Get A Free Car Insurance Quote Online – And its affiliates may earn a commission when you purchase a plan from the auto insurance providers described here. These commissions come to us at no additional cost. Our research team has thoroughly reviewed dozens of car insurance providers. See our

Shopping for car insurance quotes online may seem tedious, but it’s actually one of the easiest ways to compare quotes from multiple companies – especially if you use a price comparison tool like the one above. When choosing an insurance company, you should always get several quotes before deciding on a policy to make sure you get the best deal.

Contents

- Get A Free Car Insurance Quote Online

- Car Insurance Form Pdf

- Factors That Determine Your Car Insurance Rates

- Get Free Auto Insurance Quote Res Lp 008

- Get Free Car Insurance Quotes (2024 Guide)

- Buying Car Insurance Online: How To Do It (2024 Tips)

- Compare Car Insurance Quotes (march 2024 Rates)

- Understanding Car Insurance Quotes

- Gallery for Get A Free Car Insurance Quote Online

- Related posts:

Get A Free Car Insurance Quote Online

Our review team has studied all the best providers on the market and found the best car insurance companies that stand out from the crowd. You can get car insurance quotes online from all the top insurance companies by simply providing basic information about yourself and your car. We tell you what you need to know about buying insurance online and how to find the best offers.

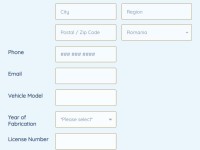

Car Insurance Form Pdf

There are three main ways to get a car insurance quote: online, over the phone and in person. Here is an overview of the advantages and disadvantages of each type of situation.

In general, it’s the fastest and easiest way to get car insurance quotes online, especially if you want to compare multiple quotes at once. It lacks the human element of dealing with an agent online or over the phone, but remember you can always get a quote online first and then call an agent to talk about your specific insurance needs.

You can work with an agent if you have questions about which level of coverage is best. As a general rule, we recommend that you take out as much liability insurance as you can afford, as one unfortunate accident can cause more damage than the state’s minimum plan can cover. For even more personal service, visit an agent at your local office.

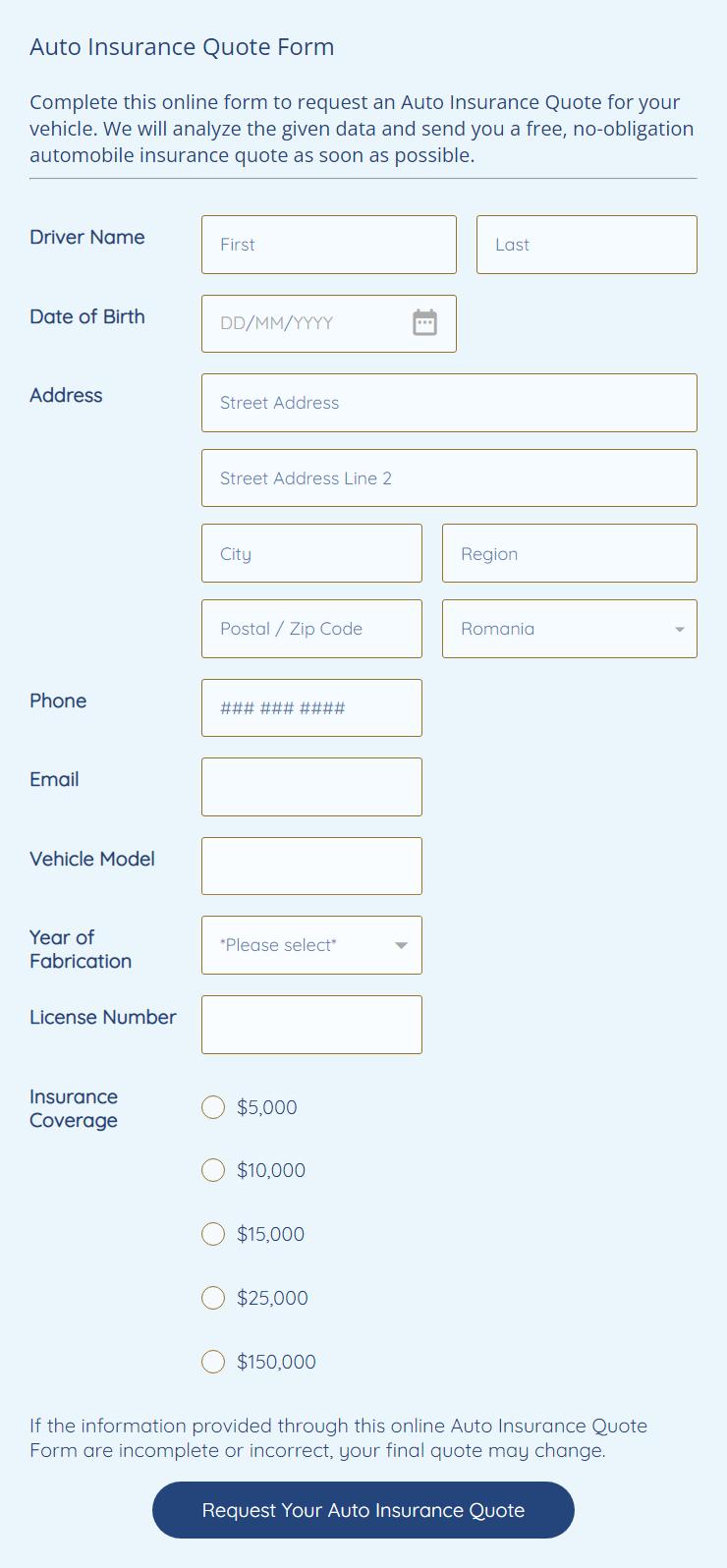

With a little planning ahead, you can make the process of getting a car insurance quote online quick and easy. More importantly, with the right information, you will get the most accurate estimates possible. Quotes are highly personal and based on who you are and what car you drive, so the more details you provide, the better. Here is the basic process for getting car insurance quotes online:

Factors That Determine Your Car Insurance Rates

1. Choose your level of coverage: Each state sets its own insurance minimums, but sometimes they don’t cover the full cost of an accident. For example, if your state requires $25,000 in personal injury liability coverage, and you cause an accident that leaves others involved with $50,000 in medical bills, you will be on the hook for the amount your insurance company pays out. t cover. You can choose higher policy limits to avoid this situation.

