Landlord Insurance – Homeowners insurance can be more complicated than most types of insurance – it comes in different forms, has two types of premiums, and has different types of coverage. That’s why we’ve created this walking guide to explain renter’s insurance jargon, explain the different policies, and simplify the decision-making process. What you need to know about renter’s insurance.

Renters insurance is an insurance policy for renters who rent out their apartments, condos, or apartments. If you currently have homeowner’s insurance, it will only cover you until you start renting out your home to tenants.

Contents

- Landlord Insurance

- Landlord Insurance — Bestford Insurance

- Do You Need Landlord Insurance?

- Homeowners Insurance Vs Landlord Insurance

- Compare Landlord Insurance

- Homeowner Insurance Vs Landlord Insurance

- Strata, Contents And Landlord Insurance: How To Know Which Is The Right Insurance For You

- Gallery for Landlord Insurance

- Related posts:

Landlord Insurance

For this reason, it is recommended that landlords purchase renter’s insurance as soon as possible so that they are always protected when agreeing to rent a property.

Landlord Insurance — Bestford Insurance

There may also be additional insurance that you can add, all of which will help protect you as a renter. An example of this is as follows.

The cost of purchasing homeowners insurance depends on where you live, the size of your property, the cost of repairing the damage, and the level of coverage you’re looking for. The average premium for a homeowner’s protection policy is usually between $800 and $1,200 per year. By comparison, the average homeowner’s policy can cost between $700 and $1,000 per year, depending on the size.

Generally, the more extensive the coverage, the more expensive the policy. If you add options like “lost rental income” the premiums will be even higher.

If you are a recent landlord and have tenants in your rental property, the answer is yes. Renters insurance not only protects your property, but also helps protect you as a renter if something happens during your tenancy.

Do You Need Landlord Insurance?

However, if you only rent the property for a few weeks a year, your homeowner’s insurance will usually provide adequate coverage. Similarly, if you live in the same house or building as a tenant, you can get “tenant accommodation” insurance.

Homeowners insurance comes in many forms and can have two different types of premiums. Different types of renter’s insurance are called home policies, and they fall into three categories.

There are two different types of payments for each of these rental policies. A cash settlement is a payment that gives you cash for everything you lose. This amount is the amount you would pay for a similar item for less than the current price. Replacement cost, on the other hand, is usually just replacement cost without cost. Therefore, the replacement cost is usually higher and more accurately provides the required cash.

If you have a choice between cash payment or replacement value, I recommend choosing replacement value, because it usually gives you more money to cover the cost of replacing the damaged property.

Homeowners Insurance Vs Landlord Insurance

Liability insurance protects your financial assets in case someone makes a claim against you. Tenants can sue landlords for damages such as financial hardship, emotional distress, physical injury, or death. Employers can make claims, but they are usually successful if you are actually responsible for the damages.

While following all these protocols, it is wise to get liability insurance in case of liability.

A tenant may be liable in a variety of circumstances. The most common are slip injuries, property damage from leaking pipes, and damage from vandalism. Homeowners can be held liable for these hazards if they are negligent.

For example, a tenant may be liable for damages if they fail to properly address maintenance issues or fail to keep the unit safe and in good working order. The best way to avoid liability is to keep your unit and building as safe as possible, inspect conditions regularly, and correct potential hazards promptly. Even if you try to keep things in good condition, it’s wise to get renter’s liability insurance to help cover damages and legal expenses if a claim is made against you.

Compare Landlord Insurance

Fair rental income protects the tenant if the property becomes untenable due to damage. When your unit becomes obsolete, you lose income. A reasonable rental income provision covers lost income during the time it takes to repair your unit. Generally, this provision only covers income for 12 months.

According to the Insurance Information Institute (III), most renter’s insurance costs 25% more than a typical homeowner’s policy because renters need more coverage than the typical homeowner. The idea behind this is that when you rent out your unit to tenants, you are increasing your risk of going broke.

Several factors are used to determine the cost of a rental policy. The Insurance Information Institute (III) lists the following factors:

Whether you’re a new renter, a DIY homeowner, or a seasoned renter, landlords recommend that you get renters insurance. Often, tenants blame the landlord for their stolen belongings. It may be the landlord’s fault that the house is not destroyed, but the easiest way to avoid this problem is to ensure that you have renter’s insurance. Their renter’s insurance covers things like stolen items.

Homeowner Insurance Vs Landlord Insurance

Renters insurance is important if you rent out your property for a long period of time or rent it out while you are away. Being a homeowner increases your risk of liability and loss, so your insurance costs will increase, but so will the amount of coverage you receive.

Once you’ve secured renters insurance, the next step is to manage your rental property with rental software to simplify the time-consuming process. Create an account to screen tenants, create rental applications, access attorney-reviewed rental agreement templates, and more. You have done it. You are the owner of the land. As you know, being a landlord is not an easy job and you are responsible for an incredible number of things and the list never seems to end. But apart from your daily activities, you should also protect yourself from potential damages and liabilities that come with owning someone else’s property. Can be different things. It is very important to be prepared for many situations that are out of your control.

