Motor Insurance Quote Online – Who pays more for auto insurance? No one! However, it can be very difficult to find the right coverage at a price you are happy with. You don’t have time to drive across town or make multiple phone calls to different companies to find out who will provide the coverage and price you need. Thanks to the internet, you don’t have to! It’s that easy to get quotes online for drivers like you.

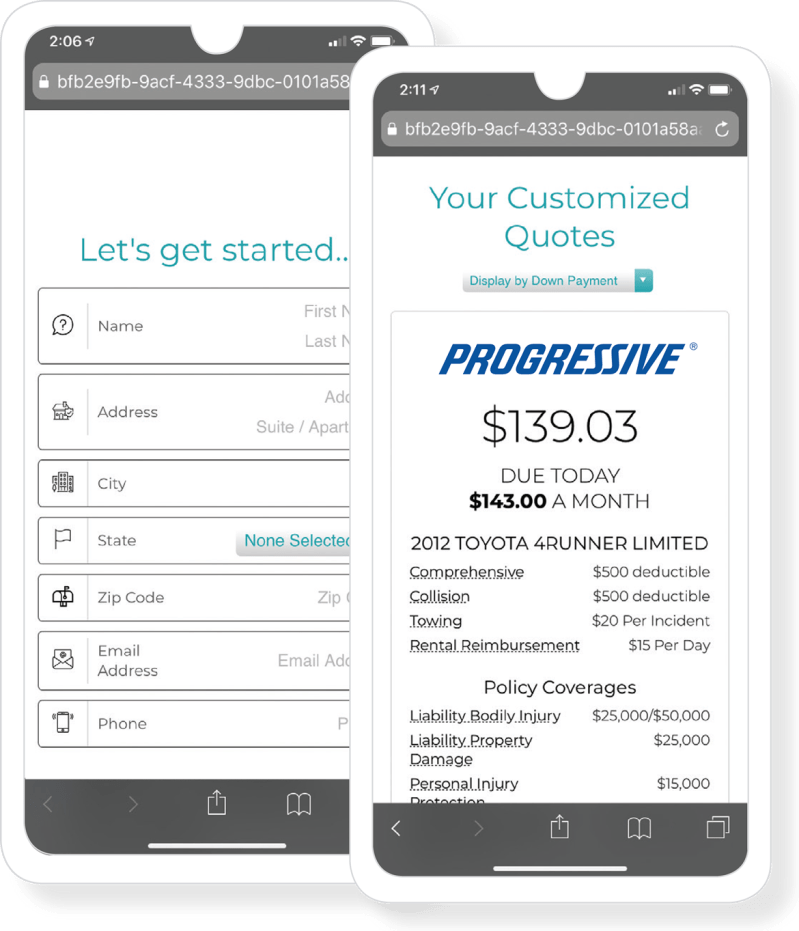

When you’re comparing prices online, provide as much information as possible to get the accurate estimate you need. The more detailed information you provide in advance, the more accurate the estimates will be. Providing accurate and detailed information when shopping for insurance will help you get a quote that matches the actual price you’ll pay. You must provide the following:

Contents

- Motor Insurance Quote Online

- Quotes For Car Insurance: How To Find The Best Deal

- How To Buy Car Insurance (consumer Guide)

- Car Insurance Quote In Florida

- Compare Car Insurance Quotes & Rates (2024)

- Tips To Get Auto Insurance Quotes Without Using Personal Information

- Looking For Affordable Car Insurance? Way App Can Be Your Answer!

- Car Insurance Quote

- What Is Full Coverage Insurance In Georgia?

- Compare Auto Insurance Quotes & Purchase A Policy Online

- What You Need To Know About Car Insurance

- Gallery for Motor Insurance Quote Online

- Related posts:

Motor Insurance Quote Online

The insurance company will review your claims history related to accidents or damage to your vehicles. Just “No! No accident!” But the insurance company will see your true story before the coverage is authorized, so you’ll just end up making your guess wrong.

Quotes For Car Insurance: How To Find The Best Deal

They want to know up front how financially responsible you are. Your credit score tells them this, and it can significantly affect your rate. You don’t need to know your exact score when you apply for an offer, as it changes frequently. It matters whether it is bad, fair, good or great.

A recent speeding ticket or traffic violation will significantly affect the amount you pay each month, especially if it’s in the past three to five years. Again, the insurance company will check your motoring record before offering you their official rate, so be honest with your estimate!

