Car Insurance Rates – Our goal is to help you make educated insurance decisions with confidence. We have an advertising relationship with some of the offers on this site. However, this does not affect our editorial judgment or recommendations. Rankings and lists of our reviews, tools and all other content are based on objective analysis and we fully own our opinions.

Your insurance premium is based in part on how old you are. Find out why age is factored in and at what age you can expect to pay the most and least for car insurance.

Contents

- Car Insurance Rates

- Best Car Insurance Companies Of 2023

- Steps To Cheaper Car Insurance Rates

- Here’s How To Save Money On Car Insurance

- Infographic: Average Auto Insurance Premiums For All 50 States — My Money Blog

- How Age Changes Your Car Insurance Rates

- What’s Affecting Your Insurance Rates?

- Average Cost Of Car Insurance

- Factors That Affect Your Car Insurance Rates—how To Save

- Gallery for Car Insurance Rates

- Related posts:

Car Insurance Rates

Laura is an award-winning editor with content and communications experience spanning auto insurance and personal finance. She has written for several media outlets, including the USA Today Network. She most recently worked in the public sector for the Nevada Department of Transportation.

Best Car Insurance Companies Of 2023

John is the editor of , Insurance.com and Insure.com. Prior to joining QueenStreet, John was an Associate Editor at The Wall Street Journal and was an editor and reporter for numerous other media outlets covering insurance, personal finance and technology.

Car insurance rates are based on a number of factors, with age being the most important. After all, teenage drivers between the ages of 16 and 19 are nearly three times more likely than drivers 20 or older to be involved in a fatal crash, according to the CDC.

The average cost of car insurance for people under 25 is relatively high. Teenagers and young drivers are generally inexperienced behind the wheel and more prone to accidents, making them a high risk for car insurance companies. More risk equals higher interest.

Editors broke down the average cost of car insurance for 16- to 75-year-olds in each state. Here’s what you can expect to pay for car insurance at each age.

Steps To Cheaper Car Insurance Rates

California Auto Insurance Rates by Zip Code Enter zip code for average rates. Then enter your age, gender and coverage level for a custom rate.

State Minimum: Required liability coverage for legal driving in your state; some states require additional coverage, such as accident coverage, uninsured motorist, underinsured motorist. Liability Only 50/100/50: $50,000 per person/$100,000 maximum per accident for bodily injury; $50,000 for property damage. Liability pays for loss/damage you cause to others. Full coverage 100/300/100: $100,000 per person/$300,000 maximum per accident for bodily injury; $100,000 for property damage; comprehensive and collision coverage with a $500 deductible. Liability pays for loss/damage you cause to others. Comprehensive and collision protection for damage to your car.

Commissioned Quadrant Information Services to provide a report on the average price of 2017 Honda Accord car insurance for nearly every zip code in the United States. We calculated prices using data from up to six major carriers. The default averages are based on the monthly coverage for a male driver, age 30, for the state’s minimum liability coverage. The adjusted average rate is based on the age and gender of the driver for the following insurance levels: state minimum liability, 50/100/50 and 100/300/100 liability with a $500 comprehensive liability and collision liability. These imaginary drivers have clean records and good credit. Average prices are for comparison. Your price depends on your personal factors and the vehicle.

In the tables below, you can see the average price of car insurance by age for the following insurance categories:

