Flood Insurance – Flooding is the most common and costliest natural disaster in the United States. However, flood risks are generally not covered by most homeowners and renters insurance policies.

Since more than 20 percent of National Flood Insurance Program (NFIP) claims come from outside high flood risk areas, those living in low to moderate flood risk areas should understand their risk and consider flood insurance. FEMA’s flood mapping service allows you to determine flood risk. Risk levels are divided into three categories:

Contents

- Flood Insurance

- Flood Insurance Coverage Rules Kick In For Citizens

- Flood Insurance Coverage That Protects Your Home

- Fema Flood Insurance Rates Could Spike For Some, New Study Shows

- California Is In For A Flood Insurance Wake Up Call

- What Is Flood Insurance And How Does It Work?

- Flood Insurance Icon Royalty Free Vector Image

- Homeowners Urged To Get Flood Insurance

- Gallery for Flood Insurance

- Related posts:

Flood Insurance

The number of flood insurance claims has increased in recent years. 2015 – 25,798, 2016 – 59,322, 2017 – 95,235

Flood Insurance Coverage Rules Kick In For Citizens

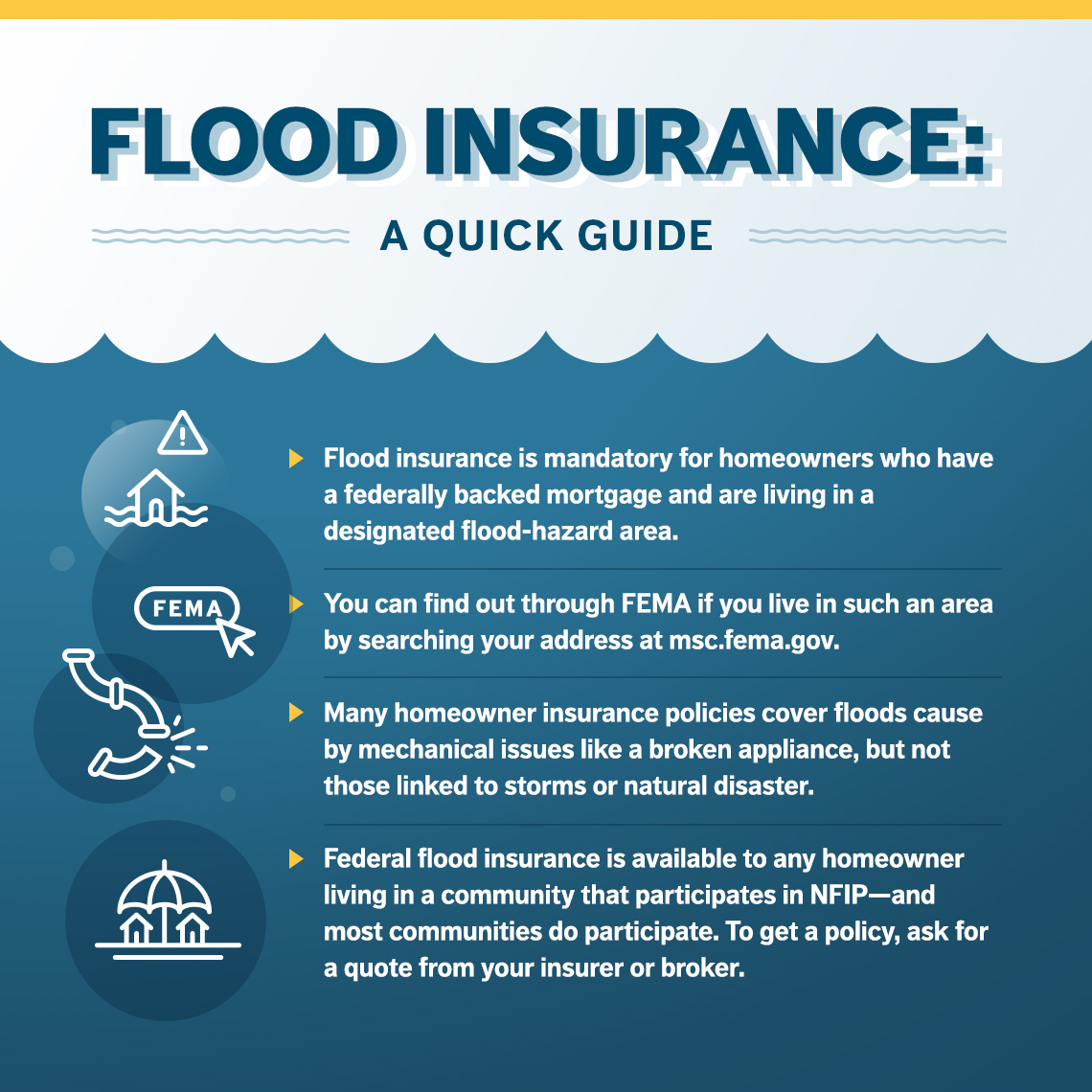

Flood insurance is special coverage that you can purchase through the National Flood Insurance Program (NFIP), administered by FEMA, or sometimes through private insurance. Your agent may be able to help you with an NFIP policy or a policy from a private insurer. To find out more about purchasing an NFIP policy, contact the NFIP Call Center at 1-800-427-4661. For more information about private insurance companies that write flood coverage in your area, contact your insurance department.

When choosing private flood insurance, shop around and compare coverages and premiums before deciding which policy to buy. Be sure to ask about the wait time. NFIP and other private flood policies have a 30-day waiting period unless the policy is purchased at the same time as a newly purchased home.

NFIP standard flood insurance pays for direct physical damage to your insured property up to the lesser of replacement costs or the actual cash value (ACV) of the actual damage, or policy limits.

Policy Comparison Homeowners Insurance Coverage: Leaky roof (unless properly repaired), burst pipe, overflowing bathtub, personal property damage due to covered perils, backup water from outside septic tank (usually requires a driver). Flood Insurance Coverage: Damage to property or property up to $250,000 due to flood, inland water overflow or tide, mud run by river or stream.

Flood Insurance Coverage That Protects Your Home