Value your car’s year, model for insurance rates. But you can provide more detail by listing the 17-digit VIN, which gives the insurer all these details, including the body style, transmission and engine.

Pronto Insurance never forces Miami, FL drivers to choose between great insurance and fair pricing. We offer several ways to get lower rates, including several ways to get discounts on car insurance in Miami, Florida. Do you have a clean driving license? Do you have good credit? These are the answers you need to provide to get started with your online quote.

How To Buy Car Insurance (consumer Guide)

You get more care than you pay each month, just like you want. What makes Pronto Insurance truly unique is the quality we offer in addition to our low prices. Whether you’re online, on the phone or sending an email, our customer service is second to none. After all, what good is cheap insurance if you can’t contact anyone to file a claim?

Regardless of your driving record or not, Pronto Insurance offers amazing rates. Get a quote today and see how affordable your car insurance in Miami, FL can be. You can choose the auto insurance policy that fits your lifestyle, insurance needs and budget! The first step is to get a quote online! Safe driving. Great insurance! I switched from Geico, paid 6 months up front and went from $1100 in 6 months to $743 in 6 months.

Trying to root was the best decision I ever made. Now I have full coverage, but I’m paying $400 less than I was paying Progressive for only partial coverage.

The prices are half what everyone else (Progressive, State Farm, etc.) wants and when our car was destroyed by a fallen tree, Ruth was in touch the next day and had it done by the end of the week. If I could give more than 5 stars.

Car Insurance Quote In Florida

Customize your policy or choose a plan recommended by Root. See how your cost varies with different levels of coverage.

Start saving with a rate based primarily on how you drive. The better you drive, the more you can save.

Each of our policies includes minimum state requirements and roadside assistance**. You can then add more cover or change the level of cover to make the right policy for you.

We make sure you have minimum state liability requirements, including bodily injury and property damage insurance.

Compare Car Insurance Quotes & Rates (2024)

You can add Collision and Comprehensive to your policy. These insurances and liabilities are referred to as “Comprehensive Insurance”.

Add other coverages such as medical benefits and uninsured/underinsured motorist bodily injury. You can view all our materials here.

Most traditional auto insurance companies base their rates solely on things like age, credit rating, marital status, and zip code.

At Root, we calculate your car insurance rates primarily based on your driving behavior. The Root app uses mobile technology to measure your driving habits. Drive as usual and the app will do the rest.

Tips To Get Auto Insurance Quotes Without Using Personal Information

Get rates based primarily on how you drive. The safer you drive, the more you save.

*4.7 out of 5 based on 48.9K ratings for Root on the App Store as of February 2021.

**Roadside assistance is included everywhere except California and Nevada where you can add it as separate coverage. Simply call to collect your policy – your policy and proof of insurance will be emailed to you.

It will only take 90 seconds. It’s a quick, easy and free online tool to help you get the best deals.

Looking For Affordable Car Insurance? Way App Can Be Your Answer!

It’s been over a year since I got the insurance and I have to say I’m never satisfied. Their service is excellent and they always go out of their way to help me and answer any questions I have. They explain it in an easy to understand way and I really appreciate that! Thanks for the rock!

This is a wonderful place. Who doesn’t love a free quote? The staff is very friendly. Finding a suit can be difficult for some, but they make the process quick and painless.

The staff is always welcoming and willing to go the extra mile to make sure my insurance needs are met. I admire the relationships they foster and their willingness to put their customers first.

Uses artificial intelligence to give you monthly personalized advice and reminders based on your goals and preferences.

Car Insurance Quote

It also gives you an electronic digital diary where you can safely store photos, receipts and other records. To better understand how to compare car insurance prices to find the best policy, a team of insurance experts has developed a comprehensive guide with average rates from each major car insurance company for each state and for different driver groups.

Auto insurance companies are currently experiencing historic losses, which have led to higher auto insurance rates. Insurance companies are likely to keep raising prices for the foreseeable future. Comparison shopping for car insurance is the best way to find the best coverage available to you at the cheapest rate. It’s a good idea to compare individual quotes every six months, as the market changes quickly.

Many factors determine your rate, including your age, location, driving record, education level and the type of car you drive. Each insurance company has its own different way of weighing these factors, so the price of the same policy may vary depending on where you get the quote from.

