Term Life Insurance Quotes – Have you recently acquired a new home or asset? Do you have children about to go to college? With term insurance, you can protect your family from the potential burden of loans.

Getting older? If you want to cover final expenses and leave wealth for your loved ones, whole life insurance is a good option with its cash value savings.

Contents

- Term Life Insurance Quotes

- Life Insurance Quote

- Free Life Insurance Quotes

- Life Insurance Rates By Age

- Types Of Life Insurance

- Life Insurance Coverage For You And Your Family

- Term Vs. Universal Life Insurance: What’s The Difference?

- Whole Life Insurance: What It Is & How To Buy

- Term Life Insurance Quote By Dynamic Dreamz

- Guaranteed Surrender Value Tata Short Term Life Insurance, Age Limit: 75 Year, 10 Year To 65 Year

- Gallery for Term Life Insurance Quotes

- Related posts:

Term Life Insurance Quotes

Looking for coverage similar to whole life insurance, but with more flexibility? Universal life insurance may be right for you.

Life Insurance Quote

When you shop for life insurance, you are taking an important financial step. It can save your family a life insurance payout if you suddenly disappear. The money can help your family stay in their home, pay everyday expenses, fund college or help with any other financial need.

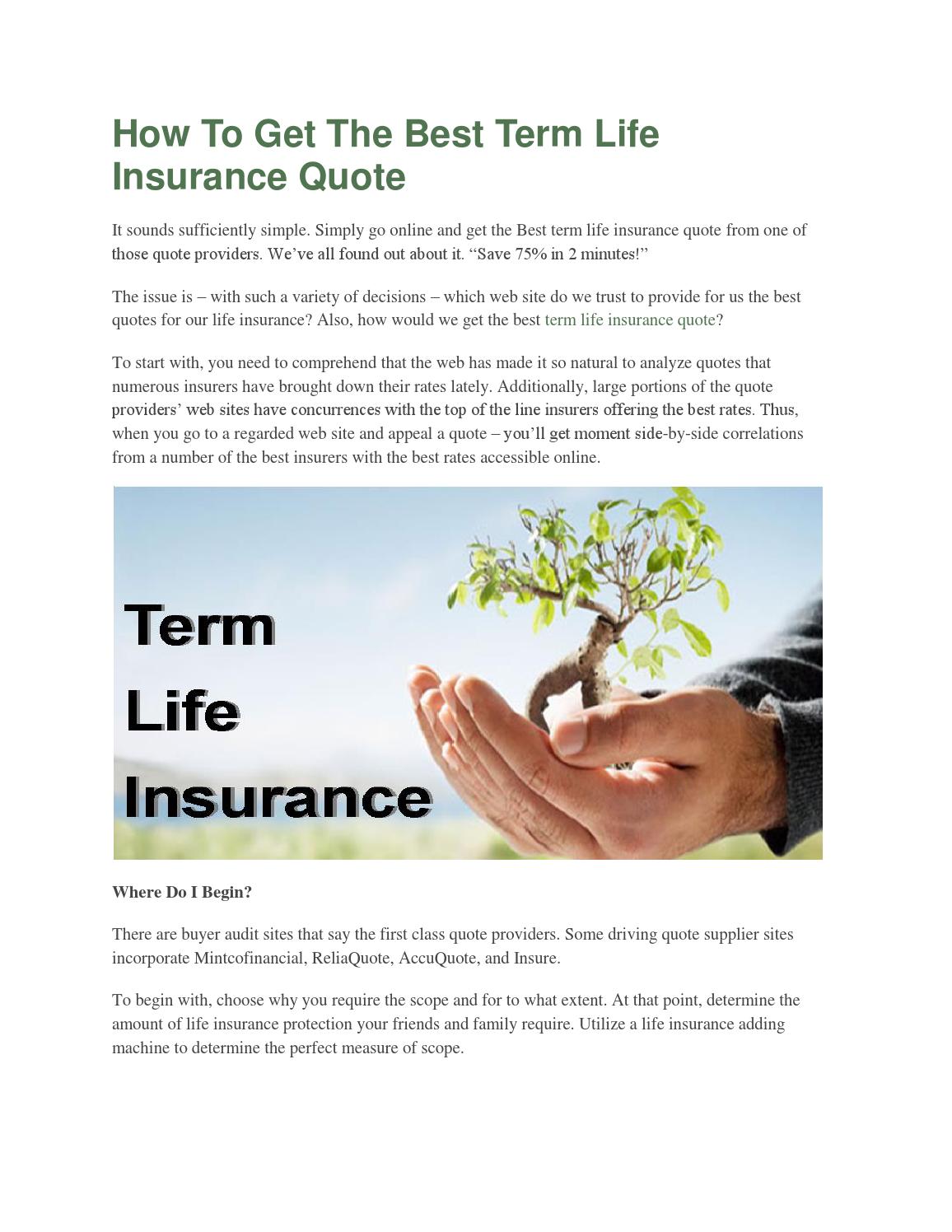

The best way to save money is to comparison shop and get life insurance quotes from multiple companies. This is because rates vary between companies.

