Affordable Medical Insurance – How to find the best health insurance plan for you and your family: Shots – Health News The open enrollment period to buy health insurance on HealthCare.gov starts now and runs through January 15, 2022. Look for more options and expanded grants this year and more help registering.

If you’re buying health insurance outside of an employment-based plan, you’re in luck this fall. After years of cuts to the Affordable Care Act under the Trump administration and, some say subversively, the Biden administration is pulling out all the stops to help people find better health plans on HealthCare.gov , the open enrollment period begins this week. You’ll have more time to sign up, more free help choosing a plan, and more likely to receive subsidies to help lower the cost of a health plan you buy through the ACA Marketplace.

Contents

- Affordable Medical Insurance

- Short Term Insurance

- How To Choose Affordable Medical Insurance Policy?

- Health Insurance Coverage In The United States

- Life Vs. Health Insurance: Choosing What To Buy

- Will My Health Insurance Premiums Go Up If I Have A Claim?

- Individual Health Insurance Plans & Quotes California

- Best No Exam Life Insurance Companies (2024)

- Gallery for Affordable Medical Insurance

- Related posts:

Affordable Medical Insurance

Still, choosing health insurance can be a daunting task, even if you choose a plan through your employer. There are a lot of confusing terms and the process forces you to think a lot about your health and finances. Plus, you have to navigate everything on a deadline with only a few weeks to explore your options and make decisions.

Short Term Insurance

Whether you’re aging out of your parents’ plan and choosing one for the first time, you’re on a plan that’s no longer working for you and you’re ready to switch things up, or you’re uninsured and want to see if there are viable options, there is good news. Asking yourself a few simple questions will help you zero in on the right plan from everyone else on the market.

Here are some tips on where to look and how to get reliable advice and help if you need it.

It’s not always clear where to look for health insurance. “It’s a real quilt of options in this country,” says Sabrina Corlette, who co-directs the Center for Health Insurance Reform at Georgetown University.

If you are 65 or older, you are eligible for Medicare. It’s a federally administered program—the government pays for most of your health care. You may be eligible if you have certain disabilities. For those already enrolled in a Medicare or Medicare Advantage plan, the open enrollment period to change your supplemental health and drug plans for 2022 extends through December 7 of this year.

How To Choose Affordable Medical Insurance Policy?

For those under 65, Corlett says, “Most of us get our coverage through our employer. Employers typically cover 70% to 90% of your premium cost, which is a lot” . Check with your supervisor or your company’s human resources department to find out what plans are available to you through your job.

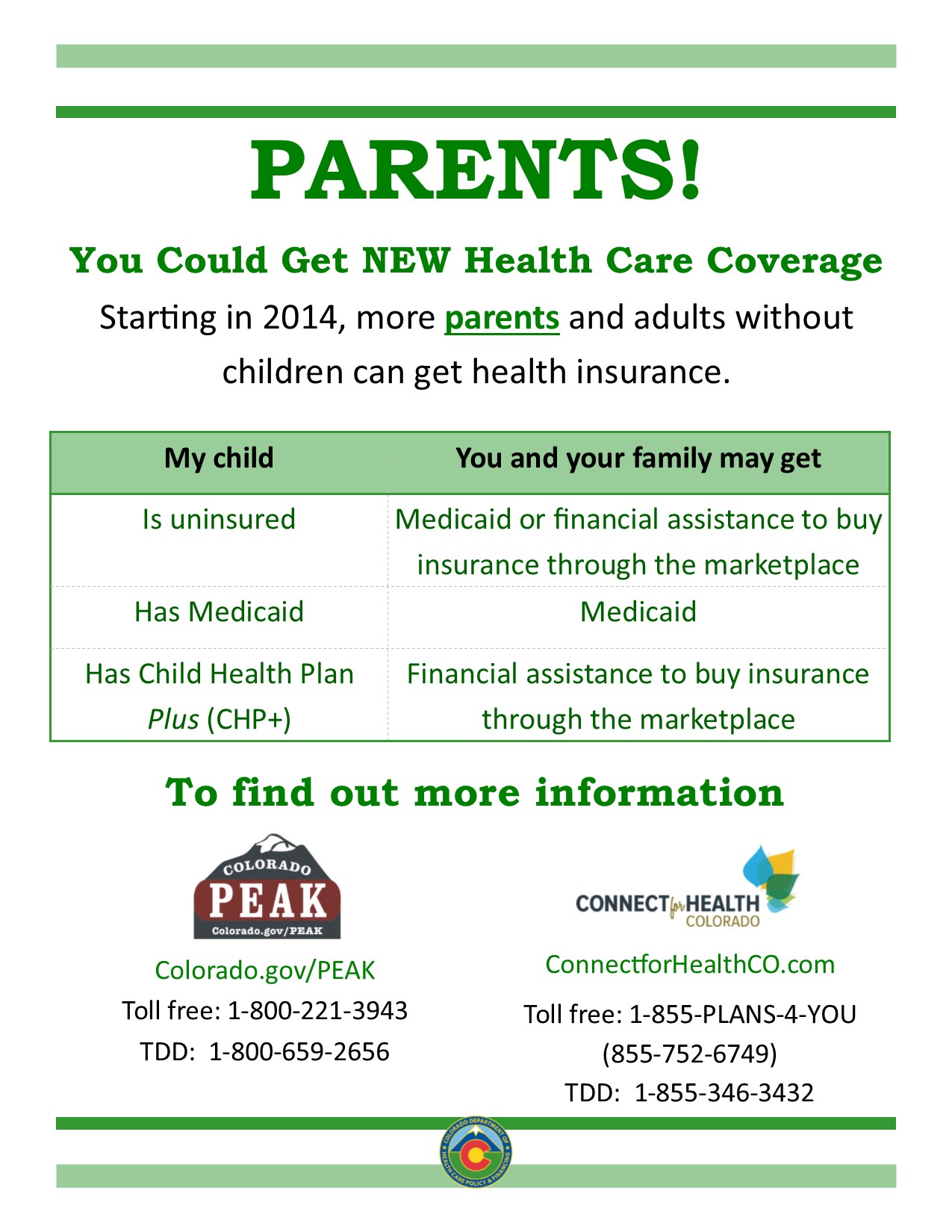

Then there’s Medicaid, the health insurance program for low-income people, which covers about 80 million people, about one in four Americans. It’s funded by the federal and state governments, but administered by each state, so what you’re eligible for depends on where you live.

