Vehicle Insurance – The new four-wheeler and two-wheeler insurance policy announced by IRDAI (Insurance Regulatory and Development Authority of India) is effective from August 1, 2020. The current law was formed on the orders of the Supreme Court of India. IRDAI operates a long-term mandatory third party motor vehicle policy. It provides coverage of three years for four-wheelers and five years for two-wheelers in the first car insurance policy. The previous law only required third party (TP) liability car insurance coverage for all car owners, leaving the loss policy (OD) open to their discretion.

Insurance: The insurance company paid compensation to the car owner and the second party

Contents

- Vehicle Insurance

- The Basics Of California Automobile Insurance Requirements

- New Jersey Governor Signs Law Raising Automobile Insurance Coverage Minimums

- Business Automobile Policy (bap): What It Is, How It Works

- Benefits Of Auto Insurance

- Salient Features Of Vehicle Insurance & How To Buy?

- Vehicle Insurance Cartoon Royalty Free Vector Image

- Vehicle Insurance Png Transparent Images Free Download

- Auto Insurance Icon Royalty Free Vector Image

- Gallery for Vehicle Insurance

- Related posts:

Vehicle Insurance

Third Party Insured: Persons other than the vehicle owner are called third party insured, i.e. public. For example, if a motorcycle accidentally hits a pedestrian and injures itself, the pedestrian is considered the third party insured. If the owner only carries third party insurance, he will only be compensated for the damage caused to the third party, i.e. the owner will not be reimbursed for his personal expenses in the event of an accident.

The Basics Of California Automobile Insurance Requirements

Comprehensive or general insurance: This type of insurance covers the loss of the owner and third parties. Among these, comprehensive or general insurance policies are premium in comparison to third party insurance.

3 Two Wheeler Motor Vehicle Insurance

2. Coupling Policy: 3 years TP and 1 year OD policy for four wheelers and 5 years TP and 1 year OD policy for two wheelers and

3. Standard three years TP policy for four wheelers and five years TP policy for two wheelers.

New Jersey Governor Signs Law Raising Automobile Insurance Coverage Minimums

However, on August 1, 2020, IRDAI intends to sell long-term comprehensive car insurance packages covering three years for four-wheelers and five years for two-wheelers. In June, it ordered insurers to stop selling long-term car insurance for new cars sold starting August 1, 2020. The long-term third-party policy remains in place, but from August 1. Car buyers will have to pay upfront for five years for two-wheelers and three years for four-wheelers. . Additionally, insurance companies can only sell long-term policies in bundles, where the package includes a 3-year TP and 1-year OD policy for four-wheelers and a 5-year TP and 1-year OD policy for two-wheelers.

For example: A person who buys a car after August 1st will be forced to buy long-term third-party insurance that means three years for four-wheelers and five years for four-wheelers, and the same for third-party insurance. All insurance companies have similar packages.

A policyholder can cover his car against loss by purchasing a package that includes a long-term third-party liability policy or a package that includes one-year loss coverage, which is a tie-in policy, or two policies, i.e., TP and OD policies. . Both groups usually cover the owner as well as third party damages.

If the required limit is not exceeded and the deductible amount is deducted at the time of policy renewal, the policyholder is entitled to an annual premium.

Business Automobile Policy (bap): What It Is, How It Works

Long-term car insurance can be taken out at any time during the applicant’s time, and the portability of the insurance is an option that is compatible with the rates quoted by other insurance company providers.

Policyholders have the freedom to change the insurance provider after one year, however, new car owners must take three years of Third Party (TP) cover, five in two-wheelers. -years.

Auto dealerships are losing out on getting their customers to buy long-term OD insurance coverage (which has a higher rate than the premium policy).

In short, the new car insurance law shines as a long-term step to ensure the effectiveness of car insurance, while freeing police carers from the clutches of long-term insurance policies that do not benefit them. It’s no secret that auto insurance rates are on the rise, so you’ll want to get the best price before that happens. In fact, they have increased steadily over the past few years. So what is causing interest rates to rise? There are several factors at play, some of which we will take a closer look at in this blog post.

Benefits Of Auto Insurance

Economist Mike Clark predicted: “I hope you’re going to be careful and pay attention … [car insurers] are feeling the price pressure, and they may not want to accept it.” “You’ve done nothing – no damage, no ticket – and you could be facing an extra bonus if you’ve done nothing.”

The CCID-19 pandemic has affected our economy, especially the supply of semiconductor chips used in car manufacturing, leading to higher prices for new and used cars.

