Group Life Insurance – A special type of life insurance is group policy life insurance. It provides coverage to multiple people through one policy and is typically offered as a bonus by companies and employers. The coverage is usually minimal, but carries a cost for the person insured by the policy. Due to the low costs associated with this policy, participation is high in larger corporations.

Group life insurance is a special branch of life insurance that provides coverage for multiple people within one policy. It is typically offered as term insurance, meaning the coverage is temporary, but the cost is less than other types of life insurance. The best life insurance companies offer group term life insurance that is usually issued in the form of a periodically renewable policy.

Contents

- Group Life Insurance

- How To Sell A Group Life Insurance Policy: The Ins And Outs

- Group Life Insurance: What It Is And How It Works (2023)

- Group Life Insurance Icon. Flat Design. Isolated Illustration. Long Shadow. Royalty Free Svg, Cliparts, Vectors, And Stock Illustration. Image 45881255

- The Essential Glossary Of Group Benefits Terminology

- Should You Offer Group Life Insurance?

- Group Vs Individual Life Insurance Comparison 2023

- Join An Association For Group Life Insurance

- Gallery for Group Life Insurance

- Related posts:

Group Life Insurance

There are currently four types of group life insurance: basic employee life, optional employee life, basic dependent life, and optional dependent life.

How To Sell A Group Life Insurance Policy: The Ins And Outs

The main distinctions are usually made between the two types of working life and dependent life. Employee life is the most basic option for group life insurance and provides coverage for the employee’s dependents in the event of the employee’s death. This differs from dependent living arrangements as they provide coverage in the event of the death of any of the employee’s dependents.

The employee’s basic life pays a pre-specified amount of money, in the form of how much coverage is offered, if the employee dies. This money is given to the employee’s dependents listed on the contract and divided accordingly. These rates are traditionally reviewed annually based on the premiums paid by the employer.

Employee elective life allows employees to supplement life insurance coverage provided by their employer. This means that employees will be able to add their own policies on top of the group life insurance offered by their employers to get more coverage for their loved ones in the event of their death. However, this requires the employee to pay out of pocket to add to the policy.

Basic life for dependents is similar to basic life for employees in that a pre-established amount of money is paid in the form of the amount of coverage offered. The difference is that it protects the employee in the event of the death of one of his dependents. It is only available to an employee’s spouse and dependent children.

Group Life Insurance: What It Is And How It Works (2023)

Coverage is typically $5,000 or $10,000 for a spouse and $2,500 or $1,000 for each dependent child.

Optional dependent life allows employees to supplement employer-provided life insurance coverage. This means employees will be able to add their own policies on top of the group life insurance offered by their employers for more coverage if their loved ones die. However, this requires the employee to pay out of pocket to add to the policy.

