Health Insurance Rates – Health insurance is a hotly debated political issue in the United States. It’s something we all need, but it’s often expensive and out of reach for some people. Although the health insurance debate takes place on a national level, health insurance rates actually vary from state to state. The two maps below show health insurance rates by state and the average annual deductible for the Silver plan. Find out your situation and compare it with others.

The map above divides them into four categories based on average monthly payments per person. States in red have an average monthly premium of $651 to $780, states in pink have an average monthly premium of $451 to $550, states in light green have an average monthly premium of $451 to $550, and states in black have an average monthly premium. of $411 to $450 USA. Data collected from United Benefit Advisors.

Contents

- Health Insurance Rates

- How Much Do Employers Pay For Health Insurance?

- Health Insurance: Plans & Policies In India

- Massachusetts Family Health Insurance Premiums $21,424 Average 2019

- Employers’ Rising Health Insurance Costs Leave Many Families Underinsured

- Complete Guide On Basics Of Health Insurance

- Gallery for Health Insurance Rates

- Related posts:

Health Insurance Rates

This map divides countries into four categories based on average annual Silver Plan withdrawals. Dark purple states have an average deduction of $5,000 to $6,913, light purple states $4,000 to $4,999, states $3,000 to $3,999, and dark gray states from $1,733 to $2,999. . Data was collected from Stride Health. The numbers are calculated based on the average deductible for the four most popular silver plans in each state for single, 40-year-old, non-smoking men with an annual income of $51,640 (median income for men that age). Data was collected from Stride Health.

How Much Do Employers Pay For Health Insurance?

The first map of health insurance averages shows that most states fall into the bottom two categories. Wyoming and Alaska have the most expensive health insurance rates in the country. Only 11 countries fall into the second highest category, between $551 and $650 per month. Average annual deductibles are more spread out compared to other health insurance rates. States in the Midwest, with some notable exceptions in the Rust Belt, have lower incomes compared to the rest of the country.

The Rust Belt is one of the worst health insurance regions in terms of costs and deductibles, but there are a few exceptions. To a lesser extent, this applies to the south. Deductibles are higher in the South, but premiums tend to be lower. Indiana appears to have the worst combination of health insurance premiums and deductibles. The state ranks 13th in average monthly income at $552 and has the second highest deductible in the nation at $6,763. A Rand Corporation study found that some Indiana hospitals charge more than three times what they charge Medicare for the same procedures. . Neighboring Illinois ranks second worst, with the ninth highest monthly premium at $552 and the 11th highest average annual deductible at $5,325.

There appears to be no relationship between monthly premiums and annual withdrawals. For example, consider New York and New Jersey. New York has the third highest monthly premium at an average of $624 per month, but the fifth lowest deductible at $2,175. A similar trend is seen in New Jersey. The state has the fifth highest monthly premium at an average of $591 per month, but also has the third lowest annual deductible at an average of $2,075. People in New York and New Jersey pay more monthly but pay less in their deductibles.

Now compare New York and New Jersey and Nevada and Kentucky. Nevada has the lowest monthly premium at $445 per month and the 9th highest annual deductible in the state at an average of $5,513. Kentucky has the lowest monthly premium at $437 and the 13th highest deductible at $5,025. Although residents of Kentucky and Nevada pay less per month for health insurance than residents of New York and Kentucky, they must pay more for their deductibles. if they need treatment. Nevada is currently creating its own health insurance to help people get paid.

Health Insurance: Plans & Policies In India

Alaska is the most expensive state, with an average of $780 per month. But despite the high monthly premiums, the average annual deductible in Alaska is around $3,750. The federal government says Alaska has anti-competitive health care laws that drive up health insurance costs and hurt consumers. Hawaii has the lowest monthly premiums in the nation at an average of $411 per month and the seventh lowest deductible at $2,750. When considering both monthly health insurance premiums and annual deductibles, Hawaii comes out on top compared to other states.

Both the average monthly health insurance cost and the average annual deductible vary across the 50 states. But as the data shows, it is not easy to find out if your deductible will be based on your monthly health insurance costs. It is good to consider both aspects. Based on these two factors, Hawaii has the best overall health care score. But if you spend all day at the beach, your stress levels are so low that you might not even need therapy!

