Quote For Car Insurance – Whether you own a high-performance car, invest in a popular brand, or settle for a hatchback or luxury SUV to meet your family’s needs, you need coverage that will work with your engine.

Of course, just because you want to make sure you have the best car insurance doesn’t mean you have to force yourself to pay more than you can afford for the policy. And that’s where we come in.

Contents

- Quote For Car Insurance

- What Is A Car Insurance Quote By Workflowy44

- Young America Auto Insurance Coverage

- Get Expert Insurance Quotes Online

- Car Insurance Quote Analysis

- Car Insurance Quote

- Cheapest Car Insurance

- Common Car Insurance Mistakes

- Car Insurance Coverage Types

- Gallery for Quote For Car Insurance

- Related posts:

Quote For Car Insurance

Quotezone.co.uk is one of the UK’s leading car insurance comparison platforms, and we’ve put together – the online home for real enthusiasts – to help you find the right car insurance policy your land at a price that won’t break it. bank. the bank

What Is A Car Insurance Quote By Workflowy44

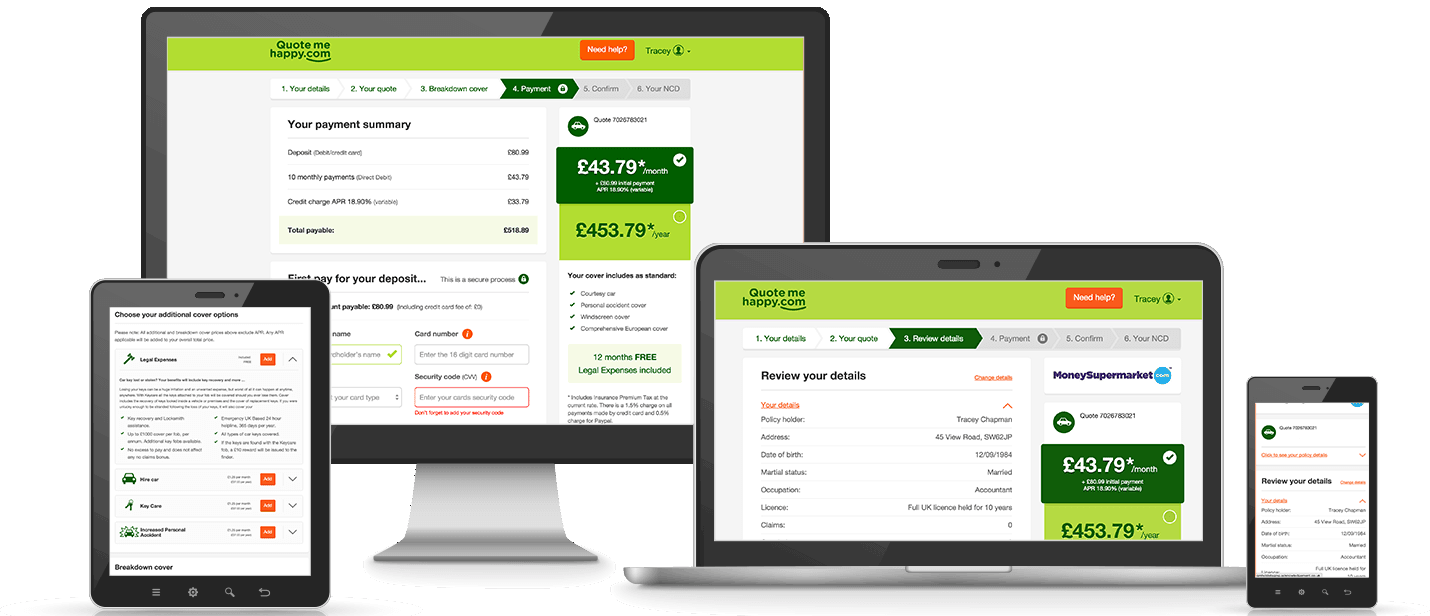

At Quotezone.co.uk we are as passionate about cars as you are and have been helping motorists find the right insurance at the right price for over 15 years. Our quote system allows you to compare more than 100 insurance providers side by side, increasing the chances of finding cheap insurance for your high-end motorcycle.

Simply visit Quotezone.co.uk, complete a short quote form and your quote will be displayed on screen, side by side.

* 51% of consumers could save £359.61 on their car insurance. The savings were calculated by comparing the average of the next five cheapest prices quoted by insurers on insurance comparison website Seopa Ltd. Based on savings from November 2022 data. The savings you can get depends on your situation and how you choose your current insurance provider.

Seopa Limited is an appointed representative, authorized and regulated by the Financial Conduct Authority (company reference number 313860) and classified as an insurance broker. If you’re like me, finding cheap insurance can be a real pain. Unlimited budgets and strong deals with various suppliers for small discounts. Well, if you want a quick and easy way to reduce your car insurance by 20-50%, you’ve come to the right place! Even better, these steps only take 10-20 minutes and you won’t have to talk to anyone!