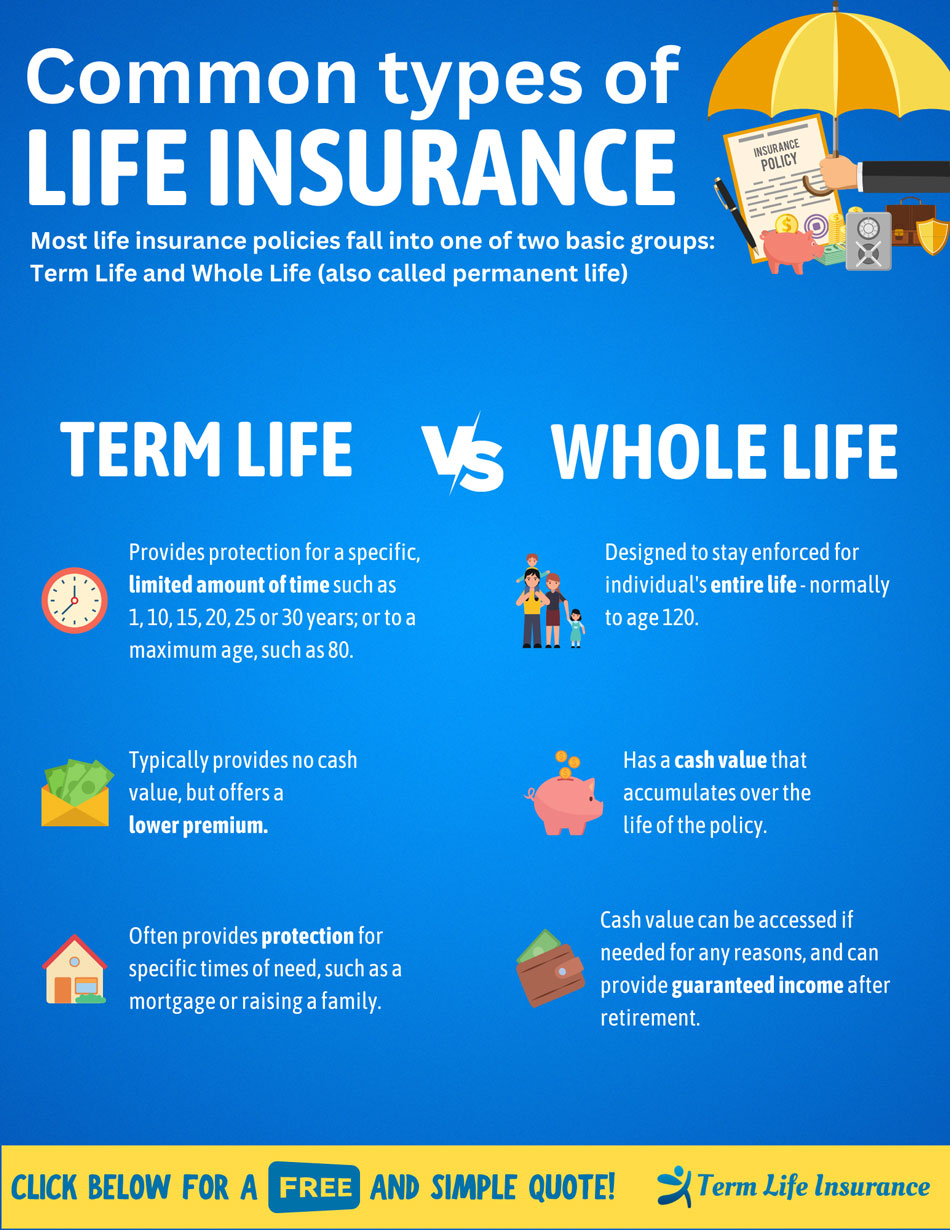

The first step in shopping for life insurance quotes is usually deciding what type of policy you want (such as term life or whole life).

Term life insurance is purchased for a specific period of time, such as 5, 10, 20 or 30 years. This is good for people who have specific financial obligations to cover, such as the years of a mortgage or the years until children graduate from college.

Free Life Insurance Quotes

Whole life insurance can provide a payout no matter when you die. It is good for those whose family always needs financial support.

Universal life insurance sometimes offers the flexibility to vary premiums and the death benefit. Coverage usually lasts until a certain age, such as 100.

Term life insurance is usually the cheapest way to buy life insurance because it only lasts for a set period of time and does not build cash value. (This means you can’t withdraw money from the policy, like you can with whole life insurance.)

Let’s say you’re 30 years old, healthy, and looking for a $500,000 life policy for 20 years. The average cost is about $300 a year for a man and about $260 for a woman.

Life Insurance Rates By Age

Methodology: We averaged the three cheapest rates we found online for term life. Rates are for men and women of average height and weight, non-smokers, with normal blood pressure, in good health, with no DUIs or tickets on their driving records. Your own rates will vary.

Methodology: We calculated average quote increases for 20-year life insurance policies for $500,000, $1 million and $2 million in coverage. The rates are for men and women of average height and weight in good health. For high blood pressure we used a reading of 141/91.

Many life insurance companies are competing for your business. Check out our list of life insurance companies, or read our life insurance company reviews below.

All life insurance quotes will be free and you can request quotes from as many companies as you want. You can get quotes from agents who work for specific companies, or use an independent agent to shop for rates between multiple insurers.

