Liability Insurance – Business owners and operators often confuse professional liability coverage, and ask why they need coverage for both, and in some cases, both.

If you’re curious about the differences between general liability insurance versus professional liability insurance, keep reading to learn how each insurance differs, their similarities, and their differences.

Contents

- Liability Insurance

- What You Must Know About Professional Liability Insurance For Therapists

- Umbrella Liability Insurance

- Liability Insurance For Llc: What Type Does Your Business Need?

- What Is Liability Insurance Coverage?

- Liability Insurance: What It Is, How It Works, Major Types

- Liability Insurance Market Size To Hit Usd 418.8 Billion By 2030

- Directors And Officers Liability Insurance

- Liability Car Insurance: Need It? (2023 Coverage And Cost)

- Liability Insurance For Health Coaches

- Is Cyber Liability Insurance Worth The Cost? Explore The Pros And Cons

- Gallery for Liability Insurance

- Related posts:

Liability Insurance

General liability insurance is a type of policy that protects your business against claims of bodily injury that occur on your premises or during the use of your products; damage to the defendant’s property; or damage caused by defamation, libel, copyright infringement, and more.

What You Must Know About Professional Liability Insurance For Therapists

Most businesses require general liability insurance coverage given the breadth of coverage that the policy will cover. In fact, an estimated 40 percent of businesses will face a lawsuit covered by their company’s general liability insurance policy.

If your business is hit with a lawsuit, the court costs and legal fees alone can be financially devastating, even if you are not at fault. This is why it is usually recommended that all businesses have general liability coverage.

If your business sells physical products, a general liability policy will cover injuries and damage caused by defective products up to a certain limit. You may also consider a product liability policy in addition to your general liability coverage. Product liability insurance can further protect your business from software errors, defective premises, or environmental exposure.

A general liability policy is a comprehensive policy that covers a wide range of liabilities, but there are limitations as to what general liability will and will not cover. For example, general liability policies tend to expressly exclude claims for negligence and injuries caused by the actions of your employees. This is why many businesses choose Employment Practices Liability Insurance (EPLI) in addition to general liability and product liability coverage.

Umbrella Liability Insurance

Employment Insurance coverage can be divided into three categories: Coverage B, which covers general termination and harassment, Coverage C, which covers general discriminatory practices, and Coverage D which covers general compliance issues.

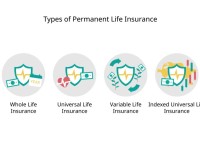

There are a few tips to understand when looking at general liability insurance vs. general liability insurance. Professional liability insurance, also known as errors and omissions (E&O) insurance, is a type of insurance policy that protects your business from claims of negligence, malpractice, errors and mistakes during the performance of professional work.

When considering general liability professional liability, there are many factors to consider. If you have been educated and trained to provide a service or business – such as a financial advisor, accountant, doctor, lawyer or dentist – you must have professional qualifications. When customers experience financial loss due to defective or inadequate service at your business location, you will face legal action.

Even if you carry out your duties and responsibilities, if the client’s expectations are not met or are dissatisfied with your work, you may be accused.

Liability Insurance For Llc: What Type Does Your Business Need?

Professional liability insurance can protect you if you give bad advice to clients or misrepresent results and results.

There are several differences between general liability insurance that can help determine which policies or procedures you should consider for your business.

General liability can cover your business for many claims including bodily injury, personal injury (resulting from libel, defamation, etc.), property damage, legal fees, product liability, and even production-related damages.

Whether you are a customer, guest, vendor, or other third party, if a physical injury occurs on or on your business property, you may face a lawsuit that will be covered by general liability insurance.

What Is Liability Insurance Coverage?

In contrast, professional liability insurance offers protection for professionals who provide bad advice, act in bad faith, infringe copyright, or misrepresent themselves or their services. If someone experiences financial loss due to a service provider’s errors and mistakes, they can contact that service provider – which is why you should consider professional liability insurance if you provide services to clients or customers. However, there is more to understand about general responsibility vs professional responsibility. Read more.

General liability insurance is a “claims-made” policy, meaning that if you had insurance when you filed a claim, you will be covered, regardless of when the alleged event occurred.

