How Much Is Car Insurance – Partner Content: This content is created by Dow Jones business partners, independent of the newsroom. Links in this article may earn us a commission. Learn more

The average cost of car insurance is $2,008 a year for comprehensive coverage, but individual factors such as your age, vehicle and driving history affect what you pay.

Contents

- How Much Is Car Insurance

- How Much Car Insurance Do I Need In 2024? All 50 States

- How Much Car Insurance Do You Need?

- Best Car Insurance For 18 Year Olds

- Commercial Auto Insurance: How To Insure Your Business Car And Fleets

- See Average Cost Of Auto Insurance By Michigan Zip Code

- Why Is Car Insurance So Expensive? Rates Explained (2024)

- How Much Auto Insurance Is Enough?

- How Much Is Car Insurance For A Lamborghini?

- Rental Car Insurance

- Gallery for How Much Is Car Insurance

- Related posts:

How Much Is Car Insurance

Written by: Daniel Robinson Written by: Daniel Robinson Writer Daniel is a team writer for Guides and has written for numerous automotive news websites and marketing companies in the US, UK and Australia, specializing in finance and cars. Care topic. Daniel is a team member who advises on car insurance, loans, warranty options, car services and more.

How Much Car Insurance Do I Need In 2024? All 50 States

Edited by: Rashawn Mitchner Edited by: Rashawn Mitchner Managing Editor Rashawn Mitchner is an editorial team editor with over 10 years of experience covering personal finance and insurance topics.

Reviewed by: Mark Friedlander Reviewed by: Mark Friedlander Consultant Mark Friedlander is director, corporate communications, at the Insurance Information Institute (Triple-I), a nonprofit research and education organization in New York focused on providing consumers with a better understanding of insurance. . Mark serves as a national spokesperson for Triple-I, covering a wide range of insurance industry media issues. His responsibilities also include leading the association’s hurricane season communications strategy and supporting member companies and media outreach in Florida, where he is based.

What is the average cost of car insurance in the United States? In this article, we on the Guides team will explain the average car insurance premiums by state and how to keep your rates low. We also recommend three of the best car insurance companies worth considering in the section below.

Best Car Insurance Companies 10 Largest Car Insurance Companies in USA Lowest Car Insurance Companies Cheap Car Insurance for Seniors Best Car Insurance for 18 Year Olds Best Car Insurance for New Drivers

How Much Car Insurance Do You Need?

The advisory team is committed to providing reliable information to help you make the best decision to insure your vehicle. Because consumers rely on us to provide objective and accurate information, we have created a comprehensive rating system to create our ranking of the best car insurance companies. We collected data on dozens of auto insurance providers to rank the companies on a variety of rating factors. After 800 hours of research, the final result is an overall rating for each provider, with the insurer with the highest score at the top of the list.

The average cost of comprehensive insurance is $2,008 per year or $167 per month, while minimum liability coverage is $627 per year or $52 per month. However, what you pay for auto insurance varies based on your individual qualifying factors. This is because insurers consider factors such as your location, driving history, vehicle and required coverage when calculating premiums.

There are good reasons for the wide price difference between full auto insurance and minimum liability coverage. Liability insurance has two components: bodily injury and property damage. It is required in most states and covers injuries to other drivers and damage to the vehicle when you cause an accident.

Comprehensive car insurance goes beyond the state’s minimum coverage by adding collision and comprehensive coverage to protect against liability. Collision coverage pays for damages to your vehicle, regardless of who caused the accident. Comprehensive coverage protects your car from damage from natural disasters, theft, fire and vandalism.

Best Car Insurance For 18 Year Olds

All states set their own auto insurance rules and requirements. Factors such as driving conditions also vary by state, which can affect car insurance prices.

We’ve collected average car insurance premiums from the Quadrant data service to let you know what drivers in each state pay on average per year. Auto coverage costs vary by state due to various factors, including the frequency of accidents and claims. The cost of parts and labor can also lead to higher fees in some parts of the state compared to others.

The cost estimates in the table below include estimates for minimum car insurance and full coverage for a 35-year-old driver with good credit and a clean driving record.

The best way to see how much car insurance will cost for your vehicle is to compare free quotes from carriers in your state.

Commercial Auto Insurance: How To Insure Your Business Car And Fleets

Age is one of the most important factors in determining car insurance rates. Teen drivers and those in their 20s can pay thousands more per year than those with more experience behind the wheel. This is because young drivers often have car accidents. Insurance companies pay higher premiums to help offset the risk of insuring these inexperienced drivers who tend to exhibit more risky behavior behind the wheel.

