Medical Insurance Plans – Medical expenses have increased dramatically, and a proper plan is needed to avoid financial problems. Medical emergencies can bring a financial crisis and cause problems. Life insurance is your salvation in such a time. But which is more beneficial, group life insurance or individual life insurance?

When you think of life insurance, two names come to mind. One is employer health insurance, and the other is an individual health insurance plan. Both are policies that cover health expenses and medical expenses based on the sum assured and the policy’s legal document issued to the policyholder stating the nature and coverage; also called the ‘Politics of Multiple Interests’. But there are many differences between the two programs. If you are in doubt about the features of the program, give this a quick update to remove any doubt.

Contents

- Medical Insurance Plans

- S Best International Medical Insurance Plans For Global Citizens Announced By International Citizens Insurance

- Understanding The Insurance Benefits Type In Sap Successfactors Employee Central Global Benefits

- Health Insurance Plans — Investment Matters

- Malaysia Private Health Insurance Market Size & Leading Companies By 2029

- Gallery for Medical Insurance Plans

- Related posts:

Medical Insurance Plans

Group health insurance or employer health insurance is an employment benefit that a family employer provides to their employees. In this program, the employer is responsible for paying the benefits when the employee and their dependents can enjoy the policy a legal document submitted to the policy manager explaining the nature of the insurance; also called the ‘Politics of Multiple Interests’. In contrast, individual health insurance is an individual purchase for medical benefits. Here you buy a policy An official document issued to the owner explaining the requirements of the insurance; also called ‘Multiple policies and paying taxes as the program chooses.

S Best International Medical Insurance Plans For Global Citizens Announced By International Citizens Insurance

Although the main function of both policies is to cover medical expenses in case of emergency, there are many differences between the policies.

In both policies, you have to pay the premium to get the coverage benefit. In individual life insurance, the individual owner pays a premium to the insurance company in order to protect the coverage provided by the multiple policies he or she is responsible for paying. They can take the plan as they can and pay the premium from their limit to maintain the insurance benefits. In contrast, the employer is the decision-maker regarding the group health insurance policy. also called ‘Death to politics. Employer of the family or business covered by the policy An official document issued to the owner that governs the requirements of the insurance; also called ‘Multiple policies and premiums’. They pay their own taxes, and the employees agree to enjoy the benefits of the plan without paying taxes on the policy. also called ‘Death to politics.

Insurance is a basic tool, why most people choose a health policy. By making an insurance card, the individual owner pays the premium of the insurance company to pay for the coverage provided by the policy. The insurance policy also allows you to pay the medical expenses if you provide the necessary and proper documents. But in both policies, there are differences depending on the area of the system.

In individual life insurance, only the owner who pays the premium to the insurance company for the coverage offered by the multiple policies can enjoy the benefits. If the insurance plan is under your name, you can enjoy the coverage. No family member or dependent member can enjoy the benefit of the community. When you are in a group health plan, you get comprehensive coverage. In the user’s health policy, the official legal document governs the terms and conditions of the insurance; also called ‘Multiple policies, you and your family, including your spouse, children and parents, can enjoy local benefits.

Understanding The Insurance Benefits Type In Sap Successfactors Employee Central Global Benefits

Exclusion criteria in a life insurance policy An official document issued to the policyholder stating the terms of the insurance; also called ‘political Die’ refers to the period of planning. This is when the insurance company will charge the medical expenses to cover the premium. On the other hand, cancellation of a health plan means where the owner pays the premium to the insurance company in return for the coverage provided by the policy. insurance; also called ‘More policy and stop paying premium. Policy Endorsement The legal document issued to the owner that governs the terms and conditions of the insurance; also known as ‘Many ways and exits are different in two life insurance plans.

In an employer’s health insurance plan, the policy is a legal document issued to the policyholder that explains the terms of the insurance; also called ‘Multiple policies valid until the service period is active. It means if the employee leaves the job, then the benefits of the plan will be stopped. Here the employee cannot stop the payment of premium at their will and will continue to receive the coverage of the plan until the last day of employment. On the contrary, for personal opinion, the decision is yours alone. You can cancel the plan without paying or submitting documents to the insurance company. Exit criteria for individual plans may vary depending on the insurance company’s policy.

