Compare Health Insurance – When you buy insurance through iSelect, Market Compare or Comparison Club, they take a percentage of the premium. If they don’t get a commission, they won’t show you a policy, even if it’s the best one for your needs.

Canstar and Finns charge fees from participating insurers, which affects what they show in their comparisons. By default, they will only show you insurers – you have to uncheck the box to show them only insurers who don’t pay.

Contents

- Compare Health Insurance

- How To Compare Health Insurance Policies?

- How To Compare Best Health Insurance Plans By Iiflinsurance

- Infographic: How To Compare Health Insurance

- Compare Overseas Student Health Cover (oshc) And Get More Oshc Commission

- How To Compare Health Insurance Plans For Employees

- Health Insurance Plans: A Comparison

- Health Insurance Marketplace

- Consumer Web Portal For Insurance Plan Shopping

- Gallery for Compare Health Insurance

- Related posts:

Compare Health Insurance

How is it different? First, we do not charge commissions from health insurance companies. You pay us directly for an extensive search and use our expert scores to find the best price policy for your needs.

How To Compare Health Insurance Policies?

We’re also non-commercial and we’re not here to sell – so you won’t receive any pushy phone calls or emails from us.

The table was updated on March 1, 2023. We only cover insurers who have policies available for purchase at that date, not just corporate funds.

Our experts are not here to sell you a policy or earn a commission. They reveal policies that make real sense for you.

We’ve provided health insurance information and tools in this section to help you find the right health insurance policy for your needs.

How To Compare Best Health Insurance Plans By Iiflinsurance

We do not provide you with specific financial advice or endorse any particular product. We guide you through a process that will lead you to make direct inquiries of your health insurers and, if necessary, seek your own professional financial advice. The information we provide cannot replace these measures. We have included links to specific providers as a convenience, but should not be construed as an endorsement of the providers or their products. We do not charge commissions from health insurers.

We do not provide any medical advice regarding your particular situation. If you have any questions about a medical condition, you should consult your GP or other appropriate healthcare professional. The information we provide is, in most cases, obtained from third parties. Although we make every effort to verify this information, we do not guarantee its accuracy or correctness. Again, after reviewing this information, you should make your own inquiries with the respective providers.

FOR THE FOREGOING REASONS, HEALTH INSURANCE DISCLAIMS RESPONSIBILITY FOR ANY ERRORS OR OMISSIONS IN THE INFORMATION AND IS NOT RESPONSIBLE FOR YOUR USE OF THIS INFORMATION OR SECURITY OF THIS INFORMATION OR TOOLS.

Good pricing, matching requirements, no need to submit contact details that lead to sales calls. Damian is a member

Infographic: How To Compare Health Insurance

This is saving me $100 a month on the same policy with a much better rating. Signs – a member

I use it every year. With the tool, it can help make health insurance a lot less confusing. Tony is a member

The policy offered was with an insurer I had never heard of, so if it hadn’t been for that I would never have considered switching. Definitely worth becoming a member. Sandra is a member

The only comparison site that compares all funds. Choosing health insurance is one of the most difficult and time-consuming tasks. I chose the fund after using your site. Thank you!!! James is a member

Compare Overseas Student Health Cover (oshc) And Get More Oshc Commission

Private health insurance can help you pay for other health expenses such as hospital stays and visits to the dentist or physio. This is an additional cost you contribute to Medicare through your taxes, but depending on your coverage level, you can choose your doctor and stay as a private patient at a public or private hospital.

