Insurance Car – While driving safely can go a long way in saving your car from damage, you never know when an unfortunate incident will leave you in the pocket. Buying car insurance is important to minimize financial loss

Buying a car is a big decision in life. Not only does it cost good money, it also has immense sentimental value. While driving safely can go a long way in saving your car from damage, you never know when an unfortunate incident will leave you in the pocket. Buying car insurance is important to minimize financial loss. Here are the main things to note:

Contents

Insurance Car

Car insurance has two components: own damage and third party. Three years of third party (TP) insurance is mandatory by law if you buy a new car, while own damage (OD) cover is optional. It is important to know that you do not need to buy both covers from the same insurance company.

Car Insurance Terminologies

1) Third party separate coverage. when you buy TP insurance from an insurance company only without getting OD coverage. It is also called liability insurance.

3) Comprehensive policy. A comprehensive policy not only covers third-party liability, but also covers damage caused by accident, theft, fire, etc.

You can find another type called package insurance. It’s a combination of several products that cater to all your car needs, from casual to theft. “The insurance package is a combination of zero wear and tear, key replacement, loss of personal effects and personal accident cover, etc.,” says Indranil Chatterjee, director and co-founder, RenewBuy.com.

“These days, it is always advisable to opt for packaged products as many companies offer premium discounts on packaged products,” he added.

Pay As You Drive

The sum insured is called the Insured’s Declared Value (IDV). It is the value of the car which is calculated by adjusting the stated selling price of the car by the percentage of depreciation set by the insurance regulator IRDAI. So, when you buy a policy, check the IDV value you get against the premium amount. Don’t blindly choose a lower premium. You should compare IDV, premium and other features between insurance companies.

“One should always compare the car’s RTO city, extras (zero wear and tear, engine/tyre cover, consumables, RTI) and its cover, make and model, variant (diesel/petrol) and most importantly, IDV. all parameters must be considered as many companies do not offer all products due to their own underwriting restrictions,” says Chatterjee of RenewBuy.com.

Zero Depreciation (Zero Amortization) coverage is offered among all add-ons. This ensures that you don’t have to pay out of pocket to repair the car. In general cases, at the time of claim, the insurer takes into account market value depreciation to calculate the total amount payable. In the case of zero premium, the price difference between the market value and the depreciated value is borne by the policyholder. However, Zero Deep Cover offers full coverage without fading. This means that if your car is involved in an accident, the insurance company will cover the entire cost of repairs.

There are other important additions as well. “If you live in an area with a high tendency for water to build up, an engine and transmission cover can be helpful. So always check which add-ons are most suitable for your car, city and usage,” advises Vivek. Chaturvedi, Govt. Marketing and Direct (Online) Sales at Ank Bima.

Car Insurance Day February 1: Purpose, Benefits & Importance

“Add on covers like parts wear and tear cover, consumables cover, invoice returns are very helpful for financial protection in case of damage. While every coverage add-on comes with an additional cost, car accident coverage. Also comprehensive,” says Pankaj Arora, MD & CEO, General Insurance, Raheja QBE.

You should always check the list of exclusions in the policy document. Includes wear and tear, breakdown, consequential damage and loss due to driving with an invalid license or driving under the influence of alcohol.

No Claim Bonus (NCB) is a fixed percentage paid as a bonus for each claim free extension year subject to a maximum bonus limit. This is availed while renewing a new policy, reducing the total renewed premium. Please note that a used car does not get NCB benefits due to change of ownership, hence the insurance premium increases as the insurance company treats it as an old car.

Chatterjee of RenewBuy.com says vehicle inspection inspectors are like your doctor, with whom you should never share incorrect information. They have the right to cross-examine and can dismiss a claim based on “misrepresentation of facts”. “Vehicle documents like RC, valid driving license, pollution certificate, vehicle fitness (for commercial vehicles only), drunk and driving, consequential damage intentionally omitted, claim may be rejected,” he says. :

Car Insurance Royalty Free Vector Image

Also, before zeroing in on an insurance company, check the company’s claims process with their claims TAT (turnaround times).

Old or new car, says Digit Insurance’s Chaturvedi, the idea is not to get a good deal, but the optimum IDV at an affordable premium with appropriate add-ons. He suggests contacting an insurance company to facilitate the process of transferring ownership from an insurance perspective. “You have the option of either transferring the x-owner insurance in your name or you can get fresh insurance for the second-hand car after providing the relevant transfer documents,” says Chaturvedi. To buy a car after August 1. Know your own damage policy changes in stores In India, 40 percent of cars older than three years remain insured.

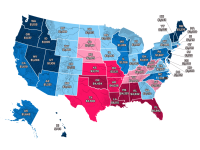

It is mandatory to buy third party (TP) liability insurance for motor vehicles in India. Buying car insurance for own loss (OD) is optional. However, the level of compliance with this mandatory provision is low. According to a March 2018 Supreme Court Commission report, every third car has third-party liability insurance. Buying insurance for your own losses is even less. Regulators, governments and courts have repeatedly tried to solve this problem. In July 2018, the Supreme Court ordered that all new cars must buy long-term third-party liability insurance. Four-wheelers had to buy coverage for three years and two-wheelers for five years. In August 2018, IRDAI asked insurance companies to draft third-party long-term liability policies to comply with court orders. He also asked insurance companies to offer package policies that would offer long-term coverage for both third-party liability and self-damage. From August 2020, this long term package policy combining TP and OD cover has been withdrawn.

The above iterations highlight the complexity of the problem. Before we get into how this affects the policyholder, here’s some context behind these decisions. As of the July 2018 order, the Supreme Court had said that insurance companies should pay Rs. 11, 480 million for compensation of death, injury, third party property damage and other damages caused by traffic accidents during the 2015-16 financial year. The smooth operation of this compensation system depends on timely decisions by the MACT courts and vehicles having valid third party liability insurance so that compensation can be paid quickly. . Getting vehicle owners to take out 3-year or 5-year third party insurance was one way to ensure compensation for victims of such accidents. Later, Natural Extension found itself offering long-term self-damage coverage to increase the insurance premium. The car dealer may be in a better position to convince the buyer to insure his damages if he purchases coverage to cover claims from third parties. However, these measures were criticized by OEMs. Higher upfront insurance costs were cited as the reason for the lower sales.

How Does Car Insurance Work?

Against this background, in June 2020, IRDAI issued orders to withdraw the long-term package cover. It cites several issues, including challenges of actuarial pricing, affordability and the potential for forced sales. This is a positive step for policyholders as the regulator has responded to concerns raised by policyholders. However, to the layman, the frequent changes can be confusing. The impact of these changes will depend on when you bought your car.

You need to buy long-term third-party liability insurance, three years for four-wheelers and five years for two-wheelers. TP premiums are the same for all insurance companies and the coverage is the same. So you don’t have much of a decision to make. There are two options for insuring your car against your own damages. First, you can buy a “package” policy. This will be a combination of a third party long term liability policy and one year of own damage cover. Second, you can purchase two separate policies. One is a standalone long term TP policy and the other is a standalone own loss policy. Your no-claim bonus will be charged annually. You can use your No-Claim Bonus (NCB) to get a discount at the time of renewal of your own loss policy.

You would buy long term TP

Compare car insurance rates, car insurance quotes, car warranty insurance, best car insurance company, car repair insurance, car insurance no deposit, best car insurance rates, state farm car insurance, car insurance near me, car insurance providers, cheapest car insurance ontario, car home insurance