Get Cheapest Car Insurance Quote – Partner Content: This content is produced by a Dow Jones business partner, independent of the newsroom. Links in this article may earn a commission. learn again

Even if you don’t have auto insurance with no deductibles, we can help you find liability and full coverage insurance policies with low down payments.

Contents

- Get Cheapest Car Insurance Quote

- Best Cheap Car Insurance For Those With A Bad Driving Record

- Steps To Getting Cheap Car Insurance

- New Driver: Am I Doing Car Insurance Quotes Wrong?

- The Definitive Guide To Finding The Best Cheap Car Insurance

- Shop Auto Insurance

- Young America Auto Insurance Coverage

- Discount Car Insurance Coverage Jacksonville

- Cheapest Car Insurance Companies Of May 2024

- Related posts:

Get Cheapest Car Insurance Quote

Written by: Daniel Robinson Written by: Daniel Robinson Author Daniel is a leading columnist and has written for several automotive news and marketing sites in the US. Daniel is a team leader in auto insurance, loans, warranty options, auto service and more.

Best Cheap Car Insurance For Those With A Bad Driving Record

Edited by: Rashawn Mitchner Edited by: Rashawn Mitchner Managing Director Rashawn Mitchner is a leading team editor with over 10 years of experience covering financial and insurance topics.

Technically, there is no such thing as no-cost car insurance or “free car insurance”. All eligible auto insurance policies require you to pay up front. If the insurance company offers “low-cost insurance” or “low-deposit car insurance,” the deductible is the first month’s premium. In most cases, the deposit is only one percent of the total amount and is not a separate fee.

At The Leaders Team we explain insurance discount rates and guide you through the options to find the best auto insurance rates. To find the best rates, we recommend getting quotes from the best auto insurance companies in the industry.

National Auto Insurance Companies Auto Insurance Rates By State 10 Largest Auto Insurance Companies In The US Related To Car Insurance Rates Best Car Insurance Companies Cheap Car Insurance Issues

Steps To Getting Cheap Car Insurance

Leaders Group is committed to providing reliable information to help you make the best decisions about insuring your vehicle. Because customers trust us to provide complete and accurate information, we have created a comprehensive rating system to ensure our ranking of the best auto insurance companies. We collected data on several auto insurance providers and ranked these companies based on a range of proprietary features. After 800 hours of research, the result is an overall ranking for each provider, with the insurance companies with the highest scores at the top of the list.

A down payment is the amount required to start your auto insurance policy – your payment for your first month, six months or year of insurance coverage. Once you pay the down payment, you will be covered under the policy you purchased. If you haven’t paid for your car insurance, you won’t be able to file a claim and get paid from your insurance. Car insurance providers take risk in underwriting, so by offering discounted rates, they offset some of the risk.

Deductibles may vary depending on state laws, the policy you purchase, and insurance company guidelines. High-risk drivers, those with poor credit, or drivers who want to drive the SR-22 should pay more. The vehicle you insure will also determine how much you pay. Newer and more expensive vehicles tend to have higher insurance premiums.

This means you pay your car insurance premium as a single payment or in installments with a payment plan. If you choose to pay in monthly installments, you will end up paying more in the long run. Paying for six months or a year will save you money, especially if the full payment is discounted.

New Driver: Am I Doing Car Insurance Quotes Wrong?

Here are some things you can do to lower your car insurance rates. In the sections below we’ve outlined several ways to help you find affordable car insurance.

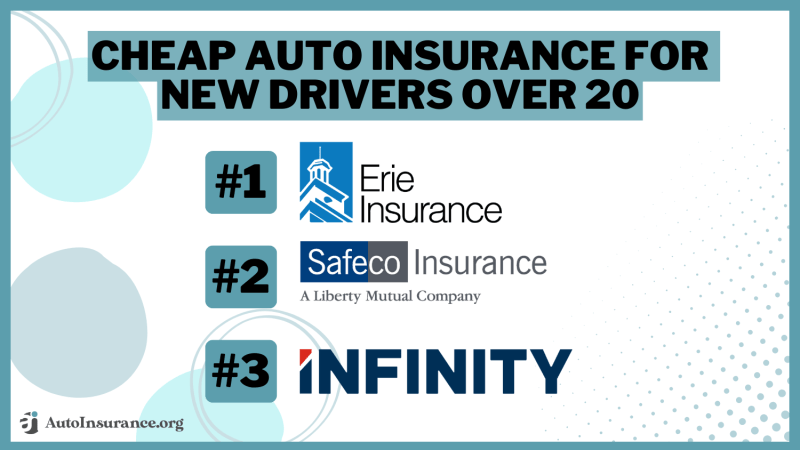

To find the best rate, compare car insurance quotes from multiple providers. The estimates below are based on a 35-year-old married driver with a clean driving record and good credit.

