Cost Of Car Insurance – One of the most frequently asked questions from new and used car buyers is, “How much will it cost to insure my new vehicle?” Unfortunately, there is no simple answer to this question.

Some consumer advocates point to averages for guidance. According to a report by the National Association of Insurance Commissioners, the average cost of a “comprehensive” insurance policy (one that provides liability, comprehensive, and collision coverage — a little more of those) was $1,062 in 2021 (new information NAIC) .

Contents

- Cost Of Car Insurance

- Average Car Insurance Cost Update

- The Hidden Costs Of Owning A Car

- The Auto Insurance Game

- Directors And Officers Insurance Cost

- What Is The Average Cost Of Car Insurance In The U.s.?

- Average Car Insurance Cost In Us By State, Company & Type

- Factors That Impact Your Cost Of Car Insurance

- Best Car Insurance For Seniors In 2024

- Gallery for Cost Of Car Insurance

- Related posts:

Cost Of Car Insurance

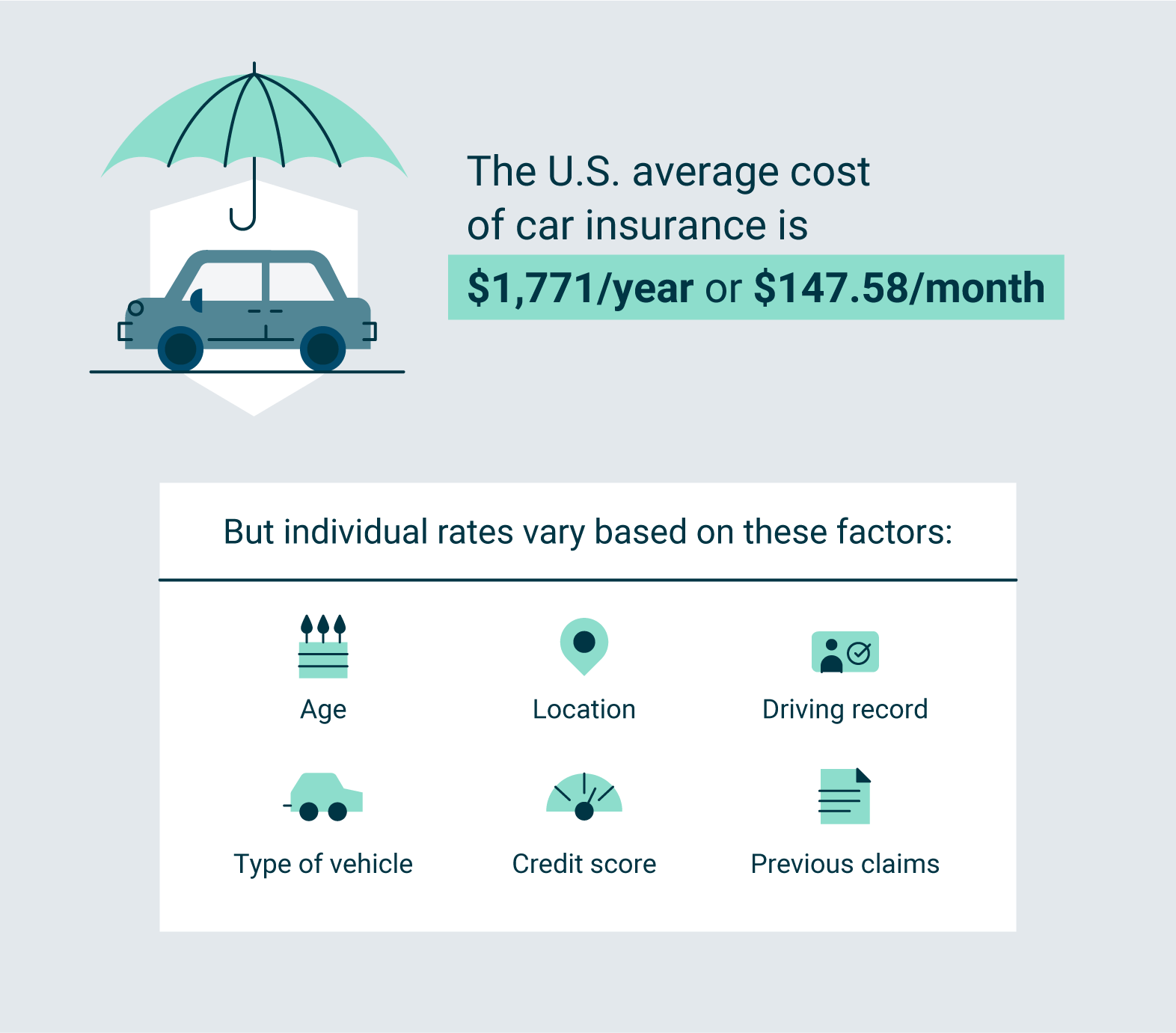

Those numbers give you a rough idea of how much you might pay for an insurance policy. But they are average – in fact, just average. This means that they are not better than expected. Costs vary from state to state, state to state, insurance provider to insurance provider. So you should choose a provider wisely.

Average Car Insurance Cost Update

Only the insurance company you choose – Allstate, Progressive, USAA, Farmer’s, GEICO or others – asks “How Much?” Can answer. Accuracy questions. Each has a list of factors and formulas to assess the risk and, accordingly, determine your annual premium.

Regardless of the carrier, however, there are some standard factors you can expect to consider when deciding how much you should pay. We’ve divided them into three categories: you, your car and the type of cover you want to buy. Here’s how each price factor into the equation.

Focusing on Your Risk There are several different “components” that companies look at when deciding whether to insure you for your vehicle.

Insurance companies typically take the last few years of driving history into account when determining your rates, says Michael Barry, chief communications officer at the Insurance Information Institute.

The Hidden Costs Of Owning A Car

“The insurer will want to assess the likelihood that you will make a claim, and someone with a significant number of moving violations or serious cases like driving under the influence will affect the cost of insurance,” Barry explains.

This means that if you have a clean driving record, you are not a risk. If you have a moving violation that results in your license being revoked, you’re at significant risk — and your premiums will increase.

Statistics show that older, more experienced drivers are safer than younger drivers. According to the Insurance Institute for Highway Safety, young, inexperienced drivers are more likely to crash than experienced drivers.

