Property Insurance – It is easy to assume that if a business suffers any damage, it will be covered by insurance. But this is often not the case, as most insurance policies have some caveats about what can be covered. Commercial property owners should know what property damage insurance covers for their business under their commercial property policy.

If you own and operate a business, protecting your property and its contents is a top priority. Many insurance companies offer a variety of policies to help protect a business and its valuable assets should the unexpected happen. Understanding the ins and outs of a commercial property policy can seem like a daunting task, but it puts business owners in a better position if an insurance company mistakenly denies or doesn’t pay a claim.

Contents

- Property Insurance

- Frequently Asked Questions About Homeowners Insurance

- What Is Personal Property Insurance?

- Protect Your Business With Commercial Property Insurance: Learn More Here!

- What You Need To Know About Property Insurance Rate Increases

- New Jersey Business Property Insurance Broker

- Real Estate Investors

- Gallery for Property Insurance

- Related posts:

Property Insurance

In general, three types of policies can be purchased to offer protection against various causes of damage or loss, including:

Frequently Asked Questions About Homeowners Insurance

Commercial properties may be compromised at some point during operation. Vandalism, natural disaster damage, and years of wear and tear are potential causes of commercial property damage; however, just because a property is damaged does not mean it will be covered by a commercial insurance policy.

In most cases, an insurance policy classifies property damage as physical damage to tangible property, such as a building, table, or computer. Most property damage claims involve damage to a business or tangible property under the control of the business owner. It is important to note that the specifics of property damage coverage are defined and included in the policy language of each insurance contract. However, because of the complex political language, it is sometimes difficult to distinguish what is not being addressed. Reviewing the policy with an experienced attorney can help decipher it.

Often these policies are combined into something called a business owners policy (BOP). Although each of these three policies covers different events, both business buildings and contents may be covered after direct material damage. Some insurance policies require specific risks to be specified in the contract, while others do not; They are called and known as all risk policies:

Similar to home coverage, a business may have personal property that needs protection through an insurance policy. However, the types of property owned by a business are different from the property owned by an individual. The personal property of the enterprise consists of movable, immovable or unsecured property. Buying and insuring personal property for a business is a taxable business expense.

What Is Personal Property Insurance?

Business personal property can be considered tangible or intangible. Tangible personal property can be felt or touched. Typically, this includes furniture, fixtures, equipment, and other valuable physical items in and on the business premises. Intangible personal property is intangible and intangible and may include securities, bonds and/or business intellectual property. These items are considered personal property as they can be bought, sold and/or licensed.

Not all business personal property can be insured under a commercial policy. In most cases, business owners will need to purchase multiple policies to purchase the right policy. The most common items of personal business property include:

In order for the company’s personal property to be covered by an insurance policy, it must always be on the premises. In the event of a commercial move, the owner may need to purchase additional coverage. This is especially true for company vehicles, which are not considered personal business property and must be covered by a commercial vehicle policy.

For the home business models that have become quite popular in recent years, there are certain conditions under which the business is considered to be a personal property. For example, homeowners insurance will not cover business-related losses, business equipment, and technology. Home business owners will likely need to purchase multiple insurance policies to adequately protect their business.

Protect Your Business With Commercial Property Insurance: Learn More Here!

While there are many ways in which commercial property can be damaged, it is important to know whether your insurance company will cover damages due to loss or wear and tear. This difference is one of the most common reasons insurance companies use to determine whether property damage is covered by a claim. If the insurance company believes the damage is due to wear and tear, it is usually not covered. This can be tricky, as there are not always well-defined standards for what is considered “wear and tear” and it is left to the discretion of the insurance adjuster when investigating a claim. However, “wear and tear” often shows up if the property is not properly maintained.

Even if a commercial property owner knows their policy well and works to maintain the property, insurance claims for damages can be denied, unpaid or delayed. This is because insurers want to make more money by injuring their policyholders rather than paying out claims.

Insurance companies often underpay, delay or deny insurance claims. Under the law, insurance companies must comply with various legal requirements, including notifying the policyholder of the claim, informing them that the claim has been denied or why, and within a specified period of time. When an insurance company fails to comply with these legal requirements or the terms of its policy, it is doing it wrong. When this happens, it is in the policyholder’s best interest to hire experienced legal counsel.

