Company Car Insurance – Then our friendly, licensed insurance professionals help take care of all the details so you can save quickly and easily!

Answer a few quick questions and find your driver’s license, VIN and make, model and year of your vehicle automatically!

Contents

- Company Car Insurance

- Existing Customers Company Car Insurance

- Choosing Car Insurance Company Onboarding Mobile App Screen. Walkthrough 4 Steps Editable Graphic Instructions With Linear Concepts. Ui, Ux, Gui Template 27576837 Vector Art At Vecteezy

- How Do You Sue An Insurance Company After An Auto Accident In Brooklyn?

- Business Car Insurance

- Unfallversicherung Für Alle Fahrschüler

- How To Cancel Car Insurance

- Internet Marketing Company: How Much Car Insurance Coverage Drivers Do Actually Need?

- Understanding Auto Insurance Coverage

- Car Insurance Company Tricks And Tactics

- Geico Wants To Jack Up Your Car Insurance, Latest Company To Ask For A Hike

- Gallery for Company Car Insurance

- Related posts:

Company Car Insurance

![]()

Restock your coverage automatically 30 days before renewal and take care of the details if you want to switch!

Existing Customers Company Car Insurance

Automatically buy back your car insurance when your policy is due for renewal. Make sure you always have the best coverage at the lowest rates.

The type of coverage you choose and the amount of your limits will affect how much you pay for auto insurance and how much you will spend out of pocket. Choosing your coverage and limiting your amount wisely will ensure that you have adequate coverage at an affordable rate. There are many types of car insurance coverage options.

There are two types of liability insurance coverage: property damage liability and bodily injury liability. Property damage liability includes the cost of repairing someone else’s damaged vehicle. Bodily injury liability covers the medical expenses of the driver or other passengers.

If you need a hospital visit or need X-rays or surgery after an accident, medical payment coverage, also known as MedPay, pays for these costs. This coverage also helps pay for medical expenses for passengers in the vehicle in the event of an accident.

Choosing Car Insurance Company Onboarding Mobile App Screen. Walkthrough 4 Steps Editable Graphic Instructions With Linear Concepts. Ui, Ux, Gui Template 27576837 Vector Art At Vecteezy

When you are in an accident, collision coverage will cover the cost of repairing your vehicle after the accident. This coverage is not always required unless you have a leased car or are paying off a car loan.

If your vehicle is damaged or suffers a significant disaster and needs to be repaired, comprehensive coverage helps pay for the repairs.

Personal Injury Protection, or PIP, pays for expenses incurred after an accident that may include child care or lost wages. Personal injury protection can also cover some medical expenses. Not required in every country.

This type of coverage provides payment for medical bills or repairs to your car if an uninsured or underinsured driver hits you or you are the victim of an accident.

How Do You Sue An Insurance Company After An Auto Accident In Brooklyn?

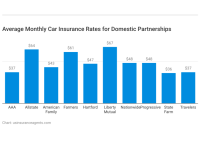

Each insurance company uses a unique formula to determine customer rates, and each offers its own discount.

When you compare car insurance quotes, you ensure that you get the most coverage at the lowest rate. Buying car insurance makes sense if your rates have gone up. But there are other good times when you get a new quote.

There are many factors in how insurance companies determine your rate. The most common ones are location, your age, driving record, credit score, type of vehicle, number of miles driven and the type of coverage you have.

The type and amount of coverage you choose will affect your overall rate. Your policy may include elements of liability, collision, comprehensive, uninsured motorist and personal injury protection. Also, the lower your deductible, the higher your rate.

Business Car Insurance

The car you choose can greatly affect your car insurance. Insurance companies will also consider the year of the vehicle, the risk of theft of the particular make/model, the cost of repairs, and the overall safety rating. Additionally, vehicles with high claim histories command higher claim rates.

If you have a clean driving history – no accidents, no tickets – you will be offered the best rates the insurance company can offer. Many insurance companies also give you a discount if you don’t have an accident for several years in a row.

It may seem like a strange connection, but many companies take credit scores into account when determining rates. The idea is that individuals with low scores are high-risk consumers.

In general, younger drivers will pay higher rates due to their higher risk of accidents and limited driving experience.

