Cheap Home Insurance – When you click on the seller’s link, we may earn an affiliate commission and help fund the nonprofit’s mission. It tracks your activity using third-party cookies. By clicking on the link, you agree to this.

Famous for its medieval cathedral and top university, Durham is also the cheapest place to get home insurance in the UK, according to new figures from MoneySupermarket.

Contents

- Cheap Home Insurance

- Best Cheap Homeowners Insurance Of 2023

- Military Home Insurance: 3 Reasons Why Cheaper Isn’t Always Better

- Tips For Finding Cheap Home Insurance

- Homeowners Insurance Guide: A Beginner’s Overview

- Revealed: The Cheapest And Most Expensive Areas For Home Insurance

- Confused.com Cheap Car Home Insurance Stock Photo

- How Much Does Home Insurance Cost?

- Best Homeowners Insurance Companies Of November 2023

- Mobile Home Insurance: Do You Need It And What It Covers

- Gallery for Cheap Home Insurance

- Related posts:

Cheap Home Insurance

Living in the cheapest area can save you up to £134 a year compared to the most expensive places – so how does your insurance premium compare?

Best Cheap Homeowners Insurance Of 2023

Here we look at the cheapest and most expensive areas of home insurance and how you can find the best home insurance policy to suit your needs.

Get more stable in your finances with expert advice in our newsletter – it’s free every week.

This newsletter contains free content related to money and other information about? Group products and services. Unsubscribe if you want. Your information will be handled in accordance with our privacy policy

In Durham, people paid an average of just £117 a year to protect their homes.

Military Home Insurance: 3 Reasons Why Cheaper Isn’t Always Better

Residents in Newcastle and Sunderland, which had the second cheapest home insurance premiums, paid just one pound more at £118 a year.

North West London tops the list of the most expensive areas, with households paying an average of £251 a year to cover their property. This is 114% higher than the national average of 138 pounds.

Central and West London, including Westminster, Hammersmith and Fulham and the Royal Borough of Kensington and Chelsea, with average premiums of £249 a year.

Use the searchable table below to see how your home insurance premium compares to other parts of the UK.

Tips For Finding Cheap Home Insurance

It’s unlikely that you’ll be upping sticks and moving out just to keep your insurance costs down – although if you’re moving, it’s always worth considering the cost of living in your new area.

It’s common for people to overpay or underpay for home insurance because they miscalculated the value of its contents or the cost of home repairs.

Using tools like a property insurance calculator can help you get an accurate idea of the home insurance you need.

Price comparison websites are a quick and easy way to find out what home insurance deals are available and which providers offer the right coverage for your needs.

Homeowners Insurance Guide: A Beginner’s Overview

If you’re considering upgrading, looking for a better deal can also give you the chance to get a better deal with your current provider if you want to stay with them.

While price is a key factor to consider when purchasing home insurance, it’s important to make sure your home insurance policy actually covers what you need.

Simply checking the terms and conditions will confirm this; you get the right level of protection, your excess is available and you’ve included any additional services or add-ons you need for better protection.

The fine print on home insurance can confuse and confuse readers, so if you’re unsure about something, ask your provider for clarification.

Revealed: The Cheapest And Most Expensive Areas For Home Insurance

Remember that once you have agreed to the terms of the policy, it will not be possible to make a claim for anything that is expressly excluded.

To help you find the best home insurance policy, experts have analyzed standard and building insurance policies from over 30 providers and combined this with feedback from thousands of customers to develop home insurance company reviews. Consider if you use the Galaxy Fold. Unlock your phone or view it in full screen mode to enhance your experience.

Advertiser Disclosures Many of the offers that appear on this site are from companies from which The Motley Fool receives compensation. This compensation may affect how and where products appear on this site (including the order in which they appear), but our reviews and ratings are not affected by the compensation. We do not cover all companies or all offers available in the market.

Many or all of the products here are from our partners who compensate us. This is how we make money. But our editorial integrity ensures that our experts’ opinions are not influenced by compensation. Terms and conditions may apply to offers listed on this page.

