How Much Is Cheap Insurance – Average cost of car insurance by state in 2023 Posted on April 14, 2023 | 6 minutes. read

It is illegal to drive without insurance in the United States. Depending on the state you drive in, the consequences of doing so can range from a fine to a misdemeanor on your record. So, if you plan to hit the road soon, make sure you buy car insurance to avoid fines.

Contents

- How Much Is Cheap Insurance

- Car Insurance Discounts For First Responders

- Cheapest Car Insurance In Arizona (may 2024)

- Best 5 Cheap Car Insurance Quotes Pennsylvania With No Deposit For Those Who Don’t Drive

- How Much Are You Paying For Insurance

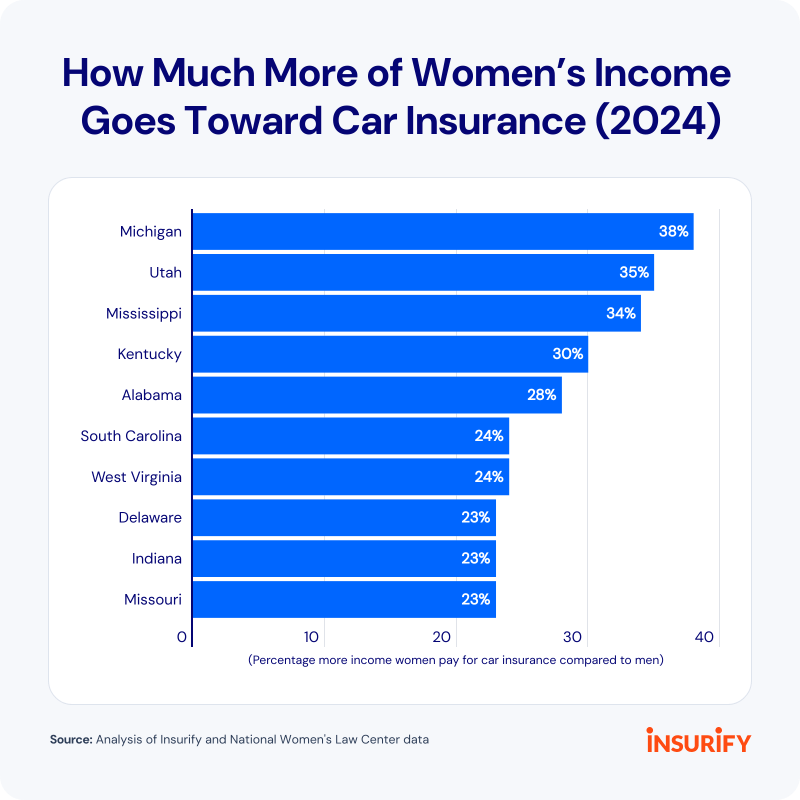

- How Gender Inequity Affects Car Insurance Costs (2024)

- Related posts:

How Much Is Cheap Insurance

In this article, we’ve researched the average cost of car insurance by state to give you a better idea of how much to budget for.

Car Insurance Discounts For First Responders

According to AAA, the national average cost of auto insurance for a full coverage policy in 2022 is $1,588. This number is based on a driver under the age of 65 who lives in an urban or rural area and has more than six years of driving experience. , and has not had any accidents.

When calculating the cost of car insurance, the state you live in affects how much you can expect to pay. That’s because factors like population density, weather, road conditions, and crime rates in your area can affect your likelihood of getting a claim.

According to Insurance.com, the cheapest auto insurance states if you’re looking for the least coverage are Iowa, South Dakota, and Wyoming, with an average cost of $263, $267, and $293, respectively. Meanwhile, the least expensive states for full auto insurance are Ohio ($1,023), Maine ($1,116) and Idaho ($1,121).

The most expensive states for auto insurance by minimum coverage are New Jersey, Florida, and New York, where drivers pay an average of $989, $908, and $875, respectively. For comprehensive insurance, drivers in Florida ($2,560), Louisiana ($2,546) and Delaware ($2,137) pay the highest national average.

Cheapest Car Insurance In Arizona (may 2024)

Another factor that affects how much you can pay for auto insurance is the specific company through which you purchase your plan.

According to U.S. News & World Report, USAA, Geico and State Farm offer the lowest coverage plans, while USAA, Geico and Nationwide offer the lowest coverage coverage.

Farmers, Progressive and National offer the least expensive coverage rates, while Allstate, Farmers and Progressive offer the most expensive coverage plans.

According to CarInsurance.com, the minimum and full cost of auto insurance decreases with age, as seen in the chart below. However, there was a recovery around the age of 70 when prices started to rise again.

Best 5 Cheap Car Insurance Quotes Pennsylvania With No Deposit For Those Who Don’t Drive

Young drivers are the most expensive age group to insure. Although there are some exceptions, insurance costs tend to decrease with age among young drivers.

According to the Insurance Information Center, your score is a good indicator of how many insurance claims you will make. As a result, insurance companies use scores to determine risk, and those with good scores pay lower premiums. Abila found that people with low incomes paid about 114% more than those with better incomes.

As you can see from the charts above, the cost of car insurance varies depending on the following factors:

Minimum auto insurance coverage (liability coverage) is required in most states and used if you are at fault in an accident. This coverage pays for damages and injuries to the other party when they are responsible for the incident.

How Much Are You Paying For Insurance

On the other hand, comprehensive insurance or accident coverage includes coverage for civil liability and damage to the vehicle itself. Remember that lenders often require that you get full insurance before getting a car loan.

Your driving record is one of the factors that affect your auto insurance rate. As a result, those with traffic violations or accidents on their record can expect to pay higher premiums.

The cost of your maintenance insurance usually does not go down after you pay off your car. However, you have the option to reduce the amount of car coverage after paying.

For young drivers in particular, car insurance rates drop every year, you renew your policy without submitting a claim. You can expect to see the biggest price drop in 25 years.

How Gender Inequity Affects Car Insurance Costs (2024)

The average cost of car insurance varies based on factors including state, age, insurance company and score. Some factors, like your age, are out of your control, but other factors, like your score, can be improved.

Check your score for free today to see if it’s one of the reasons your car insurance is high.

How much is employee insurance, how much is roofing insurance, how much is landscaping insurance, how much is commercial insurance, how much is cheap car insurance, how much is llc insurance, how much is cheap health insurance, how much is humana insurance, how much is contractor insurance, how much is restaurant insurance, how much is handyman insurance, how much is contractors insurance