Car Insurance Uk – Hello adventurers. We’re busy creating even bigger things and we can’t take you on tour right now.

Without a car? Ungrateful. Get temporary car insurance and you’ll be on the road in minutes. This is an opportunity.

Contents

- Car Insurance Uk

- Yoga Insurance Partners With Ageas

- Best Car Insurance For Young Drivers In The Uk

- Uk Certificate Motor Insurance Hi Res Stock Photography And Images

- Average Cost Of Car Insurance In Uk United Kingdom

- Google Results For

- Uk Watchdog Sets Three Month Deadline To Improve Car Insurance

- Which Car Insurance Cover Is Best?

- Average Cost Of Car Insurance Uk (december 2023)

- Gallery for Car Insurance Uk

- Related posts:

Car Insurance Uk

Get insurance for exactly the time you need it. From just an hour to 30 days and everything in between.

Yoga Insurance Partners With Ageas

Comprehensive protection as standard, so you have the highest level of protection available when you’re away from home

Insurance for your personal belongings that are lost, damaged or stolen as a result of accident, fire or theft

Insurance against accidental damage to both the insured vehicle and the “other” vehicle in the event of an accident

Up to £2,500 per claim or up to £5,000 per term if you or your partner suffers death or loss of limb/sight/hearing as a result of a car accident

Best Car Insurance For Young Drivers In The Uk

Temporary car insurance, also known as short-term insurance, is a form of vehicle insurance that provides coverage from 1 hour to 30 days.

Term policies offer fully comprehensive coverage for cars, vans and campers with no risk to you or the vehicle owners. No claims made in case of a joke. Click here to learn more about.

Temporary car insurance allows you to drive another vehicle from 1 hour to 30 days.

Once you have obtained consent from the owner of the vehicle, you will need to answer a few questions about yourself, your driving history, the vehicle you want to insure and the period for which you want coverage. Once you provide this information and meet the eligibility criteria, you will receive a quote. If you agree and pay, your short-term insurance will start on the date and time you specify. It really is that simple.

Uk Certificate Motor Insurance Hi Res Stock Photography And Images

If you only need 3 days of insurance to lend your car to a friend, why should you pay for annual insurance? Maybe you’re going on a family vacation and want to share the ride. Or maybe you’re going to college and you’ll only need your car when you’re home. The possibilities are literally endless.

If you still need to drive after this period, simply take out another short-term car insurance with . It’s that simple.

You must be between 18 and 75 years old. You must also have a full valid UK driving license (issued in England, Wales or Scotland) and have held it for at least 6 months, or 3 months if you are over 25.

You must also have a current permanent address in the UK. Please note that you may be asked to provide proof of residence in the event of a claim.

Average Cost Of Car Insurance In Uk United Kingdom

*On average, 40% of customers aged 40-64 paid £0.29 per hour for their car policy (1 October 2022 to 31 March 2023) Preius car insurance has several methods to find the best and cheapest advice. Here’s what you need to do to get the best prices.

Planning allows you to get the best price deals when you renew your car insurance. There are many ways to lower your premium and secure the best deals.

Start your search early. It is better to get up early and renew your insurance because insurers think it is your responsibility. You must bargain for the value of the prize before the last entry.

Insurance companies say it’s cheaper to arrive about 21 to 26 days before your renewal date to get better rates. If you wait until the day before your renewal date, you will not have the opportunity to bargain and cooperate, and insurers will not look favorably on you and instead charge you a higher premium.

Google Results For

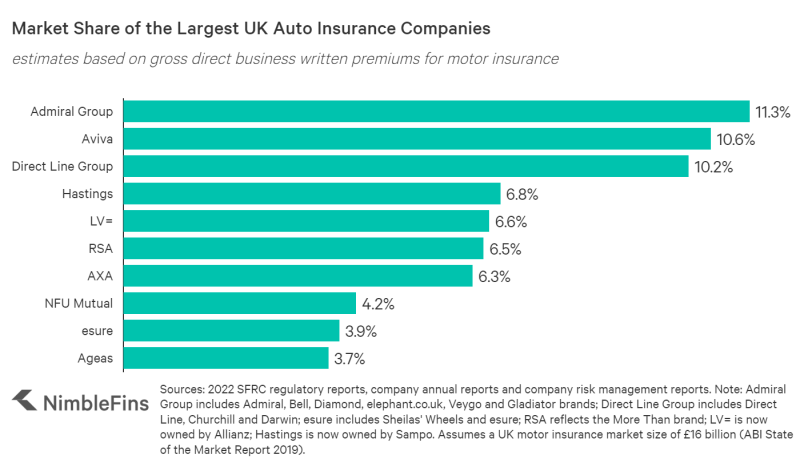

Look for the best. Price varies from £571 to £1,277 depending on experienced drivers and young drivers (aged 17 to 24). Under the rules, which come into effect in January 2022, insurance companies have been instructed not to charge existing policyholders for ore. However, there is no harm in using new insurance companies as it has been found that people receive an average of £328 a year. Preiu searchers can check out Confused.co and oneysuperarket.

