Rental Insurance – Home insurance that mortgage companies must carry; To protect their property, belongings and potential injuries to visitors. But what about people who rent or lease their residences?

Here’s everything you need to know about renters insurance: what it is, what it covers, what it doesn’t cover, and how to get it.

Contents

- Rental Insurance

- Should You Require Renters Insurance As A Landlord?

- Renter’s Insurance: Why Your Tenant Needs It

- American Express Car Rental Insurance

- Your Guide To Renters Insurance Coverage

- How To Get Renters Insurance: A Guide For Choosing The Best Policy For You

- Little Known Things Renters Insurance Covers

- The Best Cheap Renters Insurance In California

- Gallery for Rental Insurance

- Related posts:

Rental Insurance

Renters insurance is a type of property insurance that covers damage to personal property and protects the insured against liability claims. This includes injuries not caused by structural problems with your rental. Injuries caused by structural problems are your landlord’s responsibility. Renters insurance covers everything from a studio apartment to an entire house or mobile home.

Should You Require Renters Insurance As A Landlord?

Whether you’re just starting out or have lived somewhere for a year, getting a renters insurance policy (probably the cheapest and easiest insurance you can get) is a wise investment. You may not think you have something of great value, but you probably do; More than you can easily replace in case of a nasty theft or fire.

Also, no matter how careful you are about your own apartment (the kind most renters live in), you can’t control your neighbors. They may leave your security doors open, allow malicious strangers to enter your building, or start a serious fire by sleeping with a cigarette in hand.

Your landlord’s property insurance may cover the building itself, but it won’t cover the contents of your apartment or damages that someone who had an accident in your apartment or rented space could sue you for.

This guarantee is for the contents of the house you are renting. Named perils typically include fire, theft, vandalism, plumbing and electrical malfunctions, some weather damage, and other named perils. More specifically, a standard HO-4 policy is for renters and covers losses to personal property due to events such as hail, explosions, riots, aircraft or vehicle damage, vandalism, and volcanoes. However, earthquakes are not covered by insurance and require separate insurance policies.

Renter’s Insurance: Why Your Tenant Needs It

Liability coverage protects you up to a certain amount if someone else sues you for an injury or other damage that occurs in your home. It pays for any harm done to you, your family, your pets or others. It pays any judgments and legal fees up to the policy limit, which usually starts at $100,000 and goes up to $300,000. For even higher coverage, you need to purchase an umbrella policy.

This coverage means that if your unit becomes uninhabitable due to one of the covered perils, you will be paid an amount to cover the cost of temporary housing. Hotel bills, restaurant meals, temporary rentals, and other expenses incurred while renovating your property are all included.

You should know that there are a lot of things that most policies don’t automatically cover: sewage backing up into your home, earthquakes, floods, and other “natural disasters.” If you feel you are at significant risk, these things may be covered for an additional premium.

Also, if you have unusually expensive or valuable items, such as high-end electronic devices, fine jewelry, musical instruments, and a substantial collection of art and antiques, you may need to purchase rider-style float insurance to cover them. These items. Additionally, some areas may require a special driver to cover wind damage from hurricanes.

American Express Car Rental Insurance

When you apply for renters insurance, it’s a good idea to take photos or digitally videotape everything you own. For valuable items, be sure to include serial numbers to help substantiate your claim.

You can go a step further and enter the items into a spreadsheet along with an estimate of each item’s value. Although these steps require extra effort, you should do them for two reasons.

Once you’ve determined how much insurance you need, you’ll be ready to find insurance companies that offer renters insurance policies in your area. You can search online for renters insurance and your state to find a company.

Another approach is to check with family and friends for recommendations and prices. Tell your insurance agent how you found it and whether you have other policies, as you can often get family rates or package deals (for example, if you bought home and car insurance together). Once you’ve found potential insurers, research the companies’ insurance ratings through a company like AM Best, which rates the insurer’s ability to pay you when you make a claim.

Your Guide To Renters Insurance Coverage

Once you’ve researched your options, it’s time to start the application process. If more than one company has done a financial check, there’s no reason not to check them all out to see which one offers the best combination of low rates and solid coverage.

Some companies may allow you to complete the entire process online. Others may want to talk to you on the phone or send you some paperwork to fill out. In most cases, it is not necessary to meet a representative in person.

Filling out the application is relatively simple. The only questions that may surprise you are related to the type of construction of your residence, the year of construction, and the roofing material used. For some properties, you can actually find this information on Zillow.com; Otherwise, you can get it from your landlord.