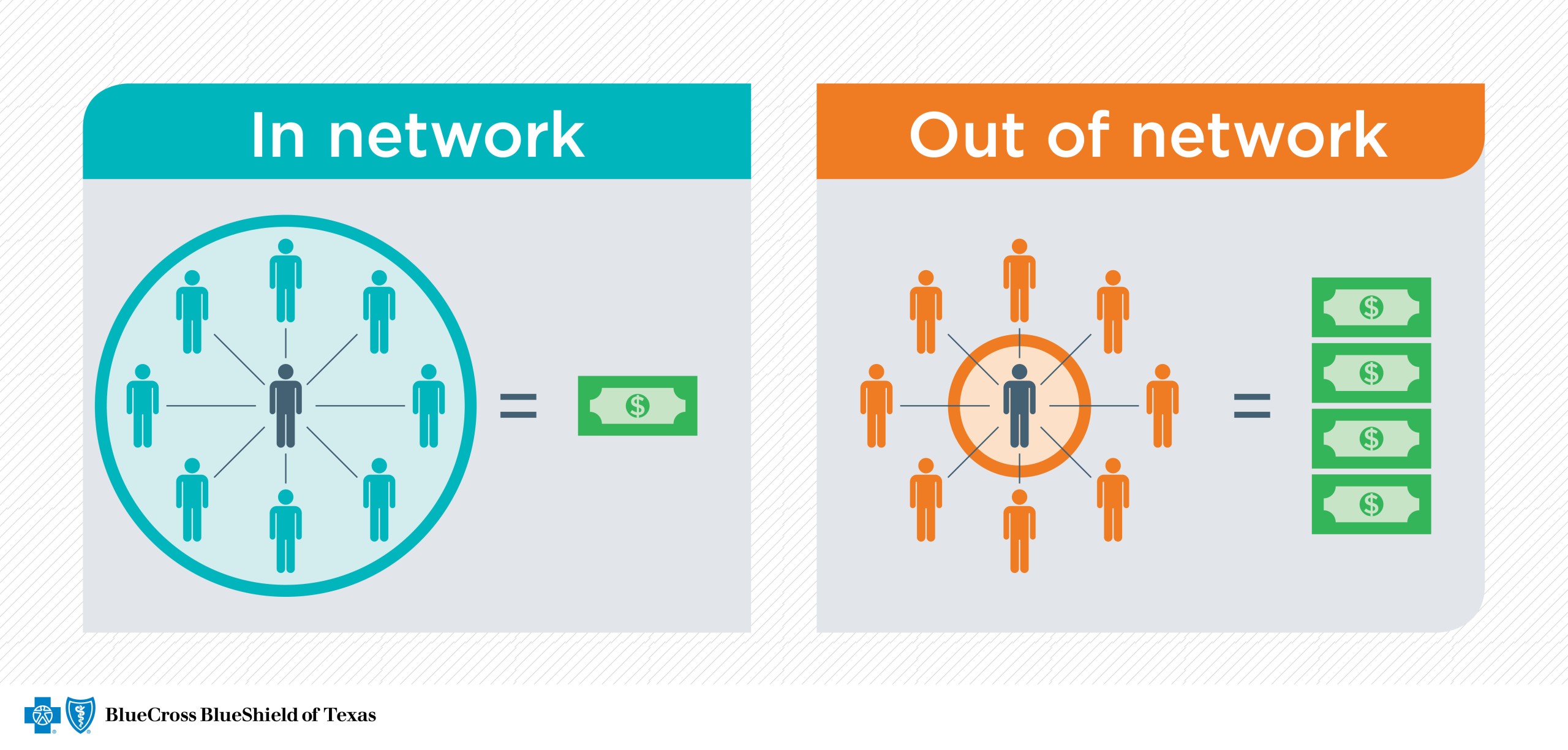

You can buy health insurance that covers hospital and out-of-hospital expenses. This usually contributes to the cost of the hospital room and the doctor you choose, but you will have to pay extra out of pocket. Health insurance that contributes to hospital costs is usually called a “co-pay” and helps pay for dental and optical services.

The average annual cost of private health insurance in Australia, with high government benefits, is $2853 for an individual with a hospital and excess policy, or $5885 for a family policy that combines hospital and excess cover. Couples often spend the same amount as families. The cost of health insurance can vary depending on the state you live in and the type of coverage you purchase, as well as what state subsidies and penalties apply to your individual circumstances.

