Term Life Insurance – Home » How does life insurance work? » Types of Life Insurance » Advantages and Disadvantages of Term Life Insurance

Dorothea Hudson has been writing professionally in a number of disciplines since 2013. He has written about entertainment, insurance, finance, travel, technology, artificial intelligence, renewable energy, cryptocurrency, fundraising and real estate for many websites. His work has been published for UK retailer Marks & Spencer, Kroger Magazine, Vision Group, etc. His passions include writing, music, running, traveling,…

Contents

- Term Life Insurance

- Whole Vs. Term Life Insurance — The Insurance People

- What Oil & Gas Professionals Need To Know About Universal Life Insurance

- Pros And Cons Of Converting Term To Whole Life Insurance

- Life Insurance Education

- How To Buy Term Life Insurance

- What Is Term Life Insurance

- Term Life Insurance

- Should You Get A Term Life Insurance Plan? We Explain How It Works

- Term Life Insurance By Onlinelifeinsurancequotes

- Decoding Term Insurance Vs Life Insurance: Benefits And Key Differences

- Gallery for Term Life Insurance

- Related posts:

Term Life Insurance

Dani Best has been an authorized insurance producer for nearly 10 years. Dani started her career in insurance in 2014 as a salesperson with State Farm. During her time at Sales, she earned a bachelor’s degree in psychology from Capella University and is currently pursuing a master’s degree in marriage and family therapy. Since 2014, Dani has been licensed in life, disability, property and casualty and maintains…

Whole Vs. Term Life Insurance — The Insurance People

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Competition shopping should be easy. We are not affiliated with any life insurance provider and cannot guarantee any provider’s referrals. Our life insurance industry contributions do not influence our content. Our opinions are our own. To compare quotes from many different companies, enter your zip code on this page to use the free quote tool. The more offers you compare, the more likely you are to save.

Editorial Guidelines: We are a free online resource for anyone who wants to learn more about life insurance. Our goal is to be an objective third-party resource for all things life insurance. We update our site regularly, and all content is reviewed by life insurance experts.

I want to offer a few ideas for you to think about and decide for yourself. Some say term life is a waste of money, while others say you should buy term and invest the difference.

I believe there is no one policy that suits everyone. We all have different needs, income, family size and health conditions that need to be considered when buying a life insurance policy. To solve this easily, let’s take a look.

What Oil & Gas Professionals Need To Know About Universal Life Insurance

As the name suggests, permanent life insurance provides coverage for a specific time frame and pays the benefit only if you die suddenly during that specific period. Your beneficiaries will receive a specific payment (called the death benefit) as specified in your policy.

This type of insurance can also be called “pure life insurance” as it does not have any savings component or any other additional benefits. In short, it provides a death guarantee for a specified period.

Michael is a 32-year-old married single with two young children. He wants to ensure the financial security of his family in case of his untimely death. After careful consideration, Michael decides to purchase a life insurance policy for 25 years. Here’s how he assesses the pros and cons:

Michael recognizes lower premiums than permanent life insurance options, allowing him to allocate more funds to other financial goals. She believes that the adequate coverage provided by the policy is valuable in supplementing her income and meeting her family’s living expenses, mortgage payments and children’s education expenses.

Pros And Cons Of Converting Term To Whole Life Insurance

The flexibility of choosing the term to match its long-term financial obligations is also attractive. Michael acknowledges that there is no cash accumulation or investment component in the term life insurance policy.

He understands that the coverage ends after the policy expires, leaving his family without protection for life if that period lapses. He knows that if he decides to renew the policy or buy a new policy after the initial term, the premium may increase significantly.

Lisa is a 45-year-old small business owner who recently received a loan to expand her business. She wants to make sure her business debts will be covered if something happens to her. Lisa chooses a life insurance policy for 15 years and evaluates the pros and cons:

Lisa appreciates the affordability of Premium, which fits into her business budget. She acknowledges the ample coverage provided by the policy, ensuring that her business debts will be paid and that the financial stability of her company will be preserved in the event of her untimely death.

Life Insurance Education

Flexibility to reassess the coverage requirements after the expiry of the policy as per the financial situation of his company. Lisa admits that there is no cash growth or savings component in the term life insurance policy.