They will be on sale soon. We’ll email you when it’s ready, just put your address in the box.

If you wish to use our image in books, magazines, reports, educational materials, etc., we can issue a license that gives you exclusive rights to reproduce, store, publish and distribute. News Release Benchmarking Employer Survey Finds Average Family Pay Now Over $20,000. Among the affordability issues, low-wage workers are nearly half as likely to receive employer benefits as other workers.

Massachusetts Family Health Insurance Premiums $21,424 Average 2019

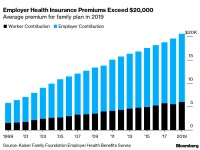

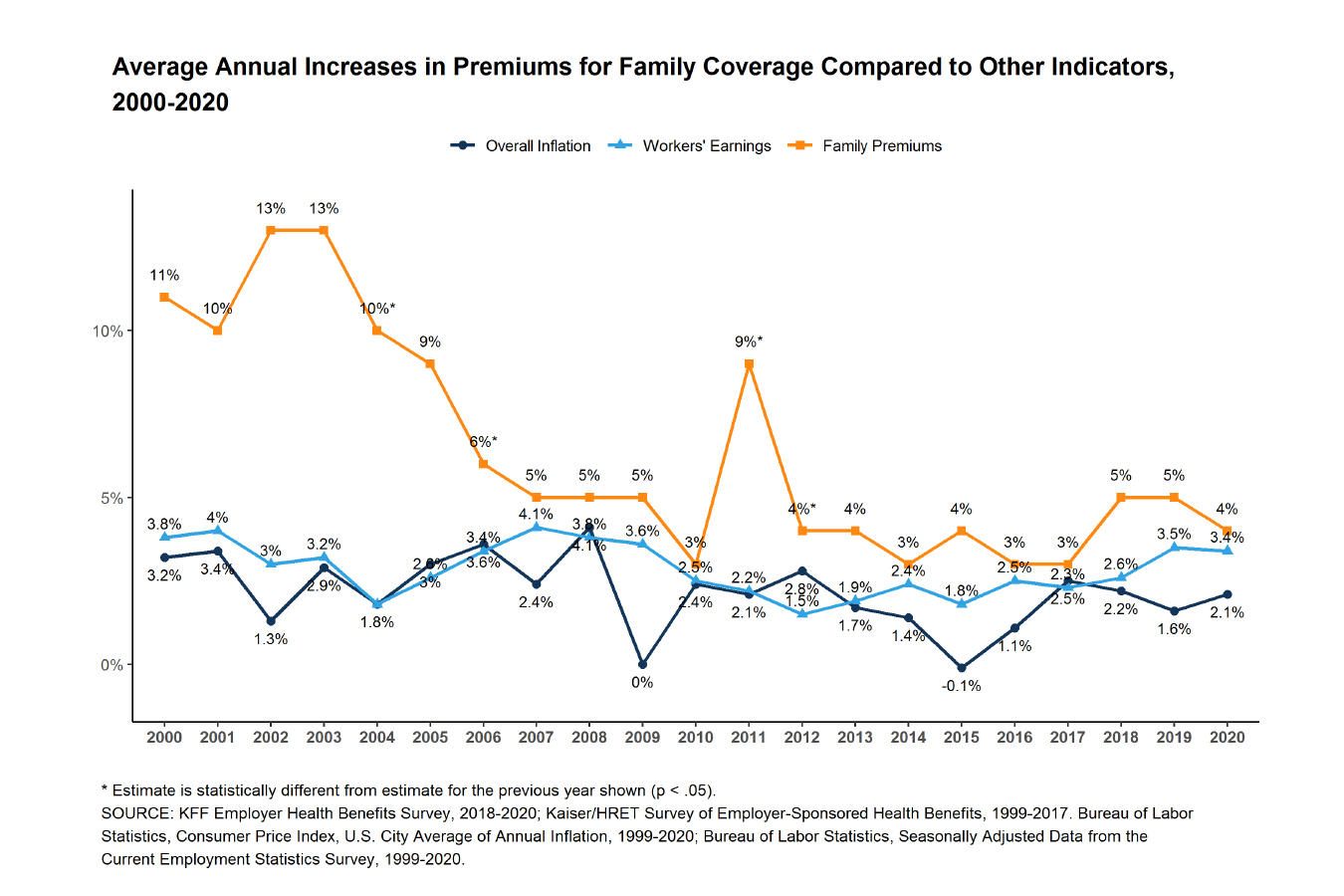

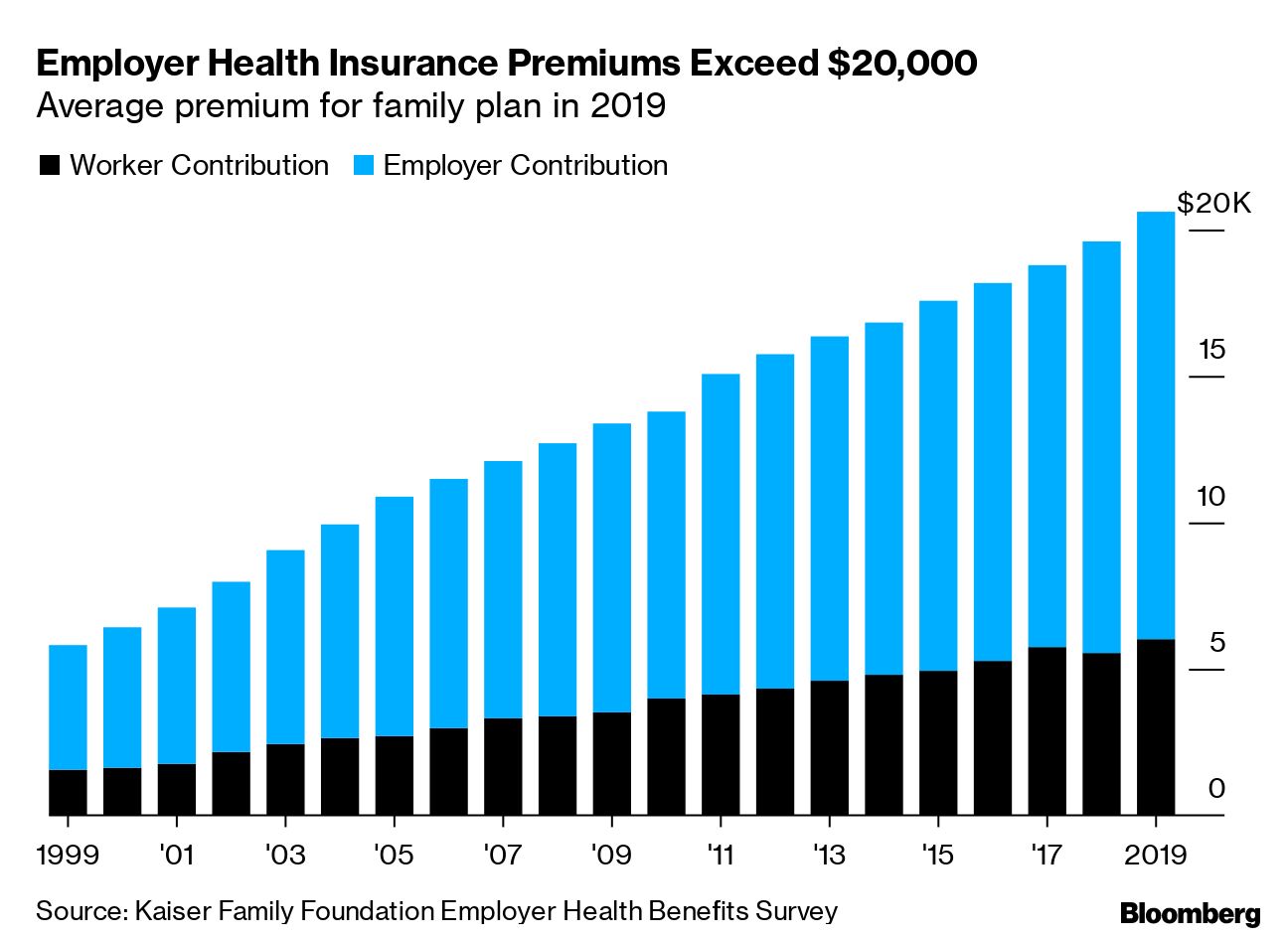

San Francisco. – Annual family premiums for employer-sponsored health insurance increased 5% this year to an average of $20,576, according to the 2019 Employer Health Benefits Survey released today. Labor wages increased by 3.4% and inflation increased by 2% over the same period.