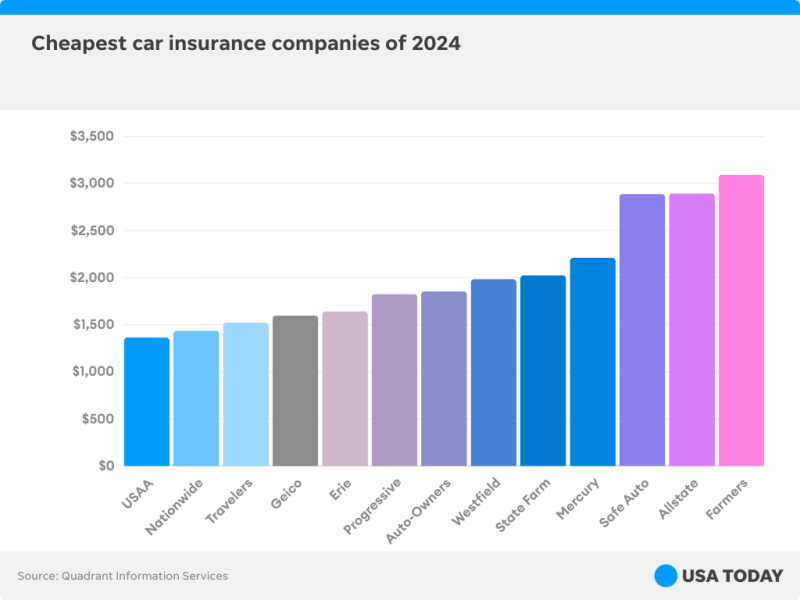

Car insurance premiums vary greatly depending on your carrier. Here are some national and regional companies that offer lower than national average prices for comprehensive car insurance:

USAA usually offers low car insurance rates in all areas of the United States, but its policies are only available to military, veterans and their families. Erie Insurance is another affordable option if you live in one of the 12 states (and Washington, DC) that the company serves.

Auto insurers must weigh the risk factors in each driver’s record. If you have one or more speeding tickets, at-fault accidents or other violations in your driving history, you will pay higher premiums than those with a clean record for many years. Here’s a look at how the average rate for 35-year-old men changes when they have a driving violation:

See Average Cost Of Auto Insurance By Michigan Zip Code

Each car insurance company weighs risk factors differently. The following sections provide rate estimates for various driver profiles from major insurers.

Having an accident on your record usually results in a higher automatic coverage rate for at least three years. State Farm and Erie Insurance offer the lowest average rates for these drivers.

Acceleration can also lead to higher car insurance for a minimum of three years. Here are some average rates for drivers with previous speeding violations for going 16-20 mph over the limit. Erie Insurance and USAA lead the way with the lowest rates.

As you might expect, a DUI violation will increase your car insurance rates by at least three years. State Farm has the lowest rates for drivers with a previous DUI, followed by Erie Insurance, USAA and Progressive.

Why Is Car Insurance So Expensive? Rates Explained (2024)

The type of vehicle you drive plays an important role in determining your car insurance rate. Replacement and repair costs, accident probability and safety features All vehicle risks contribute to how much you pay for car insurance. Here are some types of vehicles that tend to be more expensive to insure:

More affordable standard size cars with modern safety features are usually the cheapest to insure. As a bonus, features like anti-lock brakes, anti-theft systems and passive restraint systems can also get special discounts from some insurers.

Car insurance costs are determined based on several factors. How each factor affects your total premium can vary from carrier to carrier, so it’s important to compare average car insurance rates from multiple insurers.

The table below includes the main factors that generally determine the cost you will pay for auto insurance:

How Much Auto Insurance Is Enough?

Drivers typically see the highest rates between the ages of 16 and 25. The rate gradually decreased and increased slightly for about 65 years.

Insurers can set rates based on your gender, except in California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania, where insurers are prohibited from using gender as a factor in rates.

Drivers with good credit are often offered lower rates. In California, Hawaii, Massachusetts, Michigan and New Jersey, insurers are not allowed to set rates based on credit scores.

Your city and state affect your car insurance premiums. If you live in an area with a particularly high rate of accidents or theft, you may see higher insurance rates.

How Much Is Car Insurance For A Lamborghini?

If your car model has a high rate of theft or accidents – such as many sports cars – your premiums may be higher. The value of your car is also used to determine the cost of comprehensive and collision insurance.