“The 18- to 25-year-old age group is more likely to file a claim than any other age group,” Barry says. As a result, they pay more for coverage.

The Auto Insurance Game

As drivers age, the accident rate decreases with age before leveling off again. Physical changes that come with aging — such as vision, hearing and cognitive decline — cause some senior drivers to take extra care and avoid driving altogether.

According to the Insurance Institute for Highway Safety, women drive fewer miles than men, engage in less risky driving habits (such as not wearing seat belts), and are less likely to speed or drive while impaired. Per mile, female drivers in all age groups have a lower fatality rate than males.

Because men cause more accidents as a group, they generally pay higher insurance premiums. These binary gender classifications can inadvertently penalize non-binary and transgender drivers.

Insurance scores and credit scores are different, but they are related. Both are calculated from information in the credit rating report such as existing loans, bankruptcies, length of credit history, collections, new applications for credit, number of credit accounts in use and timeliness of loan repayments.

Directors And Officers Insurance Cost

As such, your credit score is considered a liability metric. Insurance providers use it to evaluate you on the behavior of your vehicle and your ability to make a claim. They call it insurance points.

Insurance carriers don’t necessarily weigh the cost of the car, but rather how much it will cost to repair it. Say a clash between Lamborghini and Kia. Refurbishing a Lambo requires expensive, handcrafted parts in Italy. Kia replacement parts can be purchased online at almost every aftermarket parts store. Therefore, since a sports car costs more to repair, the owner of a bullish bull will pay more for insurance.

“If you’re in a crowded area, you’re more likely to have an accident,” says Barry, assessing your risk. “That’s why rates are going up in states like New York and New Jersey.”

Vandalism and car theft are also common in populated areas. Meanwhile, areas prone to natural disasters also mean higher risk ratings.

What Is The Average Cost Of Car Insurance In The U.s.?

During hurricane season, Barry says, “I immediately think of Florida, Louisiana, Texas. Flooded cars, downed trees, claims for events that generate a lot of auto insurance claims.”

The five primary coverage types that make up your policy—liability, collision, comprehensive, personal injury protection, and uninsured motorist—also help determine your monthly premium price. Therefore, it is best to know what these are and how they work.

Each state’s “minimum required coverage” is usually the least expensive insurance you can buy. There should be only one responsibility. It is mandatory in most states and protects you from costs if you injure someone or damage their property in an accident.

