Renters Insurance – It’s a good idea to insure your tenants in case of catastrophic events, but if you simply don’t have the money to cover the premium, it can be difficult to justify. Renter’s insurance premiums drop by $15 to $30 a month, according to the National Association of Insurance Commissioners, but the cost of up to $360 a year for something you don’t need can seem like a stretch on the budget. Fortunately, the cost of renters insurance is not set in stone, and there are several ways to reduce it.

You can lower renter’s insurance costs by searching for better deals, package coverage and installing safety equipment, among other options. Read on to learn 10 ways to lower the cost of your coverage.

Contents

- Renters Insurance

- What You Can Expect From A Renters Insurance Policy

- Best Renters Insurance

- What Does Renters Insurance Cover? A Quick [expert] Overview

- Renters Insurance Quotes Compare

- How Much Renters Insurance Should A Landlord Require?

- What Is Renters Insurance & What Are Its Benefits?

- Get A Renters Insurance Quote Online & Buy Today

- Gallery for Renters Insurance

- Related posts:

Renters Insurance

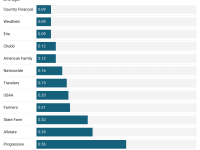

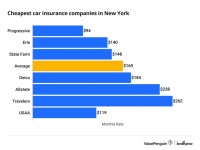

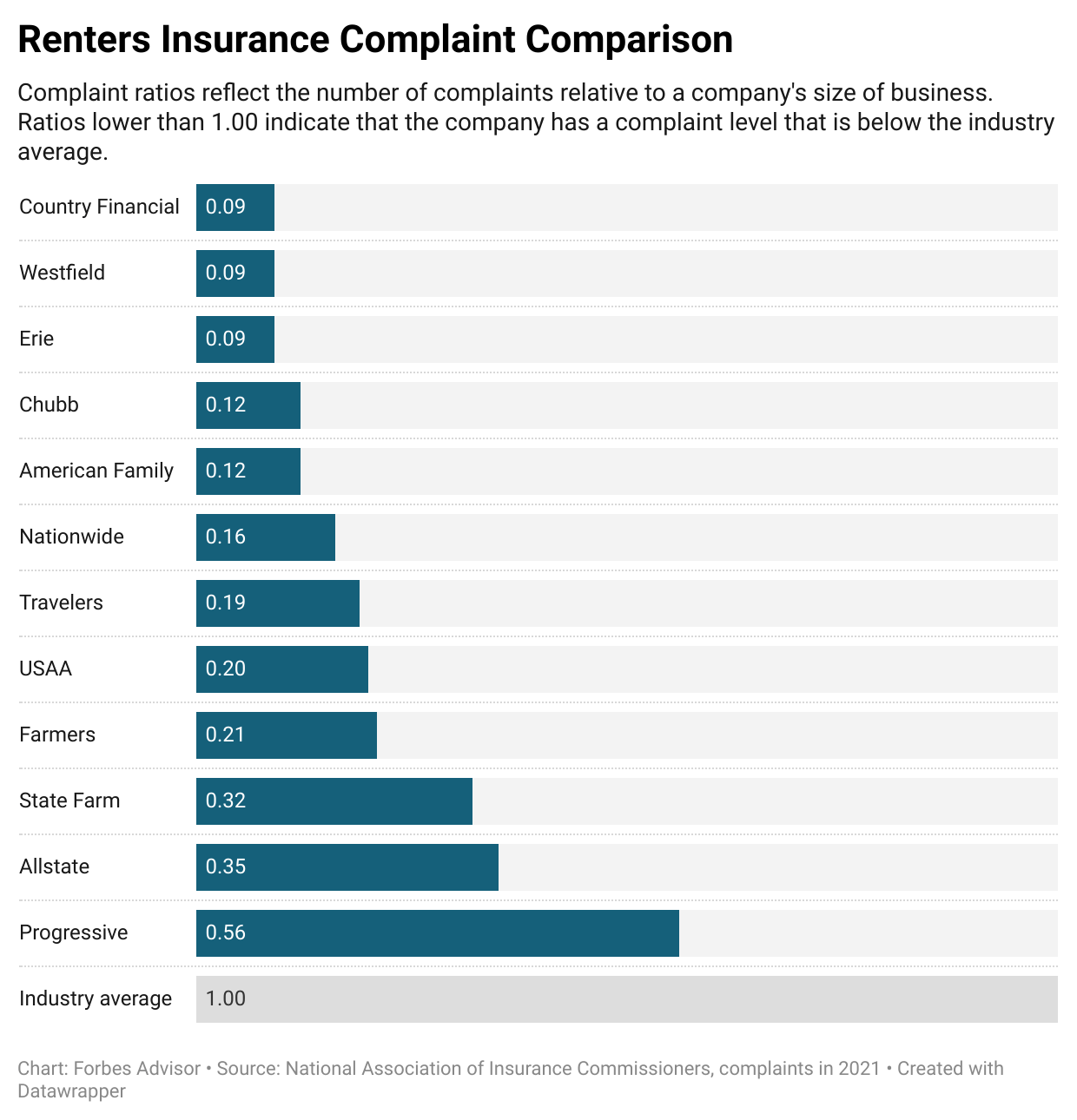

The first rule of thumb for buying insurance is to collect quotes and information from multiple providers. It’s important to find out what rates and services you can expect, rather than just accepting the first offer you receive. But when shopping, compare apples to apples.

What You Can Expect From A Renters Insurance Policy

A certain policy may be much cheaper than others, but probably for a reason. It may, for example, have strict coverage rules or low cash reimbursement limits. So be sure to compare the amount you pay with the coverage amount and find the most reasonable price.

Shopping around for the best price is important, but if you have the ability to get rental insurance from your current auto insurance company or other insurance provider, this may be the best option. Bundling can result in an average savings of about $130 per year with a combination of car and renter’s insurance.

Increasing your deductible — the amount you pay out of pocket before your policy kicks in — is a strategy that’s useful for many types of insurance, including renters, to save money. When you raise your renter’s insurance deductible, you’re essentially saying you want to pay lower premiums now, but are willing to pay more out of pocket if you need to file a claim in the future.

