Mortgage Insurance – Our ratings and reviews are influenced by our advertising relationships, but we may receive commissions from our affiliate links. This content is independently created by our editorial staff. Learn more.

Are you crunching the numbers in preparation for buying a home? If you have to pay this additional fee on your monthly payment, you should know about private mortgage insurance (PMI).

Contents

- Mortgage Insurance

- On Average, What Can I Expect My Private Mortgage Insurance (pmi) Rate To Be?

- Mortgage Insurance Policy Ppt Powerpoint Presentation Summary Graphics Template Cpb

- What Is Mortgage Insurance And Do I Really Need It?

- How Much Is Mortgage Insurance? (2023)

- How Lender Paid Mortgage Insurance (lpmi) Works

- What Is Mortgage Insurance?

- What Is Mortgage Insurance? How Pmi Works And Its Benefits

- Private Mortgage Insurance (pmi) Faq

- What Is Mortgage Insurance And Who Needs It?

- Gallery for Mortgage Insurance

- Related posts:

Mortgage Insurance

PMI protects your lender’s financing if you default on your mortgage. It is usually required for conventional loans if your balance is below a certain threshold. Lenders buy PMI and pass the cost (premium) on to you. You usually pay a premium to the lender as part of your monthly loan payment.

On Average, What Can I Expect My Private Mortgage Insurance (pmi) Rate To Be?

PMI costs can have a significant impact on your home buying budget. The good news? You can avoid the PMI requirement altogether, reduce the amount of PMI you need (by reducing costs), or get rid of PMI after you build equity in your home.

When the borrower offers a mortgage loan, he assumes some risk. In the best case, the borrower will repay the loan, and the borrower will benefit from the interest paid. In the worst case scenario, the borrower will stop paying the loan.

To mitigate the financial effects of that worst-case scenario, lenders will purchase PMI when offering mortgages to “risky” borrowers. They will require the borrower to pay a PMI premium. If you don’t put down what your lender considers to be enough equity in your home when you take out a mortgage, you’ll fall into the risky category.

For conventional loans, lenders typically require PMI for borrowers who pay less than 20% of the purchase price. So, you buy a house for $300,000. If the down payment is less than $60,000, your lender will require PMI. If you have a down payment of 20% or more, you don’t need to pay PMI.

Mortgage Insurance Policy Ppt Powerpoint Presentation Summary Graphics Template Cpb

When you apply for a mortgage, your lender will tell you that you must pay PMI. The lender will then purchase a PMI policy from a selected provider and typically add a premium to the monthly loan payment.

In some cases, lenders may offer you the opportunity to pay PMI in one lump sum with your closing costs. This obviously increases the amount of closing costs, but can save you money by reducing your overall PMI costs.

Lenders may also offer what is known as borrower-led PMI (LPMI). In this case, the lender covers the cost of PMI but charges a higher interest rate on your mortgage.

PMI costs vary among insurance providers and vary by insurance product. Other factors that affect the cost of PMI are within your control.

What Is Mortgage Insurance And Do I Really Need It?

Your credit score predicts how likely you are to repay your loan. Your credit score not only affects the interest rate on your loan but also what you pay for PMI.

Scores can range from 300 to 850. A higher score means the lender is more likely to consider you able to repay the loan, which helps lower your PMI costs. You can achieve a higher credit score by paying your bills on time and practicing other responsible credit habits.

The LTV ratio is an expression of the financial equity you have built up in your home: It is a ratio that compares the balance of the mortgage to the value of the home. Pay 15% down, and your LTV ratio is 85%. Pay 5% down, and your LTV ratio is 95%. A higher LTV means you pay more for PMI.

Larger loans with longer terms usually result in more expensive PMI. Conversely, smaller loan amounts and shorter loan terms (for example, 20 years instead of 30) can lower PMI costs.

How Much Is Mortgage Insurance? (2023)

Adjustable rate mortgages (ARMs) typically have higher PMI costs than fixed rate mortgages. This is because variable interest rates make it more difficult to predict the amount of your mortgage payment. That’s why ARMs are a rather risky proposition for borrowers.