Professional liability insurance is also a right of way policy but has a retirement date exception. This means that if the event giving rise to the claim occurs before your policy’s retirement date, your current insurance policy will not cover the claim. This is why it is important for service providers to be aware of when their policy coverage will expire and must be renewed. If there are gaps in coverage, businesses should also look at past practices.

Although there are significant differences in coverage and how they are covered, there are some similarities between general and professional liability insurance. Due to the separation and overlap, many businesses benefit from both types of policies simultaneously.

Liability Insurance: What It Is, How It Works, Major Types

When contracting with strategic partners, vendors, or others, there may be a requirement that your business must be insured, either with a general liability policy, a professional liability policy, or both.

Some states legally require professional liability coverage depending on the industry or profession in which your business operates. For example, many states require medical professionals to have malpractice insurance, such as coverage under professional liability policies.

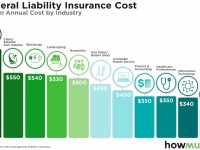

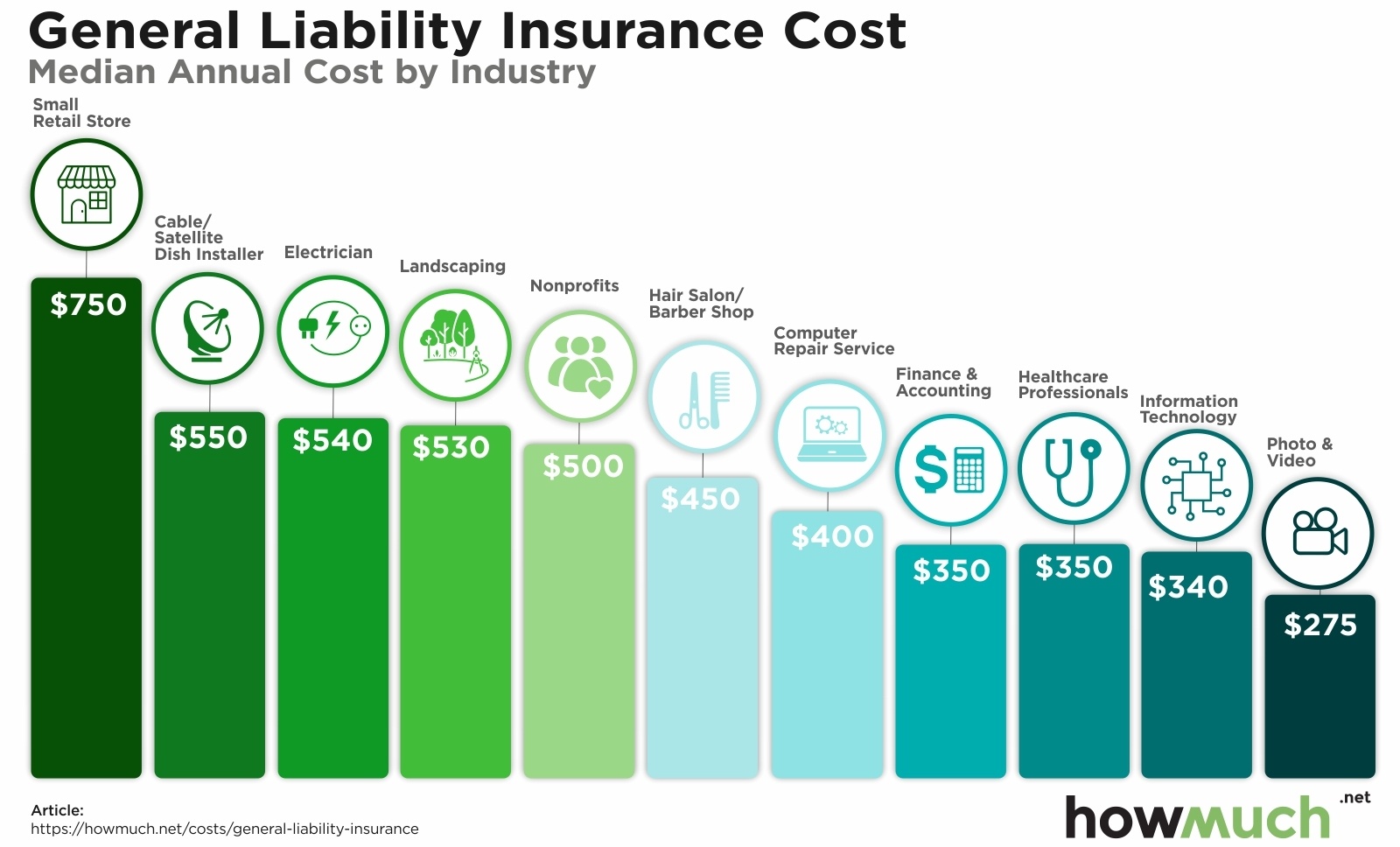

When calculating the cost of general and professional liability insurance, your premium will depend on factors specific to your business.

For example, if you want to purchase a general liability insurance policy as a remote contractor, you will have a very different level of risk compared to a hardware store owner.

Liability Insurance Market Size To Hit Usd 418.8 Billion By 2030

Likewise, a contractor who has a professional liability policy will experience very different costs if the client is a multibillion-dollar national business versus a local brick-and-mortar store.

If you’re still considering whether you need general liability insurance instead of professional liability insurance, ask yourself a few questions.

You might think that if customers interact with your business online, you don’t need a general liability policy. However, in many cases, you may also face personal injury lawsuits based on the content of your site, such as copyright infringement or defamation lawsuits.

Most industry experts will recommend having a general liability insurance policy. Even if you believe your business has a very low risk of being involved in a lawsuit, talk to an insurance broker to learn more or get a general liability insurance quote.

Directors And Officers Liability Insurance

If you answered yes to any of the above questions, you should consider exploring your options with an insurance broker and getting a professional liability insurance quote right away. can customize professional liability policies to uniquely meet your business needs. Additionally, it also offers the first fully digital professional liability product created specifically to protect law firms from common professional risks and potential legal malpractice claims.

