Universal Life Insurance – Laura McKay is the founder and COO of Canada’s fastest growing digital life insurance company. In 2021, she was named one of Bay Street Bull’s Women of the Year. Laura has a BA in Mathematics from the University of Waterloo. His degree focused on actuarial science, which included learning about mortality risk, the basis of life insurance pricing and valuation. After graduation, she was employed by Manulife and Munich Re in actuarial science. Laura then worked at the famous management consulting firm Oliver Wyman in New York from 2013 to 2018. In this capacity, she worked with several Fortune 500 life insurance companies and helped them develop growth strategies and resolve operational issues and regulatory issues.

Universal life insurance is a type of permanent life insurance that will cover you for your entire life as long as you continue to pay the premiums.

Contents

- Universal Life Insurance

- Why An Index Universal Life May Be What You Are Looking For?

- Auswaehlen Des Richtigen Beguenstigten Fuer Ihre Gruppe Universal Life Policy

- Group Universal Life Insurance, What Is It? (2023)

- The Power Of Overfunding Universal Life Insurance

- Universal Life Time Bomb…myth? • The Insurance Pro Blog

- Permanent Life Insurance: Universal Life Vs Whole Life Vs Term 100 [2023]

- Universal Life Insurance

- Do I Need Life Insurance?

- Difference Between Term, Universal And Whole Life Insurance [infographic]

- Term Vs Universal Life Insurance Comparison: A Kids’ Guide

- Universal Life Insurance: Insurance Products Overview 2023

- Whole Life Insurance Vs Universal Life: A Comparison

- Whole Life Vs. Universal Life Insurance: What’s The Difference?

- Gallery for Universal Life Insurance

- Related posts:

Universal Life Insurance

Part of what you pay goes to the life insurance itself, while another part is divided between savings and investment components.

Why An Index Universal Life May Be What You Are Looking For?

TikTok may have convinced you that universal life insurance is a good investment strategy and a “cheat code” for the rich, but that’s not always the case.

Universal life insurance is easy to customize. But you need to closely monitor your policies to ensure investments are being made and make adjustments as needed.

Your premiums may increase if the investments continue to underperform. It could mean you can’t pay your policy and it lapses.

The value portion of your policy may increase or suffer losses as the investment portion changes.

Auswaehlen Des Richtigen Beguenstigten Fuer Ihre Gruppe Universal Life Policy

This part of the cash value is often what attracts people to universal life insurance, as they may know enough to realize that you can take money out of the policy by withdrawing or borrowing money.

You’ll need to keep a close eye on your policy to make sure you’re paying the right premiums and that your cash value doesn’t drop. If this happens, you may lose the policy.

A universal life policy isn’t worth it for most Canadians. While universal life is supposed to provide financial protection for your family

The investment portion of universal life is not known for having great returns, and certainly not as good as using tax-advantaged accounts like RRSPs and TFSAs that have investments.

Group Universal Life Insurance, What Is It? (2023)

“Most Canadians should not invest in universal life insurance, at least not until they have maximized other investment options. Also, the complexity of these types of policies makes it difficult to ensure that their investment strategy will work over time.

Most Canadians are better off with a simple type of life insurance. This is where term life insurance comes into play.

Term life insurance covers you for a specified period of time, usually between 10 and 30 years. This gives you protection at a lower cost, without all the unnecessary bells and whistles of a universal policy.

The idea is that you will have more flexibility to choose how much your premiums will be within a specific range set by the insurer.

The Power Of Overfunding Universal Life Insurance

This range will always cover the cost of insurance, also known as a death benefit, and the cost of providing the service to you through administration fees.

The extra amount is added to your cash value if you pay more than the minimum down payment.

This cash value can grow over time, but it’s important to remember that any numbers projected for you for growth are only predictions, not guarantees.

This type of coverage usually offers flexible premiums that allow you to monitor and adjust the amount you pay. They also offer the opportunity to access the cash value of the policy.

Universal Life Time Bomb…myth? • The Insurance Pro Blog

Universal life insurance is a type of permanent insurance, which means it is designed to last your entire life. It will not expire as long as you continue to pay your premiums.

These policies usually guarantee a rate up to a certain age. You may have to pay a significant amount to keep the policy in force if you happen to live past that age.

If your policy lapses due to non-payment, you will have to start over with a new policy later in life, which can be expensive, making it better to get a senior life insurance policy in Canada.

“Universal life insurance is for those who want to be practical with their policy and their investments. It’s not a ‘set-it-and-forget-it’ type like term life insurance.”

Permanent Life Insurance: Universal Life Vs Whole Life Vs Term 100 [2023]

Universal life insurance tends to be expensive and complex to manage, so it’s not the best choice for most people who need affordable payments and a simple policy they can understand.

In addition, life insurance policies are less tax-exempt, making universal life insurance less attractive due to new Canadian tax rules from 2017.

The truth is that most Canadians need long-term life insurance, at least those who have dependents they rely on financially.

The most convenient premiums of the range means that you can save your money and invest the difference. Then, when the term ends, you can continue to invest without tying up your money in an expensive policy.

