Commercial Vehicle Insurance – Many companies use different vehicles for commercial purposes. Depending on the company, the vehicles used range from taxis to minibuses. Commercial vehicle insurance is a good idea to protect commercial vehicles.

The transport and logistics industry in Australia generates approximately $201 billion in annual revenue. To put this number in perspective, it is 15% of GDP. This shows how important good lighting is for commercial vehicles.

Contents

- Commercial Vehicle Insurance

- Vehicle Insurance(car,bike,truck)@ National Insurance/digit

- Car Insurance Logo Concept Protect Icon Royalty Free Vector

- Car Insurance Calculator Online

- Types Of Commercial Truck Insurance

- Insurance Hub In Kanpur,kanpur

- Motor Insurance Policy

- Irdai Proposes To Hike Third Party Insurance Premium For Cars, Two Wheelers For Fy 2020 21

- Gallery for Commercial Vehicle Insurance

- Related posts:

Commercial Vehicle Insurance

Commercial vehicle insurance covers a number of things depending on the type of insurance. Basically, you can choose between three types of insurance for your company: liability insurance, fully comprehensive insurance and liability insurance.

Vehicle Insurance(car,bike,truck)@ National Insurance/digit

This is the cheapest form of insurance and, as the name suggests, protects against damage or personal injury to third parties. This means that your vehicle is not insured and your company will have to cover all repair costs in the event of damage.

This is an extension of liability insurance and offers more protection. In addition to liability insurance, this policy also covers protecting your vehicle from fire damage. This also includes theft or damage caused by attempted theft.

It is the most expensive of the three insurance policies, but offers the best form of coverage and the highest level of protection. This policy covers damage to your vehicle or a third-party vehicle in the event of an accident or incident.

Your company may also assign a specific driver to a vehicle if you have assigned a vehicle to a specific driver using the Named Driver policy in your organization. If your company has a driver pool that rotates between vehicles, you can choose the “Any Driver” policy. All three types above support this. Your organization may also define certain other terms for drivers, such as: B. their age, criminal record, etc.

Car Insurance Logo Concept Protect Icon Royalty Free Vector

Before purchasing commercial vehicle insurance for your business, there are some nuances you need to understand. If you do not have an in-house resource to assess your loss, we at Insurance are here to help.

We have many years of experience in the insurance market, regardless of what type of vehicle you and your company have – a single car or an entire fleet. Our team will carry out a risk analysis with you and develop the best protection plan.1. What is commercial vehicle insurance? Commercial vehicle insurance is a specialized vehicle insurance policy designed to cover damage and loss to a commercial vehicle and its respective owner. This includes accidents, collisions, natural disasters, fires, etc. including damage and losses in cases such as , vans and trucks.

If your business owns one or more vehicles, it is important to purchase commercial auto insurance that will financially secure your business and protect you from damage and loss caused by your vehicle(s) and the people who use them. caused.

Commercial vehicle insurance is a specialized vehicle insurance policy designed to cover damage and loss to a commercial vehicle and its respective owner. This includes accidents, collisions, natural disasters, fires, etc. including damage and losses in cases such as , vans and trucks.

Car Insurance Calculator Online

Terms of Use – Privacy Policy – UsCop Copyright © 1996-2023 InterMESH Ltd. All rights reserved. Did you know that India is considered one of the busiest countries in the world when it comes to road transport? Around a million new car registrations are registered every year. With around 90% of passenger traffic and 65% of freight traffic, the majority of the country’s transport load is carried by road. With the increasing use of automobiles, road safety has become a top priority for the country’s citizens.

Every year thousands of deaths are recorded in accidents involving all types of vehicles, including commercial vehicles. Damage to commercial vehicles due to unforeseen circumstances can affect business and result in significant financial losses. However, you can protect your business from such losses with commercial vehicle insurance.

Commercial vehicle insurance is an insurance plan that protects businesses that use vehicles. It protects you from accidents, theft or damage to commercial vehicles such as pickups, vans, trucks, taxis, autorickshaws, various vehicles, buses, school buses, etc.

