Life Insurance Comparison – A licensed insurance professional has reviewed this page for accuracy and compliance with the CMS Medicare Communications and Marketing Guidelines (MCMGs) and guidelines for Medicare Advantage (MA/MAPD) and/or Medicare Prescription Drug Plan (PDP) providers.

Apa Simmons, C. (2023, October 18). How to Compare Medicare Plans. Retrieved November 18, 2023, from https:///medicare/compare/

Contents

- Life Insurance Comparison

- Term Vs. Whole Life Insurance: What’s The Difference?

- Why Millennials Should Be Thinking About Life Insurance Now

- Life Insurance Comparison: Compare Quotes Online

- Accidental Death Insurance On Top Of Life Insurance

- Do I Need Life Insurance? If So, What Kind Should I Buy?

- Guaranteed Issue Life Insurance Quotes. No Health Questions

- Best Life Insurance Ireland 2023

- Latest Insurance Articles: Traditional Life Insurance

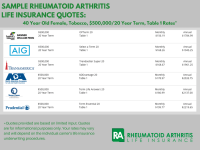

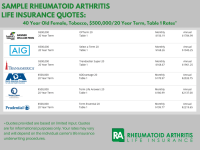

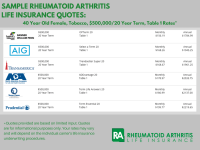

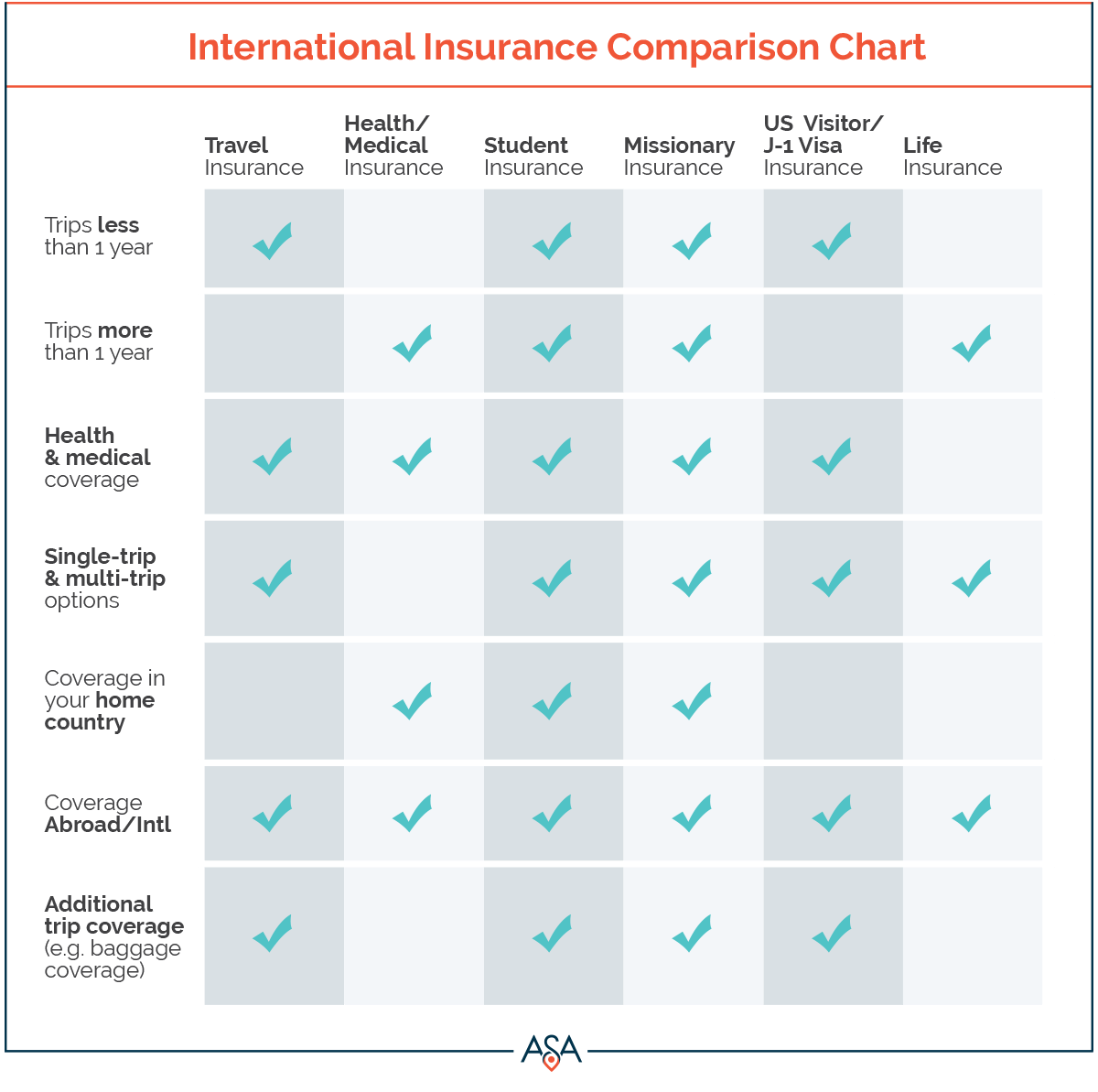

- International Insurance Comparison Chart

- Latest Insurance Articles: Ageas Federal Life Insurance

- The Protection People

- Get Free Life Insurance Quotes Online In 120 Seconds

- Life Insurance Needs Analysis

- Gallery for Life Insurance Comparison

- Related posts:

Life Insurance Comparison

Providing resources to seniors will help them make important financial decisions that impact their retirement. Our goal is to arm our readers with the knowledge that will lead to a healthy and financially sound retirement

Term Vs. Whole Life Insurance: What’s The Difference?

We are committed to providing thoroughly researched Medicare information that guides you in making the best possible health decisions for you and your family.

Content and tools created according to strict Medicare and editorial guidelines to ensure quality and transparency.

While experts from our partners are available to help navigate our Medicare plans, she retains full editorial control over the information she publishes.

We operate independently of our partners, allowing our award-winning team to provide you with unbiased information.

Why Millennials Should Be Thinking About Life Insurance Now

Visitors can count on our flexibility in terms of our editorial autonomy. We do not allow our partnership to influence editorial content in any way

Medicare Part A and Part B won’t cover all of your medical bills According to a 2022 survey from the Kaiser Family Foundation, 40% of seniors have delayed or forgone treatment because of the high costs. Seniors over the age of 65 are especially likely to have difficulty paying health care costs covered by Medicare.

But there are three options that can help you lower your out-of-pocket costs. This includes adding or replacing other plans sold by private insurers.

