Car Insurance Comparison – You’ve done all your research, got a good test, and now you’re ready to put pen to paper.

Should you get gap insurance from the dealer or can you get a better deal elsewhere? When you factor in the down payment, terms, and discount, your stock may not be fully stocked if the term is shortened. seller’s stock, even if fully charged. In just a few minutes, it can help you find gap coverage that won’t leave you stranded.

Contents

- Car Insurance Comparison

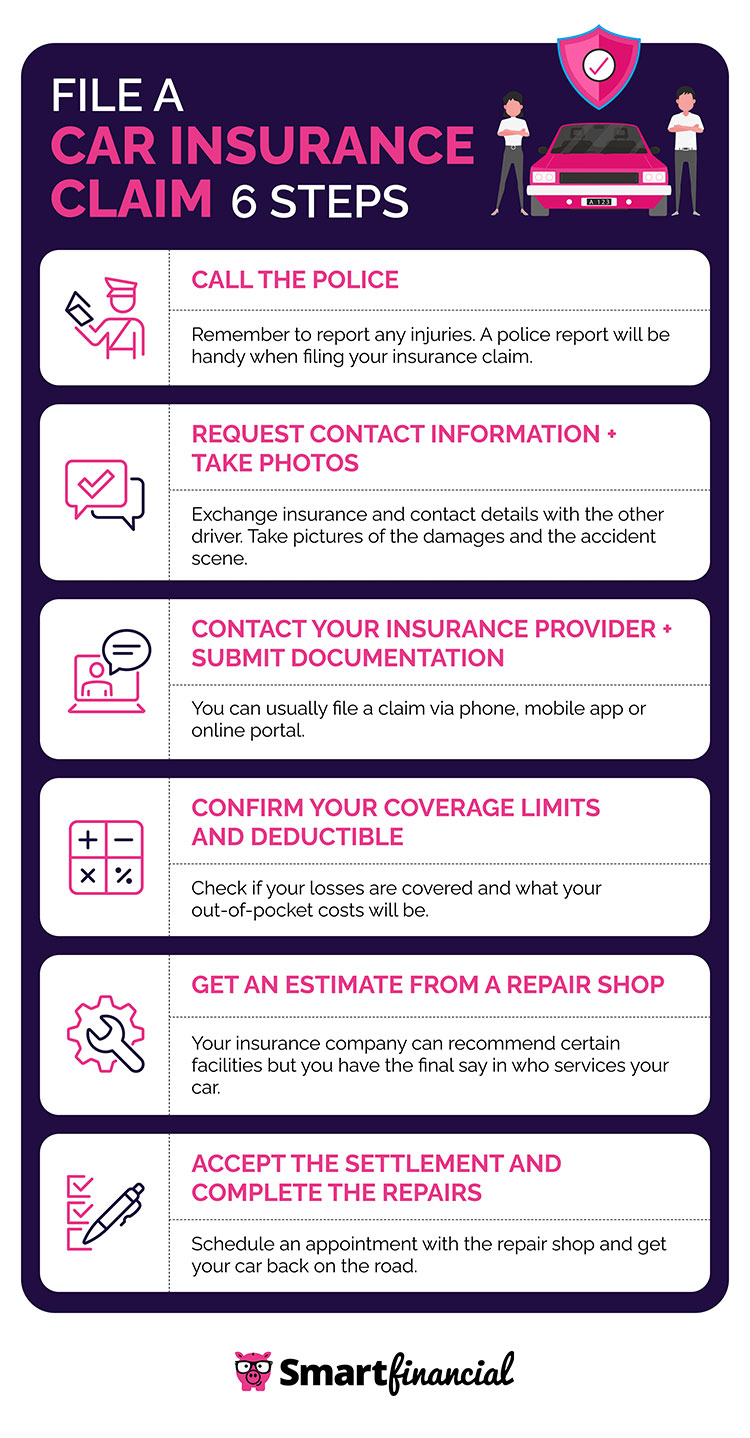

- How Can I File A Car Insurance Claim?

