Motor Insurance – An estimated 42,915 people died in motor vehicle crashes in 2021, a 10.5 percent increase from 38,824 deaths in 2020. In Connecticut, our wrong-way traffic fatalities alone in 2022 rose to 15, which is almost twice as much. eight people killed in each of the last two years. It is important that all drivers have adequate auto liability insurance.

Connecticut law requires every driver to have auto liability insurance of at least $25,000 per person, $50,000 per accident and $25,000 for property damage. These minimums were increased in 2017 from the previous $20,000/$40,000/$10,000 requirement that had been in place for over 50 years.

Contents

- Motor Insurance

- Car Insurance: Part 1

- Why Need A Motor Insurance Policy

- Car Insurance Plan Features

- Take A Look At Your Car Insurance

- Phased Liberalisation Of Motor Insurance

- What Happens If Car Insurance Is Canceled?

- Car Type, An Important Factor Which Determine Car Insurance Premium

- Gallery for Motor Insurance

- Related posts:

Motor Insurance

Liability coverage protects the driver and owner of the vehicle from claims for injuries and damage caused in a collision. This is coverage that protects you in the event that you are responsible for causing injury or damage to another person while driving. However, liability coverage does not protect you from damage caused to you or your vehicle. Your insurance policy will provide additional options to cover personal losses.

Car Insurance: Part 1

Because the elements of a legally recognized tort claim include medical expenses, lost wages, and non-economic damages, including loss of ability to enjoy life activities, permanent injuries, and future losses, minimum limits are usually insufficient to fully compensate the victim. Fun. They are often grossly inadequate, even if the accident and resulting injuries do not seem dramatic.

The Connecticut Department of Insurance strongly recommends that you consider purchasing higher limits. Although higher limits mean a fine, the best way to insure yourself is with higher limits and a separate umbrella or excess policy. Since auto liability insurance protects you and your property, price should not be the only factor when choosing insurance coverage.

Liability insurance should reflect the risk assessment of the insured property. Risk is a function of your personal assets and exposure. The more you have, the more coverage you need to buy to protect your assets. Your coverage must be at least equal to your personal assets, such as equity in real estate, savings and retirement accounts.

If you have equity in your home, savings, stock accounts or retirement savings, the minimum limits are seriously inadequate. If insurance coverage limits do not adequately cover losses, substantial real estate may be subject to a lien and/or judgment. A minimum of $100,000 per person, $300,000 per accident and $100,000 for property damage is generally recommended.

Why Need A Motor Insurance Policy

In terms of cost, increasing coverage from the required minimum to $100,000/$300,000/$100,000 can be purchased for an additional $500 or $600 in many cases.

Ideally, basic liability coverage limits of $250,000 or $500,000 with separate umbrella policies of $1,000,000 or more are the best type of coverage. The cost of umbrella coverage is surprisingly reasonable and affordable, and provides additional coverage for the homeowner.

Attorney John F. Buckley Jr. is a partner at Buckley Wynne & Parese in New Haven. You can reach him at 203-776-2278 or [email protected].

Attorney John Buckley was highly recommended to me by many people and after the first meeting where we discussed my case I immediately knew I was in good hands. He took the time to explain everything to me in detail and stayed in touch throughout my case. Also, his staff was extremely friendly, professional and VERY accommodating! In fact, I never had to contact about my case because they were over the top with me from start to finish. My accident was very unfortunate, but I am extremely grateful to have worked with Attorney Buckley through it all! I highly recommend this law firm!!!

Car Insurance Plan Features

Recently involved with BWP in relation to a car accident. From the initial consultation and throughout the process, John Parese and the entire staff were respectful, very knowledgeable, understood my goals and supported me in working to achieve the best possible outcome. It was a very seamless, friendly relationship and a company I would highly recommend to anyone.

I contacted BWP in June 2019 when I was hit by a drunk driver. John Wynn was my lawyer. I could not be happier with the services I received. Everyone I came in contact with was very professional and made sure I got all the help I needed. I highly recommend this law firm.