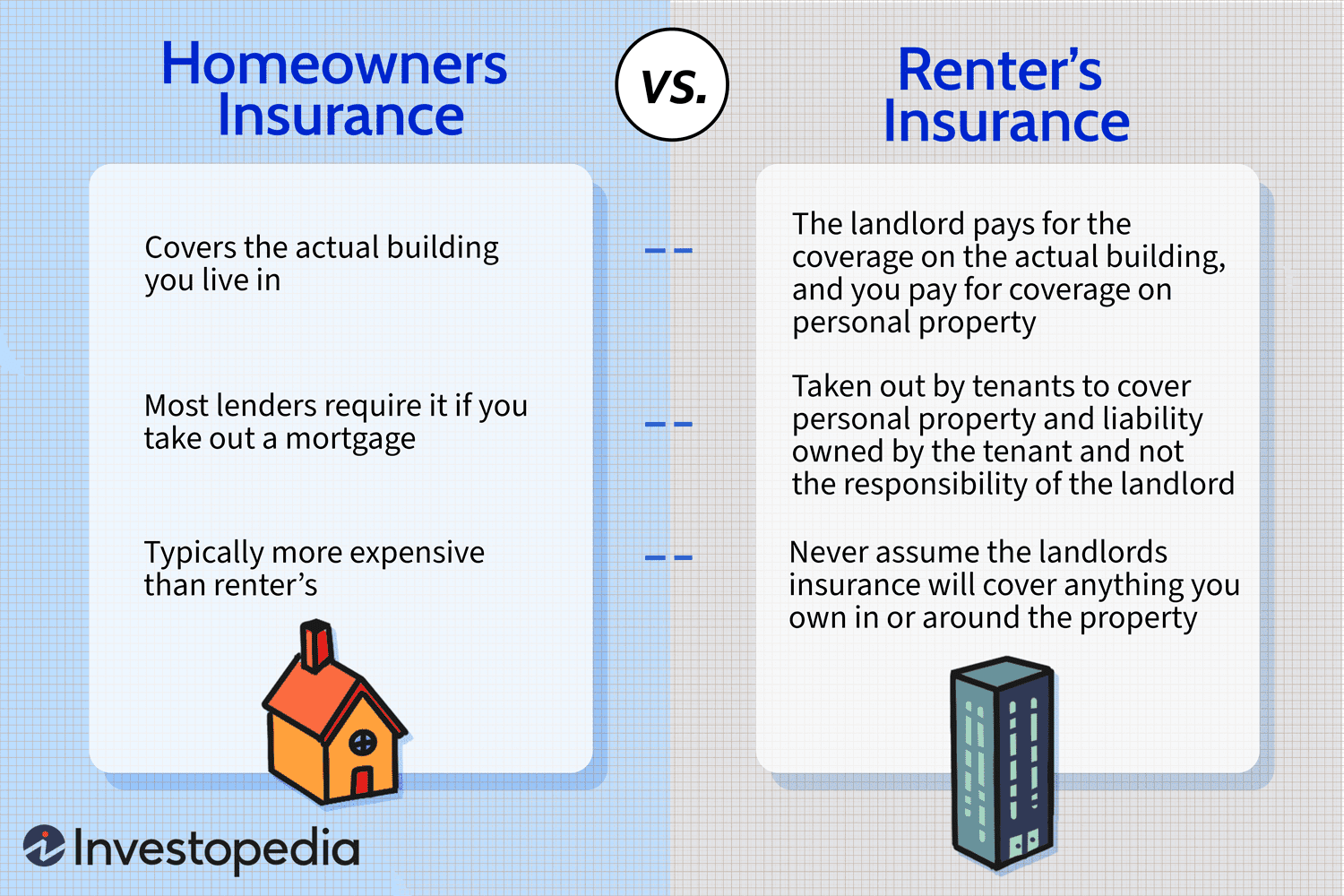

Landlords may have experience with real estate and may be knowledgeable about marketing and finance. But many people don’t know much about renter’s insurance, especially things like renter’s insurance. For example, many people struggle to tell the difference between renter’s insurance and homeowner’s insurance. But don’t worry, Wade Ross is here to clear the air. Below, we’ve covered all the ins and outs of renter’s insurance, so we can give you all the insight and knowledge you need for a successful and protected rental.

Renters insurance is an insurance package designed specifically for people who rent out their property. Consisting of both property and liability coverage, renter’s insurance protects the property owner against loss, damage, or accidents related to their tenant. It’s really quite simple.

Strata, Contents And Landlord Insurance: How To Know Which Is The Right Insurance For You

If you own a lake house or vacation home and rent it out during the off-season, renter’s insurance is very important. Basically, renter’s insurance is mandatory when you have a formal landlord. But if you’re just staying with a friend who’s going on an extended vacation, you’re not a landlord. If it is not a verb, we will create it. Homeowner’s insurance is a must-have package for anyone who rents out their home, whether it’s your full-time job or a side gig. You may be surprised to learn that many things that are not covered by standard coverage on your home insurance policy will inevitably come up in a rental situation.

Many people confuse them and there is some overlap, but renter’s insurance and homeowner’s insurance differ in several important ways. For example, renter’s insurance and homeowner’s insurance cover the house or apartment, as well as other large structures such as garages and sheds. However, when it comes to personal property, renter’s insurance only covers items and equipment needed to service the rental property. Think lawnmowers or other items used in home maintenance. That’s why it’s always a good idea to take out a renter’s insurance policy to make sure that your tenants’ personal property is covered in some way.

Homeowners insurance covers a variety of important terms, but the main terms that are often included in a renter’s insurance policy are property damage protection, liability protection, and protection against loss of rental income. Renter’s insurance covers your home, other structures on your property, and some personal belongings. If your garage burns down at your rental, you will be covered. If your renter accidentally puts a dent in the drywall, renter’s insurance is definitely covered

Landlord insurance north carolina, landlord insurance online, state farm landlord insurance, best landlord insurance uk, landlord insurance australia, landlord insurance uk, landlord insurance compare, landlord insurance nc, landlord homeowners insurance, landlord insurance quote, landlord insurance quote online, landlord insurance california