Universal Life Insurance

As a type of permanent insurance, your universal life insurance policy remains active as long as you pay your premiums.

You can usually make adjustments to your cover amount and premium payments over time, giving you flexibility as your lifestyle or income changes.

When you pay your premiums, some of the money goes into an account that represents the value of your policy and can earn interest over time.

As with most life insurance policies, the death benefit paid to your beneficiaries is tax-free. However, the interest earned on the value portion of your policy is tax-deductible, which can be an advantage in your situation.

Do I Need Life Insurance?

There are several types of universal life insurance, and these options give you some flexibility in choosing how to use the investment portion of your policy.

Universal life insurance is not an affordable option for most people. This can be very expensive, making it difficult for policyholders to keep up with payments to keep the policy active.

Term life insurance rates are among the most affordable in Canada; And life insurance for couples offers a 10% discount in the first year when they apply together.

Your insurer may limit your cash value return or how much you can invest based on tax laws, so ask about things like “participation fees” or contribution limits before you sign up.

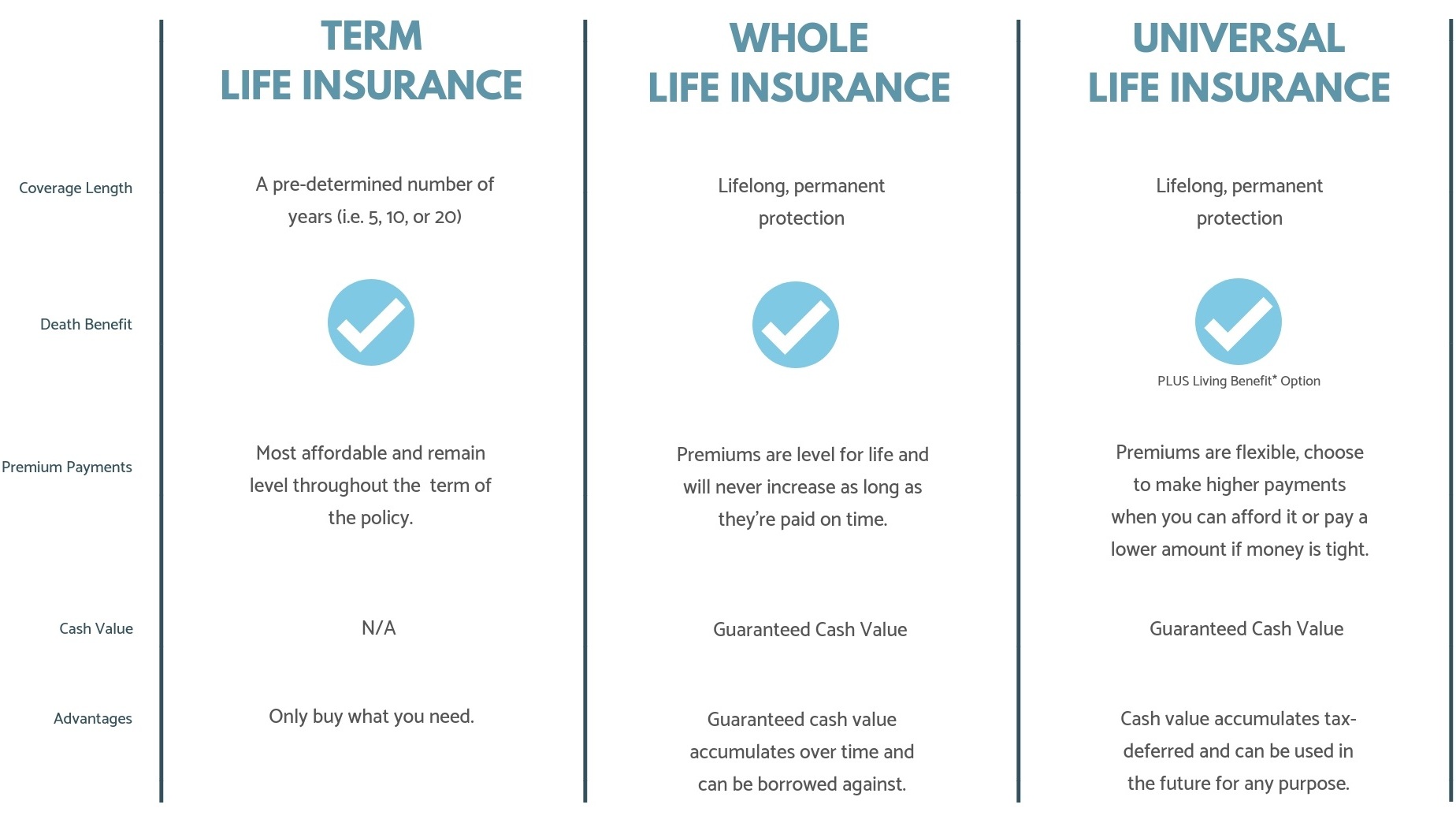

Difference Between Term, Universal And Whole Life Insurance [infographic]

There is no version of this policy. You’ll need to keep a close eye on your policy to make sure you’re paying the right premiums and that your cash value doesn’t drop. If this happens, you may lose the policy.