John Buckley was prompt and consistent in providing information about the process and he and his staff were always supportive of all my requests. John’s experience and strategic knowledge changed the relationship with the insurance company and thanks to his vigilance we achieved the best possible result. I cannot recommend BWP highly enough!

I am at a loss for words to describe how wonderful it was to work with John Parese. He took my family and me under his wing during a difficult time. He was with us for 3 years while I was undergoing treatment. He was thorough, meticulous and patient. He was always there to answer questions and made us feel like he was in our corner. John explained our options and walked us through the process many times. It was WAY out of my comfort zone to go to court, but he believed in me and my cause. He was phenomenal on the field and I was very proud to be part of his team. We are forever grateful and would recommend him to anyone!

Take A Look At Your Car Insurance

John Parese is an excellent attorney who provided the care that was needed over an extremely difficult and long period of time. He and his team are very dedicated and provide expert guidance in various aspects. I am very grateful to have some degree of relief from a painful accident and injury that was unfortunate and terrifying. Mr. Pareze is very kind, patient, honest and extremely knowledgeable. I would highly recommend his help to people who need it.

John Parese is an excellent attorney! He kept checking on me to make sure I was doing better after the accident and kept me updated on where we were in the process. I never doubted that I was in good hands. Thanks Jānis and your team! Two thumbs up!

Wonderful staff. They gave the impression that they really care about their customers. I will call again in the future if necessary.

John helped me with a few questions. He is a great lawyer who always fights to protect his clients. I was able to recover medically knowing that John would completely handle the insurance and issues with my case. I will continue to use it in the future.

Phased Liberalisation Of Motor Insurance

Lawyer Parese helped me in a car accident. He is very professional and his team is wonderful. I highly recommend his car accident services!!! Thanks John. The global motor insurance market is a huge industry that is constantly growing. The market is estimated to be around $600 billion in 2021. With the increase in the number of vehicles on the roads and increasing awareness of the benefits of insurance, the market is expected to grow in the coming years.

