Buy Whole Life Insurance Online – Navigating the world of life insurance can be daunting because there are so many different options to consider. Whole life insurance, a type of permanent cover, offers the benefit of a fixed value, premium component and dividend potential.

These reviewers are industry leaders and professional writers who regularly contribute to popular publications such as the Wall Street Journal and The New York Times.

Contents

- Buy Whole Life Insurance Online

- Life Insurance For Young Adults: 8 Reasons To Invest In Your 20s

- Whole Life Insurance: Understanding The Cash Value Component

- Non Participating Whole Life Insurance

- Whole Life Insurance: Lifetime Protection And Long Term Benefits

- Unlocking Life Insurance Consulting Power With Blue Chip Macro

- How Much Should Life Insurance Cost? See The Breakdown By Age, Term And Policy Size

- Infinite Banking Life Insurance: What Is It & Can You Make Money?

- Term Vs. Whole Life Insurance: How To Know Which One You Need

- Related posts:

Buy Whole Life Insurance Online

Our expert reviewers review our articles and recommend changes to ensure we maintain our high standards of accuracy and professionalism.

Life Insurance For Young Adults: 8 Reasons To Invest In Your 20s

Our professional reviewers hold advanced degrees and certifications and have years of experience in personal finance, retirement planning and investing.

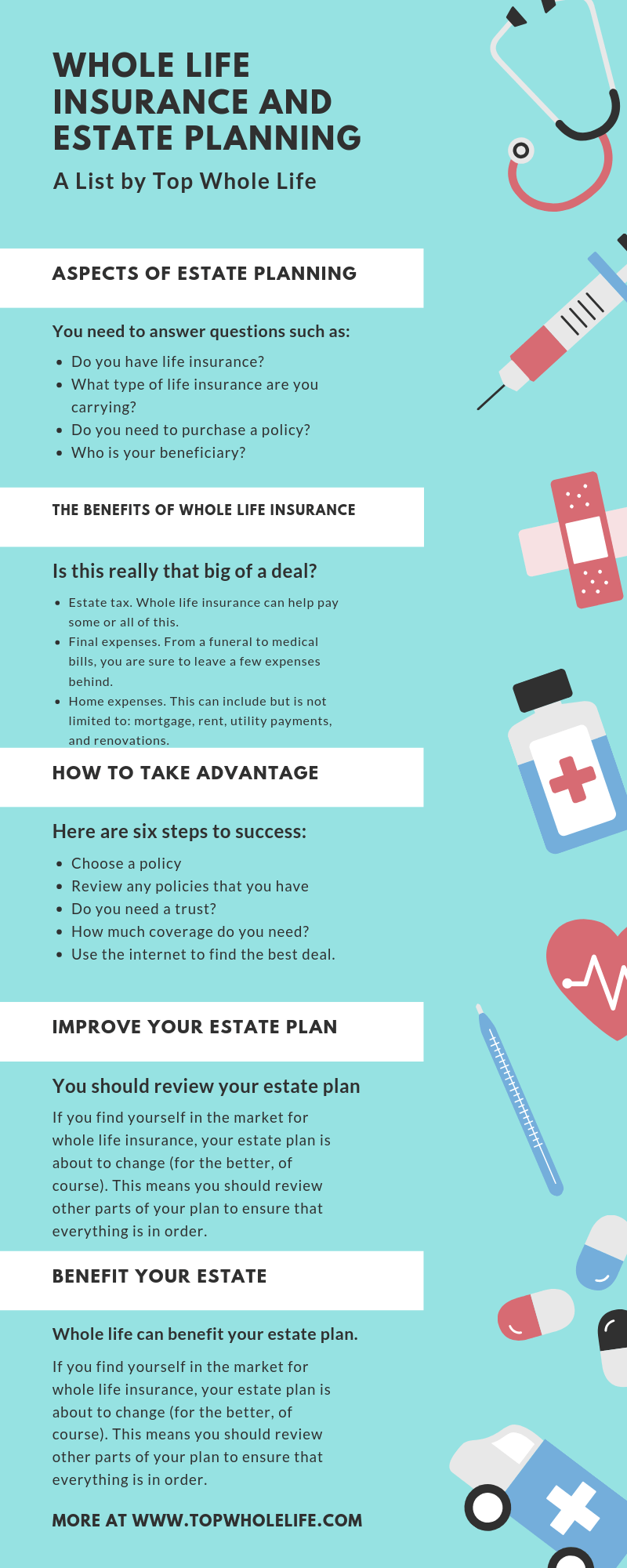

There are many reasons to get life insurance – both personal and business. However, for most people, the main purpose is to protect other individuals or groups from financial loss in the event of death.

When looking for the type of coverage to buy, there are two main categories that life languages fall into.

Life insurance is considered the most important type of life insurance on the market. It consists of pure death protection with no premium or investment component. This is why life insurance is usually the cheapest type of life insurance – especially for those who are young and in good health, even if there are no life insurance policies with a medical exam if needed.

Whole Life Insurance: Understanding The Cash Value Component

Permanent life insurance policies have two components – death benefit plus cash value sharing. These types of policies provide an insurance component that pays a certain amount of income if the insured dies. It also offers a premium feature that accumulates cash that the user can use for withdrawals or loans.

Guaranteed for the “whole” life of the insured or until the beneficiary pays, the whole life is considered a permanent life insurance plan. This is the simplest permanent life insurance package that is frequently purchased by consumers.

One of the reasons why planners look at whole life insurance plans is that the premium does not change over the life of the policy. Although premiums for whole life insurance may be higher initially, unlike fixed-amount policies, premiums do not increase as policyholders age. The cover may also be generally referred to as general life or direct life insurance.