Insurance covers damage to both the commercial vehicle and its drivers, including injury and even death. It also protects companies from accidents or liabilities that may arise from someone else’s property, injuries or accidents.

Types Of Commercial Truck Insurance

Commercial vehicle insurance is mandatory. Failure to comply with these requirements may result in large fines or legal sanctions.

Car insurance provides financial security in the event of an accident, theft or damage to your vehicle. This can help the company avoid unexpected costs and large financial losses.

Commercial vehicle insurance also covers liability arising from accidents, injuries to drivers, passengers or third parties, and other perils. This can protect the company from lawsuits or disputes that may arise from commercial vehicle accidents.

Business owners can rest easy knowing that commercial vehicle insurance protects them from unexpected events that could financially impact their business.

Insurance Hub In Kanpur,kanpur

This type of policy covers personal transport vehicles such as commercial vehicles/cabs/cabs, autorickshaws, school buses or tourist buses. Passengers who drive a car have major liabilities in their passenger life, so it is always important to avoid liabilities caused by an unfortunate incident.

Autorickshaws are three-wheeled petrol or CNG autorickshaws used to transport passengers over short distances.

A commercial vehicle is a taxi, cab or commercial vehicle primarily used for app based transportation like Ola/Uber and other tourist transportation.

School or Passenger Vans – Minivans like Tata Ace Magic and Mahindra Supro are mainly used for ferrying passengers (for school children or local transport).

Motor Insurance Policy

Trucks are used to transport public or private goods from one place to another. This category includes trucks, pickups, vans and tricycles. Transporting goods involves heavy loads and can lead to damage to the insured vehicle. Therefore, a commercial vehicle policy should protect everyone involved in the event of an accident.