- Get Free Car Insurance Quotes Online (from $34/mo)

- Common Car Insurance Mistakes

- Compare Car Insurance Quotes & Rates (2024)

- How Does Insurance Differ State To State?

- Insurify Raises $4.6m Lead By Massmutual And Nationwide; Launches First Facebook Messenger Insurance Comparison Service

- Gallery for Car Insurance Comparison

- Related posts:

Car Insurance Comparison

After comparing more than 25 million quotes across the country and many in Nevada, a list of the best mid-range insurance companies was compiled, based on the average annual premium for rental cars , often take gap insurance. Although not on our list, Allstate may deserve an offer because it is one of the few companies that pay deductibles. Note that State Farm only offers gap insurance if you bank with their bank. Travelers lead the group with an average of $222 per month.

How Can I File A Car Insurance Claim?

Since every driver is different, the best way to find the cheapest insurance deals is through a car comparison site like . Try comparing multiple auto insurance quotes for free today and save up to $996 a year.

“GAP” is an abbreviation for “Guaranteed Asset Protection”; rarely, it’s called a GAP warranty. Coverage fills the gap between what you owe on your auto loan and the actual value of the vehicle in the event of theft or total loss. Unlike car insurance, gap coverage is an optional extra unless your lender requires a portion of your car loan.

Generally, gap insurance is sold as a financing option by new and leased car lenders. You can get gap insurance for a used car, but it’s rare because the car’s value has already been depreciated. Insurers sometimes refer to the coverage as “loan/lease hire” and cover both new and used cars. Fortunately, gap insurance pays regardless of the fault.

Let’s say you get a new car for $30,000. After a year, your car will lose about 20 percent of its value, according to Insurance Information (III). For simple math, let’s say that this same year you still owe $27,000 on your loan balance, but the car is only worth $24,000. . Your insurance will cover the $3,000 gap between what you owe and the value of your car after paying the deductible.

Get Free Car Insurance Quotes Online (from $34/mo)

Here, if you have a $500 deductible, your accident coverage will cover $24,000 and your coverage will cover the remaining $2,500. You will rarely find gap insurance companies that will pay your deductible as well. Here are some details on what’s included:

As soon as you leave the parking lot, your new car loses 10 percent of its value, and after five years, your car will be worth an average of 40 percent of its value. sale, according to CARFAX. In the early years, there can be more to do than poke your back pocket. Gap insurance may be a wise choice if you have:

Gap includes options in Nevada. However, the law divides the gap into two types: insurance gap and forgiveness gap, although they are used interchangeably. Gap insurance is an insurance product, and gap waivers are special financing items, not insurance. Although the Department of Insurance regulates coverage gaps rather than eliminating coverage gaps, both consumer protection and coverage are nearly identical.

Gap insurance is a one-size-fits-all product, so you don’t have to worry about how big it is. While more expensive cars may have slightly higher insurance rates, unlike credit limit insurance, where you set the amount. Gap insurance covers the difference between what you owe and the actual value of the car.

Common Car Insurance Mistakes

Is gap insurance worth the extra cost? It depends on how much you owe to the bank and the value of your car. Many people are pleasantly surprised by the prices they get from insurance companies for gap insurance. The monthly cost can be as low as $60 a year or $5 a month, on your car insurance bill.

Compare that to the average sales price of $500 to $700, according to Fox Business. Consumers save a lot of time when they remove gap insurance from their car insurance company. If you have already signed and paid with the seller, it is not too late to change. Just buy gap insurance from a car insurance company and cancel your policy when your new policy expires.

In the past, car buyers were at the mercy of finance departments or insurance agencies, but now you can find additional options for gap insurance online. It’s easier than ever to get the best price on car insurance and insurance in Nevada, and you can even get a discount on most policies if you bundle it with your home. or life insurance.

A comprehensive comparison tool will help you find the best insurance for your vehicle, location and unique vehicle information. Simply submit up to 20 unique quotes from top insurers in minutes.