Based on our ratings, Union Mutual and American National Insurance offer the cheapest credit insurance policies on average. Note that Union Mutual coverage is only available to residents of New England states.

Your rates may differ from these rates based on your age, driving history, credit score and more.

The Definitive Guide To Finding The Best Cheap Car Insurance

We found that Union Mutual and Pekin Insurance offer the lowest annual premiums for comprehensive auto insurance. Although Union Mutual is only available in the New England states, several providers in the chart below offer full-price insurance in general service areas:

Many insurance companies have very low deductibles that most policyholders can afford. As mentioned above, many providers discount your full premium at the beginning of your policy term. You can also save with some companies by signing up for automatic online payments and opting for paperless credit.

This discount is usually given to drivers who have been accident free for some time.

Your provider may lower your monthly premium if you enroll in a mobile insurance plan. Also known as driver-based insurance, these programs use provider plug-ins or mobile devices that track your driving habits while you’re behind the wheel. There are many programs that track your speed, how hard you brake, how long you drive, and more. Depending on your driving style, some programs may be worth more than your money.

Shop Auto Insurance

The best way to pay less for car insurance is to drive safely. Insurance premiums for drivers with speeding or DUI convictions are higher than those with a good driving history. Always be sure to drive within the speed limit, be aware of your surroundings and limit phone use.

In the world of car insurance, higher deductibles translate into lower premiums. Keep in mind, however, that raising your deductible means paying more out of pocket each time you make a claim.

Reducing your policy to the lowest level you need is one way to lower your car insurance premium. If you own or rent a car, you should carry comprehensive insurance and collision coverage. However, if you own a vehicle, you can reduce the coverage to lower your insurance premiums.

If you own an older vehicle, comprehensive maintenance and collision coverage is not a bad investment. If your car down payment is more than 10%, it’s time to consider opting out of these types of policies.

Young America Auto Insurance Coverage

If you have bad credit, you may pay more for car insurance than someone with good credit. Work to improve your credit score and lower your car insurance premium.

In short, you won’t find the right car insurance that doesn’t require a premium. You can get cheap car insurance by driving safely, searching for car insurance quotes and getting free quotes from cheap car insurance companies.

State Farm has built a strong reputation in the auto insurance industry for offering affordable rates and strong customer service. Based on our research, State Farm’s comprehensive insurance coverage is $138 per month, 18% less than the national average of $167 per month. The company maintains a financial strength rating of AM Best and scores well in multiple JD Power surveys and will be number one in the US by 2023. Insurance Purchase Study.

Geico is the third largest insurance company in the country. According to our rate estimates, full coverage insurance policies from Geico start at about $133 per month, which is 20% lower than the national average of $167 per month. Because of the low insurance rates, we give Geico an overall rating of 9.1 out of 10.0. Geico also has great financial strength, which reflects its ability to pay claims, according to AM Best.

Discount Car Insurance Coverage Jacksonville

Yes, in many states, your credit score affects your auto insurance rates. Checking your credit report, setting up automatic payments and reducing new credit applications can help you improve your score and lower your car loan payments.

Based on our research, Union Mutual offers low cost loans with full coverage auto insurance. Union Mutual’s total premiums average $708 per year, or 65% less than the national average of $2,008 per year. However, Union Mutual only serves residents of New England states.

No, Geico does not offer free insurance. No down payment insurance. Some insurance providers offer lower rates, but most pay for the first month.

No, you cannot get $0 down on car insurance from a legitimate insurance provider. This type of insurance does not exist, but you can pay much lower prices.

Cheapest Car Insurance Companies Of May 2024

Auto insurance companies have to deal with certain risks that they have to face in order to start your auto insurance policy. You won’t find the right car insurance that doesn’t require a deposit or down payment.

Because customers trust us to provide complete and accurate information, we have created a comprehensive rating system to provide our guide with the best auto insurance companies. We collected data on several auto insurance providers and ranked these companies based on a range of proprietary features. The result is an overall rating for each provider, with insurers scoring the highest at the top of the list.

Daniel is a columnist for The Leadership Team and has written for several auto news sites and

Cheapest car insurance online quote, cheapest insurance quote, cheapest life insurance quote, cheapest car insurance quote, uk cheapest car insurance quote, cheapest ever car insurance quote, get the cheapest car insurance quote, get cheapest car insurance, get car insurance quote, cheapest home insurance quote, find the cheapest insurance quote, get cheapest insurance quote