Home Insurance Rates – Home insurance (also known as home insurance) is not a luxury. It’s a must. This isn’t just about protecting your home and belongings from damage or theft. In this post, we will guide you through the basics of home insurance.

In practice, all mortgage companies require borrowers to provide insurance for the entire property or the fair value (usually the purchase price), and they will not grant a loan or finance a residential property transaction without proof of this. Through the mortgage provision of your home insurance, the lender receives payment if your home is destroyed during the mortgage term.

Contents

- Home Insurance Rates

- Most And Least Expensive States For Home Insurance Rates

- Homeowners Insurance Guide: A Beginner’s Overview

- Discover The Reasons Behind The Soaring Homeowners Insurance Rates In Florida

- Compare Cheap Home Insurance (2023)

- Why Homeowners Insurance Rates Change

- Save On Home Insurance In Indian Trail, Nc

- Top 5 Home Insurance Companies In Grass Valley, Ca

- Gallery for Home Insurance Rates

- Related posts:

Home Insurance Rates

You don’t even have to be a homeowner to need insurance. Many landlords require tenants to maintain renter’s insurance coverage. Whether you need it or not, it’s wise to have this type of coverage.

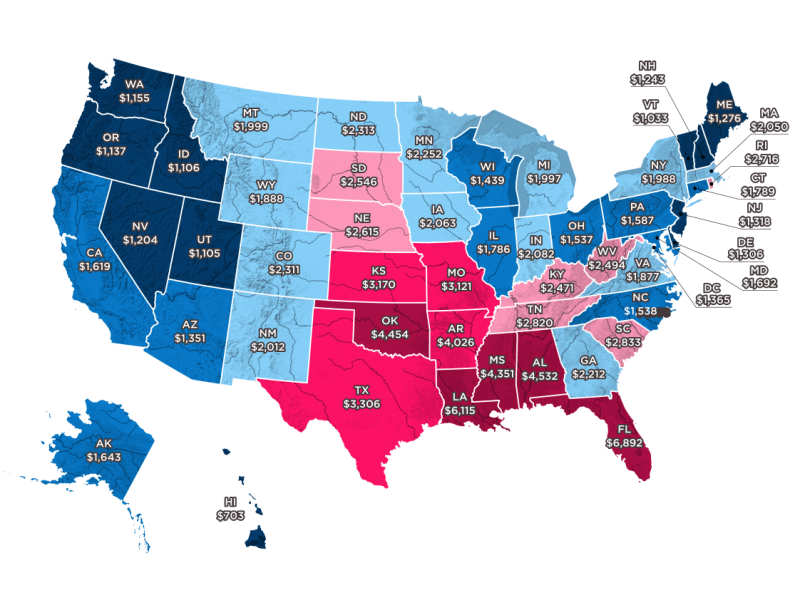

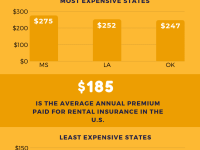

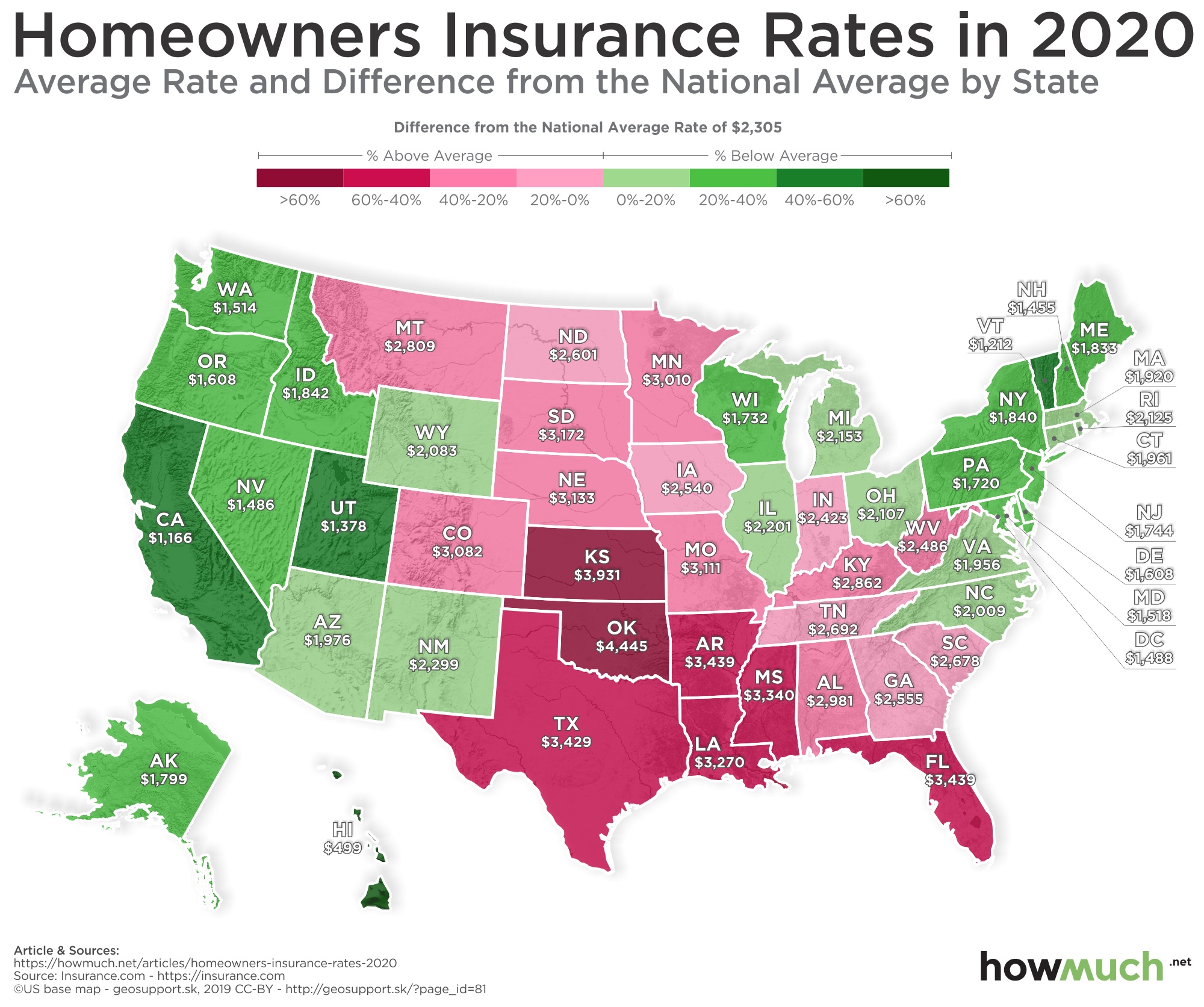

Most And Least Expensive States For Home Insurance Rates

While homeowner’s insurance is endlessly customizable, there are certain standard elements that dictate what costs the insurer will cover. Each of the broader coverages is discussed below.

If the damage is caused by fire, hurricane, lightning, vandalism, or another covered disaster, your insurance company offers a guarantee to repair or completely rebuild your home. Destruction or disintegration caused by floods, earthquakes or poor home maintenance is usually not covered and may require a separate rider if you want this type of coverage. A separate garage, shed or other structure on the property may also have to be covered separately with the same instructions as the main building.

