Commercial Insurance – When you run a business, there’s the fun part of running a successful business, but there are also some technical things you need to take care of to ensure everything stays safe and fun even in the worst case scenario. scenario. The key to all this is business insurance. There are many types of business insurance you need to know about so you can protect yourself, your brand, your employees, and your future as a business and owner.

In the most general terms, business insurance provides legal and financial protection against many of the common problems that businesses may face. This pertains specifically to your business and not your property or personal space. Below are some of the most common business insurance policies.

Contents

- Commercial Insurance

- How Much Does Business Insurance Cost?

- Old Point Insurance

- Business Insurance Risk Coverage Quiz

- Insurance Policy Review For Commercial Real Estate Lenders

- How Much Does Small Business Insurance Cost?

- Guide To 7 Commercial Insurance Companies For Your Business (2023)

- Small Business Insurance Quotes

- Business Insurance Orlando

- What Is Commercial Insurance?

- Gallery for Commercial Insurance

- Related posts:

Commercial Insurance

Most small businesses need general liability insurance for their business. It is as general as it sounds and provides protection against damages from personal injury, property damage, medical expenses, etc.

How Much Does Business Insurance Cost?

If you have a shop or warehouse or any other type of business premises/business premises, you should be insured against burglary, fire damage, etc. Moreover, flood insurance is an insurance supplement that will save you a lot of headaches if your business does flood.

If you sell products, product insurance can provide protection against defective products that cause damage or injury. While this is only necessary if you sell physical products, it can often be added to your general liability insurance.

If you or your employees have to drive for your company, you must take out company car insurance. This protects against damage, accidents and replacements and is therefore separate from your personal insurance.

If you have employees, workers’ compensation is important to protect you, them, and your brand from business-related fall or injury claims.

Old Point Insurance

In business, lawsuits against a company may arise due to such negligence or non-compliance. For this you can take out professional liability insurance that protects your company. These are always specific to your category and company.

More and more cyber problems are emerging in business, causing data loss, data theft and all kinds of problems. As such, cyber liability insurance can be great to have in your pocket, especially if you deal exclusively with online customers.

If for some reason you need to temporarily close the business, this insurance can help you recover your business losses during that closure. This can often make or break smaller companies.

As you can see, there are many things that can protect your business or make it vulnerable. Knowledge is power, and knowing which one is right for your business can save you time and the future.

Business Insurance Risk Coverage Quiz

Of course you don’t have to know everything, that’s our job. Contact Kicker Insures Me Agency here, or call/text us at (281) 487-9686 to discuss your business and determine what insurance is needed and necessary to protect you and your business.

Are you ready to save time, aggravation and money? The Kicker Insures Me team is ready to make the process as painless as possible. We look forward to meeting you! In the field of insurance, we understand the difficult challenges you face every day as an entrepreneur. No matter what industry you’re in, there are risks associated with the nature of business, and sometimes the losses can be catastrophic. Insurance coverage can help limit these losses and provide a cushion against financial disaster.

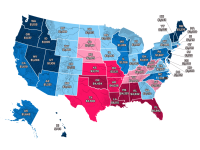

Different industries have very unique risks, so your business needs customized commercial insurance policies. From basic coverage to special protection, you can always get the right coverage for your insurance business.

Under California law, all employers are required to provide workers’ compensation insurance to their employees. In the event of work-related injury or illness, the policy covers all approved medical expenses, temporary and permanent disability benefits and death benefits. It also covers additional costs and legal fees in situations of possible employer negligence and industrial accident claims.

Insurance Policy Review For Commercial Real Estate Lenders

General liability insurance protects your business against a variety of claims, such as personal injury, property damage, and other claims that may arise from your business activities. This will cover legal costs if a claim is made.

Whether you are a manufacturer, importer or wholesaler, your company is exposed to product liability risks. Product liability insurance covers damages resulting from a claim, along with the costs of defense or settlements in certain cases.

EPLI helps protect your business against employment-related claims and provides funds to handle defenses and settle lawsuits. The most common types of claims covered by EPLI include wrongful termination, discrimination, sexual harassment, and retaliation.

