Insurance For Car – The most expensive car in 2023 is the Chrysler Voyager L, the Maserati Ghibli GranSport is the most expensive car in 2023.

Author: Lena Borrelli Lena Borrelli Lena Borrelli is a freelance writer from sunny Tampa Bay who has worked with major industry leaders such as Gronk Fitness, Morgan Stanley, Wells Fargo, and Simon Corporation. His work has recently been published on sites such as TIME, Microsoft News, Bankrate, Investopedia, Fiscal Tiger, The Simple Dollar, ADT, and Home Advisor.

Contents

- Insurance For Car

- How Does Car Insurance Deductible Work?

- Best Car Insurance Companies 2023

- How Is My Car Insurance Rate Calculated?

- How To Sue Geico Auto Insurance For Car Accident Injury Settlements

- What Is The Role Of Car Insurance Companies In Car Accident Cases?

- How To Buy Car Insurance For A New Car

- Will Your Personal Car Insurance Cover A Rental Car?

- What Is Comprehensive Insurance And What Does It Cover?

- Buy Car Insurance Like A Pro

- Gallery for Insurance For Car

- Related posts:

Insurance For Car

Reviewed by: Nupur Gambhir Nupur Gambhir Nupur Gambhir is a content editor and licensed life, health and disability insurance professional. He has extensive experience in bringing brands to life and has built award-nominated campaigns in the travel and technology categories. His insurance expertise has been featured in Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym, and end-of-life planning services.

How Does Car Insurance Deductible Work?

Is committed to providing honest, trustworthy information to help you make the best financial decisions for you and your family. All of our content is written and reviewed by industry experts and insurance experts. We maintain strict editorial independence from insurance companies to maintain editorial integrity, so our recommendations are unbiased and based on a comprehensive list of criteria.

There are many advantages to buying a used car. Since your car has already depreciated in value, you won’t have to pay as much as a new model, and you may have more room to negotiate the sale price. Buying a used car can save you money on both purchase and car insurance costs, but it’s important to do your homework to find the right used car insurance for your situation.

When shopping for a used car, there are several steps you can take to make sure you get the car you want and the right used car insurance to protect it. Car insurance can be an important factor when buying a car, so you should always compare insurance quotes for each car you are considering.

According to the data, the cheapest car model is the Chrysler Voyager L ($1,267 per year), and the most expensive car model is the Maserati Ghibli GranSport ($4,191 per year in premiums).

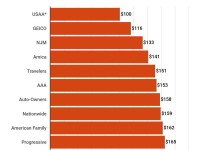

Best Car Insurance Companies 2023

Used car insurance premiums are determined by several factors. Car insurance companies consider certain insurance evaluation factors, such as where you live, your driving record, and your credit score.

However, one of the most important factors for insurance companies is which car will be under your used car insurance policy.

Family-friendly cars with safety features almost always cost less than sports cars, regardless of whether the car is used or new.

We looked at the overall coverage figures for popular used cars from 2006 to 2021 and found that the 2006 Honda Odyssey LX was the cheapest used car with an annual coverage cost of $922.

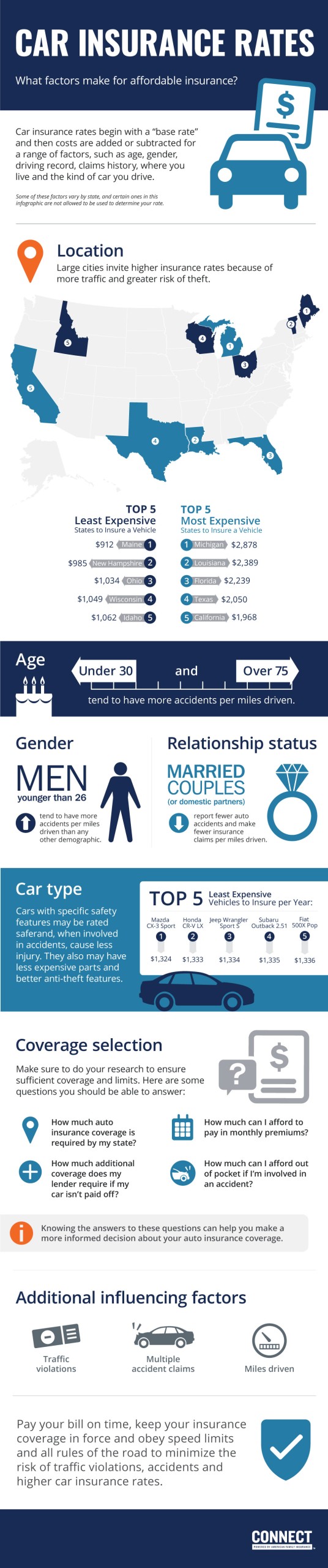

How Is My Car Insurance Rate Calculated?

On the other hand, the 2015 Porsche 918 Spyder has an annual premium of $5,239, making it the most expensive used car ever.

* Full coverage is recommended for 2020 and newer vehicles, so only full coverage rates (Collision and Liability + Liability) are shown.