Homeowner’s Contents: Personal property in your home is not included in the property listing form. However, coverage is available up to $100,000 for an additional fee.

Business Owners: Personal property is not included in the property title policy form. However, coverage is available up to $500,000 plus additional premium.

Private insurance companies may have higher limits or broader coverage than NFIP policies. Work with your agent to understand the private policy and compare it to the NFIP policy. Did you know that floods are the most common type of natural disaster in the United States? In addition, floods account for 90% of all natural disasters in the United States, resulting in billions of dollars in damages each year.

You may be surprised to learn that floods – although very common – are often not covered by standard home insurance. But don’t worry, there are flood coverage options for your property, which often require you to purchase a separate flood insurance policy.

Fema Flood Insurance Rates Could Spike For Some, New Study Shows

Flood insurance is often purchased in addition to home insurance and can protect your property and its contents up to a certain amount, depending on your policy’s coverage limits. In most places, you can purchase flood insurance through the National Flood Insurance Program (NFIP). Recently, some private insurance companies have started to provide this type of protection as well. Your insurance experts at Ananswer Financial always recommend comparing quotes and coverages to make sure you’re getting the right coverage for your situation and needs.

When you’re comparison shopping for flood insurance, it’s wise to make sure you know what type of flood is covered. Most flood insurance policies include:

Your insurance policy may have specific criteria for what is considered “flooding”. For example, if the flooded area was less than two acres or did not affect many buildings, your insurer may not consider it a claim-worthy event.

Some people think they don’t need flood insurance if they don’t live in a flood zone or near a river, but that may not always be the wisest decision. Flood awareness is important, especially if you live near:

California Is In For A Flood Insurance Wake Up Call

If you are in an area like one of these, it is wise to consider purchasing affordable flood insurance. For people living in developed areas full of impervious surfaces such as parking lots, roads, and sidewalks, urban flooding (sometimes called urban runoff) can be dangerous. In the event of a hurricane-like event, heavy rains can cause flooding due to excess runoff.

There may not always be warning about floods before they reach you, so we recommend that you prepare for the worst so that your property is covered and protected.

