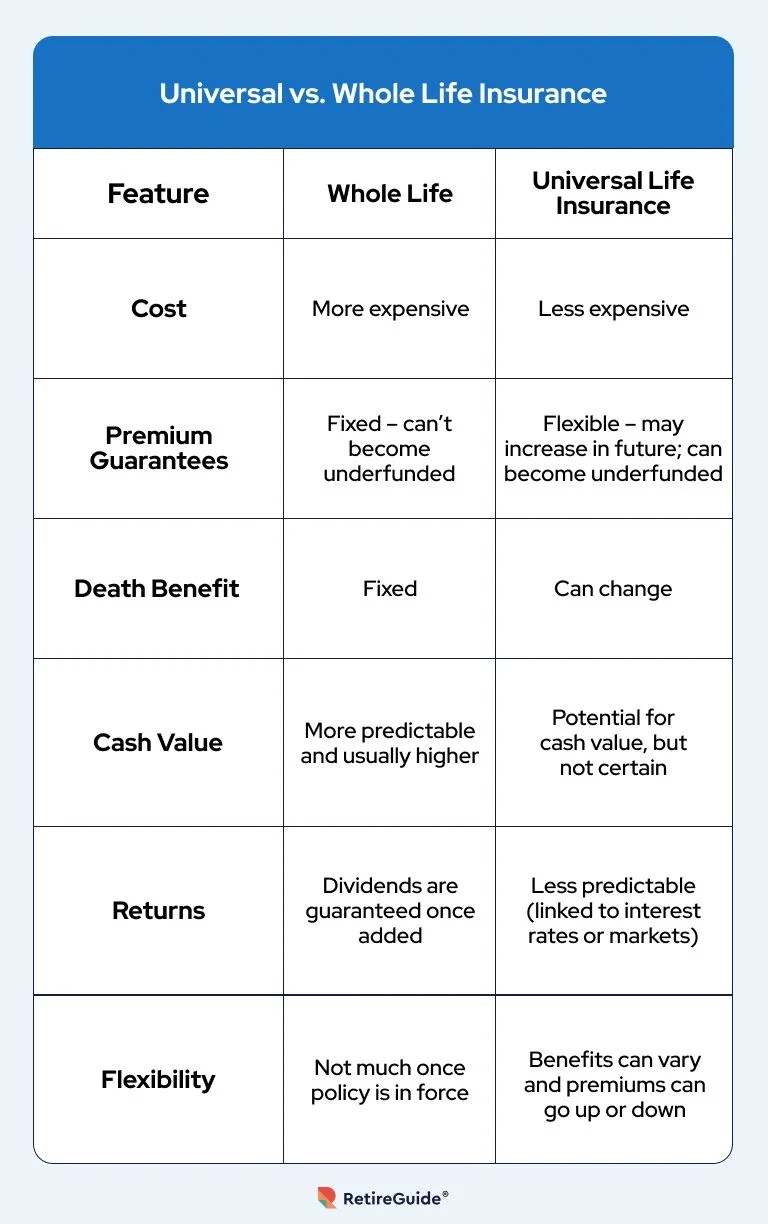

Whole Life Insurance – Although similar in some ways, there are some important differences between universal and whole life insurance policies. Universal Life (UL) insurance offers policyholders flexibility in premium payments, death benefits and the savings element of their policy. Whole life insurance, on the other hand, offers consistency in base premiums and guaranteed accumulation of cash value and death benefits.

These two types of life insurance both fall under the category of permanent life insurance. Unlike term life insurance, which guarantees death benefits for a specified period of time, a permanent policy provides lifetime coverage. When you cancel a permanent life policy, you will receive the cash value of the policy (any premiums).

Contents

- Whole Life Insurance

- Massmutual’s Flexible Whole Life Insurance Portfolio

- Whole Life Insurance

- Never Buy Whole Life Insurance.. Here’s Why.

- The Basic Elements That Define A Whole Life Insurance Policy

- Whole Life Insurance Vs. Variable Universal Life (vul) [risky Or Safe]

- Should I Buy Whole Life Insurance?

- Whole Life Insurance Or Term? A Definitive Guide.