But only consider this if you can afford a higher deductible in an emergency such as a rental fire. If you don’t think your deductible will be in your checking or savings account regularly, increasing your deductible to save money on premiums may not help in the long run.

Best Renters Insurance

You can also lower the coverage limits to get the premiums at a comfortable price. Insurance is designed to reduce losses in the event of damage, such as a burst pipe, but you may not need to cover all costs.

Talk to your insurance company about adjusting your policy if you have a healthy emergency fund to cover expenses and aren’t worried about less coverage.

Does the insurance allow you to pay the entire year’s premium at once? If so, this can result in significant savings, such as a discount.

A discount for autopay accounts may apply in a similar way. Businesses like to guarantee that all payments will be made on time and can reward customers who show payment schedules.

What Does Renters Insurance Cover? A Quick [expert] Overview

Some renters insurance policies may lower the price if your landlord has installed safety and security equipment, such as fire and security alarms. The insurance company has an interest in ensuring that your assets are well protected.

You may be a member of a group that receives discounts from certain insurance companies. For example, pensioners may qualify for a lower rate. Or maybe your job offers a lower rate through a partner insurance company as a benefit. You can even benefit from parents who have insurance with the same company. Check out discount possibilities with the organizations you are affiliated with.

Renters insurance that promises replacement value — money to replace your belongings as if you had to buy them brand new today — can cost a little more upfront. Instead, consider getting a policy that only guarantees actual cash value.

If you were to make a claim, an actual cash value policy would pay the value of your written-off items as they were on the date of claim. It probably won’t be enough to buy them out in full, but it can still help reduce your losses if you ever have an incident, while enjoying lower premiums in the meantime. Again, only consider these types of price reductions if you are sure you can afford the additional replacement costs if necessary.