One advantage of choosing private insurance over NFIP is the option to purchase higher levels of coverage if needed or desired. If you are concerned that the value of your home or its contents may exceed what a standard policy usually covers, private flood insurance can be a cost-effective option.

Most – if not all – NFIP policies are void for the first 30 days after purchase. Private flood insurance companies may offer shorter waiting periods. If you are worried about getting a policy quickly, private flood insurance may be your best option. You don’t want to wait until disaster strikes before you get your flood insurance that works.

What Is Flood Insurance And How Does It Work?

If you live in a flood-prone area, owning a home can be a little difficult. Although a natural disaster like a flood is often unavoidable, there are steps you can take to protect your other valuable assets. If you live in a two-story home and know a flood is on the way, move your expensive furniture and belongings to the second floor to avoid water damage.

You can also buy sandbags to try to keep water out of your home. Lay them like bricks around the outer perimeter to create a floodwater barrier. Finally, don’t forget to pack a flood protection kit so you have first aid supplies and other emergency supplies close at hand in case disaster strikes.

Taking pictures of your property and property can also be important if you ever need to apply for flood insurance. The more documents you can provide to your insurer, the better. As your insurance professional, we recommend photographing your home’s foundation, interior and exterior walls, and the contents of your home. It is important to prove the condition of your property before a flood occurs so that your insurer can quickly assess any damage.

Answer Financial is one of the largest personal lines insurance companies in the US and works with dozens of carriers to bring consumers like you the right coverage for your auto, home, renters, flood, motorcycle and other insurance needs. We understand that no two situations are the same, which is why customers find us the smart choice when looking to compare, shop and save on insurance.

Flood Insurance Icon Royalty Free Vector Image

On our user-friendly website, insurance buyers can quickly compare rates and customize coverage from multiple companies. If you have questions along the way, our insurance experts are ready to provide guidance over the phone. Over the years, we’ve helped more than 4 million people like you review their current policy and find affordable home insurance for their needs. You can talk to us at 1-888-737-7000 to buy or change your coverage from top rated insurance companies.

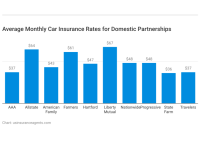

Why do car insurance quotes vary so much for the same person? One of the most frequently asked questions from customers is, “Why do car insurance rates vary so much…

Kelley Blue Book’s Expects Used Car Prices to Remain Full With factory shutdowns related to the COVID-19 pandemic, as well as microchips and other supply shortages, the current season is predicted to …

Eradicating Snow and Snow Myths In many parts of the country, snow, ice and freezing temperatures are an annual occurrence. But some things can…

Homeowners Urged To Get Flood Insurance

Answer Finance ATV Insurance Auto Insurance Auto Insurance Commercial Boat Insurance Commercial Insurance Condo Insurance Deductible Distracted Driving Earthquake Insurance Kit Flood Insurance Home Insurance Obsolete Insurance Coverage Motorcycle Insurance Personal Finance Personal Finance Car Rental Insurance RV Rental Insurance Rental Insurance RV Insurance Mini Insurance RV Insurance Mini Insurance Rescuerance Cleaning young traffic driver insurance uber umbrella insurance After years of drought, many of us are happy to hear that it could be a wet winter; however, some of us get a little nervous when we hear meteorologists predict a La Niña year after the wildfires, because that could mean floods and possible mudslides.

If you buy a home in a federally designated flood zone with a federally insured lender (and most lenders fall into this category), you are required to purchase flood insurance. Sometimes, an area that falls within a certain area on the map is unlikely to flood, but insurance is still required – unless you get a flood certificate that exempts your property from a flood zone.

Flood insurance is expensive ($1,000 to $5,000 per year). If you live on a lonely hill in a flood zone and don’t want to pay for flood insurance because you really do

Flood damage insurance, flood insurance quote, florida flood insurance, new jersey flood insurance, flood insurance quote online, cheap flood insurance, commercial flood insurance, commercial flood insurance quote, cheap flood insurance quote, business flood insurance, private flood insurance texas, flood insurance providers