On average, employees contribute $6,015 this year to cover the cost of family insurance, with employers paying the rest.

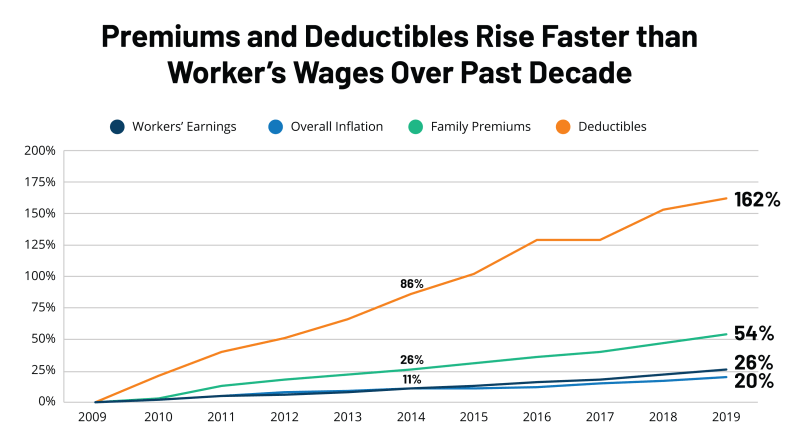

Despite the country’s strong economy and low unemployment, employer and employee bonus payments have grown faster than workers’ wages and inflation over time. Since 2009, average family contributions have increased by 54% and employee contributions by 71%, many times faster than wages (26%) and inflation (20%).

Currently, 82% of insured workers have deductibles from their plan, up from 63% a decade ago. The average single deductible is now $1,655 for workers with a deductible, similar to last year’s average of $1,573, but up sharply from $826 a decade ago. These two trends have led to a 162% increase in the total deductible burden for all covered workers over the past decade.

Employers’ Rising Health Insurance Costs Leave Many Families Underinsured

More than a quarter (28%) of all covered workers, including nearly half (45%) of small employers with fewer than 200 employees, now have a $2,000 deductible, nearly four times the share that faced a deductible in 2009. . One in eight people (13%) now face a $3,000 withdrawal.

“The biggest health care challenge for many Americans is that health care costs are rising faster than incomes,” said President and CEO Drew Altman. “The cost is negligible when workers earning $25,000 a year have to shell out $7,000 a year for their share of the family allowance.”

An estimated 153 million Americans rely on employer-sponsored insurance, and the 21st annual survey of more than 2,000 small and large employers provides a clear picture of the impact. In addition to the full report and summary of results published today, the journal Health Affairs is publishing an article online with selected results. The article, “Health Benefits in 2019: Premium Inches Higher, Employers Respond to Federal Policy,” will appear in the October issue.

Also released an updated interactive graphic showing test premium trends by firm size, industry and other firm characteristics, and a separate report highlighting the views and experiences of large employers based on focus group discussions conducted in partnership with the Peterson Center for Defense Health. .

Complete Guide On Basics Of Health Insurance

As the debate over Medicare in the Democratic primary draws attention to the role of employer-sponsored health benefits, a survey finds that workers at many low-wage companies face some of the biggest problems with employer-sponsored insurance. their families. Among companies that offer insurance, employers with more low-wage workers (those earning $25,000 or less a year) offer health benefits to a smaller share of their workers and charge higher premiums than other employers. in particular:

“Employer-sponsored insurance is expensive for employers and employees, and many who work for low-wage firms or small businesses may find it too expensive to pay for their families,” said Gary Claxton, senior vice president and director of Health. The Point of Care Project and lead author of the article Reading and Health Affairs.

The survey also assesses the experience of employers

Aarp health insurance rates, health insurance rates maryland, family health insurance rates, individual health insurance rates, group health insurance rates, health insurance rates florida, health insurance rates texas, comparing health insurance rates, health insurance rates california, best health insurance rates, private health insurance rates, compare health insurance rates