Private health insurance and Medicare cover similar treatments and services. The main difference is where you receive treatment: the public or private system. If you are a permanent resident of Australia, Medicare gives you free or subsidized access to doctors and specialists, as well as treatment and accommodation (bed or room) in a public hospital. Having a private hospital insurance policy allows you to get treatment in a private system. Even with your own private room, you can choose your own doctor, pay out-of-pocket expenses in addition to your insurance premiums, and avoid long waits at public hospitals.

How To Compare Health Insurance Plans For Employees

There is a difference between what Medicare prescribes (the Medicare Benefit Schedule) and what your doctor or hospital actually pays. You will have to pay the difference (toll), which is why it is sometimes called an out-of-pocket expense. Health funds have gap schemes that help cover your out-of-pocket expenses, covering all or part of the difference. In the “No” scheme, the insurer sets an upper limit on how much it will pay in MBS fees. If your doctor pays above the MBS but below or above the insurer’s “no copay” limit, you will have no out-of-pocket costs.

An excess is the amount you pay out of pocket for a single hospital stay to reduce your premium. You only pay the excess when you go to the hospital, so if you don’t expect to go to the hospital in a year (you don’t have any surgery planned), you’ll save money on the excess. . will be

Private health insurance relief is an amount added by the government to your private health insurance premium. You can get private health insurance discount on the amount of private health insurance premium you pay to the insurer. The exemption is means-tested, so if your income is above the relevant income threshold, you will not be able to claim the exemption. If you’re over 65, you’ll get bigger discounts, and if you’re over 70, you’ll get a bigger discount.

A pre-existing condition is an illness or medical condition that you had or had signs or symptoms of in the 6 months prior to your private hospital insurance. Insurers give you a 12-month waiting period if you apply for coverage for a pre-existing condition, with some exceptions. After the waiting period is over with the policy, if you transfer even if you have pre-existing conditions, you don’t need to reapply.

Health Insurance Plans: A Comparison

As you age, you may need certain types of treatment and surgery, such as cataracts or knee and hip replacement. If you want to take them to a private hospital, it’s only covered by expensive, premium (Gold and Silver Plus) policies, so keep that in mind when choosing health insurance for seniors. Insurance plans including CoveredCACompare Health insurance plans including CoveredCACompare Health insurance plans including CoveredCA

Protect your loved ones. Learn more about life insurance: Term vs Whole Life – What’s the Difference?