Renters Insurance Quotes Compare

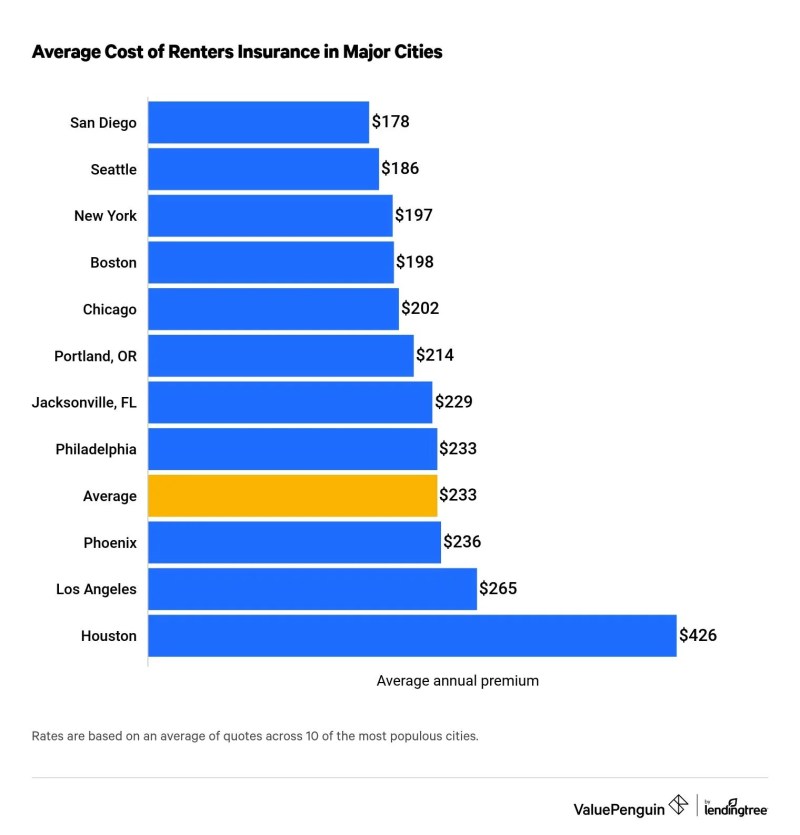

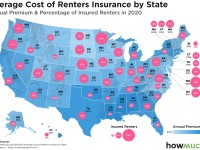

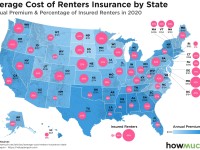

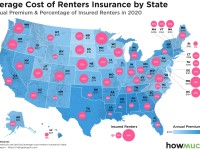

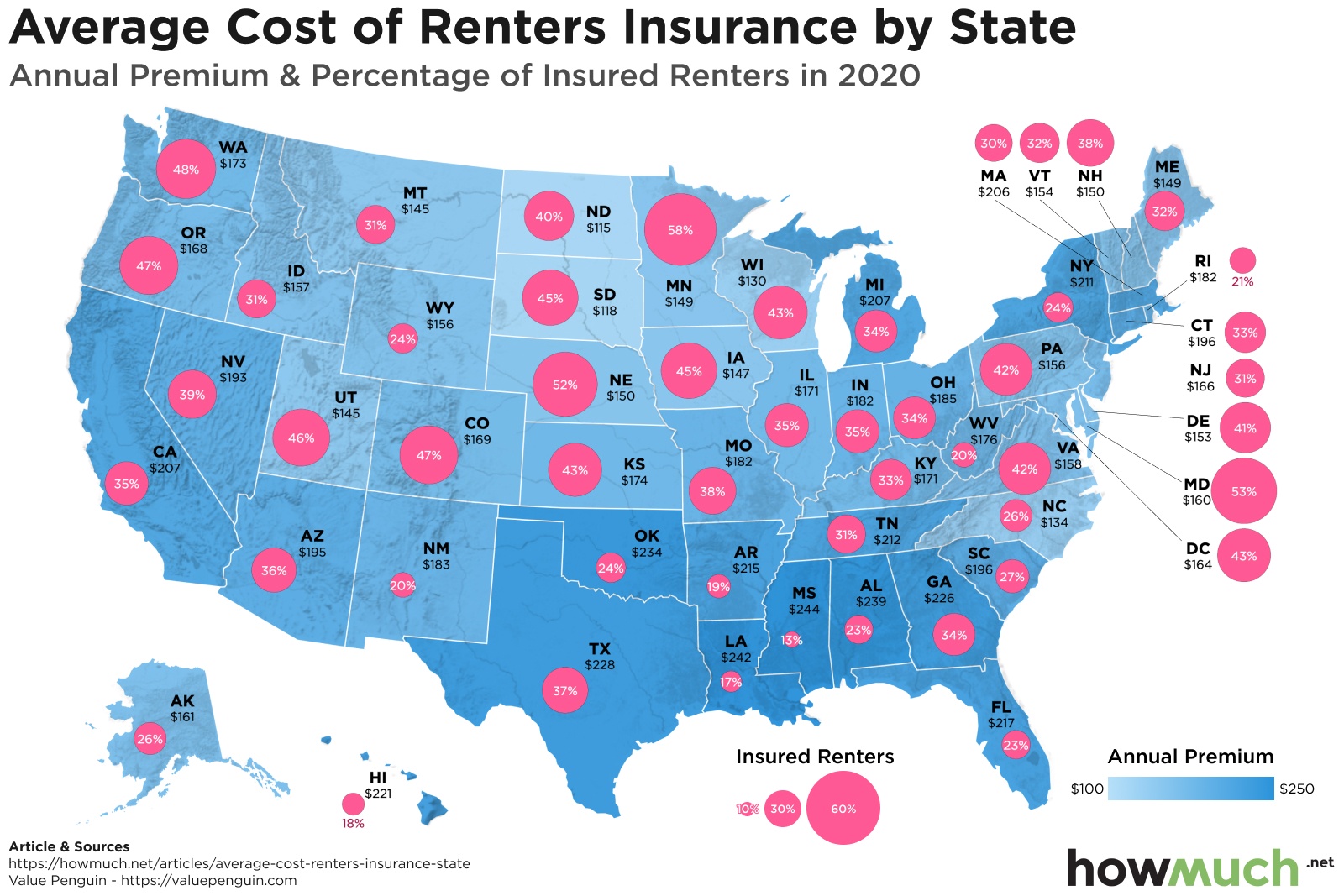

Your renters insurance depends on where you are, and the costs can come down to which block you live in or how old the building is. If there is something in your neighborhood that you believe increases your risk profile, such as high crime rates or old, run-down buildings, consider moving if it fits your budget.

Insurance companies in most states can check what’s called your credit score and treat you like a renter’s policy. It takes into account your credit history, as well as the likelihood that you will be able to file a claim, and helps the insurance company assess the risk of insuring you. Maintaining good credit can help reduce costs when purchasing renters insurance. You can check your credit report and get your score for free to see where you stand.

Renters insurance can help pay for damages and liability in the event of an emergency. However, paying yet another insurance premium can stretch your budget more than you’d like. Consider these savings tips to lower renter’s insurance costs and protect your belongings in the event of a disaster.

To get credit for bills you already pay, like utilities, cell phone, video streaming services and now rent.

How Much Renters Insurance Should A Landlord Require?

The Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB) under license from Mastercard International. Banking services provided by CFSB to FDIC members. is the presenter, not the bank.

Editorial guidelines: The information in Ask is for educational purposes only and does not constitute legal advice. You should consult with your attorney or get advice from a legal expert regarding legal issues. Remember that guidelines change over time. Posts reflect the guidelines at the time of writing. Archived messages are kept for your information, but may not conform to applicable policies.

The opinions expressed herein are solely those of the authors, not those of any bank, credit card issuer, or other company, and have not been reviewed, endorsed, or otherwise endorsed by any of these entities. All information, including prices and fees, is accurate at the date of publication and is updated with information from our partners. Some of the offers on this page may not be available on our website.

Pros and cons of the proposal are determined by our editors based on independent research. Banks, lenders and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