Less common but popular options are comprehensives that cover damage to your car caused by the insured driver’s fault, collision or coverage, and damage to your car caused by causes other than a collision. Required by state law.

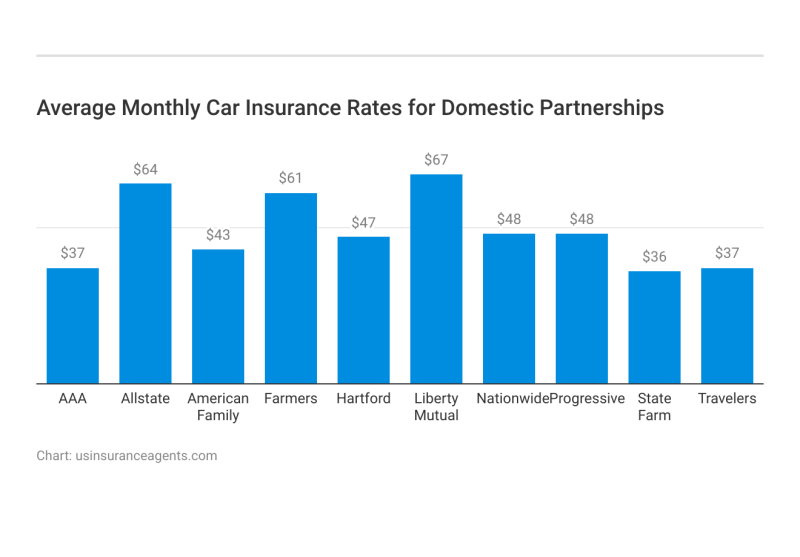

Average Car Insurance Cost In Us By State, Company & Type

Collision and comprehensive coverage are often referred to as full or comprehensive coverage. These policies cover you if your car is damaged in an accident or otherwise (eg falling trees, and guardrails). Omitting comprehensive and collision coverage may lower your monthly premiums, but it could result in higher costs down the road if you’re paying for major repairs.

Generally, your age, driving history, credit history and where you live determine the cost of insurance; There are not many cars. However, older cars cost less to insure because the parts and overall costs of the car are not as high as new cars. Expensive cars, especially Ferraris or Lamborghinis, cost more to insure because the parts are expensive.

Car insurance costs the most for new drivers. As drivers age, the cost of car insurance decreases due to less risk from insurance companies as drivers gain more experience over time.

You can buy car insurance directly from the insurance company. You can call an insurance company or fill an online form, provide all relevant information like your age, license details, car make etc. and wait for a quote from the company. It is advisable to shop around to find the lowest price.

Factors That Impact Your Cost Of Car Insurance

Insurance companies take into account the components of these three standard factors and apply them to their formulas to determine the price of your car insurance. Every insurer is different, so it pays to shop around and get quotes from different companies. Don’t forget to ask about discounts that can lower the price of your annuity.

Authors should use primary sources to support their work. These include white papers, government statistics, original reporting and interviews with experts in the field. We also refer to original research from other reputable publishers where appropriate. You can learn more about the standards we follow to produce accurate, fair content in our Editorial Policy.

By clicking “Accept all cookies”, you consent to the storage of cookies on your device to improve website navigation, analyze site usage and support our marketing efforts. Share your requirements with our concierge team and they will book you in with us. Best top rated service providers available!