Young America Auto Insurance Coverage

I haven’t used the car in over a month. The car has been moved about 20 meters in the last 28 days, and those 20 meters cost me £110 for pleasure. It’s one of my biggest monthly payments (after renting) and I’m not alone. MoneySuperMarket reported that the average price of car insurance from March to May 2016 was £470, but Confused.com says that in the last quarter of 2017, it rose to £827.

There are many insurance comparison sites that support moving house or changing cars if you want to get cheap car insurance.

Alright, thanks guys! I’m not going to change houses or change cars, but if you’re interested in knowing the things that affect your budget the most, check here.

I will use a live case study to show how this works. Case study is me! This is my introduction to price comparison on Confused.com. This is a detailed description of the BMW 330ci 2002. I am 22 years old and have 2 years of no claims. Some of you may be put off by this price, but for me it’s not bad (my last upgrade was over £1100…eek!).

Get Expert Insurance Quotes Online

The first tip here is to throw away the idea that Comprehensive is the most expensive. You should try all options; large, other lights steal from others only. The insurance company said that if you only go to other people, you don’t care about the car and they will charge you more. But these days, fire and third-party theft can also be a more expensive option than the perfect one.

For this company you can see that the third fire and theft budget suddenly adds £572. It is also worth noting that some companies are out of the TPF&T list.

However, for me, my best tip is Fire & Week Three and that’s where we’ll get into our next tip.

A black box is a small computer installed in your car that measures how you are driving and transmits that information to your insurance agent.

Car Insurance Quote Analysis

The typical black box is about the size of a telephone, must be installed, usually under the dashboard, and has three main components:

Cleaning the box starts when the car is started, and ends when the ignition is turned off. It analyzes a variety of metrics based on how the car is driven, such as average speed, time spent driving, acceleration and deceleration, and cornering speed.

As you can see it is a black box (indicated by the yellow symbol below). This is the cheapest so far. And if you’re like me and against the idea of a black box, don’t worry. This quote is still worth looking at. If you click on the ‘more info’ button and go to the insurer’s website, you can remove the black box option and calculate the price.

This recalculated quote was still £40 cheaper than my original quote and it didn’t appear on the comparison site. Of course, if you choose black box insurance, you save almost £200, but it turns out that if you question the black box from the start, you’ll be missing out on options. these are cheap.

Car Insurance Quote

But wait…because now, follow these tips including the black box. We haven’t finished our savings and if you are cheap and the end of the process is a black box, then you can lose it.

Simply put, your cache is the information your browser stores so that websites you use frequently can load faster. Clearing your cache or using Google’s incognito mode gives you a clean slate to browse.

When you look online at an insurance policy, some small files are saved on your computer browser and this makes it possible for you to come back after you have visited. back later With this information, the insurer knows that you have expressed interest in their insurance in the past, and can use that knowledge to offer you a higher price.

Mode, or clear the cache between visits to the covered site. In this way, you can browse the web without placing cookies on your computer, so that the websites you visit do not recognize you as a frequent visitor.

Cheapest Car Insurance

I went incognito, made a new account on confused.com and what’s scary is that my single word is now £27 cheaper! Saving something as small and simple as this is a big win. I don’t want to lie, stuff or even shop. I also spent 2 more minutes and saved almost £30.

This is a big deal and caught me off guard. Just moving the insurance start date to two weeks ago (instead of today) saved a hundred and twenty pounds! And it’s only £6 more if I do it a week earlier.

Basically, if you are quoting to start on the same day, the insurance company knows that you are desperate and you will benefit from it. Get your budget down in the future and you’ll save a fortune.

Another way to get cheaper car insurance is to double check. This surprised me when I tried this, but it works.

Common Car Insurance Mistakes

If most of your driving is to and from work, you can calculate the mileage, double the round trip, and multiply it by the number of days you drive. ‘in one year.

Limiting the length of time can be an effective way to lower your insurance premiums. Again, there is no point in lying because it is easy to check.

If you set your annual mileage at 1000 or 2000 kilometers, you will definitely pay more. The insurance company sees you as a high risk because you don’t have any experience on the road.

Of course, don’t put it lower than the number of miles you actually drive, but over 12,000 miles will be expensive, and around 5,000 miles seems like the sweet spot. This means you don’t have to worry about the number of kilometers you put on your car. A win-win!

Car Insurance Coverage Types

It may seem surprising, but an additional driver (the designated driver) on your policy can reduce your car insurance premiums quite a bit.

A designated driver is someone who is insured to drive your car, even though you do most of the driving. When you drive your car, the chosen driver will have the same level of insurance as you.

Don’t make them your driver if it’s not true, but add them as a named driver and see if they give you the cheapest price. An insurance agent will usually want to know the name, age, marital status, address and location of each driver. You will also need to provide your designated driver with information about any driver’s convictions or convictions. You can add one or more drivers

Quote for car insurance online, insurance quote for car, best car insurance quote, get quote for car insurance, new car insurance quote, best quote for car insurance, a quote for car insurance, look car insurance quote, car insurance quote co, online car insurance quote, car insurance quote in, business car insurance quote