Blog Marketing Explains Business Owner vs. Business Owner Strategy Business Consolidation Policies: Which Best Suits Your Business Consolidation Needs?

Business Owner vs. Business Owner Policies Business Consolidation Policies: Which Best Suits Your Business Consolidation Needs? 6 minutes reading

Business owners policy vs business plan policy—what are the main differences between the two and which plan is best suited for your business?

Liability Car Insurance: Need It? (2023 Coverage And Cost)

Let’s break down what types of business insurance policies most small businesses need, what risks those policies protect against, and why businesses buy them. Start your free trial, then enjoy 3 months for $1 per month when you sign up for a monthly Basic or Starter Plan.

Start a free trial and enjoy 3 months for $1 per month on select plans. sign up now

Try it for free, and discover all the tools and services you need to start, run, and grow your business.

When Henry Walker went to buy a pumpkin at Walmart, he didn’t expect it to be defective. But that’s exactly what happened: his foot got caught in the pallet as he reached for the pumpkin, and he fell hard and sprained his hip. When they took the case to court, they found video evidence that Walker was not the first person injured on the pallet, and the court awarded him $7.5 million in damages.

Liability Insurance For Health Coaches

But Walmart doesn’t have to pay the settlement itself. Instead, it’s likely that general liability insurance will cover the costs. While it’s unlikely your business will be impacted by a large settlement, even a moderate amount of lawsuits can have a devastating impact on small business owners.

General liability insurance is a type of business insurance that protects you in the event of general third-party claims against your business, including bodily injury and property damage. It is also called business liability insurance or business general liability insurance.

Despite having a “general” name, general insurance provides insurance coverage for claims relating to specific things: customers injured at your place of business, you or an injured employee – the customer’s property, reputational damage incurred. to others, and malicious advertising as a violation of authority.

General liability insurance provides third-party coverage, meaning payments are made to third parties involved in the claim, rather than to you directly. You are considered the “first person,” and the “third person” is the person who was harmed—whether physically, financially, or otherwise.

Is Cyber Liability Insurance Worth The Cost? Explore The Pros And Cons

Nursing liability insurance, commercial auto liability insurance, liability insurance for contractors, commercial liability insurance coverage, commercial general liability insurance, videographer liability insurance, buy liability insurance, handyman liability insurance, llc liability insurance, pro liability insurance, business liability insurance coverage, limited liability insurance