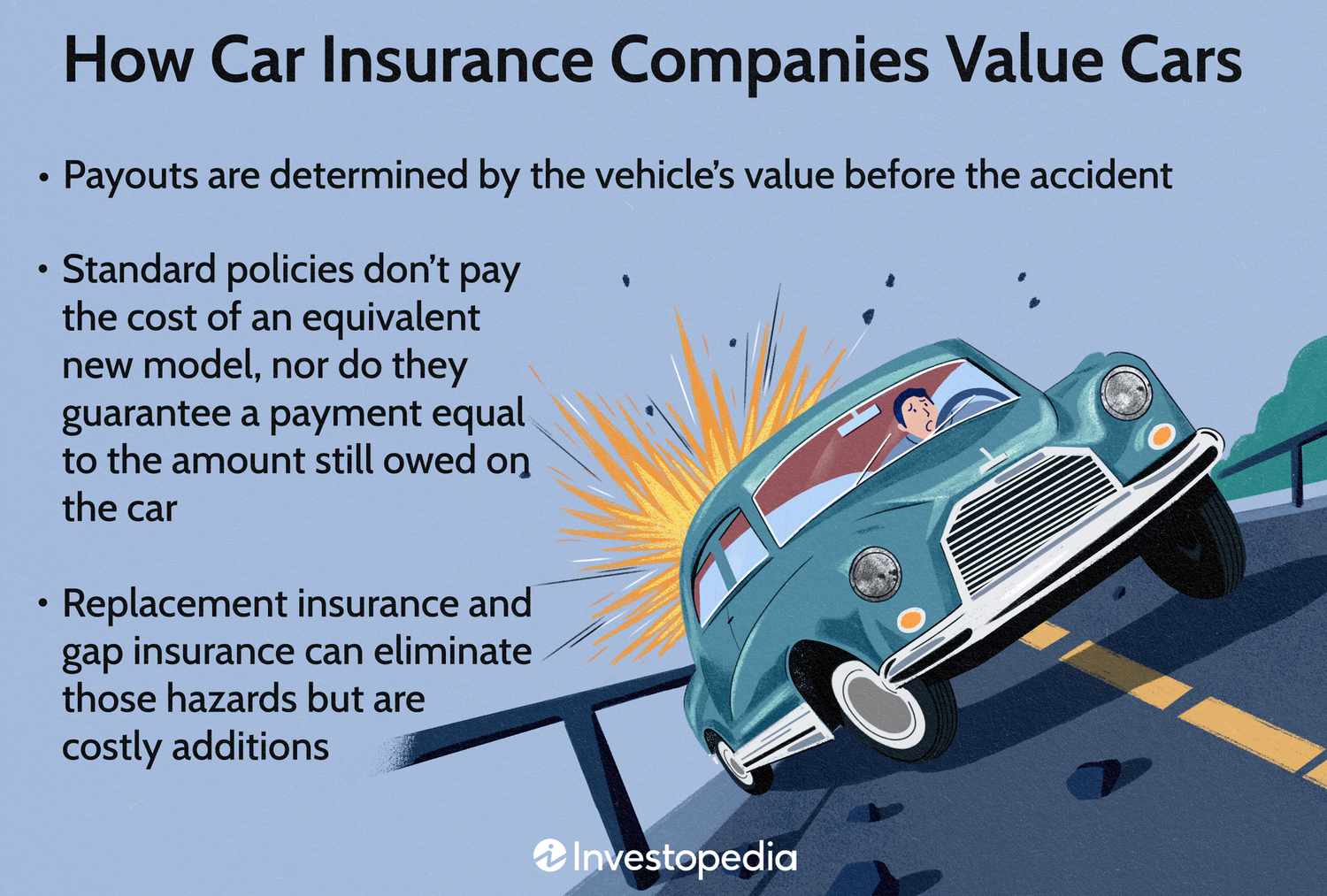

Vehicle insurance plays a key role in providing financial protection to vehicle owners in the event of accidents, theft or damage. The global motor vehicle insurance market has seen significant growth in recent years, driven by factors such as the increasing number of vehicles on the road and increasing awareness of the importance of insurance coverage.

Vehicle insurance, also known as auto insurance or car insurance, refers to a contract between a vehicle owner and an insurance provider in which the owner pays a premium in exchange for financial losses resulting from an accident, theft or damage to the vehicle. It also offers protection against liability arising from bodily injury or property damage to third parties.

Allianz, AXA, Ping An, Assicurazioni Generali, China Life Insurance, Metlife, Nippon Life Insurance, Munich Re, State Farm Insurance, Zurich Insurance, Old Mutual, Samsung, Aegon, Sumitomo, Aetna, MS&AD, HSBC

What Happens If Car Insurance Is Canceled?

The research report offers a comprehensive analysis of the global motor vehicle insurance market size across the globe as regional and country level market size analysis, CAGR estimates of market growth over the forecast period, revenue, key drivers, competitive landscape and payer sales analysis. Additionally, the report explains the key challenges and risks to be faced during the forecast period. The global motor vehicle insurance market is segmented by type and application. Players, stakeholders, and other participants in the global vehicle insurance market will be able to gain an advantage as they use the report as a powerful resource.

This report also covers an analysis based on SWOT analysis, providing Strengths, Weaknesses, Opportunities and Threats for a better understanding of the market. Porter’s five forces model for the global auto insurance market will also be available.

Verified Market Reports is a leading global research and consulting firm serving more than 5,000 global clients. We offer advanced analytical research solutions while offering information-rich research.

We also provide the strategic and growth analysis insights and data you need

Car Type, An Important Factor Which Determine Car Insurance Premium

Motor cargo insurance, compare motor home insurance, motor and transmission insurance, motor home insurance, motor car insurance comparison, motor carrier insurance, motor carrier cargo insurance, best motor home insurance, commercial motor insurance, find motor insurance, motor truck cargo insurance, commercial motor vehicle insurance