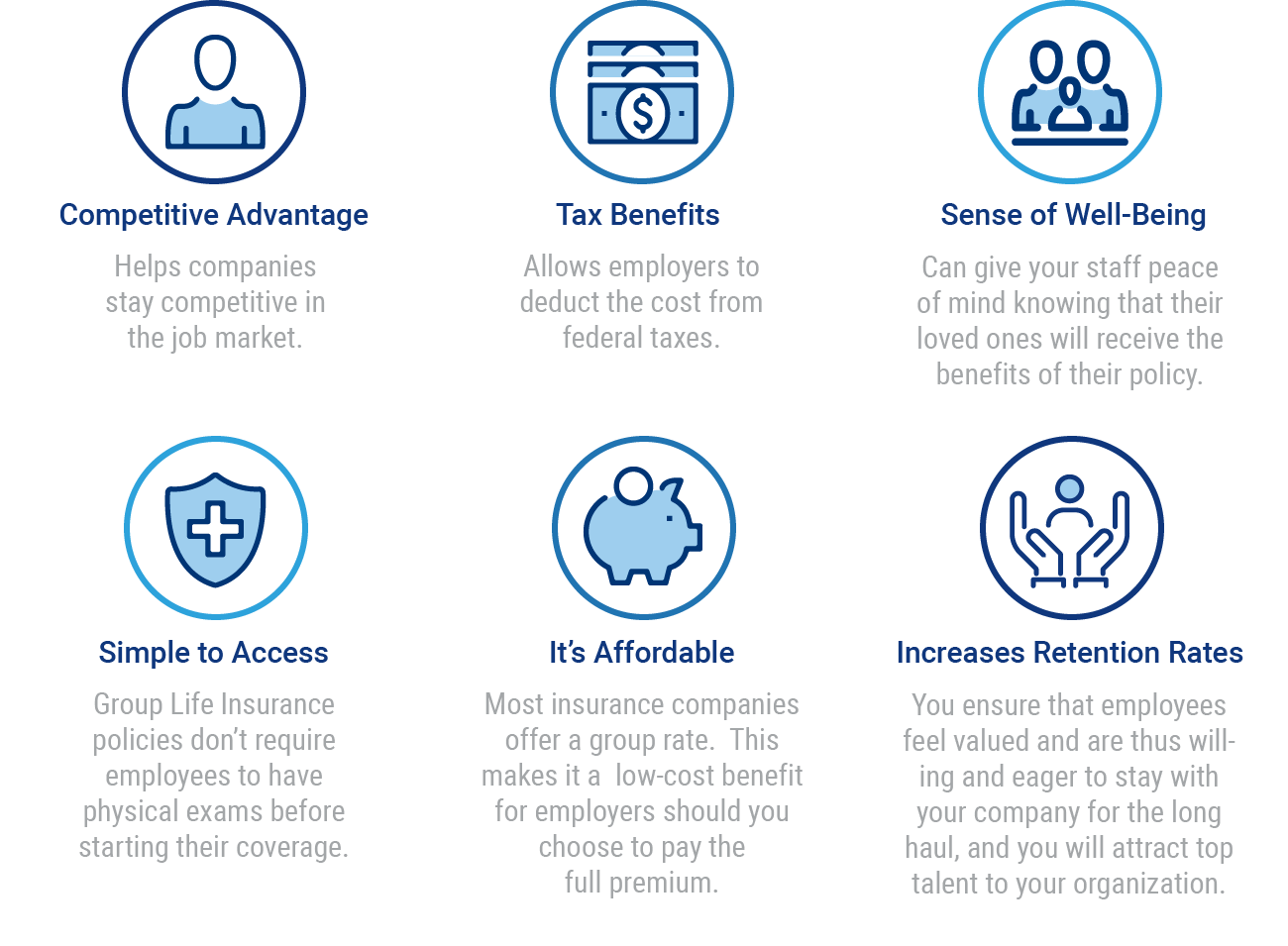

Group life insurance policies are often used by employers and corporations. They offer it as a bonus to their employees as part of their benefits package. They are responsible for covering the premiums, except for employees who wish to supplement their policies and pay the additional costs themselves.

According to the Society for Human Resources Management, about 81% of companies offer company-paid group life insurance as a benefit. It is not directly related to higher employee performance; However, studies have shown that companies with abundant benefits tend to have higher employee satisfaction.

Group Life Insurance Icon. Flat Design. Isolated Illustration. Long Shadow. Royalty Free Svg, Cliparts, Vectors, And Stock Illustration. Image 45881255

Employees are typically automatically eligible for basic coverage if they meet eligibility requirements. These requirements vary from organization to organization, but generally include work hour requirements and work assignments.

Sometimes additional group term coverage is only available if there is a qualifying life event. They will be big movements like the birth of a child or a recent marriage. Otherwise, they may be available to add during open enrollment periods.

Additional coverage also requires an additional subscription. Traditionally, this is a simpler underwriting process to determine eligibility compared to a physical exam, similar to the underwriting process for life medical insurance policies. The life insurance company will base its decision for additional coverage on the answers to the questions you ask.