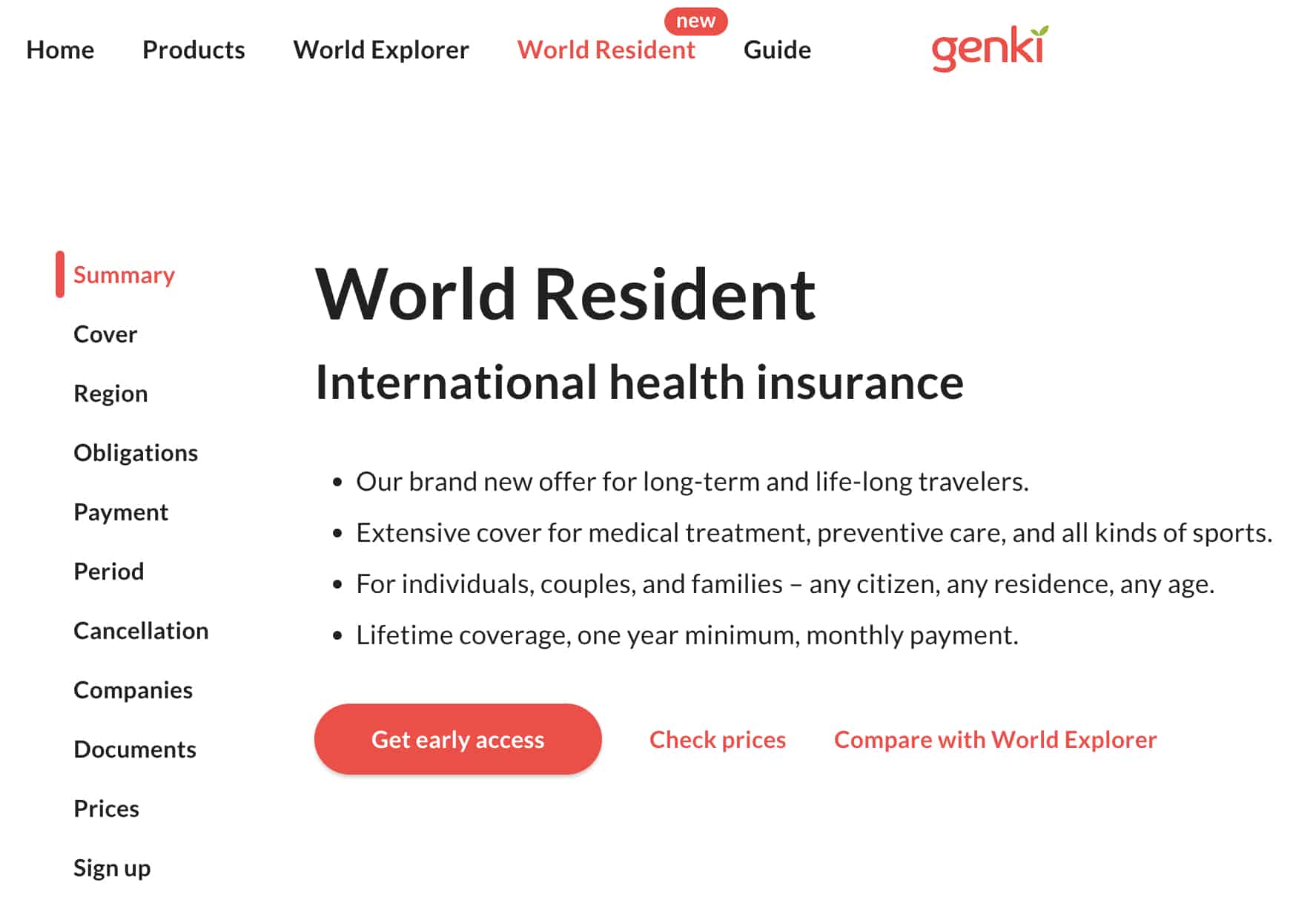

Compare and buy health insurance. Our carriers include: Blue Shield, Anthem Blue Cross, Kaiser, Oscar, Sutter Health, HealthNet, Cigna, VHP, Western Health Advantage, etc.

Find the right employee benefit package for your employees. Whether you are a small business owner with just 1 employee or over 100 employees, we can help.

Health Insurance Marketplace

Private dental insurance can be difficult. We can do it easily! Learn about dental PPO, HMO plans and compare different options!

You made a reservation six months ago. You’ve packed everything you need for your vacation, from flip-flops to sunglasses. But even the best-planned trip can be ruined by circumstances beyond your control. Learn how to protect yourself and your family during the holidays.

Vision insurance is designed to help you cover your regular vision expenses, such as routine eye exams, prescription glasses, and contact lenses. Plans start at $15 per month and can save up to $193 per year.

Compare different health insurance plans side by side for 2023. Compare bronze, silver, gold, and platinum plans and learn about health insurance companies: Blue Shield of California, Kaiser, Oscar, HealthNet, VHP, Sutter Health, Cigna, Western Health Advantage, and more.

Consumer Web Portal For Insurance Plan Shopping

(Answers to all these questions are available on our YouTube channel and other resources. Please visit us, subscribe to us on YouTube and stay updated)

Can I get a subsidized health plan from CoveredCA if my employer provides health insurance?

Compare dog health insurance, compare health insurance ireland, compare health insurance rates, compare health insurance california, health compare insurance, compare health insurance plans, compare health insurance florida, compare health insurance policies, health insurance uk compare, compare health insurance texas, compare health insurance companies, compare health insurance australia