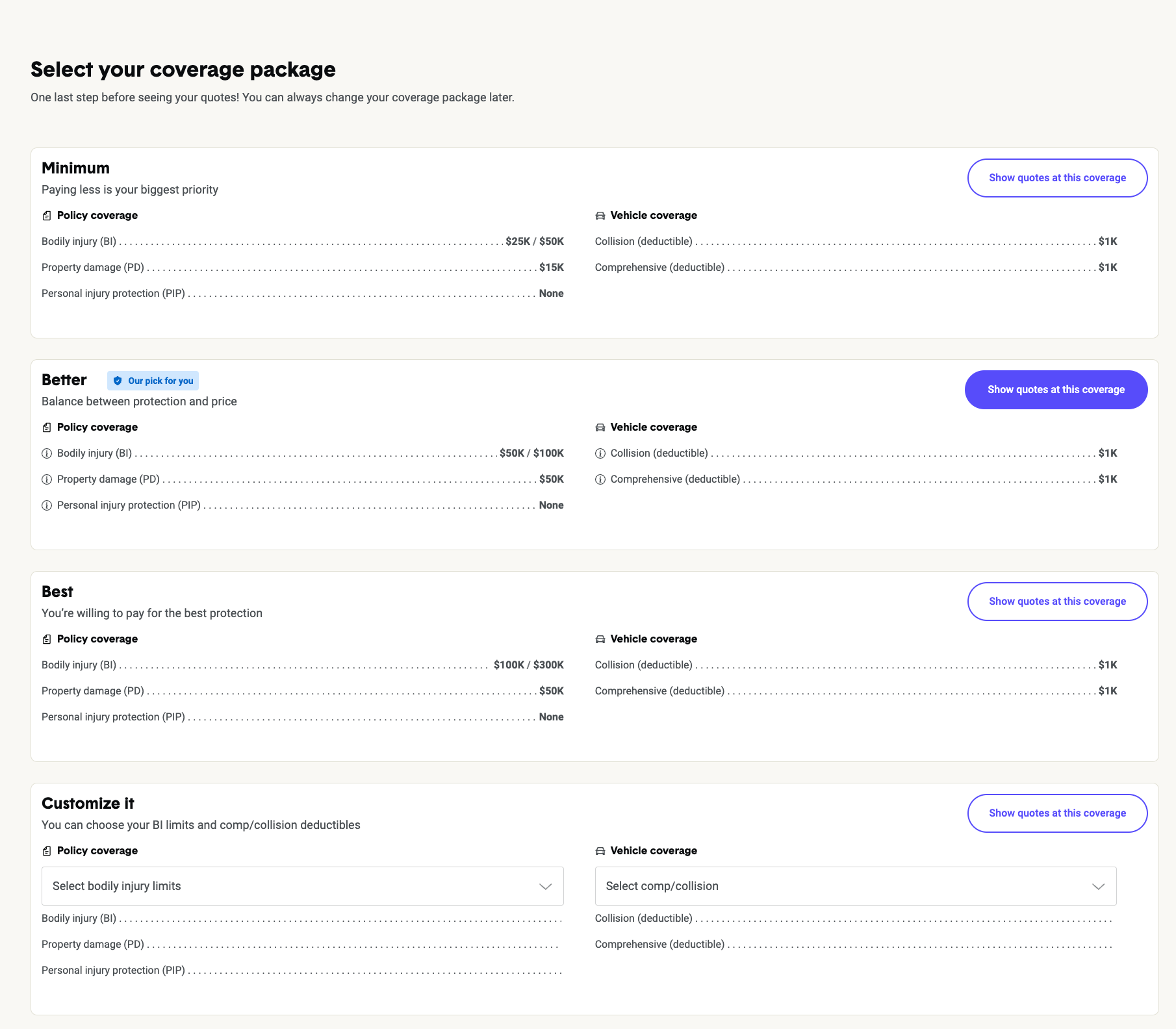

Compare Car Insurance Quotes & Rates (2024)

Data scientists analyzed more than 90 million quotes provided to auto insurance applicants in their own databases to calculate the premiums shown. on this page. These quotes are real information that comes directly from over 50 insurance company partners in all 50 states and Washington, D.C. Bid prices represent the bid price for a given stock level, driver group, and geographic location. .