Clothes, furniture, appliances and most other household contents are replaced if they are damaged in an insured catastrophe. You may also be able to get ‘other premises’ insurance, so you can make a claim for lost jewelery no matter where in the world you lose it. However, there may be a limit to the insurance company’s compensation. According to the Insurance Information Institute, most insurance companies cover 50 to 70 percent of the insurance you purchase for the structure of your home. For example, if your home is insured for $200,000, you have coverage for up to about $140,000 worth of your property.

If you own a lot of expensive items (art, antiques, fine jewelry, designer clothes), it may be a good idea to pay to cover them separately according to an individual schedule, buy a special contract or buy a separate policy. .

Homeowners Insurance Guide: A Beginner’s Overview

Liability coverage protects you from lawsuits filed by others. This clause includes your pet! So if your dog bites your neighbor Dori, your insurance company will pay the medical bills, even if the bite happened at your home or his home. Or if your child breaks a Ming vase, you can claim compensation. If Doris slips on a piece of a broken vase and successfully sues for pain and suffering or lost wages, you will likely be compensated just as if someone had been injured on your property.

According to the Insurance Information Institute, policies can provide at least $100,000 in coverage, but experts recommend providing at least $300,000 in coverage. By adding a few hundred dollars in additional coverage to your premiums, you can purchase over a million dollars or more with umbrella insurance.

It’s unlikely, but if you have to be away from home for a while, this is undoubtedly the best insurance you’ll ever buy. This portion, known as excess living expenses, pays for rent, hotel rooms, restaurant meals and other incidental expenses incurred while you wait to occupy your home. But before you book a suite at the Ritz-Carlton and order caviar from room service, remember that daily and total limits are strictly policy. Of course, you can expand your daily limit if you’re willing to pay more for coverage.