She believes that the coverage period is limited, which may not suit her long-term business goals. She knows that premiums may go up if she wants to increase coverage or get a new policy after the initial term.

James is a 38-year-old homeowner who recently purchased a home with a substantial mortgage. He wants to make sure that his loved ones are financially protected if he dies unexpectedly. James decides on a life insurance policy for 20 years and weighs the pros and cons:

James recognizes lower premiums than permanent life insurance options, allowing him to set aside more funds to pay off his mortgage or other financial goals. He appreciates the adequate coverage provided by the policy, ensuring that the mortgage will be paid and that his family will have financial stability in the event of his untimely death.

How To Buy Term Life Insurance

The flexibility to reassess coverage requirements after the policy term is up to suit the family’s changing financial situation. James understands that the term life insurance policy does not have a cash accumulation or investment component.

He admits that the coverage ends after the policy expires, leaving his family without lifelong protection if he survives the term and still has financial obligations. He knows that premiums may increase if he decides to increase coverage or buy a new policy after the initial term.

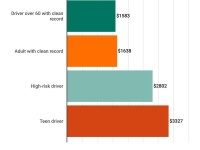

Term life insurance is probably the most popular form of protection because of its lowest cost. Whether you’re buying whole life or term insurance, you’ll still need to be in good health to get the lowest rates.

So it’s not necessarily the type of plan you buy, but the risk you pose to the insurance carrier that ultimately determines your rates. You can start life insurance quotes on this page.

What Is Term Life Insurance

Permanent life insurance provides cover for a specified period of time and pays a death benefit if you die during that period. This is a simple policy with no savings component.

When your policy expires, you have four choices: renew, convert to permanent, let it lapse, or buy a new policy.

The advantages of term life insurance are lower premiums, flexibility in choosing terms, ease of understanding the policy and temporary coverage for specific needs.

Disadvantages of term life insurance include lack of cash value or investment components, coverage limits if you outlive the term, possibility of premium increases, and no lifetime coverage.

Term Life Insurance

Term life insurance can be used to replace lost income, pay off debts, cover childcare and education costs, and provide business protection. We all want to educate our children, pay off our mortgage or debt, or simply protect our loved ones. Permanent life insurance is one of the two life policies that can help us achieve this goal.

A life insurance policy is easy to use and lasts for a fixed term (usually between 1 and 30 years). If the insured person dies during this period, his beneficiaries get financial compensation.

If you’re wondering if you should take out a life insurance policy, you’ve come to the right place. In today’s article we will discuss:

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees the payment of a fixed death benefit if the insured dies during a specified period. After the term expires, it is possible to renew it for another term, convert it to a permanent policy or cancel it.

Should You Get A Term Life Insurance Plan? We Explain How It Works

When buying this type of insurance, everyone has to make two important decisions: how long it will last and what the amount of coverage will be.

People often match the length of their life insurance policy with the financial liability they want to cover. This includes college loans, a mortgage or buying a new home. So, for example, people with a 20-year mortgage loan will probably choose a 20-year term policy, if not a little longer, to ensure that their loan is paid off.

The annual costs of this policy remain the same for the term of the tier. After the fixed period, the policy can be renewed but at higher rates every year. If the insured survives the term of the policy and does not renew it, the policy ceases to be valid.

No premium will be paid in the policy unless the individual buys a premium return life insurance policy.

Term Life Insurance By Onlinelifeinsurancequotes

We have already mentioned that many people buy permanent life insurance for income replacement. It is good because:

If the insured dies while the cover is in effect, his family (or whoever is the beneficiary) will get the death benefit of the policy. The coverage lapses if he survives the policy term and does not renew it.

Apart from regular protection in case of death, this insurance provides compensation in case of accident. This means that if the insured dies in an accident, it will be an additional death benefit.

Some life insurance companies allow their own.

Decoding Term Insurance Vs Life Insurance: Benefits And Key Differences

Term life insurance companies, get term life insurance, life insurance term policies, lowest term life insurance, affordable term life insurance, select term life insurance, ethos term life insurance, term. life insurance, cheap term life insurance, life term insurance quote, easy term life insurance, guaranteed term life insurance