Here’s How To Save Money On Car Insurance

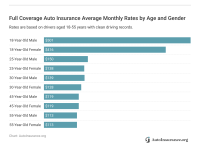

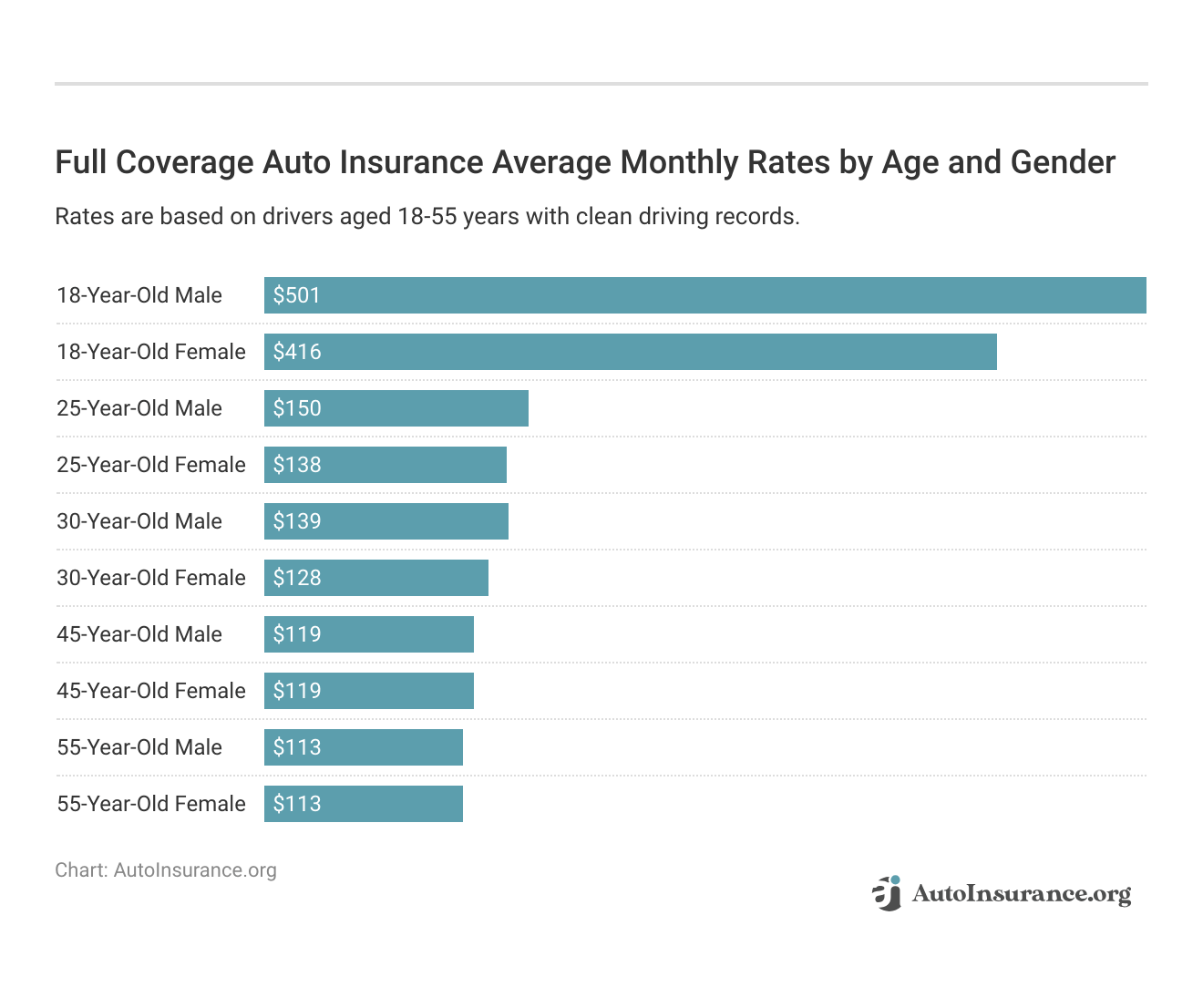

As you can see in the chart below of car insurance rates by age, rates are cheapest for drivers in their 40s, 50s and 60s. The average cost of car insurance for teenagers is high, but it drops in their twenties.

Once you turn 20, your rates start to drop, but you’ll still be paying more than most drivers until you’re 26. Below, the charts show the average cost of car insurance by age for traditional insurance packages when your teenage years are in the rearview mirror.

For a 20-year-old male, the cost is $1,159 per year; for a female driver, the same policy could cost an average of about $1,058 per year for the state’s minimum policy. Here is a breakdown of insurance premiums for different insurance levels:

For a 21-year-old male, the average price is $917 per year, and for a female driver, the same policy could cost around $850 per year for the state’s minimum policy. See the table below for a breakdown of premiums for different levels of coverage:

Infographic: Average Auto Insurance Premiums For All 50 States — My Money Blog

For a 22-year-old male, the average price is $819 per year, and for a female driver, the same policy could cost around $769 per year for the state’s minimum policy.