Confused.com Cheap Car Home Insurance Stock Photo

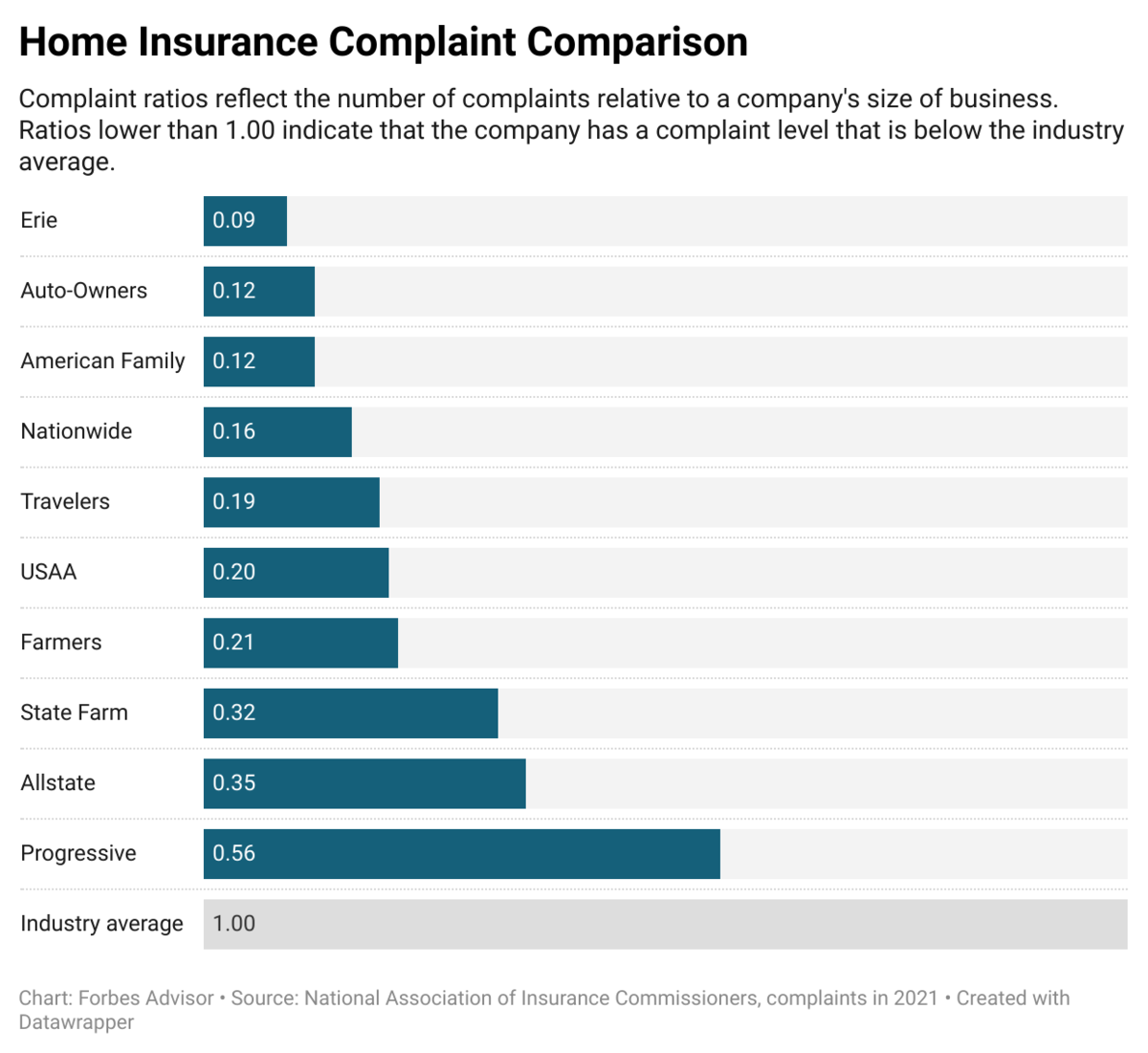

With so many home insurers out there, it can be difficult to decide which one is best for your budget and needs. In 2023, when it comes to the best cheap home insurance, there are many options, from standard insurance to special protection. Our experts have reviewed homeowners policies and rates to provide the best home insurance options available.