When considering or comparing these options, it’s important to consider factors such as your long-term health, your life expectancy, and your current and future finances to find the best deal for you.

Life Insurance Comparison: Compare Quotes Online

Medicare Part A covers hospitalization and Part B covers medical costs such as doctor visits. But it also doesn’t cover the cost of prescription drugs A Medicare Part D prescription drug plan can lower your prescription drug costs.

A Medicare Supplement Plan, also known as Medigap, can cover copays, copays, and other out-of-pocket costs that original Medicare does not cover. When combined with a Medicare Part D prescription drug plan, this combination can further reduce your out-of-pocket healthcare costs.

A Medicare Advantage plan is sold through a private insurer and replaces your original Medicare coverage. Basic Medicare coverage is required by law, but most also include prescription drug benefits. The plans may also offer vision, hearing, dental or other benefits that original Medicare does not cover

You Can’t Afford to Buy Both a Medicare Advantage Plan and a Medigap Policy You Must Choose One or the Other

Accidental Death Insurance On Top Of Life Insurance

Costs and coverage vary from plan to plan. You should consider your current and future circumstances and the long-term costs to determine which option is right for you.

Maximize your Medicare savings by connecting with a licensed insurance agent Annual enrollment is open until December 7

There is no one path that is the best option for everyone. The best option for you will depend on your health and financial situation, your family’s and your own medical history, and how long you can expect to stay in retirement.

These can be tough questions to answer on your own. A Medicare professional can help you understand how different options might work best for your situation.

Do I Need Life Insurance? If So, What Kind Should I Buy?

Each of the three pathways offers different benefits that are best for people with different health conditions and backgrounds

Stacey is a 65 year old woman who is in good physical condition. He has no serious health problems: neither hearing, teeth nor vision

Additionally, his family’s medical history showed no record of cancer, heart disease, or other chronic health conditions.

At this time, Stacey does not anticipate major healthcare costs. Adding a stand-alone Medicare Part D prescription drug plan to original Medicare will keep drug costs low.

Guaranteed Issue Life Insurance Quotes. No Health Questions

The big problem is that under Original Medicare he has to pay a 20% deductible on health care costs

Stacey could switch to a Medicare Advantage plan if she needed additional benefits, but switching to Medigap would be difficult and expensive.