For a 23-year-old male, the average price is $755 per year, and for a female driver, the same policy could cost around $717 per year for the state’s minimum policy. See the table below for a breakdown of premiums for different levels of coverage:

For a 24-year-old male, the average price is $705 per year, and for a female driver, the same policy could cost around $676 per year for the state’s minimum policy. Here is a breakdown of insurance premiums for different insurance levels:

Costs between women and men almost equalize by age 25, at $612 per year for men and $605 per year for the state minimum policy for women. Here is a breakdown of insurance premiums for different insurance levels:

How Age Changes Your Car Insurance Rates

See the chart below for average car insurance costs by year and state for comprehensive coverage. Enter your state in the search box to see what you can expect to pay.

Select your state below to see average car insurance prices by year for a full coverage policy

Age is only one factor that car insurance companies consider when deciding how much you will pay. Gender is another, although some states do not allow gender to be used as a factor in calculating rates – California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania.

Each rating factor, along with the type of insurance you choose, deductibles and discounts, will affect the price you pay for your car insurance.

What’s Affecting Your Insurance Rates?

Regardless of age and whether male or female, you can save hundreds of dollars by comparing car insurance companies and finding the one that offers the best rates for you. Our guide to the best cheap car insurance for seniors shows how much drivers aged 65, 75 and 85 can save.

Car/home package discounts achieved an average saving of 13% and for younger drivers, student discounts averaged savings of 16%. A good student discount saves drivers an average of 14% and a wedding discount is 8%.

Older drivers can also reduce costs. Drivers over the age of 65 who complete advanced driver training can save an average of 4%.

Commissioned by Quadrant Information Services to run 2022 Honda Accord LX car insurance rates on several insurance levels for a driver with a clean driving record in every zip code in every state.

Average Cost Of Car Insurance

Leslie Kasperowicz is an insurance educator and content creation expert with nearly two decades of experience, first directly in the insurance industry at Farmers Insurance and then as a writer, researcher and insurance buying educator writing for sites such as ExpertInsuranceReviews.com and InsuranceHotline.com and content management, now at .

Nupur Gambhir is a content editor and certified life, health and disability insurance specialist. She has extensive experience in delivering brands and has created award-winning travel and technology campaigns. Her insurance expertise has been featured in Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym, and End of Life Planning.

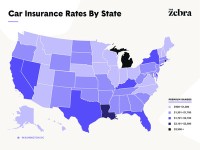

✓ Thank you, your message has been received. Our team of auto insurance experts usually respond to questions within five business days. Please note that due to the volume of questions we receive, not all may be answered. Due to a technical error, please try again later. According to the US Census Bureau, approximately 108 million American households own at least one vehicle, and 7.5 million households own four or more vehicles. But if you’re a vehicle owner thinking about moving to a new state, you may be in for a surprise when it comes to your auto insurance bill.