Coping with the real-world consequences of property damage can be incredibly difficult for commercial property owners. Claiming property damage with your insurer is nearly impossible. While it’s helpful to understand the contents of your business’s commercial property policy, insurers can interfere to avoid paying out claims in their favor.

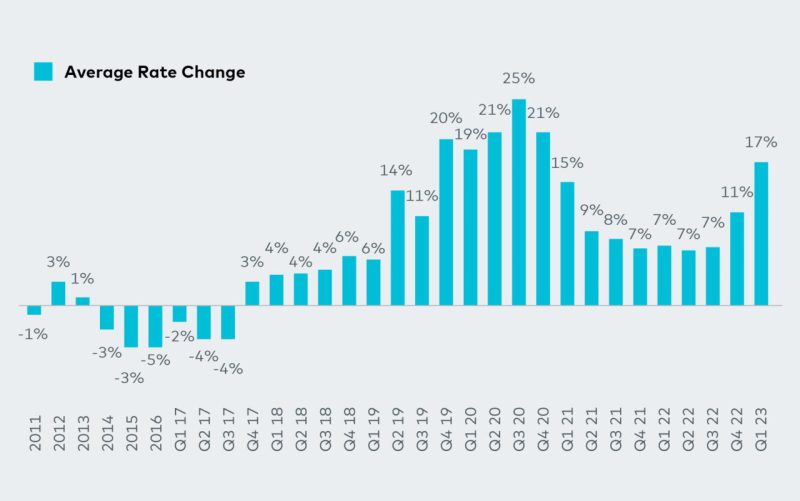

What You Need To Know About Property Insurance Rate Increases

The experienced commercial property insurance attorneys at Raisner Slania understand how frustrating these situations can be for business owners trying to get back on their feet. If you are dealing with an insurer that has unfairly delayed, failed to pay or denied your property damage claim, we can help. Homeowners insurance (also known as home insurance) is not a luxury; it is necessary. It not only protects your home and property from damage or theft. In this article, we will walk you through the basics of a homeowners insurance policy.

Almost all mortgage companies require borrowers to insure the full or fair value of the property (usually the purchase price) and will not provide a loan without proof of a real estate deal. Thanks to the mortgage clauses in your homeowner’s policy, the lender will receive a payout if your home is damaged during the term of your mortgage.

You don’t have to be a homeowner who needs insurance. Most landlords require their tenants to have renter’s insurance. Whether needed or not, such protection is reasonable.

Although they can be endlessly customized, there are certain standard elements in a homeowner’s insurance policy that cover the insured’s expenses. Each of the main coverage areas is described below.

New Jersey Business Property Insurance Broker

In the event of damage caused by fire, storm, lightning, vandalism or other domestic disasters, your insurer will provide you with compensation so that your home can be repaired or even completely rebuilt. Damage or deformation due to floods, earthquakes or poor home maintenance is usually not covered and you may need separate riders if you want this protection. Detached garages, sheds or other structures on the property may also require separate coverage following the same guidelines as the main house.

Clothes, furniture, appliances and other belongings in your home are covered if they have been destroyed by an insured disaster. You can even get off-premise cover so you can make a claim for lost jewellery, say, no matter where in the world you lost it. However, there may be a limit to the amount your insurer will pay. According to the Insurance Information Institute, most insurance companies will provide coverage for 50% to 70% of your home’s structure. For example, if your home is insured for $200,000, you will have about $140,000 in coverage for your property.

If you have valuables (art or antiques, fine jewelry, designer clothing), you’ll want to purchase a rider to cover them, or even purchase a separate policy to put them on schedule. .

Liability coverage protects you from lawsuits brought by others. This point even applies to your pets! So if your dog bites your neighbor Doris, no matter what

Real Estate Investors

Landlord property insurance, business personal property insurance, commercial rental property insurance, commercial property insurance quote, property insurance quote, business property insurance quote, property management insurance, commercial property insurance, property insurance quotes, rental property insurance quote, property insurance for business, business property insurance