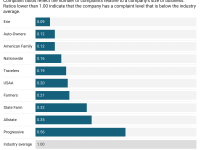

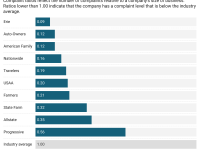

3.50/5 Circle with letter I. Our ratings are based on a 5-star scale. 5 stars equals the best. 4 stars equals Excellent. 3 stars is equally good. 2 stars equals Fair. 1 star equals Bad. We want your money to do more for you. Therefore, our ratings are biased toward offers that provide versatility while minimizing out-of-pocket costs. = Best = Excellent = Good = Fair = Poor

Mercury offers homeowners insurance in 10 states and is the leading independent auto and home insurance agency in California. Mercury has more than 9,400 independent agents. In addition to the low rates, Mercury offers up to 15% off your homeowner’s policy and up to 14.5% off your bundled auto policy.

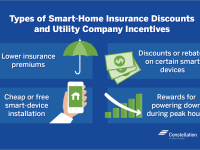

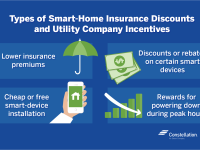

For over 160 years, Travelers has been one of the most trusted names in the insurance industry. Travelers have changed over time, expanding their insurance offerings and finding innovative ways to offer home insurance discounts. For example, if your home is already certified as a “green home” by Leadership Energy and Environmental Design (LEED), you can save up to 5%.

How Much Does Home Insurance Cost?

4.00/5 Circle with the letter I. Our ratings are based on a 5-star scale. 5 stars equals the best. 4 stars equals Excellent. 3 stars is equally good. 2 stars equals Fair. 1 star equals Bad. We want your money to do more for you. Therefore, our ratings are biased toward offers that provide versatility while minimizing out-of-pocket costs. = Best = Excellent = Good = Fair = Poor

Nationwide offers benefits that are usually add-ons — such as credit card coverage — as part of a standard homeowner’s policy. The best cheap home insurance isn’t always the one with the lowest price. Sometimes it’s the policy with the most coverage at the lowest price. Free plugins are a great place to start.

5.00/5 Circle with the letter I. Our ratings are based on a 5-star scale. 5 stars equals the best. 4 stars equals Excellent. 3 stars is equally good. 2 stars equals Fair. 1 star equals Bad. We want your money to do more for you. Therefore, our ratings are biased toward offers that provide versatility while minimizing out-of-pocket costs. = Best = Excellent = Good = Fair = Poor

Allstate offers some of the most generous rebates in the industry, including up to 25% off home and auto policies, up to 20% off switching to Allstate without recent home insurance, 10% loyalty rebates and 5% auto pay. Allstate also has an extensive network of agents.

Best Homeowners Insurance Companies Of November 2023

Lemonade is the perfect place for customers looking for affordable home insurance with premiums starting at $25 per month. The company makes it easy to purchase insurance by offering a complete online application process and fast responses. The policy can also be managed mainly through the app or online.

Most insurance companies offer one or two policy benefits. For example, free claim forgiveness is available to Farmers customers who haven’t filed a homeowner’s insurance claim in five years. While free claim forgiveness is fairly common among auto insurance carriers, it rarely applies to homeowners policies.

4.50/5 Circle with the letter I. Our ratings are based on a 5-star scale. 5 stars equals the best. 4 stars equals Excellent. 3 stars is equally good. 2 stars equals Fair. 1 star equals Bad. We want your money to do more for you. Therefore, our ratings are biased toward offers that provide versatility while minimizing out-of-pocket costs. = Best = Excellent = Good = Fair = Poor

State Farm notes on its website that you can save up to $1,127 on auto and home insurance. If they have an auto insurance policy, they say you can add a homeowners, renters, condo or life insurance policy that can save you up to 17% on your home insurance premiums. State Farm offers individual policies for homeowners that include additional coverage for pets, identity theft, and water damage.

Mobile Home Insurance: Do You Need It And What It Covers

Liberty Mutual has been in business for over 110 years and is one of the most respected names in the industry. As the fourth-largest homeowner insurer in the U.S., the company is known for two things: its AM Best A rating, which indicates strong financial resources, and its philanthropic efforts, including helping the homeless, promoting accessibility for people with disabilities, and supporting

Cheap motor home insurance, home insurance cheap, cheap home insurance quotes, cheap home owner insurance, cheap home insurance quotes online, cheap home insurance ontario, cheap home insurance rates, cheap home insurance companies, cheap home insurance company, cheap home insurance near me, cheap home owners insurance, cheap home insurance policy