The hypothetical driver is a 40-year-old male who travels 12 miles per day and has insurance limits of 100/300/50 ($100,000 for single-accident liability, $300,000 for total liability, and $50,000). A $500 deductible is provided for property damage) and collision with comprehensive coverage. Rates also include driver coverage (we cover everyone because some states require it) and PIP or medical expenses if required by state law. This hypothetical driver has a clean record and good credit.

For liability, 100/300 is the rate for the same virtual driver, but the liability limits are 100/300/50, with the amount corresponding to the lower driver or lower on PIP or MedPay if the state requires. Even if you only have liability coverage, it may be a good idea to set your limit this high. The state’s minimum insurance includes only the state’s basic liability limits and other state-mandated coverage, such as driver and PIP.

How To Sue Geico Auto Insurance For Car Accident Injury Settlements

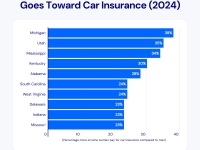

Averages were calculated for 10 zip codes per state using data from six major carriers: Allstate, Farmers, GEICO, Nationwide, Progressive and State Farm.

Some cars are more expensive than others. These are the most expensive used cars in 2021 based on 100/300/50 comprehensive liability coverage with collision and comprehensive coverage with a $500 deductible.

If you don’t have a lot of money to spend on car insurance, you can save a lot of money by choosing one of these models. This is the cheapest used car based on 100/300/50 liability coverage, with a $500 deductible for comprehensive and collision coverage.

When deciding how much to insure for a used car, it helps to know which car is more expensive. Based on used car insurance premiums by model, these are the most expensive used cars in 2023.

What Is The Role Of Car Insurance Companies In Car Accident Cases?

Some cars are more expensive than others. These are the most expensive used cars in 2023 based on comprehensive 100/300/50 liability and collision coverage with comprehensive coverage and a $500 deductible.

If you are looking for cheap car insurance, here are the cheapest used cars for 2023.

Don’t forget to consider the cost of car insurance when choosing a new car. Insurance costs can often add 15% or more to your monthly car payment.

For example, if your car payment is $400, even the lowest monthly premium on the list, a Chrysler Voyager L, will cost you $106 per month, or about 25% of your car payment.

How To Buy Car Insurance For A New Car

Research the cost of insurance for any car you’re seriously considering to make sure you can actually afford it.

Our used car insurance tool provides average insurance rates for specific vehicles, so you don’t need to call or go online to get a quote for each vehicle you’re considering. Getting a quote online will not only help you decide which car to buy, but it will also help you make sure that the car and insurance are within your budget.

Before you get a quote, know what level of comprehensive, collision and liability insurance you want. One question you must consider is how much full coverage your car insurance covers. This includes liability insurance.

If you are legally responsible for a car accident, liability insurance covers injuries to the occupants of the other vehicle or their property.

Will Your Personal Car Insurance Cover A Rental Car?

All states except New Hampshire require a minimum level of liability insurance. Liability coverage is divided into two types: bodily injury and property damage. State minimums are much lower, but experts say you should at least get:

It is always important to protect yourself with higher coverage because you may be held personally liable if you exceed the limit. Insurance companies also consider a model’s claim history when calculating rates. This means that if your car model is stolen frequently, gets into a lot of accidents, or gets ticketed frequently, your car insurance premium will be higher. It has nothing to do with your driving record.

Once you have determined the amount of liability you need, decide if you want comprehensive and collision insurance. This is car insurance that protects your car.

Collision coverage covers damage to your vehicle as a result of an accident with another vehicle or object. Comprehensive coverage includes theft and damage from flood, fire, vandalism and other causes beyond your control.

What Is Comprehensive Insurance And What Does It Cover?

You can run the numbers to see if it fits your situation. A good rule of thumb is:

Keep in mind that thieves steal more old cars than new ones. Therefore, unless your car is worth very little, it is a good idea to keep comprehensive insurance. Some car insurance companies offer the option to purchase comprehensive insurance without collision coverage. Others require you to buy both.

When shopping, don’t forget to use apples-to-apples comparisons to compare rates for the same level of coverage.

Value: The value of your vehicle, whether new or used, is very important to your RS when calculating collision and comprehensive costs. This is because if there is a total loss, you may need to cover the costs.

Buy Car Insurance Like A Pro

Repairs: Repair costs are also a consideration. Used cars with newer, more expensive technology will cost more than older cars with little or no technology. An older car that is hard to find parts for and requires repair specialists may cost more than a new car for which parts and repair specialists are readily available. The more you pay for repairs, the more you will pay in insurance.

Claim history on your vehicle: If your insurance company has historically paid out a lot of claims on your car model, it will cost you more. For example, if your model car is stolen more often, you will end up paying more than a car that is generally less popular with thieves.

Vehicle Type: Like new cars, sports cars usually cost money.

Shop for car insurance, insurance company for car, car insurance for family, cheap insurance for car, car insurance for business, shopping for car insurance, lawyer for car insurance, quote for car insurance, insurance for car transport, commercial insurance for car, insurance for car repairs, quotes for car insurance