- Whole Life Insurance And Estate Planning [2020 Guide]

- Gallery for Whole Life Insurance

- Related posts:

Whole Life Insurance

Both versions of life insurance typically consist of two parts: a savings or investment part and an insurance part. As a result, the premiums are higher than for term policies. Policymakers can also borrow from the cash value of the policy. For this reason, term life insurance is also called cash value life insurance.

Massmutual’s Flexible Whole Life Insurance Portfolio

Whole life insurance covers you for the rest of your life, no matter how long you live. As long as you continue to pay premiums, your benefit will become a death benefit if you die. This policy is ideal for long-term obligations, such as caring for an older child or post-death expenses such as inheritance taxes.

A feature of whole life insurance is that it combines coverage with savings. Your insurance company deposits part of your premium payments into a high-yield bank account or investment account. Your cash value increases with each premium payment. This savings element of your policy accumulates your cash value on a tax-deferred basis.

Whole life insurance is designed to meet a person’s long-term goals, and it is important that it lasts throughout your life.

To borrow against a whole life policy, you must meet the minimum cash value requirements since you cannot borrow against the value of the policy.

Whole Life Insurance

An interesting feature of life insurance is the guaranteed cash value. That’s because you can borrow against it, or give the policy a cash value – which offers some financial flexibility in the event of an emergency.

Some life policies also pay dividends, even though they are not guaranteed. If you accept them, you can have them paid out each year, allow them to accumulate interest, or use them to reduce policy premiums or purchase additional coverage.

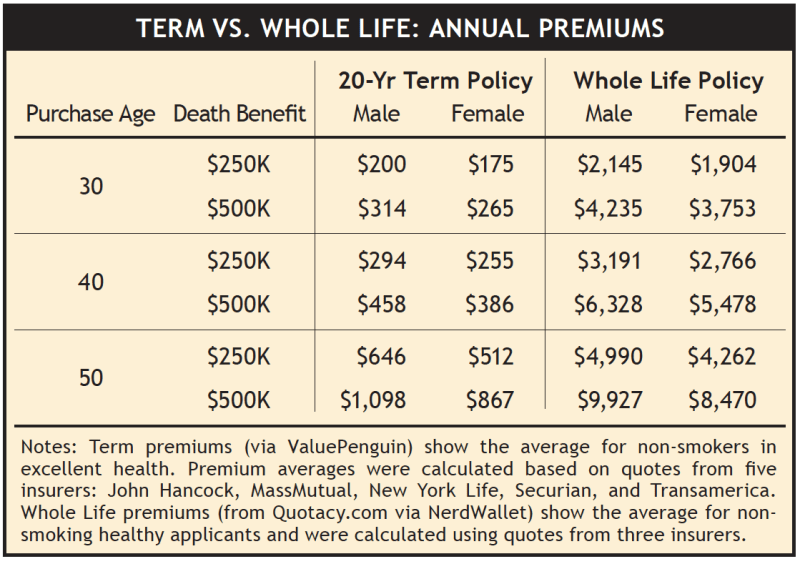

But flat premiums, death benefits and attractive life insurance (such as loans and dividends) make these types of policies quite expensive, especially compared to term life insurance. It is recommended to purchase whole life insurance at a young age so that you can give for a longer period of time.

Whole life insurance is also called adjustable life insurance. Reduce or increase your death benefit and adjust your premiums (within certain limits) if there is money in the account.

Never Buy Whole Life Insurance.. Here’s Why.

When you pay for universal life insurance, part of it goes into an investment account and the accrued interest is deposited into your account. The interest you earn grows tax-deferred, increasing the value of your money.

You can adjust the death benefit if necessary, increase it if your circumstances change (often a medical check-up) or reduce the premiums. Alternatively, you can use your cash value to pay premiums if you have enough money in that account.

The ability to adjust the cost of your coverage without giving up your policy is a feature of universal life coverage. If your financial circumstances or responsibilities change, you can increase, decrease or even stop premium payments.

Another option is to get a partial payment or a loan. However, you need to watch your withdrawals as they reduce the cash value. Withdrawing too much may leave you with less when you need it. If your premiums do not cover the cost of the insurance and you have no cash value, your policy may be voided.