For pretty much everyone, the place to go is Healthcare.gov, where you can buy insurance in the marketplaces created by the Affordable Care Act, also known as Obamacare.

Here’s where to look for health insurance if you don’t fit into any of the categories we mentioned above, Corlette says, for example, “If your employer doesn’t offer you coverage, you can’t get Medicare because you’re not ‘old enough,’ and you are not poor enough for Medicaid. You can go to the markets, depending on your income.” One can apply for help and choose a scheme.”

Health Insurance Coverage In The United States

If you’re basically healthy and have one or two plan options to choose from through your work, the choice is pretty simple. You can ask your coworkers what they like, sign up through an online benefits portal, and call it a day.

If you’re shopping in the Affordable Care Act marketplaces, the number of options can seem overwhelming at first. In Austin, Texas, “we have 76 projects to review with clients,” says Aaron DeLao, director of health initiatives with Foundation Communities.

Even with so many options, you can narrow things down with a few basic questions, says DeLaO. First, ask yourself, “Do you want insurance for that catastrophic event that could happen, or do you know you now have a health problem and need ongoing care?”

If you’re healthy enough, any number of different plans can work. But if you or your spouse or a dependent family member have specific health needs (such as an underlying medical condition or plan to undergo fertility treatments in 2022, or need to see a specific medical specialist), this information can be very useful to help him. narrow down the field for your best health insurance option. “If there’s a plan that doesn’t have your provider or your drugs in the network, they can be removed,” he says.

Life Vs. Health Insurance: Choosing What To Buy

Sometimes you can enter your drugs or doctor’s name when you search for plans online to filter out plans that don’t cover them. You can call the insurance company and ask: Is my provider in network for this plan I’m considering? Is my drug on the plan’s formulary (the list of drugs covered by the insurance plan)?

There are two main types of plans to consider. “You might choose between what’s called an HMO or a PPO,” says Corlett. A health maintenance organization has a strict network of providers: if you see an out-of-network provider, the costs are on you. A preferred provider organization “gives you a pretty broad selection of providers — it might be a little more expensive to look at than an out-of-network provider, but they’ll still cover some of the cost,” he explains.

How much can you pay for health insurance each month? To compare the true overall cost of health plans and find out which one works best in your budget, you need to familiarize yourself with several important insurance terms, such as premium, cost sharing, deductibles, and copayments.

Insurance companies use these different types of charges (premiums versus deductibles, for example) as markups to manage their own costs. The basic plan they sell may mark up the monthly premium of a given plan, making it appear cheaper. But that same plan may have a higher “mark-up” deductible of $6,000, meaning you’ll have to spend $6,000 out-of-pocket each year on health care services before your insurance starts paying its share. of cost If you choose this plan, you bet you won’t have to use many health care services and will only have to worry about your premiums, which are hopefully affordable, and the costs of a few appointments.

Will My Health Insurance Premiums Go Up If I Have A Claim?

Shots – Health News Health Insurance for $10 or less a month? You can opt for new discounts

If you have a chronic medical condition or are simply too risk-averse, you can opt for a plan with a marked premium amount. You’ll pay a little more each month than with other plans, but your costs will be more predictable: you’ll have a lower deductible and a lower coinsurance rate. That way, you can go to a lot of appointments and pick up a lot of prescriptions and still have manageable monthly expenses.

The plans available and affordable to you will vary greatly depending on where you live, your income and who is in your household, and your insurance policy. With the pandemic, Congress has approved new temporary funding to cover more out-of-pocket costs for individuals; depending on your income, you can qualify for plans with premiums of $10 or less per month at HealthCare.gov or your state’s ACA insurance exchange. .

Still feeling overwhelmed with all the ACA options? You’re lucky. Free, impartial professional help is available to help you choose and enroll in a plan. Enter your zip code at healthcare.gov/localhelp and search for a “helper” — a person also known as a health care navigator on some state websites.

Individual Health Insurance Plans & Quotes California

Aaron DeLao is one of those navigators, and he and his fellow navigators don’t work for commission: they’re paid by the government. “We are not tied up with insurance agencies,” he says. “We do it completely autonomously, unbiased. It’s about what’s best for the customer.”

By 2021, the Biden administration quadrupled the number of sailors ahead of open enrollment. (Funding for the program has been cut dramatically by the Trump administration.)

Insurance brokers can also be helpful, says Corlette. “Brokers get commissions, but in my experience, the best brokers want repeat customers, and that’s happy customers,” he says. To find a good broker, he advises, “find someone licensed and in good standing through Healthcare.gov or your local state insurance department.”

It could be the internet

Best No Exam Life Insurance Companies (2024)

Affordable medical insurance nj, affordable medical health insurance, affordable medical insurance quote, affordable medical travel insurance, affordable short term medical insurance, best affordable medical insurance, affordable care act medical insurance, affordable medical, affordable medical insurance for seniors, affordable medical insurance health plans, medical insurance affordable, affordable medical and dental insurance