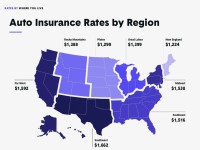

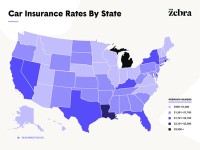

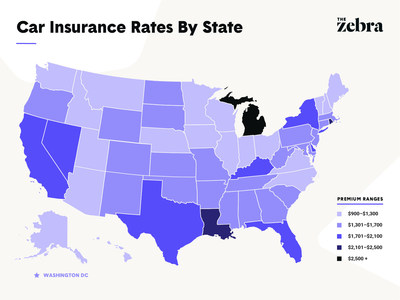

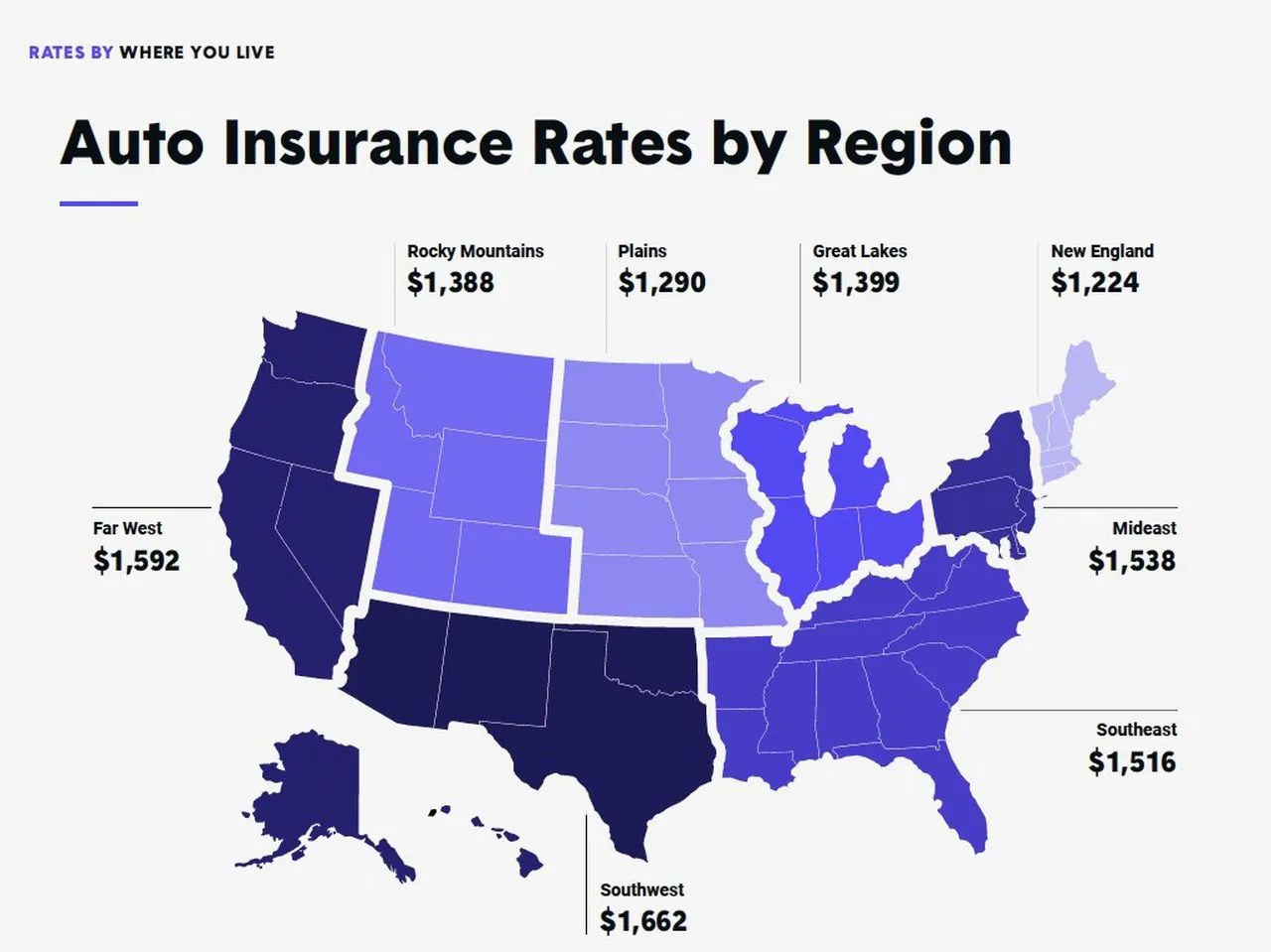

Because each state sets its own insurance rates, owning a car in some states is more expensive than others. A recent report titled Zebra State of Auto Insurance 2019 offered an analysis of average annual auto insurance premiums in each state. From September to December 2018, Zebra analyzed more than 61 million auto insurance quotes nationwide using information from insurance rating platforms and public records. Zebra’s findings are shown in our latest infographic below.

Factors That Affect Your Car Insurance Rates—how To Save

According to Zebra, car insurance rates are based on five main factors: where you live, what you drive, how you drive, coverage options, and your demographics (such as age and gender). To ensure consistency in comparing rates from state to state, Zebra used the same demographic and vehicle profile for a hypothetical insured user (a 30-year-old single male with a 2014 Honda Accord EX and a good driving record).

Zebra attributes a number of more specific factors to the disparity in insurance rates between states. States with densely populated cities tend to have higher rates because of the risk involved

Ohio car insurance rates, competitive car insurance rates, compare car insurance rates, discount car insurance rates, aarp car insurance rates, car insurance lowest rates, utah car insurance rates, best car insurance rates, good car insurance rates, low rates car insurance, oregon car insurance rates, shop car insurance rates