The rise in used car prices directly leads to people rushing to buy used cars instead of new cars due to the shock of new car prices. There is less choice, meaning buyers are forced to pay more for their car because there is less competition in the market.

Used car prices rose by 26 percent, compared to the Bureau of Labor Statistics’ forecast increase of 40.5 percent, according to the latest data from Travelers for 2020-2022.

Salient Features Of Vehicle Insurance & How To Buy?

Clark believes that the unusual market conditions have hurt everyone the most because of auto repair. Auto parts grew 6%, the report said. Insurance companies are also feeling the pinch, with average claims rising 20%.

Climate-related disasters are increasing. 2021 snowstorms, wildfires, hurricanes, hurricanes, and other 20 billion dollars in weather-related events and climate change occur, and the National Oceanic and Atmospheric Administration estimates that these storms will cause 145 billion dollars in damage in one year!

Hurricane Ida made landfall in 2021 as a powerful Category 4 storm, and its effects are still being felt in Louisiana. The storm hit the country with strong winds and caused extensive damage to homes along the coast in the southeastern United States. Because of this, they saw a 41% increase in car prices.

With all this in mind, it is important to re-evaluate your car insurance policy. Even if you have had a recent accident or ticket, you can find lower car insurance rates by shopping around.

Vehicle Insurance Cartoon Royalty Free Vector Image

“This year will be an important year to buy your auto insurance again,” Clark said. “Some insurance companies may be interested in you if you pay attention to distribution and your record is clean, and buying your coverage from someone else can make a big difference.”

Fortunately, Texan Insurance is a full service organization that can source over 40 different carriers to help you find the right coverage for you. If you are already our customer, don’t worry. During renewal, your account managers will automatically review your policy to see if they can get a better rate or coverage. Buying a car can be fun, but before you get that shiny new ride, you need to insure it. But with so many options out there, navigating the insurance spectrum can seem overwhelming. Do not be afraid, you warriors! 10 important things to consider before signing on the dotted line:

1. Coverage Needed: What kind of coverage do you need? Comprehensive and collision cover protects against accidents and theft, and liability covers the damage you cause to others. Need extras like car rental or roadside assistance? Consider your driving style, vehicle value and risk tolerance.

2. Your Driving Record: Clean Driving Record? Congratulations, you can get a better price! Tickets, accidents and violations can significantly increase your premiums. Be honest and upfront about your driving history to avoid surprises later.

Vehicle Insurance Png Transparent Images Free Download

3. Location, Location, Location: Where to stay and park. Urban areas with high traffic volumes often have high insurance coverage. Secured parking spaces give you a discount.

4. Car Issues: The make, model, year and value of your car will play a big role in determining your premium. A flashy sports car is more expensive to insure than a reliable pickup truck.

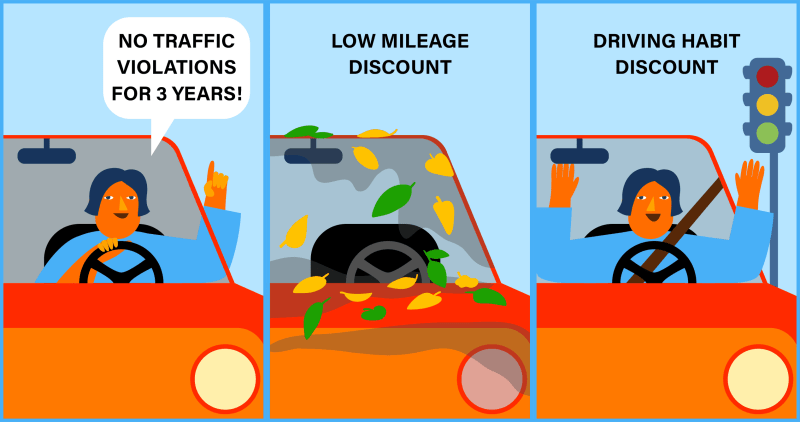

5. Discounts and Damages: Ask for a discount! Many insurance companies offer low rates for good students, seniors, multi-car policies, anti-theft devices, and even driving lessons. Don’t put money on the table!

6. Compare and Contrast: Don’t settle for the original quote

Auto Insurance Icon Royalty Free Vector Image

Vehicle repair insurance, buy vehicle insurance online, vehicle maintenance insurance, vehicle insurance providers, commercial vehicle insurance quote, insurance for commercial vehicle, commercial vehicle insurance online, cheap vehicle insurance, recreational vehicle insurance, vehicle insurance broker, business vehicle insurance, commercial vehicle insurance companies