You must also decide whether you want comprehensive and collision insurance or other extras such as roadside assistance or carpooling insurance.

2. Collect your information: You must provide the vehicle identification number (VIN), as well as the make, model and mileage of the vehicle. You’ll also need the names, dates of birth, addresses, employment information and driver’s license numbers of everyone driving, and you’ll need to provide your social security number. Online quote tool asks for information about your driving record and current level of insurance.

3. Get a quote from a provider or comparison tool: To get car insurance quotes online, you can usually visit any major provider’s website. The biggest car insurance companies usually offer potential customers the opportunity to get free quotes online. Allow at least 10 minutes to complete the proposal form once you have the information ready.

Get Free Auto Insurance Quote Res Lp 008

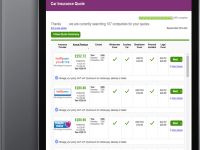

It is always a good idea to compare several quotes. You can either fill out multiple forms on different websites, or you can also use a price comparison tool like the one at the top of this article, which allows you to enter your information once and get quotes from multiple top insurance companies in your area.

4. Choose the best provider for you: When it’s time to make a decision, go with a provider that you know provides good service to drivers in your area.

We have analyzed the best car insurance providers for different situations. Here are our top 12 picks, along with an overall rating, cost rating and AM rating for financial strength for each company.

The cost of car insurance is based on the level of risk you pose to the insurance company as a driver. The company has to cover the damage under your policy, so it charges you more if it expects to pay more based on your risk profile.

Get Free Car Insurance Quotes (2024 Guide)

One of the most important factors is your age. Average car insurance rates by age range from more than $5,000 per year for teenagers to around $1,300 per year for middle-aged adults. There is a sharp price drop when you enter your 20s. Teenage males generally pay more than teenage females, but this difference diminishes with age.

Your driving experience also has a big impact on your insurance premiums. Speeding tickets, at-fault accidents, misdemeanors and felonies add to your score. A serious DUI conviction can put you at high risk and add thousands to your insurance costs.

Your postcode can also affect the prices you find. Densely populated areas have higher rates of accidents, vandalism and theft, making it more likely that your insurance company will have to cover the damage. The requirements for comprehensive insurance are higher in regions with severe weather, so these areas may also have higher costs.

One way to find cheap auto insurance quotes online is to look for discounts that apply to your situation. Insurance companies usually offer different discounts, but not all providers offer discounts on the same things. For example, GEICO is one of the few suppliers that offers a discount to federal employees. Additionally, most businesses offer some degree of a good student discount, but State Farm’s great student discount is the best in the business with up to 25% off. Other common discounts include multi-vehicle discounts, multi-policy discounts, and safety feature discounts.

Buying Car Insurance Online: How To Do It (2024 Tips)

If you are a good driver and don’t drive very often, you can also save on your car insurance by choosing a usage-based program. These programs track your driving and reward you with discounts for safe driving and low annual mileage.

While you can’t control your age or driving record, you can work to improve your credit score if it’s low to get good rates in the future. You can potentially save hundreds a year if you make a significant improvement.

Finally, it is always important to spend time comparing multiple quotes from different companies. Your situation is the same no matter where you get your quote, but providers will assess your risk differently and offer different rates. You should also shop around every time your policy comes up for renewal, just to make sure you’re getting the best rate available.

Don’t spend too much time finding the perfect provider if you risk losing your coverage. If for some reason your car insurance is not to be renewed, you must prepare a new policy. To an insurance company, a denial basically means you were an uninsured motorist at the time, and that will increase your car insurance rates.

Compare Car Insurance Quotes (march 2024 Rates)

In summary, different suppliers offer different prices. Getting multiple quotes increases your chances of finding the best price for your situation. Of course, you probably don’t have time to get quotes from the dozens of companies on the market today. We recommend checking GEICO, USAA and State Farm for low prices, or you can use our free price comparison tool below to find the cheapest prices in your area.

Our team of reviewers delve into things like financial stability, industry rankings, customer experience, pricing and claims service for all the top car insurance providers. After measuring the results, we recognize that GEICO auto insurance has the most discounts because it is strong in many areas and has a low price for many drivers.

GEICO offers a wide range of coverage options and several additional services such as roadside assistance, classic car insurance, carpooling insurance and mechanical breakdown insurance. Here are some more highlights about the company:

If you have served your country as a member of the military or if you have a close family member who has served, it is a good idea to check with USAA. The company is known for both offering cheap car insurance and quality service – two things that don’t always go hand in hand. USAA is available to military service members, veterans, and spouses and children of USAA members.

Understanding Car Insurance Quotes

Whether you want basic bodily injury and property damage coverage or comprehensive coverage with high limits, USAA auto insurance has options. Rideshare drivers can also find reliable coverage from the company. And because USAA serves the military community, it offers helpful benefits like deployment checklists and salary calculators. Here are a few more

Get a quote on car insurance online, free quote on car insurance online, get a cheap car insurance quote online, free car insurance quote, get car insurance quote, get a free car insurance quote online, online car insurance quote, get insurance quote online, get car insurance quote online, free car insurance quote online, get a free quote for car insurance, get a free car insurance quote