He also has access to any doctor, hospital or other health care provider that uses Medicare – not just the limited selection of doctors in the Medicare Advantage plan network.

Robert just gets Medicare, but he has already survived a heart attack. At 65, he is older than his father and both his grandparents when they died of a heart attack. Diabetes is another chronic disease that runs in his family

Best Life Insurance Ireland 2023

He plans to retire early and has enough money to feel comfortable. Because her family history includes the average life expectancy, she does not expect to outlive her savings

Adding both Medigap and Medicare Part D prescription drug plans to your original Medicare is the most expensive Medicare coverage option. But Robert expects expensive health care costs because of his long-term health risks, and he has extra money to cover them.

He has access to every Medicare provider and can rest assured that his out-of-pocket costs are kept to a minimum.

Heart and diabetes medications can also come with higher out-of-pocket costs that a prescription drug plan can help offset.

Latest Insurance Articles: Traditional Life Insurance

Robert can switch to one of two other options if he decides the Medigap plan is no longer practical.

John Clark, CLTC®, NSSA® | 1:27 Can you share the story of a client who guided you in making the right Medicare choice?

John Clark, licensed insurance advisor and owner of Senior Solutions Insurance Agency, gives the example of a client who made the right choice by choosing a Medicare Supplement plan.

Diane is in good health and has no family history of chronic conditions such as diabetes, cancer or heart disease. But his pension fund is not that healthy. He has limited income and resources and does not want to spend a lot of money on healthcare

International Insurance Comparison Chart

Medicare Advantage Plans Offer Diane the Best Option with Lower Monthly Payments If He Doesn’t Have Many Health Care Costs, the Savings May Be Worth It

Most Medicare Advantage plans include coverage of prescription drugs for vision, dental, and other benefits that Original Medicare does not cover.

The problem with this is that he will have a limited choice of doctors, hospitals and other health care providers. Medicare Advantage plans rely on their own networks

Diane could also face paving costs if she develops expensive medical problems. And there’s no guarantee he’ll be able to switch to Original Medicare with Medigap coverage without having to pay higher premiums.

Latest Insurance Articles: Ageas Federal Life Insurance

John Clark, CLTC®, NSSA® | 0:54 Do you have an example of someone who made the wrong Medicare decision?

John Clark, a licensed insurance advisor and owner of Senior Solutions Insurance Agency, gives the example of a client who made an expensive decision when choosing a Medicare plan.

In addition to the cost differences, different Medicare plans will also handle coverage in specific ways: some plans offer more coverage than others.

Your plan will also depend on whether your health care is provided through the federal government or through a private insurance company.

The Protection People

The basic difference between Medicare and Medicare Advantage is where your coverage comes from. While Original Medicare is paid for by the federal government, Medicare Advantage plans are sold by private insurers.

Although Medicare Advantage is a private health plan, by law all plans must provide the same level of coverage as Original Medicare. The reason Medicare Advantage is popular among beneficiaries is that many plans go beyond original Medicare to provide additional coverage.

It often includes coverage for vision and dental care, but can be more comprehensive. Many Medicare Advantage plans also include Part D coverage

One downside to Medicare benefits is that plans are available regionally and usually require you to be within a plan’s network. On the other hand, if you have Original Medicare, you can get care anywhere in the United States and not have to worry about changes in coverage if you move.

Get Free Life Insurance Quotes Online In 120 Seconds

Both Medicare Advantage and Medigap are plans offered through private insurers. The difference between Medicare Advantage and Medigap is that Medicare Advantage acts as a complete replacement for original Medicare, while Medigap is intended to supplement it.

Medigap plans exist to fill the gaps in your Medicare coverage, such as deductibles and copays, by helping you pay many of your out-of-pocket costs.

Medigap cannot be combined with Medicare Advantage. It also does not change or add anything to the coverage you receive from original Medicare; it just helps control costs

The options you choose when you first enroll in Medicare can affect what you pay for the rest of your life.

Life Insurance Needs Analysis

That’s why it’s so important to evaluate your current and future health needs when deciding on Medicare coverage options. You should seriously consider possible changes in your health for years – or even decades – to come What seems like a bargain at 65 could leave you with deep pockets

Life insurance rates comparison, term life insurance quote comparison, comparison life insurance, whole life insurance comparison, life insurance quotes comparison, life insurance policy comparison, life insurance comparison tool, comparison of life insurance, term life insurance comparison, life insurance comparison website, term life insurance rate comparison, life insurance companies comparison