While the idea of an investment share is attractive, it is wise to take a close look at the interest rates you can earn. If you’re interested in investing for your financial future, you’re better off with a traditional investment account like a TFSA or RRSP.

Cash value is one of the features most people are familiar with when it comes to universal life insurance, but it takes time to build. It is wise to have a clear picture of how long it will take before you can ever withdraw or borrow from your life insurance in the event of an emergency.

These policies are often sold as flexible coverage that can be adjusted as your needs change over time. This may seem like a good thing, but be aware that increasing your coverage may require a health check, which could trigger higher premiums.

Term Vs Universal Life Insurance Comparison: A Kids’ Guide

If you are a high income earner who has exhausted your other investment options, you may consider universal life as an option. But with limited returns, it’s usually not a great investment.

There is real concern about how these policies were sold as investments. In most cases, customers simply did not understand how the policies worked and did not monitor them as needed.

In the worst cases, returns are exaggerated when policies are sold, leaving people with the impression that they have more security than they actually have.

As time goes by, premiums increase, policies are underfunded, and people suddenly can’t afford to keep active policies.

Universal Life Insurance: Insurance Products Overview 2023

There are several types of universal life insurance policies. Although they all offer lifetime coverage, there are differences in how they are structured.

These types of universal life insurance are often proprietary, so you may need to do some research to make sure you know exactly what type of policy you’re looking for.

This is sometimes called “guaranteed non-cancellation universal life insurance”. No cash value means you don’t have to worry about your policy lapsing because you don’t have enough cash value to pay the premiums.

Guaranteed universal life insurance can be offered as a way to get the lowest possible premium payment on universal life cover.

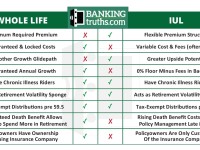

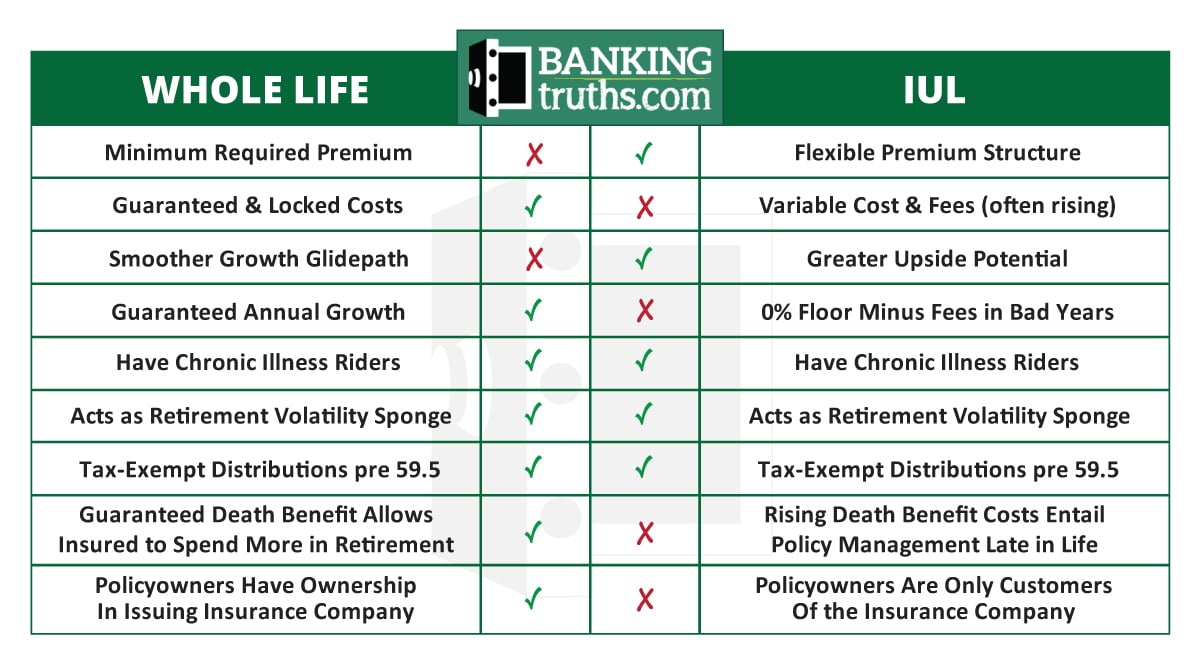

Whole Life Insurance Vs Universal Life: A Comparison

However, at this point, the policy looks more like a whole life policy, so it would be a better choice.

Even more noteworthy, if you remove the cash value component, this policy ends up being even closer to a life insurance policy.

Look into term life insurance instead if affordability is more important to you than the cash value component. Term life insurance covers you for as long as you need it at a price you can afford.

Note: Indexed universal life insurance in Canada is actually on the decline

Whole Life Vs. Universal Life Insurance: What’s The Difference?

Universal life insurance rates, nationwide universal life insurance, buy universal life insurance, guaranteed universal life insurance, universal term life insurance, prudential universal life insurance, cheapest universal life insurance, universal life insurance plan, universal whole life insurance, best universal life insurance, universal life insurance quotes, usaa universal life insurance