Unfallversicherung Für Alle Fahrschüler

Where you live has a big impact on how much you pay for car insurance. Insurers consider statistics on the number of claims, accidents and crime rates in any zip code.

Car insurance is a bill that everyone incurs. The thing is, it’s really hard to stay on top of managing to make sure you always get a good rate. Overtime, your rates will likely increase significantly and there may be some good options for you to lower your rates and maintain the same coverage. Insurance companies will consider your age, zip code and the vehicle you book to determine your rate. However, different companies usually offer different rates, so if you use your car for business purposes, it’s important to shop around with different carriers to find the right option for you. If you drive between multiple locations, or if you have friends who regularly take their cars to visit clients, you need business car insurance. You also need it if you drive hundreds of miles per week for business purposes.

Because the average company car driver drives 18,266 miles per year, more than twice as many local drivers. So it’s no surprise that business drivers were involved in 20% of the 15,000 accidents on UK roads in the last 3 years. If you are involved in an accident while driving for business purposes, you will not receive compensation unless you have the correct cover.

A personal insurance policy will usually cover you if you only use your vehicle to get to and from work. You don’t need to close your business.

How To Cancel Car Insurance

However, the truth is that many people still do not know about the use of commercial vehicles. This means that, right now, there are thousands of uninsured business drivers on the road.

Business Class 1 car insurance covers you for social, domestic and recreational use in addition to driving to and from work. It also covers policyholders for short business trips between different sites.

Sometimes this class of business car insurance will also cover your spouse, but it varies depending on your insurance company (no other driver).

Class 1 commercial use shall not cover commercial use for delivery or sales from any residence.

Internet Marketing Company: How Much Car Insurance Coverage Drivers Do Actually Need?

Class 2 business coverage extends beyond Class 1 business insurance and includes additional named drivers on the policy that are usually part of the same business as the policyholder. Like Class 1 business insurance, this class does not cover any type of delivery or sale.

The option to add co-workers to a Class 2 business insurance policy is often ideal for small businesses with only one or two vehicles. This is because there are fewer limits for the passenger and driver compared to Class 1 insurance.

Along with Class 2 business insurance, Class 3 business car insurance also covers the policyholder for unlimited long-distance travel without a specified destination.

However, for cars used as mini taxis, private hire or driving lessons, professional insurance must be arranged as they require more expertise.

Understanding Auto Insurance Coverage

* Each policy class varies by insurance company. To avoid getting caught, contact an experienced business auto insurance broker who can speak for you

If you get behind the wheel for anything other than your daily commute, you need business car insurance. Some of the reasons insurance companies treat people who drive for work differently may be:

Of course, this is not true for everyone who drives to work. Therefore, it is important to know what your requirements are for your insurance company.

Some large businesses may have insurance policies that cover employees in the event of an accident while driving a car for business use. You may not need business car insurance if your employer. One way is important to check whether it is to prevent from taking out unnecessary policies or driving without business insurance.

Car Insurance Company Tricks And Tactics

Employers typically reimburse employees for expenses incurred while driving a personal vehicle for business use. This is to cover wear and tear as business insurance also covers extra miles. This means that the amount paid per mile must be more than the cost of fuel. 45p per mile is a fairly standard rate but it can vary depending on the employer and the distance travelled.

Business auto insurance cost limits are similar to personal auto insurance in many respects. If you have not bought a car you should consider engine size (smaller is better) and fuel efficiency.

You can also install additional security devices such as immobilizer, steering lock or tracker. Also try to secure street parking for your vehicle to lower your premium.

In the specific context of a business car policy, try and agree a realistic mileage limit with your insurance company. This will help you manage your costs better than an open mileage agreement. However, you must ensure that you do not exceed the agreed limits. If you do your insurance will be invalid unless you pay a lot of fees up to the limit.

Geico Wants To Jack Up Your Car Insurance, Latest Company To Ask For A Hike

You can also help secure a good deal by using business car insurance

Online car insurance company, best car insurance company, discount car insurance company, sue car insurance company, business car insurance company, company car insurance policies, local car insurance company, philadelphia car insurance company, suing car insurance company, cheapest car insurance company, car insurance policy company, usaa car insurance company