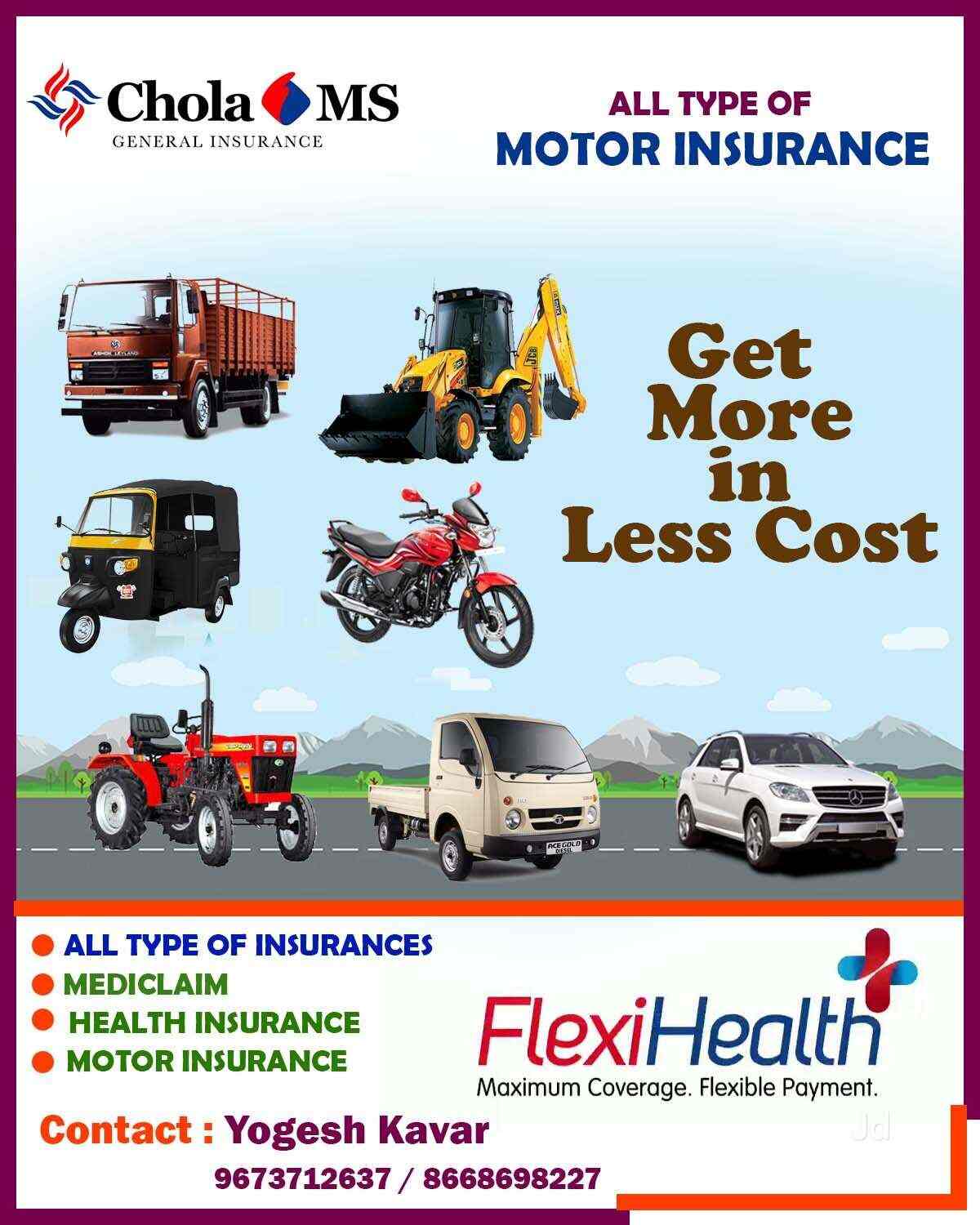

Multi-vehicle insurance covers damage to various vehicles such as tractors, JCBs, cranes and other specialist vehicles. A large number of vehicles are vehicles used for construction or rescue services, ambulance or firefighting and not for the transport of goods or passengers.

Liability insurance covers damage to the property of third parties and injury or death to others involved in an accident with the insured. According to Indian law, it is mandatory to have at least third party insurance to drive in India. Car owners are offered liability insurance if the car is very old, has a low IDV compared to the premium paid, or is driven very little.

It covers damage to third parties as well as vehicle damage in the event of an accident, theft or fire. It is not mandatory to take out fully comprehensive insurance for your commercial vehicle, but due to the limited coverage provided by liability insurance, it is always advisable to opt for it. Comprehensive insurance protects the insured vehicle against partial or total damage caused by accidents, external disturbances or natural disasters. It is therefore advisable to take out a comprehensive parcel policy.

Irdai Proposes To Hike Third Party Insurance Premium For Cars, Two Wheelers For Fy 2020 21

Accidents – Covers damage to a commercial vehicle in the event of an accident.

Theft – In the event of theft, this policy covers the loss of the vehicle if it is left unattended.

Natural disasters are losses due to natural disasters such as floods, lightning strikes and hurricanes, which can cause significant damage to vehicles. Two Wheeler Insurance, Motor Vehicle Insurance, Four Wheeler Insurance, Personal Transport Insurance, Goods Vehicle Insurance, Bajaj Allianz General Insurance. . Agents, Insurance Companies, Life Insurance Agents, Two Wheeler Insurance Agents, Insurance Agents, Health Insurance Agents, Car Insurance Agents-Reliance, Life Insurance Agents-Canara HSBC, Insurance Agents-Star Health, Three Wheeler Insurance Agents, Max Life Insurance, Life Insurance Insurance Agents – Tata Aia, Life Insurance Agents – United India Insurance, Health Insurance Agents – Cigna Ttk, Motor Insurance Agents, Motor Insurance Agents – IFFCO Tokyo, General Insurance Agents – New India Assurance, Fire Insurance Agents – Tata AIG, Car Insurance Agents, Motor Insurance Agents – Bajaj Allianz, Fire Insurance Agents – Eastern Insurance, Fire Insurance Agents – Bajaj Allianz, Health Insurance Agents – LIC , car insurance

Commercial vehicle insurance quotes, commercial vehicle fleet insurance, allstate commercial vehicle insurance, vehicle commercial insurance, state farm commercial vehicle insurance, commercial vehicle insurance nj, insurance for commercial vehicle, usaa commercial vehicle insurance, commercial vehicle insurance companies, commercial vehicle liability insurance, commercial vehicle insurance policy, best commercial vehicle insurance