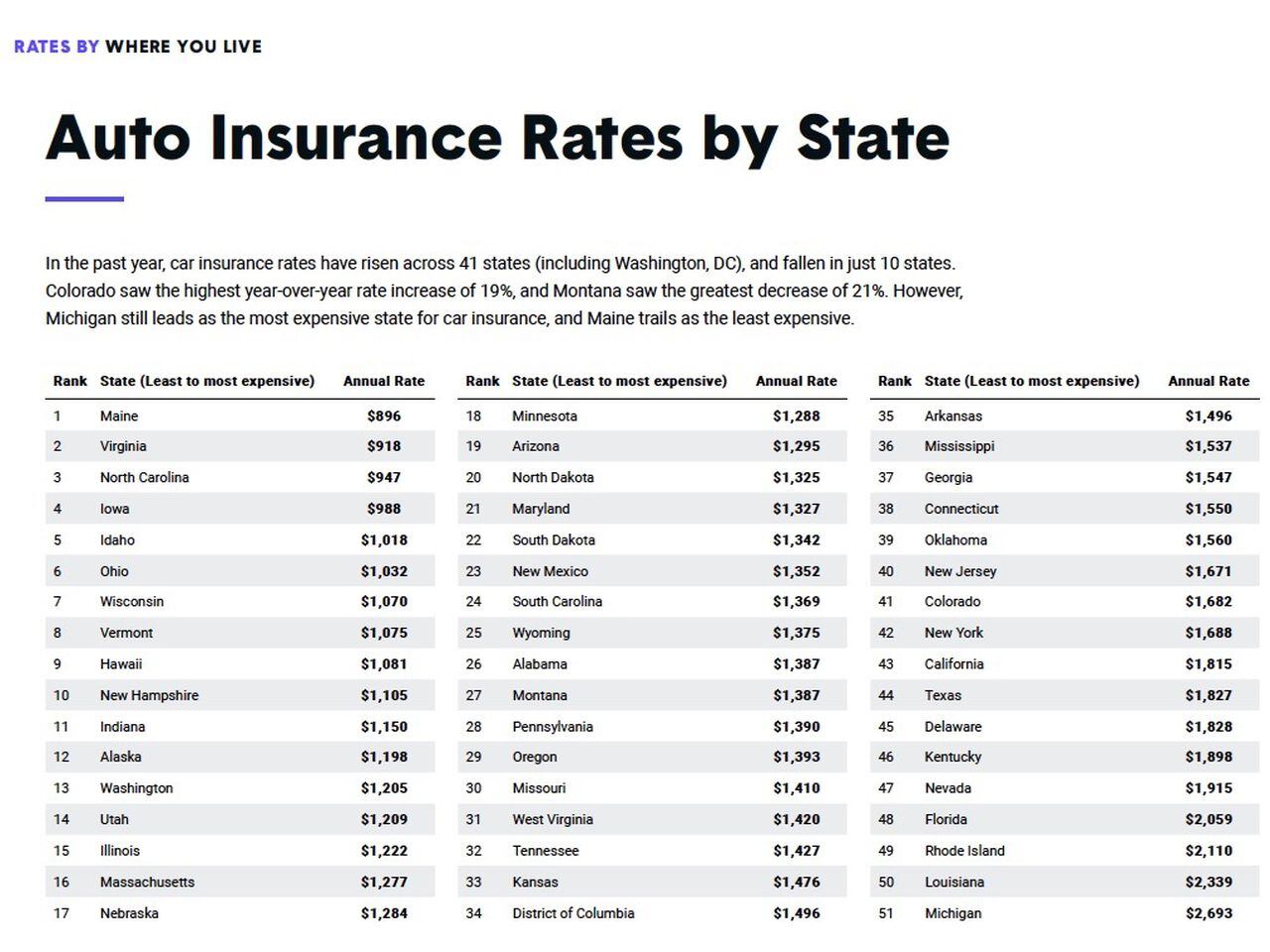

The average cost of car insurance in 2023 is $1,771 per year, but individual costs can vary based on a number of factors that affect auto insurance rates.

Best Car Insurance For Seniors In 2024

It is illegal in all 50 states to drive a vehicle without proof of your financial responsibility for accident damage or liability. Required proof comes in the form of car insurance in most states. Because of this legal requirement, understanding the current average cost of car insurance is a good choice for identifying the right auto insurance company for your needs.

When calculating the cost of a car insurance policy, insurance companies review various factors to come up with an individual rate. Those factors typically include age, location, driving history, vehicle type, previous title history and credit score. How these factors are weighed against each other also varies by insurance company. So two different people can get completely different car insurance quotes from the same company based on their unique data points.

With the current impact of inflation and rising traffic fatality rates, car insurance rates are predicted to rise in 2023. To get a handle on where average rates are now, we examined the cost of full coverage insurance policies across several demographics. Keep in mind that all of the fees listed below give you a general idea of what you can expect, but what might happen

Cost of car insurance calculator, cost of commercial car insurance, typical cost of car insurance, cost of car insurance texas, normal cost of car insurance, cost of liability car insurance, cost of insurance for car, cost of comprehensive car insurance, cost of business car insurance, average cost of car insurance, estimated cost of car insurance, the cost of car insurance