Credit insurance protects your company against unpaid invoices and ensures more secure payment management. This not only covers your buyer’s losses caused by default (bankruptcy) or slow payments, but also improves your security and your ability to extend credit limits, expand into new markets and increase profitability.

How Much Does Small Business Insurance Cost?

Marine/marine insurance covers a range of risks of losses during import, export and domestic shipments. Coverage covers goods shipped by most modes of transportation (ships, planes, trucks and trains) and includes all intermediate transit and warehouse storage.

COC provides property and liability coverage for buildings under construction. This may relate to the building construction and materials on the construction site or en route to the construction site.

Special event insurance provides short-term general liability coverage for vendors, exhibitions or organizers of an event, such as an exhibition, company outing or wedding. This is usually required by the property owners.

A business owners policy, also called BOP insurance, combines property insurance, liability insurance and additional protection in one policy. It’s smart, convenient and saves you money.

Guide To 7 Commercial Insurance Companies For Your Business (2023)

Commercial property insurance protects your business against most risks, such as fire, wind, theft and vandalism. It offers a wide range of coverage, including equipment, inventory, premises and loss of income due to business interruption.

Commercial vehicle insurance protects vehicles for business use, such as transporting goods or people, against payment. It also protects vehicles driven by employees making deliveries, running business errands or making sales visits. Whether the title is under a business or personal name, commercial auto insurance is necessary for your business to reduce liability risk.

E&O insurance protects your business against claims for negligence or failure to perform your professional duties. It is usually associated with professionals such as doctors, lawyers, architects, real estate agents and accountants. Generally, such policies are intended to cover monetary losses rather than liability or bodily injury (BI) and property damage (PD).

Cyber liability insurance provides protection in the event of unauthorized access to the company’s computer system. It covers losses due to business interruption and costs incurred from reporting a data breach, repairing damaged computer systems, credit monitoring, restoring your business reputation and more.

Small Business Insurance Quotes

Umbrella liability insurance protects you when accidents happen and your existing liability insurance may not cover all costs. For example, you currently have a general liability policy of $1 million in coverage and also a $1 million umbrella policy. If you are successfully sued for $1.8 million, your general liability policy will pay the $1 million first, and then your company’s insurance coverage can pay the outstanding $800,000 – which is a lot less painful than coming out of your business profits.

California is a state with serious earthquake risks, and earthquake coverage is a common exclusion in standard commercial property insurance in California. To protect your business property against possible damage as a result of an earthquake, separate earthquake insurance is therefore necessary.

In insurance, companies are assigned a dedicated account manager, along with a team of licensed and experienced agents who manage your account. We aim to provide the most professional and expert approach when it comes to the cover your business needs. For our valued commercial customers, you have free access to:

Risk mitigation and loss control management | Coverage analysis and annual renewal | Early claim support and follow-up Issuing a certificate

Business Insurance Orlando

Free consultation on employment and corporate law Free employment law poster and annual renewal | Free Training and Certification to Prevent Sexual Harassment Annual Audit Review and Audit Distribution for Workers’ Compensation

The insurance agency works with several A-rated insurers to meet your diverse needs with the best prices and coverage options. The distinction as a VIP agency gives us exclusive access to many suppliers, allowing us to provide our clients with the most responsive and reliable service. Start your free trial, then enjoy 3 months of $1 per month when you sign up for the Basic or Monthly Starter subscription.

Start a free trial and enjoy 3 months for $1 per month on select plans. register now

Try it for free and discover all the tools and services you need to start, manage and grow your business.

What Is Commercial Insurance?

However, running your own small business gives you entrepreneurial freedom

Insurance for commercial vehicle, commercial contractor insurance, commercial truck insurance, commercial liability insurance coverage, commercial car insurance, commercial box truck insurance, commercial general liability insurance, commercial van insurance, commercial auto liability insurance, commercial cargo insurance, commercial contractors insurance, commercial dump truck insurance