All life insurance consists of two basic parts. These include a death benefit and a cash value component. The death benefit may be a fixed amount, or it may increase over time. (Increasing the amount of money at death can cause the value of the money to increase).

Non Participating Whole Life Insurance

The cost component will usually consist of two different components. One is the actual cash, which accrues at a fixed rate over the life of the policy.

At first, the value of the policy is growing slowly. This is due to the fact that most of the initial costs cover commission and other fees. However, over time, the premiums of a whole life insurance policy will continue to grow – in most cases based on a lower guaranteed return.

As it continues to grow, this portion of the cash value will eventually “prevent” or equal the amount of the death benefit when the policy matures. This usually happens when the insured reaches 100 years of age.

In some cases, the policy may also offer a non-guaranteed premium component that includes policy dividends or excess interest. Combining some general cash value with non-guaranteed cash value accumulation can increase the value of the policy over time.

Whole Life Insurance: Lifetime Protection And Long Term Benefits

The cash value of a life insurance policy can usually be accessed by the policy holder at any time through a deductible or insurance policy. Loan repayment is optional. However, any portion of the loan that remains unpaid at the time of the death of the insured will reduce the death benefit that the beneficiary receives from the policy.

An entry policy will share the profits of the insurance company with its policyholders. This is often done by providing a dividend. No tax will be paid to the policy holders, as they are treated as a return of a portion of the policy value.

In the case of a no-pass policy, the insurance company assumes all the risk of future employment. In other words, if the insurer’s actuaries underestimate the cost of future claims, the obligation will move to the insurance company to correct the difference. In the event that there is an estimate of the insurer’s future costs for the insurance benefits, the insurance company can keep this difference. Non-participating policies do not pay interest to their policyholders.

First, although premiums may initially start higher than the premium rate for certain amounts of coverage, the premium rate remains at the whole-life level throughout the life of the policy. This makes it easier to plan goals in the long run.

Unlocking Life Insurance Consulting Power With Blue Chip Macro

Whole life insurance also offers a minimum guaranteed payout in the event of death. Since those with whole life insurance do not have to requalify, they can count on a certain amount in the event of death for their survivors with an unchanged rate.

Of course, an added benefit is that they create value. This savings component allows planners to build cash value on a tax-deferred basis. In addition, the policyholder can cancel or surrender the entire life policy at any time and receive the accumulated premium.

If the insured has a fully participating life insurance policy, he is entitled to a dividend. These dividends offer many benefits, including higher premiums or higher death benefits.

Whole life policies also allow for more retirement assets. For example, policyholders can convert their premiums into a fixed annuity and use the income for retirement, or they can withdraw the premiums and use them for an emergency or other fund.

How Much Should Life Insurance Cost? See The Breakdown By Age, Term And Policy Size

Most life insurance plans are whole life insurance policies. where payments will continue until the insured reaches 100 years of age or dies. Direct life can also be called pure or whole life.

As the name of the policy suggests, all policies must be paid according to the specified time schedule. For example, a 10-payment plan will set the value so that the policy will be paid off in full after 10 years. Then the policyholder will not owe any more premiums. These policies are designed for those who want permanent life insurance protection throughout their lives, but don’t want to pay forever.

These types of policies will also have higher premiums. This is because each cash out is higher than the amount on the direct life insurance plan. Therefore, the cash portion of a defined benefit whole life policy will also typically accumulate more quickly than that of a direct life policy. A defined benefit policy will also be subsidized if the insured reaches 100 years of age.

The whole life annuity is considered “paid” after the policyholder has paid only one lump sum. Due to the high initial deposit, the premium amount is high during the initial term of the policy. The premiums in the policy are paid in advance, so buying at a lower price is a regular thing, as opposed to a lump sum for an outright policy for a certain period of time.

Infinite Banking Life Insurance: What Is It & Can You Make Money?

Modified whole life insurance will require the policyholder to make payments throughout the life of the policy. However, premium discounts are offered for the first few years with one rate increase after several years. These policies are usually a good option for those who are looking to take out permanent life insurance but cannot afford it at the moment.

Similar to modified whole life insurance contracts, premium discounts are offered for the first few years. Instead of a single offer, there are multiple rate increases. Also, the value will increase over time. In this case, premiums are usually adjusted higher than the direct life insurance policy.

The face amount of this policy increases in response to an increase in favorable indices such as the Consumer Price Index (CPI) if the policyholder chooses to allow inflation. (Additional charge will apply to insurance). If the policyholder decides not to increase the amount, in some cases he will not be given any option to do so. Setting a cap on the total amount of growth allowed is common for those who choose a tiered plan.

Mid-premium whole life insurance works on the concept of “double premium”, which includes an average premium plus a discount that can lower the premium. These policies are considered non-participating and are designed to compete with participating life policies.

Term Vs. Whole Life Insurance: How To Know Which One You Need

The actual premium charged is never higher than the maximum premium specified in the policy. However, these plans allow the buyer to participate in the insurer’s activities by taking advantage of the premium discount when the insurer is doing well financially. These types of policies will also be subsidized when the insured reaches 100 years of age, as long as the policy is in effect.

Current assumptions are a type of traditional cash value insurance and universal life insurance. These goals

Buy whole life insurance policy, whole life insurance quotes online, whole life insurance online, why buy whole life insurance, where to buy whole life insurance, buy whole life insurance, how to buy whole life insurance, buy online whole life insurance policy, buy whole life insurance online instantly, whole life insurance quotes online without personal information, buy whole life insurance usa, get whole life insurance quote online