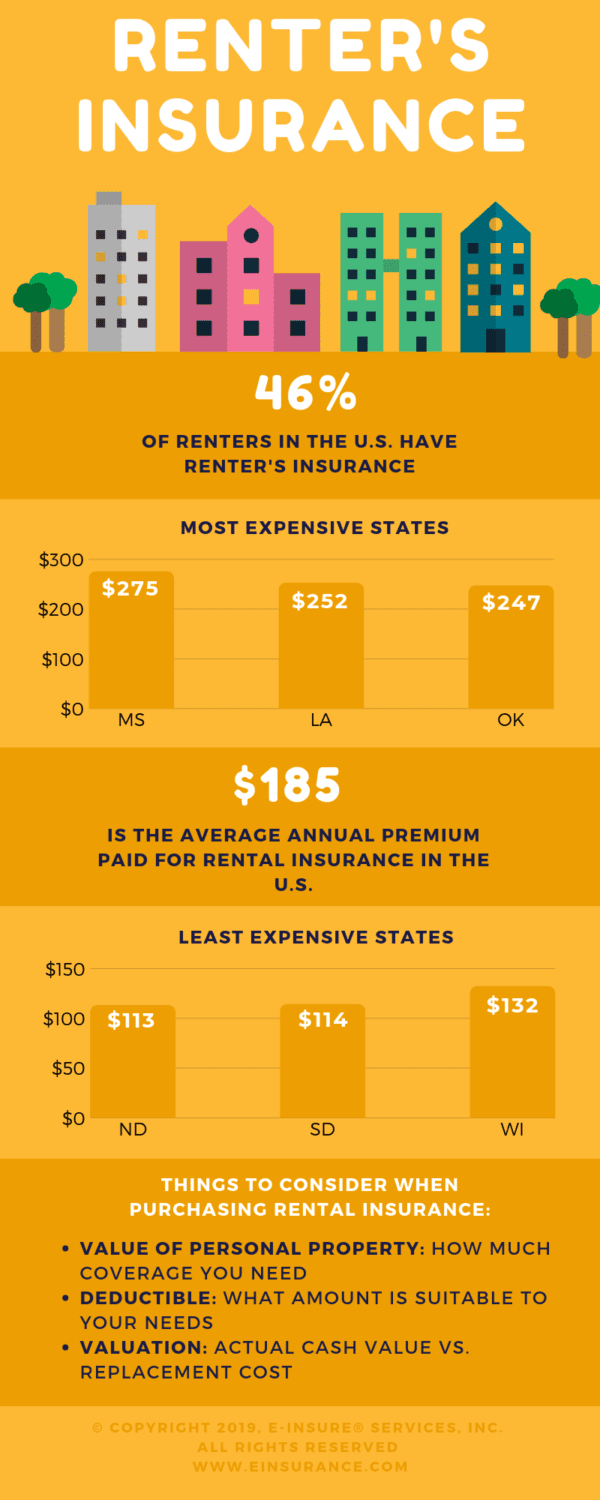

The two types of coverage offered to renters are actual cash value and replacement cost. Actual cash value coverage provides property value in the event of damage or loss, making it the lowest-cost rental insurance available. Full replacement cost coverage, replacing items or property with new ones is approximately 10% more expensive than original cash value coverage.

How To Get Renters Insurance: A Guide For Choosing The Best Policy For You

If your budget isn’t tight, it’s wise to opt for expense coverage instead. This ensures that if your sofa is destroyed in a fire, for example, you’ll get the full $1,000 you need to buy a new model instead of the hundreds of dollars you had on your old sofa. Depreciation. While replacement cost coverage is a little more expensive, the difference in premiums is often negligible compared to the large increase in coverage you get.

At this point you’ll also want to decide which deductible is best for your financial situation. As with all types of insurance, the lower your deductible, the higher the premium, because the lower the deductible, the more money the insurance company has to pay in the event of a claim. Deductions can range from $500 to $2,000. If you increase it from $500 to $1,000, you can get up to 25% off your premium. Consider how much you can afford to replace your belongings in the event of a major loss, and insure yourself for the difference. Your deductible may be low initially, but you can always increase it later.

Compared to homeowners insurance, renters insurance is relatively inexpensive. The National Association of Insurance Commissioners (NAIC) and the Insurance Information Institute put the average cost of renters insurance at $15 per month, while homeowners insurance is $75 per month. These figures reflect data through 2019, the most recent data available. Rates vary by state and company, and of course depend on the amount of insurance you purchase and other factors, including the deductible you choose.

Renters insurance often offers substantial discounts for actions you take to reduce your risk to the insurer. These can include fire or burglar alarm systems, fire extinguishers, sprinkler systems, and deadbolt locks on exterior doors. As mentioned above, you can also get an additional break if you already have a policy with a particular company.

Little Known Things Renters Insurance Covers

Insurance is cheaper when the premium is paid in one lump sum for an entire year rather than in installments; So if you can afford to pay annually you should (insurance companies like to charge an administrative fee when paying in installments). Note that some companies may request an automatic monthly withdrawal from your checking account if you choose to pay monthly.

Once you receive your new policy in the mail, you’ll want to read it to make sure you fully understand what is and isn’t covered and to confirm that any nonstandard additional coverage you purchased is mentioned. Double check that your deductible amounts and premium amounts are correct.

“What is renters insurance?” is a fair question, but a better question might be: “Why do I need renters insurance?” Answer: Prevents accidents and problems from damaging the bank account and budget. Remember that your homeowner’s insurance covers the building, but not your property. Only you can protect yourself and your property.

Authors must use primary sources to support their work. These include whitepapers, government data, and originals.

The Best Cheap Renters Insurance In California

Get rental insurance, rental home insurance quote, rental dwelling insurance, affordable rental insurance, rental property insurance quote, short term rental insurance, commercial rental property insurance, commercial rental insurance, rental insurance quotes, rental property insurance coverage, cheap rental insurance, vacation rental property insurance