Third party insurance Preius must be third party insurance from the start, but please remember that only such companies offer the cheapest insurance. Drivers always look for offers from other companies because they are the cheapest. Since high-risk Axiu drivers choose this category because of its low costs, the klais are also very high. So a fully comprehensive policy is relatively inexpensive.

Black Box Support You can also choose a Black Box policy to reduce your overhead costs. This device is installed in your car by your insurance company, which provides real data about your speed, how suddenly you brake, how many kilometers you have driven, etc. The company puts all of this together to justify what the right premium might be. burden you In case of equity, the fees are reduced and you win in the long run.

Adding a Driver to Your Policy Be honest about who you are adding to your policy. If you add a young driver, be prepared to pay a higher rate, but don’t lie to the insurance company about the users of the car. It is also a good solution to have a separate policy for a specific vehicle. In this way, the company blames the driver who was driving at the time of the accident.

Uk Watchdog Sets Three Month Deadline To Improve Car Insurance

Reduce Mileage The only great and sure way to reduce your Preius costs is to reduce the number of hours you drive or the distance you cover. Opting for public transportation and keeping your car in the garage most days can reduce your premium. Make sure your ileage claim complies with Transport regulations, otherwise your claim may be rejected.

Avoid modifying your car Changes to your car such as alloy wheels, mufflers, etc. can increase your prestige because they increase the performance of the car. If your car’s performance is improving, you may be a high-risk driver. Check before you modify your vehicle, otherwise you may run into problems.

Choosing a Career Don’t lie about who you are in the workplace. Your bonus will be higher if you are a delivery man or a footballer. Choose the profession closest to you. For example, a cook can also act as a caterer, which can reduce the bonus.

The car you drive You buy a car that fits your annual subscription. Some vehicles have a higher price, and you can choose a car that costs less. ini Coopers, for example, have a high price because young people often buy this car. The Citroen DS3, a sedan, takes a similar approach to the Range Rover. So choose your car wisely to get an affordable premium car.

Which Car Insurance Cover Is Best?

*Disclaimer: This content is written by an external agency. The opinions expressed here are those of the respective authors/units and do not represent the opinions of Econoic Ties (ET). ET does not warrant, guarantee or endorse any of its content, and is in no way responsible for the same. Please take all necessary steps to ensure that all information and content you provide is accurate, current and verified. ET hereby disclaims all warranties, express or implied, with respect to the report and any content therein. If you’re like me, getting cheap insurance can be really hard. Endless offers and difficult negotiations with various suppliers just to get small discounts. Well, if you want to quickly and easily reduce your car insurance by 20-50%, you’ve come to the right place! Plus, these steps only take 10-20 minutes to complete and you don’t have to negotiate with anyone!

I haven’t used my car in over a month. In the last 28 days the car has driven about 20 meters and yet those 20 meters have cost me £110. This is one of my biggest monthly bills (after rent) and I’m not alone. MoneySuperMarket said the average price of car insurance from March to May 2016 was £470, but Confused.com says it rose to £827 in the last quarter of 2017.

There are many insurance comparison sites that generally recommend moving or changing your car if you want to get cheaper car insurance.

Great, thanks guys! I’m not looking to move or change my car, but if you want to know which factors have the biggest impact on your rating, look here.

Average Cost Of Car Insurance Uk (december 2023)

I will use a live case study to show how it works. The case study is me! This is my starting point on the price comparison site Confused.com. This is a comprehensive quote on my 2002 BMW 330ci. I am 22 years old and have not had promotional bonuses for 2 years. Some of you may frown at this price, but for me it’s not that bad (my last extension was over £1,100… per week!).

The first tip is to stop thinking that comprehensiveness is the most expensive thing. You must try all options; comprehensive, fire and theft by third parties and only by third parties. Insurance companies say they assume that if you choose to deal only with a third party, you are not taking care of your own.

Best car insurance uk, cheap car insurance uk, car insurance quotes uk, car insurance companies uk, rental car insurance uk, gocompare car insurance uk, compare car insurance uk, multi car insurance uk, car insurance in uk, short car insurance uk, uk car insurance, expat car insurance uk