Car Insurance Renewal Quotes – Insurance is an important part of modern life. By paying for an insurance policy, you are taking steps to manage your risks. For example, driving a car means risking an accident. Likewise, owning a home can lead to damage to your residence or a lawsuit from someone injured on your property. When you pay for insurance, you pay the company a small amount at a time to ensure that it will help cover you if major expenses occur. Even if you never file a claim, the insurance company gets paid, and if you have to file, you know they will (usually) cover your big expenses.

There are many types of insurance, so it is essential to look for a good deal. Getting insurance quotes from multiple companies is a great way to save money. Some types of insurance, such as driver insurance, are legally required, while others are optional, such as life insurance. Meanwhile, landlords or lending companies may require renters insurance and homeowners insurance even when it is not required by law.

Contents

- Car Insurance Renewal Quotes

- How To Switch Your Car Insurance In 7 Easy Steps

- Buy Car Insurance Policy Online

- How To Renew Car Insurance

- Drive Worry Free With A Multi Year Long Term Car Insurance Policy

- Comparing Automotive Insurance Quotes

- New India Assurance Car Insurance Renewal Online In India 2024

- Car Insurance Renewal Online @ Best Price

- Lake City Auto Insurance Quotes

- New Driver: Am I Doing Car Insurance Quotes Wrong?

- Gallery for Car Insurance Renewal Quotes

- Related posts:

Car Insurance Renewal Quotes

The insurance quote is based on the policy you are looking for and the information you provide. Your date

How To Switch Your Car Insurance In 7 Easy Steps

Changes to your information, such as disclosure or low credit score. However, an insurance quote is only an estimate of the premium or monthly rate you will pay for your insurance.

An insurance quote template is a form that insurance companies use to compile the information you need about your quote in a logical and

. Although different companies use slightly different templates, each company should provide potential customers with information about their rates and coverage. Organizing the quote in A

Template, a company can quickly reuse the form to provide individual insurance quotes by entering information specific to that individual or group. These templates save time and labor and help streamline the process of providing information to hundreds or thousands of people.

Buy Car Insurance Policy Online

There are many types of insurance. Some types of insurance are industry-specific, such as small business insurance, or niche policies for specific situations, such as travel or rental car insurance. Typically, insurance companies offer multiple options, such as liability, personal property, and property of others. Below is a quick list of the most common types of insurance that people need.

Most places require car insurance if you drive your own car. Auto insurance quotes include six basic types of auto coverage, including:

Pro tip: Each state has different requirements for drivers. Always check the lowest insurance rates in your area before looking for coverage.

Disability insurance covers your needs if you are unable to work regularly. Although there are different types of coverage, whether it can be purchased individually or is intended to cover a group of people, it can save your life if you are injured and cannot recover quickly.

How To Renew Car Insurance

Pro Tip: You can’t use disability insurance to file a claim for a pre-existing condition, but having a disabling condition doesn’t prevent you from getting disability insurance to cover future problems.

Home insurance is voluntary, but any homeowner can tell you that it’s a great idea because homes will eventually need repairs. Here are some coverage quotes you may need:

Pro tip: Vacant properties, such as those where you plan to build a house or a hunting and camping site, also have insurance.

Health insurance is a complex system in which each company covers only agreed-upon medical needs. You may have copays for doctor and hospital visits, and there is a deductible you must pay out of pocket before the insurance company covers the rest of the bill.

Drive Worry Free With A Multi Year Long Term Car Insurance Policy

Pro tip: Employers often offer insurance, but that doesn’t mean it’s the best deal. Shop around to see who offers you the best coverage and rates.

Long-term care generally applies to adults who need regular or daily assistance. By the time you turn 65, your chances of needing long-term care reach 70%. The longer you wait to purchase this type of insurance, the higher the premium will be, as the likelihood of the company paying increases significantly each year.

Pro tip: Get your long-term care insurance when you’re between 50 and 60 because it’s more affordable at that age.