Keeping a clean driving record is one of the biggest ways to save on car insurance. Those with a history of speeding, wrong-way accidents, traffic violations or DUI are charged more for insurance. Violations stop affecting your rates after they are removed from your record, which usually happens after three years.

Each state sets its own minimum insurance requirements, but you can get additional coverage if you want to be fully protected. Buying comprehensive insurance with higher policy limits will increase the price of your car insurance.

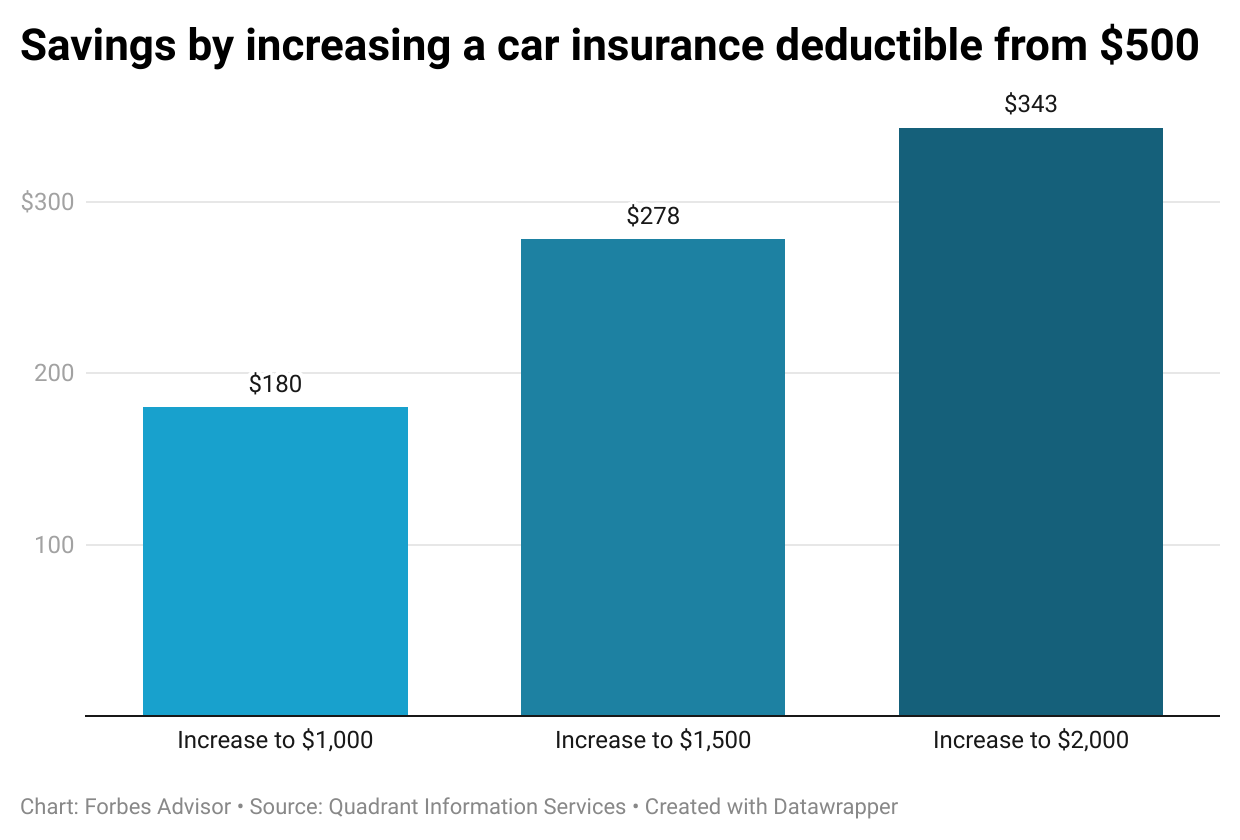

Collision and comprehensive insurance policies typically include deductibles. Choosing a higher deductible will result in a lower premium and vice versa.

Rental Car Insurance

The discounts you are eligible for will affect your rate. Common car insurance discounts include homeowners discounts, military discounts, multiple policy discounts and full payment discounts.

You may find that your car insurance premiums change slightly every six months or every year. Your premium is actually part of a regional insurance group that is sometimes affected by changes in state regulations and total claims over a period of time.

How much is average car insurance, how much is my car insurance, how much is commercial car insurance, how much is car insurance a year, how much is full coverage car insurance, how much is state farm car insurance, how much is car insurance in maryland, how much is comprehensive car insurance, how much is progressive car insurance, how much is cheap car insurance, how much is allstate car insurance, how much is classic car insurance