As independent insurance agents licensed in all 50 states and Washington, DC, we can help you find a personalized quote. By presenting customized quotes based on your profile and driver needs, you can save on your car insurance – our users save up to $717 annually.

What Is Full Coverage Insurance In Georgia?

Price is just one factor to consider when purchasing a policy. It’s also important to consider payment options, additional coverage, or special programs the insurance company may offer.

Car insurance comparison shopping gives you access to quotes from leading national and regional insurance companies. The process is simple and we can deliver your personalized offers in minutes.

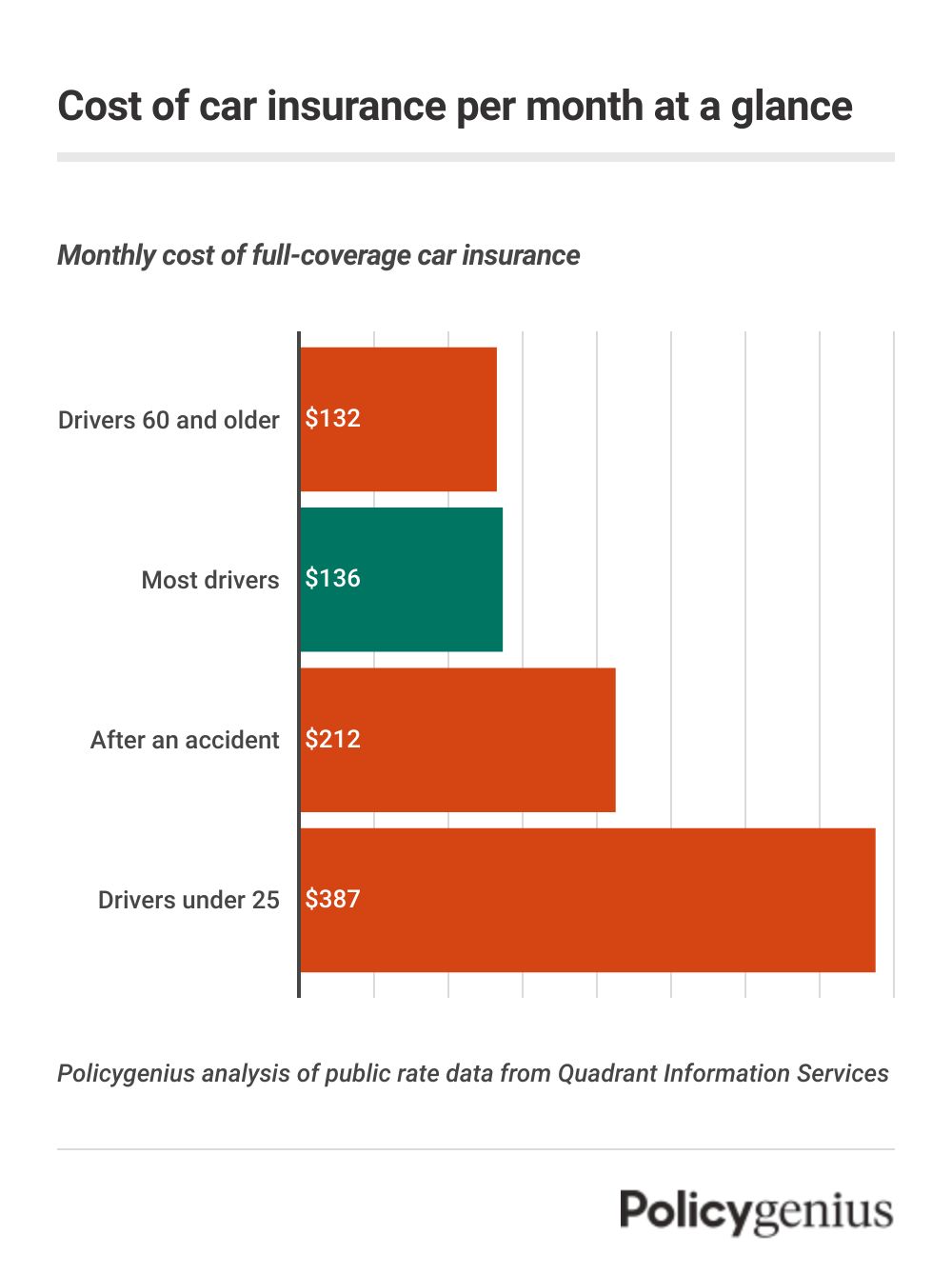

Everyone wants to find reliable car insurance at affordable rates. But the quality of the insurance company is also important when comparing car insurance. A team of insurance scientists, editors and writers have put together the chart below to help you make more informed decisions about buying insurance.