Life insurance covers your death so your family and loved ones don’t have to pay out of pocket. There are only two types of life insurance. We explain how they work below.

Comparing Automotive Insurance Quotes

Pro tip: Get term life insurance in your 20s to get the best rates possible. At this age, you have very little business risk, and locking in a reasonable rate for the next 20 to 50 years will save you money.

Renters are relieved to know that they have a way to replace their belongings and find a place to live if their rental is damaged. These are the most common types of renters insurance.

Pro tip: Get renters insurance even if your landlord doesn’t require it or you live in a low-risk area. Each building is subject to weather conditions and maintenance. Knowing that you will have a roof over your head and that you will be able to replace your belongings if necessary can help greatly reduce stress and worry.

All insurance has limits. Your policy may only pay up to a predetermined limit; Beyond that, you’ll have to pay more out of pocket. It can be small, like a few hundred dollars if you damage more cars, or much more, when someone sues you for more than hundreds or even millions of liability coverage.

New India Assurance Car Insurance Renewal Online In India 2024

American Family Insurance (https://www.amfam.com/resources/articles/understanding-insurance/what-is-umbrella-insurance) explains it well: “Umbrella coverage provides additional financial protection above personal liability limits of others. . The insurance policies you currently have are active. Think of umbrella insurance as a powerful financial shield that can help protect your savings and future income in certain circumstances.