Although you won’t know the exact cost of PMI until you own your home, you can get an idea by using the average cost. According to Chase, the annual cost of PMI ranges from 0.22% to 2.25% of the value of your mortgage.

The 2021 report by the Urban Institute shows the average cost of PMI across a range of payment values and lines of credit. In this table, the gray numbers represent the annual cost of PMI as a percentage of the mortgage value.

PMI Example 1: If you have a credit score of 620 and a 5% down payment (yielding a 95% LTV ratio), your annual PMI cost will be 1.42% of the loan value. For a $300,000 home, that’s $4,047 a year, or $337 a month.

How Lender Paid Mortgage Insurance (lpmi) Works

PMI Example 2: If you have a credit score of 700 and a 15% down payment (yielding an 85% LTV ratio), your annual PMI cost will be 25% of the loan amount. For a $300,000 home, that’s $638 a year, or $53 a month.

PMI Example 3: If you have a credit score of 720 and a 10% down payment (yielding a 90% LTV ratio), your annual PMI cost will be 46% of the loan value. For a $300,000 home, that’s $1,242 a year, or $104 a month.

As you can see from these tables and examples, your credit score can affect what you pay for PMI.

Paying 5% down on a $300,000 home with a credit score of 620 will result in $337 being added to your loan payment for PMI. A credit score of 760 will bring your monthly PMI cost to $90. That’s a savings of $247 per month or $2,964 per year!

What Is Mortgage Insurance?

Considering how much PMI can add to the cost of buying a home, many lenders are looking for ways to avoid the requirement.

Perhaps the most obvious way is to put at least 20%. This will increase the LTV ratio to over 80% and should eliminate PMI.

If you can’t save that money, you can consider a piggyback loan. With a piggyback loan, you use your home equity to borrow more money for a down payment. Since these loans usually have higher interest rates than mortgages, you need to make sure that the piggyback loan doesn’t pay more than your PMI in the long run. Your lender should help you crunch the numbers and decide if it makes financial sense.

By law, your lender must automatically waive PMI when your LTV ratio reaches 78%. Therefore, when you pay off your mortgage, your LTV ratio will drop to this level. If your LTV ratio reaches 80%, you can request that your PMI be waived (instead of waiting for your lender to reach 78%).