Types Of Life Insurance

Can connect you with agents who can provide you with pricing and personal service by answering any questions you may have.

When you get a life insurance quote, the agent will ask you a variety of questions. The goal is to give you the most accurate quote possible based on your answers, so it’s best to provide the correct information.

Expect to be asked questions about your current health, the health of immediate family such as parents and siblings, the prescription medications you take, employment, hobbies, driving record, whether you have current life insurance and who your beneficiary.

Once you get life insurance quotes and choose a company, it’s good to know what to expect. The life insurance application process can take several weeks, depending on the type of policy and company. But it is worth waiting to get life insurance.

Life Insurance Coverage For You And Your Family

Once you decide to submit an application, it goes to “underwriting”. During this time, the life insurance company collects information about you, confirms the answers you gave on the application, may request medical records from your doctor and prepare a final quote.

Once the insurer has checked all the data about you, it will give you a final life insurance quote. If you are happy with it, you will accept the policy and know that your family has a good financial safety net.

3 Types of Insurance You Didn’t Know You Needed Life Insurance Coverage for You and Your Family 6 Things You May Not Know Will Increase the Cost of Your Insurance What is Flood Insurance? Is Your Hurricane Car Insurance Ready? Term Life Insurance Provides Coverage for a Specific Period of Time, known as the term. If the policyholder dies during the term, the death benefit is paid to the beneficiary. If the policyholder does not die during the term, the policy will lapse and no death benefit will be paid. Term life insurance is usually the most affordable type of life insurance, because it has no savings or investment component and premiums are usually lower than other types of life insurance.