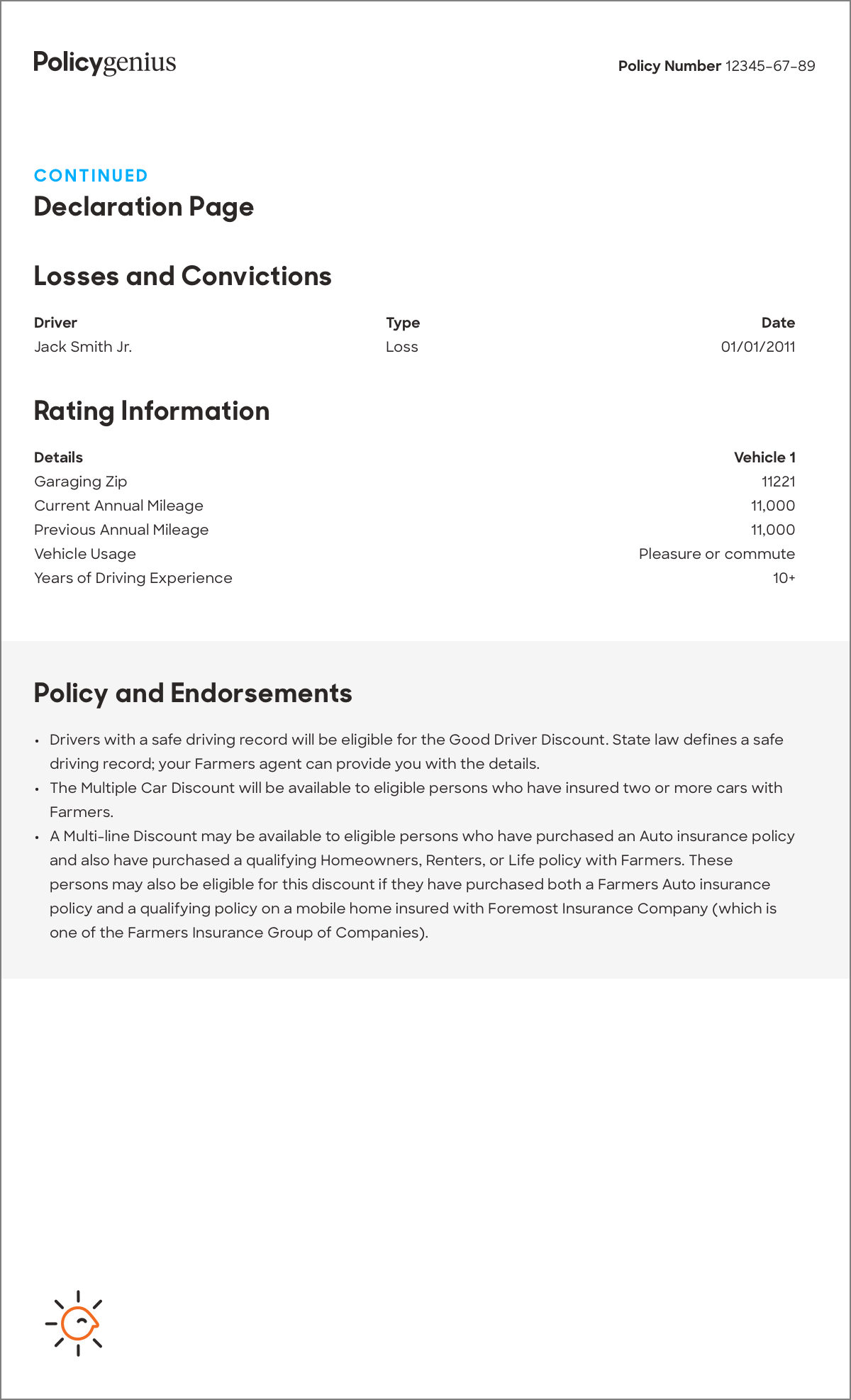

For your convenience, we have listed the most frequently asked questions about insurance quotes and templates below, along with simple answers.

Most auto insurance quote forms are for inquiries. They usually contain the following information. The quote you receive will contain all the information about the charges you will pay, some or all of the information you included when you applied, terms and conditions, and may have a time limit for acceptance. Offer.

There are three ways to get a car insurance quote. First, you can physically go to an insurance company to talk to someone face to face and ask. Second, you can contact an insurance company directly by phone, mail, or email and ask them to send you a quote. Third, you can compare prices online with a policy comparison website. However, searching in person may give you a better deal as no one charges a referral fee when you refer yourself.

Car Insurance Renewal Online @ Best Price

Getting a free car insurance quote requires certain information, such as your marital status. Here’s a quick list of everything you’ll need to get your quote.

Car insurance rates vary by driver, car, and state. However, the average cost of minimum coverage in the US is $545 per year. It costs about $1,771 a year for comprehensive coverage, but your driving record and other factors can significantly affect these prices.

The short answer is yes. You can get a car insurance quote before you buy it. You need to know what type of car, make, model and year you want, and have driver information on everyone covered by the policy.

You will receive an offer of insurance coverage with details of that coverage and monthly and/or annual rates.

Lake City Auto Insurance Quotes

To get a homeowners insurance quote, you should consult with a company that offers homeowners insurance. You will need basic information such as your name, marital status, and social security number. You can ask individual companies or check a site that compares rates.

No matter what type of insurance you offer, a custom quote template can provide your company with a significant source of added value. Customers want to know what they get and how much it costs. The ability to return those offers quickly, efficiently, and concisely will help you grow your insurance business and build trust with your customers. Some first-time drivers aren’t sure how to renew their car insurance. When a policy is about to expire, you need to make sure you are covered with no gaps in coverage. But how exactly does this process work? Does the policy renew automatically or do you have to track renewals every 6 to 12 months?

In this article, you will get answers to all these important questions. It’s important to understand what the requirements are, including when your policy expires. This way, you’ll have a better chance of securing your plan without any gaps in coverage.

Fortunately, most policies have automatic insurance renewal. This means that every 6 to 12 years the company will renew your policy.

New Driver: Am I Doing Car Insurance Quotes Wrong?

Hdfc car insurance renewal, expired car insurance renewal, car insurance renewal cost, car insurance renewal, car insurance renewal price, car insurance renewal india, car insurance renewal quote, car insurance renewal online, acko car insurance renewal, car insurance policy renewal, icici car insurance renewal, reliance car insurance renewal