To become a policyholder One pays a premium to the insurance company to cover the coverage provided by the policy Other, there are eligibility requirements for both insurance plans. If you do not meet any of the requirements to choose the selected insurance plan, then your policy The legal document issued in the policy governing the insurance requirements; also called ‘Politics of death will not be accepted. The best way to determine whether or not you should purchase insurance is to contact your insurance company representative or consult with an insurer.

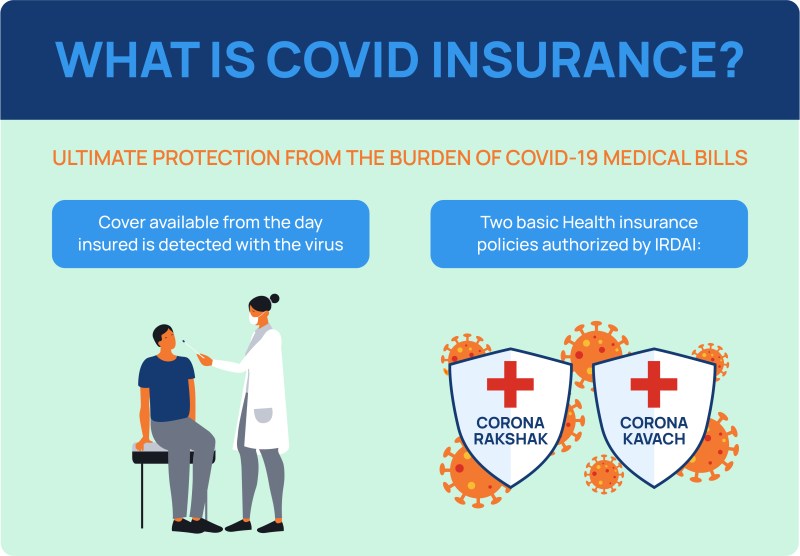

In an employer’s health insurance plan, the eligibility requirements are complicated. As a corporate employee, the eligibility criteria is to remain a full-time employee of the organization or business. That’s when you can take advantage. As a policyholder seeking to issue a policy an official document is submitted to the policyholder detailing the insurance requirements; also called ‘Benefit Policy for their employees, you also have to sign certain rules set by IRDAI. For example, the minimum employee strength must be seven to be approved for a group health policy. also called ‘Death to politics.

Health Insurance Plans — Investment Matters

In contrast, choosing a personalized health plan is easy. You must be of legal age (18 years) to take out the policy An official document written to the policy holder stating the insurance requirements; also called ‘policy More in your name. For youth health policies, an authorized guardian must be available to take care of the Premium and other important provisions.

The sum assured in a health policy may vary depending on the plan you choose. In a group health policy where the employer is the key decision maker, their affiliation is a decision. The amount is less than the individual policy and is usually between 1 million and 5 million.

On the other hand, in an individual health policy, the cost of insurance is higher because the policyholder pays a premium to the insurance company in order to protect the coverage provided by the policy Other determines the value of care. Generally, the average personal policy falls below us between 5 to 15 thousand.

Choosing a health policy means time to add benefits or increase coverage. Policy Manager The official legal document that governs the terms and conditions of the insurance; also called ‘plans’ Plans vary greatly by employer and individual insurance, so the rate of choice also varies in size.

Malaysia Private Health Insurance Market Size & Leading Companies By 2029

The user (policy holder Person who pays the premium of the insurance company to cover the coverage provided by the Multi Policy) has the option to choose the benefits/regions as per the categories defined by the providers of different insurance limits. . If the user wants to add benefits, they can, but it depends on the policy of the insurance company you choose.

Conversely, with your insurance, you have more freedom to choose additional benefits. Regular politics and

International medical insurance plans, business medical insurance plans, shop medical insurance plans, group medical insurance plans, supplemental medical insurance plans, medical supplement insurance plans, cheap medical insurance plans, employer medical insurance plans, major medical insurance plans, aarp medical insurance plans, corporate medical insurance plans, good medical insurance plans