Group Insurance – Types of group insurance – group health insurance, group insurance, group term life insurance, group travel insurance, etc.

A group insurance policy refers to an insurance policy that covers a group of people belonging to the same business, profession or association. Cover benefits are provided as per policy guidelines. These discounts apply to all members under the same category. (eg: employees, trade union members, etc.).

Contents

- Group Insurance

- Individual Vs Group Life Insurance — The Insurance People

- Group Health Insurance Basics

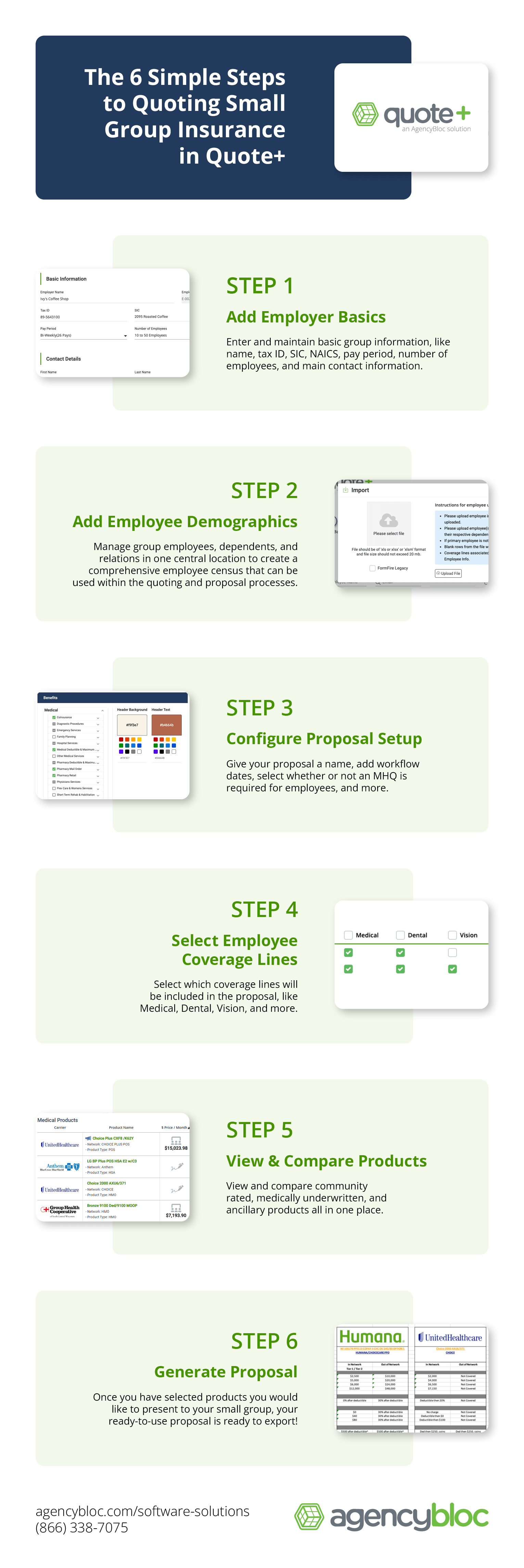

- Infographic] The 6 Simple Steps To Quoting Small Group Insurance In Quote+

- Apollo Health Insurance Group

- Advantages Of Group Medical Insurance

- Types Of Group Insurance

- Hefner Group Insurance

- Group Insurance Icon Royalty Free Vector Image

- Gallery for Group Insurance

- Related posts:

Group Insurance

Group insurance in India is highly tailored to the needs of both employers and employees. The ability to customize a group insurance policy sounds like a blessing. You can choose what works and what doesn’t to meet the needs of your employees. A group insurance policy can be customized as per the requirements like whether it covers parents or not, additional payment option and many more.

Individual Vs Group Life Insurance — The Insurance People

These are cultural, social or welfare associations where the group manager or association manager buys group insurance. Members of the association or organization are insured in this process.

There are many group insurance plans available. Although the list may vary, we can divide them into two main categories, namely: non-contributing and contributing.

In this type of group insurance policy, the premium is paid by the employers of the company. In this case, employees can use the group insurance without paying an additional fee.

In this case, employees or members must pay premiums (in part or in full) to take advantage of the coverage. For example, an employer may withhold a portion of an employee’s wages to pay the premium for a group insurance policy.

Group Health Insurance Basics

Group health insurance is one of the most common types of insurance that employers offer to their employees. As the name suggests, a group health insurance policy provides health insurance to all employees working in that organization. The group health insurance plan may also cover employees’ dependents. For example: parents, spouses, children, etc.

Road accidents can happen very suddenly and are one of the top 10 causes of death in India. Group accident insurance can help protect employees or members against unexpected accidents and expenses.

Group term life insurance is a type of policy that ensures that the families or dependents of your employees are covered in the event of their death. The employee’s representative receives the sum insured in the event of the employee’s death.

Travel is an integral part of business. But frequent travel comes with some risks. As an employer, the group can protect its employees against unexpected events and travel expenses through travel insurance.