Not all insurance policies are created equal. The cheapest home insurance will likely offer the least coverage and vice versa.

Discover The Reasons Behind The Soaring Homeowners Insurance Rates In Florida

There are several forms of home insurance in the United States that are standardized across the industry. They are labeled HO-1 through HO-8 and offer varying levels of protection depending on the homeowner’s needs and type of residence.

Actual cash value (ACV) includes the cost of your home plus the value of your property less depreciation (ie, what the item is worth now, not what you paid for it). Some policies may include a refundable depreciation clause that allows the owner to claim the amount of depreciation with ACV.

By reducing depreciation, you can repair or rebuild your home to its original value.

This most comprehensive inflation buffer covers the cost of repairing or rebuilding your home. This is true even if the amount exceeds the insurance limits. Some insurance companies offer extended claims. This means it offers more coverage than you bought, but there is a cap. Typically 20-25% higher than the limit.

Compare Cheap Home Insurance (2023)

Some advisors believe that all homeowners should purchase replacement value insurance because they don’t need enough insurance to cover the value of their home, but enough to rebuild their home. Renovating an apartment requires adequate insurance, preferably for its current value (which may have increased after purchase or construction). Guaranteed replacement value contracts cushion increased replacement costs and provide homeowners with a cushion if construction costs rise.

Homeowners insurance policies typically include coverage for a wide variety of perils and events that could damage your property or assets. However, there are also some general exclusions, which are situations or events that are not covered by standard insurance. If you want coverage for many of these specialty products, you’ll likely need to purchase separate or individual coverage.

There are several natural disasters that are not covered by standard coverage. Standard home insurance usually does not cover damage caused by floods. Earthquake damage is usually excluded from standard home insurance policies. Some policies include limited coverage for sudden and accidental submersion damage, but often also exclude extensive or gradual submergence damage.

Some home repair and maintenance costs are not covered. Many standard policies exclude damage from drain or drain storage. Repairs or replacements due to normal use are also usually not included. Damage from termites, rodents, other pests and mold can also be ruled out, especially if preventative measures are not taken.

Why Homeowners Insurance Rates Change

Finally, there are many functions that are not covered. Damage caused by war, terrorism or civil unrest is usually not covered by standard home insurance, nor is damage caused by a nuclear accident or radiation. If you intentionally cause damage to your own property, the insurance may not compensate you. Additionally, if your home needs to be rebuilt or repaired under updated building codes or laws following a covered loss, the additional costs may not be fully covered by standard insurance.

So what drives up interest rates? Typically, rates are determined based on the insurer’s perceived “risk” – the likelihood that the homeowner will make a claim. When determining the risk, home insurance companies strongly take into account the home owners’ previous home insurance claims as well as claims related to property and apartment credit.

Insurance companies exist to pay claims and they are also in it to make money. Insuring a home that has suffered multiple damages in the last 3-7 years can raise your home insurance premium to a higher price level, even if the previous owner makes a claim. Based on recently made claims, you may not be entitled to home insurance, the bank says.

The neighborhood, crime and the availability of building materials also affect the amount of the share. Of course, your coverage options, such as deductibles or add-ons for art, wine, jewelry, etc., and the coverage you want will also affect the amount of your annual premium.

Save On Home Insurance In Indian Trail, Nc

What else affects prices? In general, almost anything that affects your risk potential can affect your interest rates. For example, a poorly maintained home can increase the need for major damages. Another example is that homes with certain types of dogs may be more prone to damage. At a high level, prices are determined based on the insurer’s probability of compensation. The more variables that affect this risk, the higher the interest rate.

It doesn’t cost anything to opt for cheaper coverage, but there are ways to lower your premiums.

Burglar alarms monitored by a central police station or connected directly to a local police station can help homeowners reduce their annual insurance premiums by at least 5%. To receive the discount, homeowners must provide the insurance company with proof of centralized control, usually in the form of an invoice or contract.

Smoke alarms are another big problem. They are standard in most modern homes, but installing them in older homes can save homeowners over 10% of their annual insurance premiums. CO detectors, locks, sprinkler systems and in some cases weather control devices can also help.

Top 5 Home Insurance Companies In Grass Valley, Ca

Health insurance or

Home insurance rates ontario, home owners insurance rates, compare home insurance rates, texas home insurance rates, lowest home insurance rates, home owner insurance rates, best home insurance rates, cheapest home insurance rates, cheap home insurance rates, average home insurance rates, home mortgage insurance rates, oklahoma home insurance rates