The data shows the average monthly cost of comprehensive coverage insurance from well-known names in the industry. It also makes it easy to compare the Company Quality Score, which ranks companies on 15 criteria, including:

Compare Auto Insurance Quotes & Purchase A Policy Online

Constantin has led data processing teams in a variety of industries, including insurance, travel and life sciences. He led the engineering team for more than three years.

Quality Score The Quality Score (IQ) uses more than 15 criteria to objectively rate insurance companies on a scale of one to five. The editorial team examines data received from insurance companies to determine the final score.

Disclaimer: Tabular data is derived from real-time quotes from over 50 insurance provider partners and Quadrant Information Services quote estimates. Actual rates may vary depending on the policy buyer’s unique driver profile.

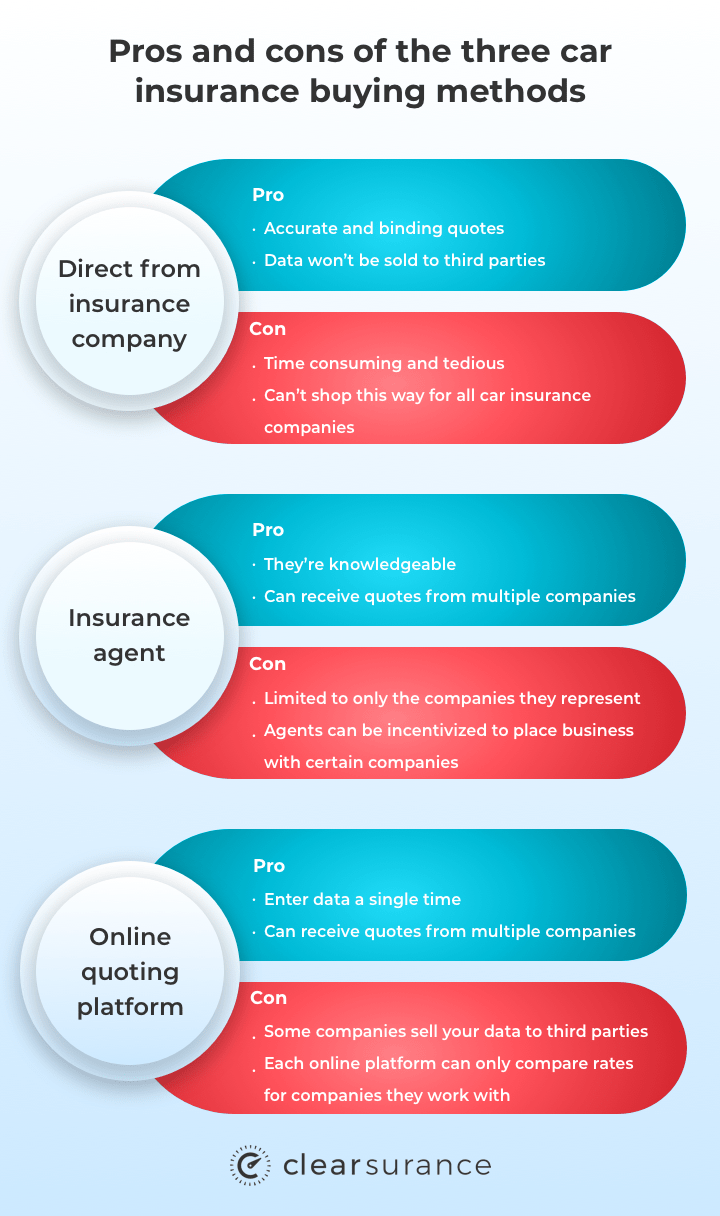

You have several options for comparing car insurance rates. you can do

What You Need To Know About Car Insurance

Get motor insurance quote, get motor insurance quote online, motor insurance quick quote, motor bike insurance quote, motor home insurance quote, commercial motor insurance quote, motor vehicle insurance quote, commercial motor insurance quote online, motor cycle insurance quote, motor insurance online quote, motor insurance quote, business motor insurance quote