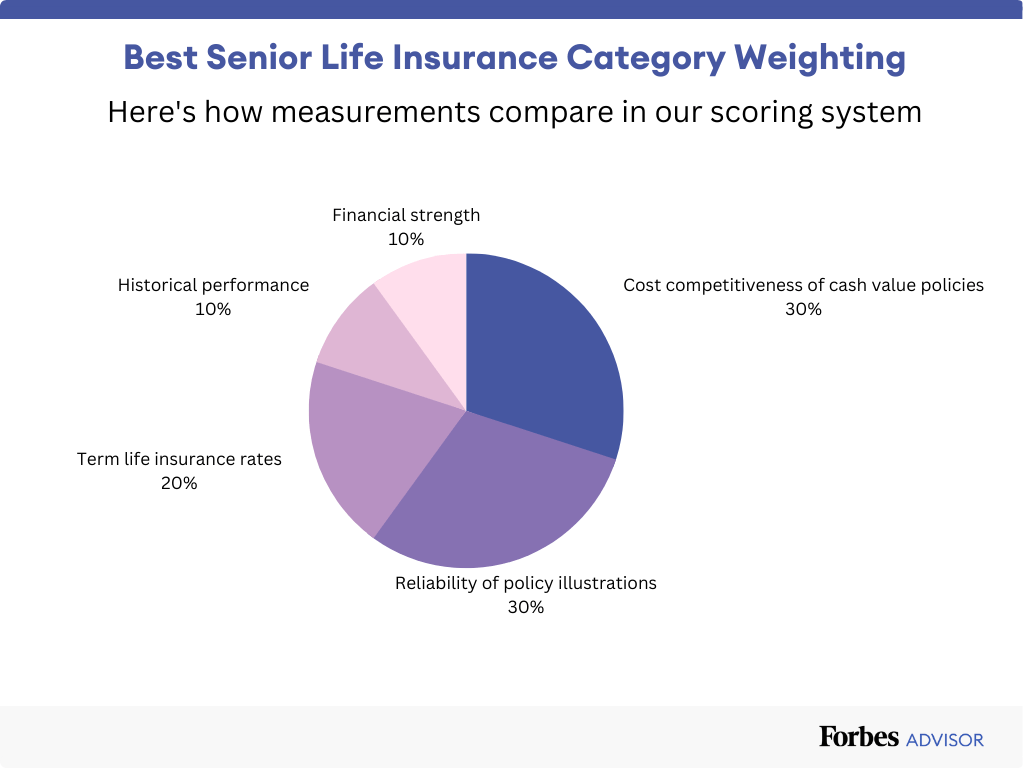

With so many options for life insurance these days, it’s easiest and most effective to look at the bottom line first.

Is Life Insurance Worth It?

We look at the different options and the insurance products on offer that are better suited to different consumers. The focus is on term and whole life policies and the strength of these specific policy products.

We look at the overall strength and health of the company as an indicator that can highlight stability that gives peace of mind. A company’s strength may include:

Dana George holds a BA in Management and Organizational Development from Spring Arbor University. He has been writing and reporting on business and finance for more than 25 years and remains passionate about his work. Dana and her husband recently moved to Champaign, Illinois, home of the Illini game. And while he finds that most people don’t like the color orange, he thinks they’ll enjoy Champaign immensely.

Share this page Facebook icon This icon shares the page you are on from Facebook via the blue Twitter icon. Share this website on Twitter LinkedIn icon This image refers to sharing the page on LinkedIn. Email icon Share this website via email

Colonial Penn Life Insurance Review

We firmly believe in the Golden Rule, so editorial opinions are ours alone and have not been previously reviewed, endorsed or approved by the advertisers involved. Ascent does not include all offers on the market. The Ascent’s editorial content is separate from The Motley Fool’s editorial content and is created by a different team of analysts.

Dana George holds positions at Target. The Motley Fool has positions in and recommends Costco Wholesale and Target. Motley has a non-disclosure policy.

The Ascent is Motley’s service that evaluates and rates products relevant to your everyday finances. If you just want a quick online quote for $1,000,000 Whole Life, you can get it in seconds at Online Whole Life Insurance Quotes or use our quote provider link below. You can compare whole life insurance prices, company strength, cash value growth and company size.

I would like a $1 million quote on whole life insurance now, the best whole life at the best price

Life Insurance Incontestability Clause (terms Explained)

This article will tell you everything you need to know

Cheap guaranteed life insurance, get cheap life insurance, good cheap life insurance, cheap term life insurance online, life insurance cheap, cheap life insurance rates, cheap life insurance for couples, cheap whole life insurance, cheap whole life insurance rates, cheap term life insurance, cheap life insurance in texas, best cheap life insurance policies