Group life insurance works the same way as most other traditional life insurance policies in that you pay a monthly premium. In exchange, your dependents will receive cash benefits in the unfortunate event of your death. The difference is that your employer will usually pay the premiums on your behalf or deduct the cost of the monthly premiums from your paycheck. The latter is rare.

The Essential Glossary Of Group Benefits Terminology

Life insurance coverage is usually directly related to your salary or a fixed amount decided by the company. Employment for the purposes of group life insurance coverage generally includes only the deemed salary. This type of income-based benefit generally pays a benefit based on a multiple of income, usually one or two times the annual salary.

On the other hand, a fixed benefit plan does not pay income-based benefits. Instead, everyone will have the same amount of coverage under the policy contract. This typically ranges from $25,000 to $500,000, as determined by the employer. The different limits of these areas are usually related to the employee’s position within the company.

The level of coverage offered by group life insurance may be sufficient, but you may need more coverage for your particular situation. It may be beneficial to speak with an advisor to determine the best path to achieving your financial goals.

Comparing policies and quotes from some of Canada’s best life insurance companies to help you find the perfect life insurance policy is what we’re here for at Protect Your Wealth. We have been providing expert life insurance solutions since 2007, including no-medical life insurance, term life insurance, and permanent life insurance, to create the best package to give you the protection you need.

Should You Offer Group Life Insurance?

Contact Protect Your Wealth or call us at 1-877-654-6119 to speak with an advisor today! We are proud to be based in Hamilton and serve clients throughout Alberta, British Columbia and Ontario, including areas such as Grande Prairie, Surrey and Oshawa.

Group life insurance coverage lasts until you leave the company. The policy is traditionally based on term life insurance, meaning it is renewed each year. If your employment is terminated, the policy and coverage will terminate along with it.

Group life insurance premiums paid by the employer on behalf of an employee are taxable benefits, but the benefits themselves are not taxable.

This will depend on your specific situation, but usually the answer is no. Most people look for life insurance that covers up to five or even ten times their annual salary to ensure adequate financial coverage for their loved ones. Group life insurance typically only covers one to two times your annual salary.

Group Vs Individual Life Insurance Comparison 2023

In most cases, group life insurance policies convert to a one-year adjustable term policy, a term policy through age 65, or a regular permanent insurance plan. You can understand group life insurance and individual life insurance. It’s important to know the difference between these two types of life insurance plans, as well as how a license or cancellation can affect your group life insurance.

Individual life insurance is the most common type of life insurance. Your policy applies to you regardless of your employment status. To receive the benefits of individual life insurance, you must go through an application process and often a medical exam and risk assessment.

Group life insurance is tied to your job and can be a good option when your employer pays for it, but it only lasts as long as you work there. Your policy is part of a group contract, with a simple application and without proof. The premiums for your group life insurance policy are reviewed annually (or every five years) and may increase for the entire group.

Group life insurance, provided through the workplace, is typically offered through the company’s group life plan. If you are furloughed or laid off, you are no longer part of the company’s group life plan and your employer is not responsible for covering you. In other words, you no longer have access to your group life insurance. With unemployment rates at record levels this year months of 2013-12 terms and conditions for the entire session>>>>> + week>>>> week>>>>>>> clipart » 202007 .

Join An Association For Group Life Insurance

Understanding the basics of individual and group life insurance is essential to protecting you and your family. If you have additional questions about coverage, rates and benefits, we will be happy to explain your options! Do you want to purchase group term life insurance for employees? Or would you like to know the benefits of purchasing a group term insurance policy? ?

If so, maybe this blog will talk about those different benefits.

Group permanent life insurance, group whole life insurance, veteran group life insurance, veterans group life insurance, employee group life insurance, life insurance savings group, group credit life insurance, group life insurance quotes, group life insurance plan, group life insurance policy, supplemental group life insurance, life insurance group