The Basic Elements That Define A Whole Life Insurance Policy

Another aspect of whole life insurance is the interest rate, which often depends on market conditions. If the policy performs well, there is potential growth in your savings fund. On the other hand, if it performs poorly, the predicted profits will not be realized – and this can increase your premiums.

Another negative feature: cost. As with all permanent life insurance policies, surrender charges may apply when terminating the policy or withdrawing funds from the account, especially in the early years.

Before you cancel your premium, discuss the status of your cash value fund with your insurance advisor or broker. If you stop paying premiums and the cash value is insufficient to cover the cost of the insurance, your policy may lapse.

With a whole life, you pay higher premiums for the guarantees you provide. An equivalent universal life policy would cost less, but would also entail some risk for policymakers.

Whole Life Insurance Vs. Variable Universal Life (vul) [risky Or Safe]

The right life insurance policy for you depends on your family structure and financial situation, as well as your risk appetite and flexibility. In addition to universal life and whole life, you can also look at other types of life insurance, such as term life insurance, group insurance and more.

Regardless of which policy you choose, compare the companies you are considering to ensure you get the best life insurance policy or the best universal life insurance policy.

Term life insurance is an inexpensive option that offers a death benefit for a certain number of years (term), such as 10 or 20 years. A term policy, unlike whole or universal life, does not accumulate cash value. Terminal life is often the cheapest option.

Indexed universal life (IUL) is a variant of universal life (UL) in which the cash component of the policy is tied to the performance of a stock market index such as the S&P 500. It is up to the policyholder to decide how much cash value is determined. a fixed-income account or a stock-indexed account.

Should I Buy Whole Life Insurance?

Above this the ceiling applies, the policy does not credit the account, for example 12% per year. So even if the S&P 500 rises 20% in a given year, the policy only returns 12%. If the index falls, returns may be lower, although there are bottoms to prevent major losses.

If a universal life policy is fully funded and premiums are paid on time, the UL policy remains in effect forever until the person dies.

Depending on the insurance company and the terms of the term policy, you may be able to convert it to permanent coverage without the need for a new medical exam. Higher premiums apply to the new life-course policy, depending on your age at the time of conversion.

Universal Life (UL) and Whole Life are two types of permanent life insurance. Their differences include that universal life insurance offers flexible premiums and death benefits, but fewer guarantees, while whole life insurance offers predetermined premiums and guaranteed cash value.

Whole Life Insurance Or Term? A Definitive Guide.

You can get cash value with both types of life insurance. Keep in mind that a whole life policy usually has higher premiums than an equivalent UL policy.

Requires writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. If necessary, we also refer to original research from other reputable publishers. You can find out more about the standards we use to produce accurate, consistent content in our editorial policy.

By clicking the “Accept All Cookies” button, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Life insurance policies, because of their unique features, include consistent, equal premiums for life, the ability to accumulate cash value, and life insurance benefits. Some life insurance policies are particularly unique because, in addition to creating cash value, they also provide dividends to the policyholder. This option is only offered through mutual life insurers. These companies are not owned by shareholders or private equity firms, but by political owners. Let’s explore the key features and find out if a life insurance policy is right for you.

Whole life insurance is permanent life insurance. Even once the premiums have been paid, this applies to your entire life. Whether you die after purchasing the coverage or after 50 years, your beneficiaries will receive the benefit.

Whole Life Insurance And Estate Planning [2020 Guide]

In addition to regular premiums, your policy can also build cash value in the form of dividends over time. Mutual life insurance companies, such as MassMutual, offered through United Benefits, operate for the benefit of participating policyholders and members and are managed with the policyholders’ long-term interests in mind. Policyholders are entitled to an equal share of the company’s surplus, the so-called surplus, which is paid out annually as dividend. Dividends are not guaranteed;

Permanent whole life insurance, whole life insurance options, cheapest whole life insurance, buy whole life insurance, whole life insurance online, whole life insurance plan, whole life insurance plans, top whole life insurance, whole life insurance quotes, cheap whole life insurance, senior whole life insurance, find whole life insurance