Infographic] The 6 Simple Steps To Quoting Small Group Insurance In Quote+

Here are some features that provide employee healthcare services designed specifically for the modern Indian workforce.

Make sure you have continuous support for queries or support. So 24*7 support is available.

It is always better to have a single point of contact to streamline the claims process. ensures that you receive a specific SPOC for all inquiries to make claiming hassle-free.

Sometimes group health insurance may not be enough for employees. enables employees to increase insurance cover by up to 20 lacs with the super top-up feature of group health insurance.

Apollo Health Insurance Group

Has its own dashboard that provides a one-stop solution for all insurance-related questions for you and your employees. From managing group insurance and tracking policies in real-time to making approvals, HRMS’ built-in dashboard makes everything easy.

It also offers free wellness packages so that mental health is not overlooked as it is just as important to a person’s overall well-being. Our site uses cookies to improve your visitor experience. By browsing our website, you accept the use of cookies and agree to our privacy policy.

Group life insurance is a type of life insurance offered by an employer or organization to its employees or members. It provides financial protection to beneficiaries in the event that the insured person dies during membership of the group.

This is relatively common, as nearly three-quarters of full-time workers access group life insurance through work.

Advantages Of Group Medical Insurance

Term or universal group insurance is often an easy way to get basic coverage. While most workers participate in some type of group insurance, you’ll want to do your homework to determine if this type of life insurance policy meets all of your needs. Here’s what you need to know.

In general, larger organizations such as corporations, unions, alumni associations, and other membership groups can get a better deal when purchasing life insurance because they have a larger pool of potential participants. This helps keep their costs relatively low, and these organizations can pass the savings on to participating members and employees. Depending on your employment or membership status, you may receive free basic life insurance or a small premium from your salary.

In most cases, you won’t have to undergo a medical examination or fill out bulky group coverage questionnaires. This is because insurance coverage is for a group of people and not for each person. Therefore, insurance coverage is more appropriate than purchasing benefits on your own. However, coverage is often limited to smaller death benefits, so consider whether this is sufficient for your situation.

Group insurance works like any other life insurance policy – you choose your policy terms, death benefit and beneficiary. You will then pay your reward within the deadline. If you die, your death benefit will pass to your beneficiary as long as your coverage is valid and your premiums are up to date. They can use these funds to replace your income, pay off outstanding debts, pay for funeral services or pay home expenses such as a mortgage.

Types Of Group Insurance

In most cases, with group insurance, you can get a death benefit of one or two times your basic salary for free or at a very low premium. For example, if you earn $50,000 a year, you may be eligible for a death benefit of between $50,000 and $100,000. Also, some employers may allow you to increase the death benefit under their policy, while others may impose a limit. , for example up to five times the basic salary. Any premiums you have to pay for additional coverage will come out of your salary.

Depending on your employer, coverage may be delayed. Some employers typically have a waiting period of 30 to 90 days before benefits begin. Changes may be made during the open enrollment period.

In most cases, if you get insurance through work, it’s group life insurance. Term coverage means that your policy covers you for a specific period of time, such as 10, 20 or 30 years. When the policy expires, your coverage stops. You must purchase a new policy to continue coverage.

If you have group insurance coverage at work, the policy is usually valid as long as your employer continues to offer it. You can usually buy cover equal to your basic salary up to a set limit. In most cases, your guarantee is one to two times your base salary. In some cases, however, premiums may be increased every 5-10 years, as the cost of life insurance generally increases with age.

Hefner Group Insurance

Also, in most cases, if you leave your employer, your policy will no longer be valid. In this case, your life insurance will not continue if you quit your job or quit if something happens in the middle of the job.

Some organizations offer group universal life insurance as an incentive to attract employees, although this is not very common. These policies typically have limited options compared to purchasing non-occupational coverage. However, a universal policy is a type of permanent life insurance. So it will last you a lifetime as long as you pay the bills. Consequently, this usually means premiums are more expensive than term insurance.

As with other policies, group universal life insurance pays a death benefit up to a specified sum assured. Depending on your employer, you may be able to increase your death benefit by taking it out of your salary.

Universal policies also have a cash value component where a portion of your premium is invested. The fund has the potential to accumulate over time, depending on the market. You can usually withdraw from the deposit without penalty. However, any withdrawals can reduce your death benefit until it is paid, often with interest.

Group Insurance Icon Royalty Free Vector Image

It should be noted that in many cases, employers allow employees to follow universal group life policies for other jobs. However, check the fine print when you sign up to find out what happens if you leave your employer.

This type of policy has benefits for participants – these plans are so popular for a reason. Here are some benefits.

If you have specific questions about your employer’s group policy, feel free to ask HR. Experts can answer most of them

Small group insurance, small group health insurance, group health insurance coverage, group health insurance, large group health insurance, group insurance for employees, small group insurance plans, group health care insurance, group home insurance, employer group health insurance, group health insurance policy, business group health insurance