Unless otherwise noted, rates listed reflect drivers between 20 and 70 years of age with a clean driving record and average night driving. the more credit (600 points or more).

Prices for Allstate, Farmers, GEICO, State Farm and USAA are estimated based on Quadrant Information Services auto insurance data.

We are America’s leading insurance comparison site. is committed to providing users with a safe and hassle-free shopping experience. Compare quotes, unlock discounts and save up to $489 on your insurance today.

How Does Insurance Differ State To State?

Progress vs. State Farms: Which is Best? (2023) Progressive and State Farm both have similar auto insurance options, but State Farm’s rates are lower. Here’s how to choose which insurance policy is best for you 16 min. read | Dec 20, 2023 GEICO vs. Progressive: Which is better? (2023) GEICO and Progressive are major insurance companies and are available nationwide. Compare the two to find out which one suits your insurance needs.14 min. read | December 20, 2023 Allstate vs. GEICO: Which is Better? (2023) How Allstate and GEICO compare on average prices, customer reviews, stock options and more.14 min. read | Dec 20, 2023 Liberty Mutual vs. Progressive: Which is better? (2023) Liberty Mutual and Progressive are large insurance companies with many options. Which one is right for you? 13 minutes. read | December 19, 2023 AAA vs. State Farms: Which is better? (2023) Compare AAA and State Farm auto insurance rates, customer service, coverage options and discounts to find out what most suitable for you. 12 min. read | December 19, 2023 AAA vs. GEICO: Which is better? (2023) Compare GEICO and AAA rates, advertising, customer service and more to find your best insurance. 10 minutes. read | December 19, 2023 Comparing car insurance online is one of the fastest and most effective ways to ensure you are properly covered at the best rates.

Auto insurance is a broad category of personal auto insurance products that protects: cars, boats, vans, convertibles, jeeps,

), and ships, to name just a few. Choose the type of car insurance that best describes the car you want to insure and let us provide you with free information and advice. . Compare auto insurance quotes and coverage policies from multiple carriers. In most cases, you have the option to activate and manage your policy online depending on the mode of transportation and geographical location.

Car Insurance Stay Smart and Safe with Car Insurance Free Ride Car Insurance and Cheap Car Insurance ATV Insurance Take the Risk on All Types of Vehicles Car Insurance Snow Driving Winter Roads and Car Insurance Snow RV Insurance Make the Road Like Home with RV Insurance Boat Insurance your worries about beach and boat insurance

Insurify Raises $4.6m Lead By Massmutual And Nationwide; Launches First Facebook Messenger Insurance Comparison Service

Most states have mandatory insurance requirements for most vehicles. If you have a car, truck, vintage / used car, convertible, SUV or other vehicle on four wheels – no matter how big your car is! – you need some kind of car or car insurance. While there are minimum auto insurance rates for cars and trucks etc., you should consider the level of coverage that suits your lifestyle and exposure. To get the right auto insurance quote, you need to make sure your auto insurance quote matches your needs. To help you better understand how to compare car insurance quotes to find the best policy, our team of insurance experts has created a comprehensive guide with quotes from major car insurance companies for each state with different car parts.

Auto insurance companies are currently experiencing historic losses that are driving up auto insurance rates. Insurers may continue to raise premiums for the foreseeable future. Car insurance comparison shopping is the best way to find the best deal at the lowest price available

Car insurance price comparison, car insurance quotes comparison, car auto insurance comparison, car insurance comparison website, best car insurance comparison, comparison car insurance, car insurance cost comparison, car insurance companies comparison, car insurance quote comparison, car insurance rate comparison, car insurance comparison tool, motor car insurance comparison