Whole life insurance, on the other hand, is a type of permanent life insurance that provides coverage for the entire life of the policyholder. Unlike term life insurance, whole life insurance remains in effect as long as the policyholder continues to pay premiums. This type of insurance also has a savings or investment component, known as the cash value, which accumulates over time and is accessible to the policyholder. Whole life insurance is usually more expensive than term life insurance, but it offers lifetime protection and the potential for cash value growth.

Term Vs. Universal Life Insurance: What’s The Difference?

When choosing a life insurance policy, it is important to consider your personal circumstances and financial goals. You should also compare quotes from multiple insurance companies and consider working with an insurance broker to help you find the right policy for your needs.

Overall, life insurance is an important tool to protect your loved ones and ensure their financial security in the event of your death. Don’t put off buying a policy – start today to compare quotes and explore your options.

A tip for buying whole life insurance is to carefully consider your long-term goals and financial needs. Because whole life insurance provides coverage for the entire life of the policyholder and has a savings or investment component, it can be a useful tool for building financial security and wealth over the long term.

Before purchasing a whole life insurance policy, it is important to think about your future financial needs and how a whole life policy can help you meet those needs. For example, you may want to use the cash value of your policy to supplement your retirement income, pay for your children’s education or leave a legacy for your loved ones.

Whole Life Insurance: What It Is & How To Buy

The Ultimate Guide to Stainless Steel Vacuum Insulated Tumblers Tired of your morning coffee getting too cold or your iced tea getting lukewarm on a hot day? If so, it’s time to invest in…

Make your stylish home a priority: sweet floral decor and upscaling your closet In our fast-paced lives, it’s easy to overlook the sanctuary that is our home. This is where we relax, rest and express our personality…

10 Seconds That Ended My 20-Year Marriage August in Northern Virginia, hot and humid. I haven’t showered since my morning ride. I wear my stay at home mom…

The ChatGPT hype is over — Now see how Google is going to kill ChatGPT. It doesn’t happen right away. The business game is longer than you know.

Term Life Insurance Quote By Dynamic Dreamz

Five. Road. million. Dollars. The year was 2008, about a year after Twitter was officially founded. It is a Monday. I woke up in our little place in Berkeley and, to…

Thoughts on Israel and GazaIt’s been 17 days since Hamas launched its horrific attack against Israel, killing more than 1,400 Israeli citizens, including defenseless… Our new website makes it easy, affordable to get affordable life insurance and dare to say it’s fun? Term life insurance helps people who are married and/or have children because it provides affordable financial protection to your loved ones, just in case.

Get free quotes and securely apply online for term life insurance from an A+ rated insurance company with great rates and over $500 billion in life insurance in force.

Banner Life Insurance is a 65-year-old company with $587 billion in life insurance in effect. Banner has excellent rates and ranks third among all US companies for new coverage provided.

Guaranteed Surrender Value Tata Short Term Life Insurance, Age Limit: 75 Year, 10 Year To 65 Year

Term life insurance is cheaper than permanent life insurance. Since costs go up as you get older, you want to get as fixed a term as possible. We provide 10, 15, 20 and 30 year level life insurance policies with options for every need and budget.

People often wonder how much life insurance they need. A rule of thumb is to have a policy that pays at least 6 to 8 times your pre-tax income. However, if you want to pay for a child’s college or have other needs to provide for, be sure to factor that in as well. How to Get Multiple Sclerosis Life Insurance [2023] Understand how to get multiple sclerosis (MS) term life insurance. it has its challenges. But MS is alive

Affordable term life insurance quotes, aaa term life insurance quotes, online term life insurance quotes, term life insurance free quotes, whole term life insurance quotes, get term life insurance quotes, cheap term life insurance quotes, best term life insurance quotes, life insurance term quotes, term life insurance rate quotes, instant term life insurance quotes, full term life insurance quotes