What Is Mortgage Insurance? How Pmi Works And Its Benefits

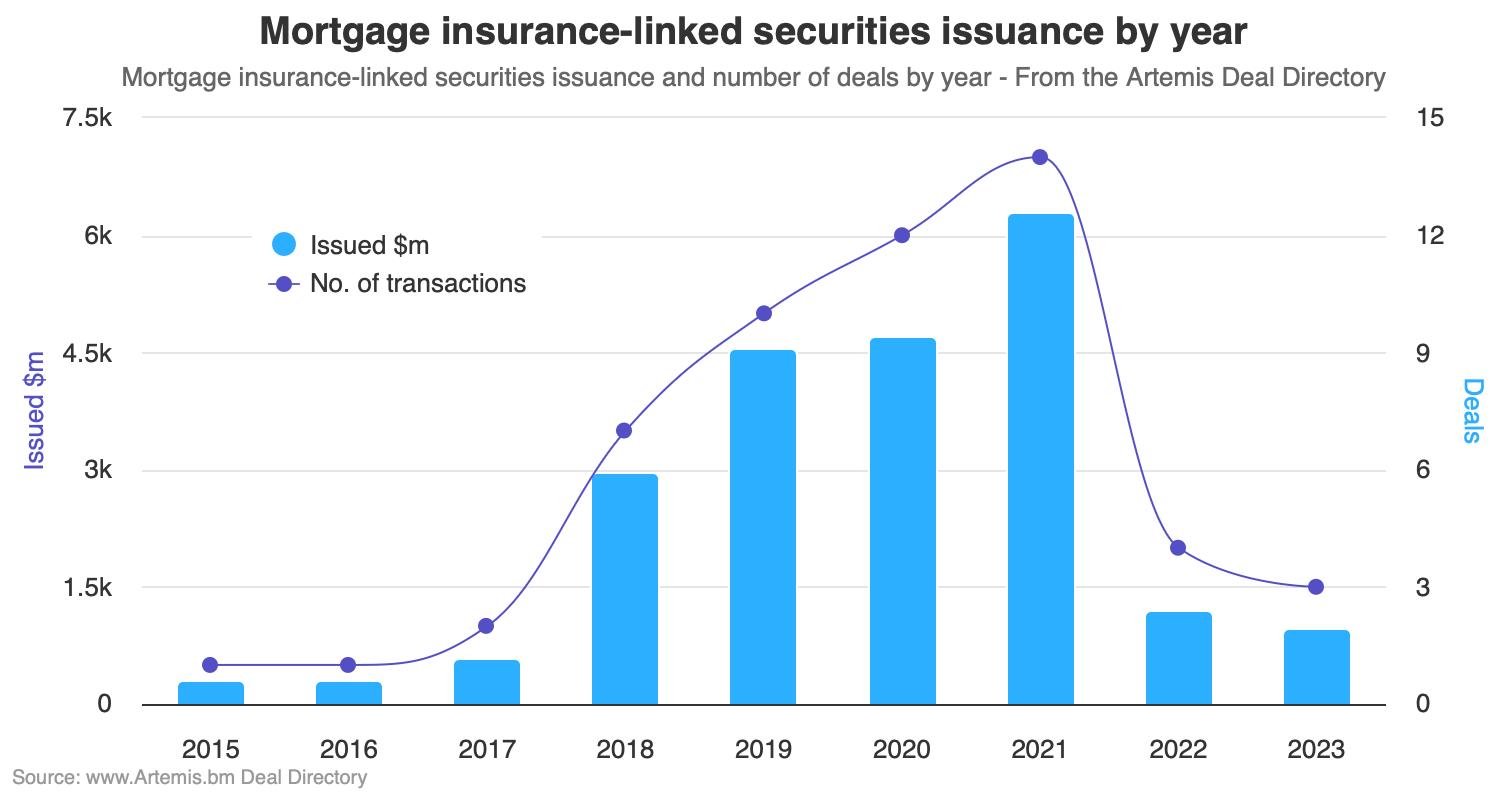

You may notice that home values are rising rapidly in many states starting in 2021. This inflation can increase home equity and help lower your LTV ratio. If you think your home’s value has increased until your LTV ratio drops below 80%, contact your lender and ask about PMI waivers. Lenders may require a property appraisal to confirm the value of your home, but this may be a small price to pay to save thousands of dollars in PMI payments each year.

The PMI we discuss in this article relates to traditional mortgage lending. If you’re applying for a government-backed mortgage, such as a Federal Housing Administration (FHA) loan, you should know that PMI is handled differently.

All FHA loans require mortgage insurance, regardless of credit rating or LTV ratio. You pay this portion of the insurance at closing (the Up Front Mortgage Insurance Premium), then pay the rest (the mortgage insurance premium) as part of your monthly payment.

All VA loans are backed by a VA Guarantee. Therefore, you do not have to pay for mortgage insurance. Instead, you pay a monthly “finance fee” based on your service details, payment amount, and several other factors. It is intended to help fund programs for the next generation.

Private Mortgage Insurance (pmi) Faq

Like FHA, USDA loans do not require PMI, but they do require mortgage insurance. You pay this portion at closing, and the rest is spread over monthly payments.

When buying a home the high cost of PMI is always known. But it’s worth considering everything PMI does.

First, prospective home buyers simply cannot get a mortgage with at least 20% down. Lenders are reluctant to take on risky borrowers, so those with little savings must find a way to get the money—or wait.

S has long been changed. Introduced in 1957, PMI allows people with less money to buy a home. And with a little knowledge, you can minimize the impact of PMI on your home buying budget.

What Is Mortgage Insurance And Who Needs It?

According to the Internal Revenue Service, the marginal deduction for mortgage insurance premiums has expired for tax year 2022. Keep challenging yourself

Mortgage protection insurance quotes, mortgage insurance quote, mortgage protection life insurance, mortgage life insurance companies, mortgage insurance quotes, best mortgage life insurance, home mortgage life insurance, best mortgage insurance, mortgage insurance leads, mortgage life insurance quote, mortgage life insurance policy, mortgage protection insurance providers