What Is Renters Insurance & What Are Its Benefits?

Advertiser Information: Offers displayed on this site are from third-party companies (“our partners”) from whom Consumer Services receives compensation. This compensation may affect how, where and in what order products are displayed on this page. The offers on the website do not represent all available financial services, companies or products.

* For full details, see the terms and conditions of the offer on the website of the issuer or partner. After clicking Apply, you will be directed to the issuer’s or partner’s website, where you can read the terms of the offer before applying. We show a summary instead of the full legal terms – and before you apply you should understand the full terms of the offer as stated by the issuer or partner themselves. Although Consumer Services makes reasonable efforts to provide the most accurate information, all information about offers is provided without warranty.

Websites are designed to support modern, modern browsers. does not support Internet Explorer. If you are currently using an unsupported browser, your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended to update your browser to the latest version.

© 2023 All rights reserved. . and trademarks used herein are trademarks or registered trademarks of the Company and its affiliates. The use of other trade names, copyrights or trademarks is for identification and reference purposes only and does not imply any association with the copyright or trademark owner of the product or brand. Other product and company names mentioned herein belong to their respective owners. Licenses and Disclosures.

Get A Renters Insurance Quote Online & Buy Today

Results will vary. Not all payments are eligible for promotion. Some users may not receive improved scores or chances of approval. Not all lenders use credit files and not all lenders use scores that are affected by BoostCAMP PENDLETON, CA. It’s a quiet Monday morning in beautiful Southern California. The sun has not yet risen and a blanket of mist is calmly covering the windswept hills near your home. You hear a familiar sound from your phone, the daily alarm is set for 05:00.

You reach for your phone and press snooze. “It is easy

Renters insurance massachusetts, renters insurance colorado, renters insurance ontario, renters insurance bc, renters insurance new jersey, progressive renters insurance, renters insurance illinois, commercial renters insurance, renters insurance wisconsin, renters insurance texas, business renters insurance, renters insurance arizona